Luke Norman, Co-Founder of U.S. Gold Corp., Discusses the Company’s Pursuit of Nevada’s Next Major Gold Discovery & 2019 Plans

In this interview, U.S. Gold Corp.’s co-founder Luke Norman discusses how the company was able to obtain the Keystone project in Nevada and explains why Dave Mathewson, VP of U.S. Gold Corp.’s exploration program and one of Nevada’s most successful exploration geologists, calls Keystone “the best exploration project I have seen in my career.” Luke also shares regarding the 2019 plans and catalysts for the Keystone and Copper King projects.

Luke Norman is a seasoned mining executive and company builder. Luke possesses over 15 years of experience in the venture capital markets and has been responsible for direct capital raises in excess of $300 million. He also co-founded Gold Standard Ventures, which went from a $15 million to a $1 billion market cap due to a Nevada gold discovery.

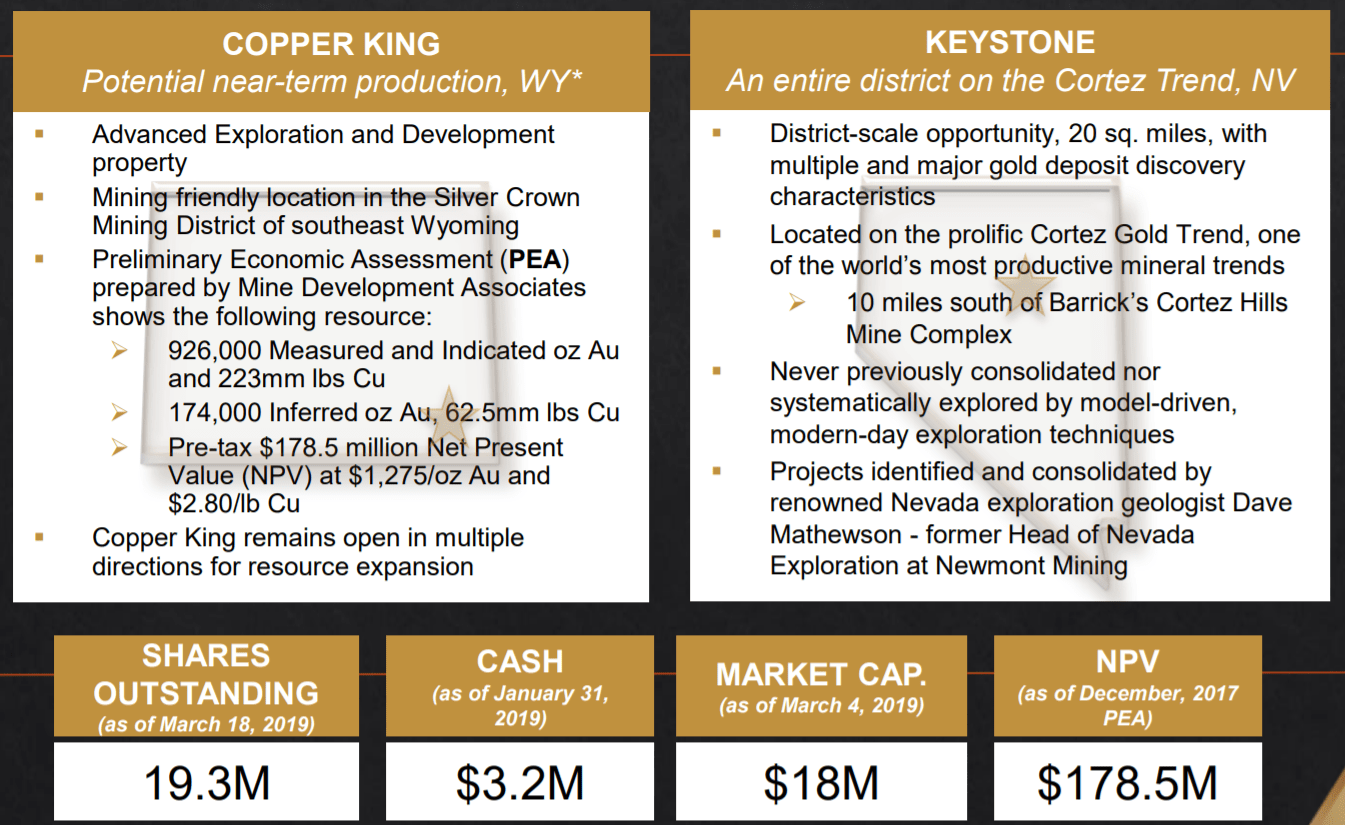

U.S. Gold Corp. (NASDAQ:USAU) is a U.S. focused gold exploration and development company advancing high potential projects in Nevada and Wyoming. The company is advancing the Copper King project towards production in Wyoming and has consolidated an entire district on Nevada’s productive Cortez Trend. U.S. Gold Corp. has assembled a team of renowned explorers and prolific company builders and remains well financed with a tight share structure.

0:05 Introduction

1:55 Luke Norman’s background and past mining success

5:50 How did USAU acquire the Keystone project?

8:45 Did Placer Dome previously explore Keystone?

10:20 Why does Keystone have great potential for a major discovery?

13:52 Key catalysts and plans for Keystone in 2019

20:57 How long might it take for a discovery at Keystone?

