This Gold & Silver Junior Mining Company has Extreme Return Potential!

Simply sign up for our free e-letter and receive the complete company report

The next upward phase in gold’s secular bull market is ramping up and now is the time to position yourself for big gains before gold takes off again.

In January 2016, gold and silver began to rebound off a multi-year decline amid an overall secular precious metals bull market which began in 2001. Due to skyrocketing sovereign debt that can never be repaid, along with the continued debasement of currencies, many analysts foresee both gold and silver breaking through their 2011/2012 highs of about US $50/ounce silver and US $1,900/ounce gold in the next several years.

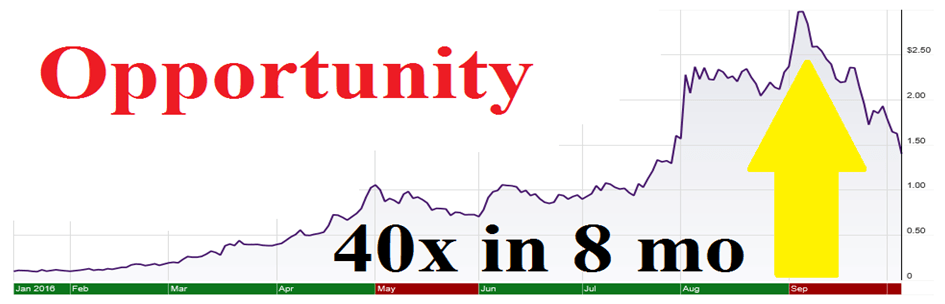

From January 2016 until July 2016, gold rose from a multi-year low of about US $1,060/ounce up to US $1,365/ounce. That was a 29% rise in just six months! During that same timeframe, silver rose from about $14/ounce up to $21/ounce: a 50% rise in just six months! As spectacular as those quick returns are, in that same period of time investors who positioned themselves in quality small and micro-cap gold and silver junior mining companies experienced 10, 20, 30 and even 40-fold returns in months! Yes, months—not years! Just take a look at the chart of this junior gold/silver miner from last year:

What you are about to read describes the one Absolute, MUST-OWN Gold-Silver Junior Miner

After combing through hundreds of junior gold stocks, we believe that we have found the one company that has the greatest possibility to rise exponentially in share price and produce truly out-sized, life-changing gains for its investors over the next several years. This firm expectation comes from an analysis of the company’s current assets and near-term catalysts. We will email you the full company report on this hidden gem, but for now here are several key reasons why we expect this junior gold stock will greatly reward investors:

- Unknown-to-Known Catalyst: Often times in junior resource investing, one of the best places to invest is in a newly-launched company that starts off with an existing, high-quality property. The 40-fold share price rise depicted in the chart above was exactly that. Not many investors were originally aware of the company, but as the gold and silver prices rose in 2016, investors began to seek out high-quality junior gold investment opportunities. Investors then poured into the stock pushing its share price up 40-fold. Our top junior gold stock just went public in 2017 and has not yet been discovered by the broader investment community. As soon as more investors become aware of our top gold company and compare its assets relative to its market capitalization, we expect a steep share price appreciation. Investors who take positions in this company now should greatly profit from this coming catalyst.

- Large, Proven Resource: Our top junior gold stock already possesses a proven resource of 81.3 MILLION ounce of silver and 755,000 ounces of gold at its flagship property. At a silver/gold ratio of 70:1 the resource estimate can be recast as 1.92 MILLION equivalent ounces of gold or 134.2 MILLION equivalent ounces of silver. Once you discover this company’s market cap relative to the resource it possesses, you will truly be astonished at the extreme value proposition it affords the investor.

- Cheapest Gold on the Market: When you divide a junior gold company’s market capitalization by the number of ounces of proven gold in the ground it possess, you would be hard-pressed to find a better value than our top junior gold stock. Peers of our top junior gold company are trading at about $28/ounce of gold in the ground, while our company is trading at a jaw-dropping $6/ounce of gold in the ground! Not only is that astonishing, but there are also many gold exploration companies with ZERO proven ounces of gold that are trading at a higher market capitalization than our top gold pick. Some of these explorers with NO proven gold in the ground are trading at multiples of our favorite junior gold company’s market capitalization.

- Resource Expansion Potential: Our top junior gold pick is currently undergoing drilling on its flagship property to expand its existing gold/silver resource. Past exploration of the property has already identified nine mineral occurrences and there are numerous open-ended resource targets that are expected to hold silver/gold mineralization. The potential for an even larger proven gold/silver resource is great and will push the share price higher.

- Near-Term Production Catalyst: In the extractive resource industry, one of the places of greatest share price appreciation consistently occurs right before and as a mining company brings its first mine into production. Our top junior gold company is quickly progressing towards this goal of beginning production as it is currently undergoing professional engineering, geological, and financial studies to determine how to most profitably build a mine out of its existing silver/gold deposit and begin production. Investors taking a position in this company now still have this huge catalyst ahead of them.

- Huge “Blue Sky” Exploration Potential: In addition to the company’s proven resource on its flagship property, our top gold company also owns three other exciting porphyry Copper-Gold-Molybdenum projects that offer true “blue sky” exploration potential. This is icing on the cake for an already undervalued asset. This exploration potential can potentially produce untold returns for the investor.

- Proven Management Team with a lot of “Skin in the Game”: Our top junior gold stock pick is run by a skilled, competent management team that has decades of experience and success in the mining industry and in the specific jurisdiction of the company’s properties. Management also has a lot of “skin in the game” as it owns 12.3% of the company. That means the management’s goals are aligned with the company’s investors. The management team will become rich, not through salaries, but rather only as they make their investors rich through share price appreciation.

Sign up for our free e-letter to learn the name of this company and to receive a complete company report!

This Junior Miner is Potentially the Most Undervalued Gold Stock on the Market

Simply sign up for our free e-letter and receive the complete company report

As a subscriber to our e-letter you will also receive periodic, valuable emails containing:

- Educational articles regarding how to profit through natural resource investing

- Interview summaries and transcripts from the numerous natural resource investment professionals we exclusively interview

- Stock profiles of undervalued junior mining companies that we expect to rise in share price.

- Commentaries regarding trends and profit opportunities resource investors should be aware of

Don’t miss out on the coming gold rush!

World-famous resource investor Doug Casey, who has already made a fortune via investing in junior gold stocks, says he sees a future coming rush into gold stocks that will greatly surpass anything he’s profited from thus far. Because the gold and silver sector is relatively small compared to the broader equities markets, when investors desire to pour into the gold market it will cause the price of gold and the gold equities to rise exponentially. Casey has described this coming gold rush like trying to force the contents of Hoover Dam through garden hose. The torrent of this coming gold rush will send gold equities skyrocketing!

There are few investment opportunities that offer as much upside potential as gold and silver stocks. And we think we’ve found the junior gold stock that can outperform them all! Enter your email below to receive the complete company profile of our top gold/silver junior mining stock pick!

This Silver & Gold Junior Mining Company has Extreme Return Potential!

Simply sign up for our free e-letter and receive the complete company report

NO-SPAM COMMITMENT & DISCLAIMER: We will NEVER sell or give away your email address for any reason. Unsubscribing from your Mining Stock Education e-letter subscription is simple and easy. If the Mining Stock Education e-letter does not meet your needs, simply click at the bottom of one of our emails to unsubscribe. The content produced by Mining Stock Education is not personalized investment advice. Our writers strive to give wise and relevant commentary and investment ideas but are not licensed to address or provide advice on your particular individual investment situations. Nothing you receive from Mining Stock Education should be considered personal investment advice. It is for informational purposes only. Any potential investment ideas presented by Mining Stock Education should only be made after consulting with your investment advisor and only after reviewing the prospectus and financial statements of the company. Mining stocks are inherently risky. You could multiple your investment several times over or you may lose all of your capital invested. We usually hold equity positions in or are compensated by companies we feature and therefore we are biased. Use the ideas presented by Mining Stock Education as a starting point to carry out your own personal due diligence. Its your money so be careful and wise.