24:20 Past Nevada gold discoveries as potential comparables to Keystone

27:40 Discussing the Copper King project in Wyoming

BEIGN TRANSCRIPT:

Bill: You are listening to Mining Stock Education. Thanks for tuning in. I’m Bill Powers, your host. Well, today we’re going to be talking about a company that I’m invested in, that being U.S. Gold Corp. which is also a sponsor of this show. Last year you might remember if you’re an avid follower, that I interviewed Dave Mathewson, who is the lead geologist for U.S. Gold Corp. I found out that that was a very popular interview, especially with geologists. I happened to be in the subway in Vancouver last summer when I was going to the Sprott Conference and began chatting with the geologist next to me on the subway, and he referenced the recent interview with Dave Mathewson, which he really liked because he was a geologist himself. Dave leads up the exploration for U.S. Gold Corp. and has an excellent reputation in the industry and among geologists because he has been a key factor and a leader in finding many million ounces of gold there in Nevada.

Well, I’m not speaking with Dave Mathewson today. I will be speaking with Luke Norman, a very successful mining entrepreneur. He’s a seasoned mining executive and business builder. Luke has over 15 years experience in the venture capital markets, and he’s been responsible for direct capital raises in excess of $300 million. He’s also the co-founder of a successful company, Gold Standard Ventures, which was listed on the TSX-V and NYSE American. And through discovery, he led that company from a 15 million dollar market cap all the way up to a billion dollar market cap Canadian. With that being said, Luke, thanks for coming on the show and joining me today.

Luke: Thank you, Bill.

Bill: For those that don’t know your background,speak a little more about your pedigree and the success you had in particular with Gold Standard Ventures in Nevada?

Luke: My pedigree, as you’ve put it, I started out with a very keen interest in the late nineties actually, in the gold exploration space. I just felt that there was going to be a lot of follow through from what was happening in the tech space. I thought the capital would start to open back up into the gold mining space. Of course, you have to remember back to 1997 when the Bre-X scandal occurred it really had wiped out the miners, had a horrible effect on the gold investment space and sector overall. So I felt that that was a bottom situation and that was a good time to get involved. So in the late nineties, I looked to fund a small junior, I went and met with several brokers around North America, and one in particular in Vancouver, Canada, his name’s Ian Gordon or is Ian Gordon. He was very active investor in the space at the time and he said, look, I’ll help fund your junior, but you have to quit that company and come and work with me.

So in the late nineties and early 2000s, he and I went on a program of tracking down new investors, in particular institutional investors in the space, and we introduced them to new early stage opportunities in the gold exploration and development space in particular. From there, I recognized very quickly that we were raising a lot of money for a lot of companies, but a lot of those companies weren’t meeting their milestones, they weren’t achieving the things that they would profess there’d be achieving in these meetings. And very quickly, I recognized that management was a very key ingredient to the success of these juniors. So the old adage of, you want it done right, do it yourself, I moved from funding other people’s opportunities to funding opportunities that I felt were worthy of time and effort, but got more involved in the managemental side and helping structure these. So that morphed into a really keen interest in one project in particular, it was tied up in a junior, and that project was called the Railroad Gold Project. It was on the Carlin Trend in Nevada.

So I focused about five years of my time acquiring that project and then myself, Dave Mathewson and Jonathan Awde, who’s still the CEO over at Gold Standard Ventures today, began what is now Gold Standard Ventures. We had a really, really tough road with that company because of course we were founding it and trying to fund it through the ’08 and ’09 meltdown that was occurring in the US. So capital was very, very scarce at the time, especially for junior explorers. But we managed to put that company together, and as you mentioned, there was about a 15 million dollar market cap when we began. But we realized these opportunities, that is a district scale opportunity on a major gold trend in Nevada, can really have huge impact on you as a company and on you as an individual if you can get into a discovery there. Gold Standard was one of the successful companies, I think probably the most analogous to what we’re going to discuss today.

Bill: Like at Gold Standard, you’re working with Dave Mathewson again, and Dave had said that that Railroad project is excellent as it was. Your current project Keystone, he said is like Railroad on steroids and it’s the best exploration project that he’s seen in his career. Before we talk about the specifics of it, can you talk about how you actually went about acquiring this project?

Luke: It’s quite a process in Nevada because you’ve got hundreds of years of underlying owners and claims within any district like that where you have the legal obligation to track down all those owners and essentially cut a deal with them. And if you don’t, you end up with holes and key sections of the project that you make a discovery and those holes become very, very, very valuable or can be very, what we’ll call nuisance claims, to the future development of a project like that. So you really have to take your time and spend a lot of money on your diligence to make sure that you have encapsulated all of the ownership within the key sections of what you deem to be that district before you can proceed. So with Railroad there had been being years and years of work prior to us going into the project.

The original owner of the Railroad project, for 40 years, he had owned the center of that project, but over time he had lost key sections of it off to different companies just because of the expense of being a private owner of a big land package like that. You have Bureau of Land Management payments every September of every year. But that can be very hard on an underlying owner. So we were cognizant of that. We cut a deal with his family, he had passed away, and then began the work on surrounding owners. So it was even more of a process actually at Keystone and Dave Mathewson completely, was at the helm of that ship in regard to trying to get the Keystone district and it was about a 25 year process for him.

So he owned key sections within Keystone, but the bulk of Keystone was actually owned by a company called Placer Dome. And Placer Dome, of course, ended up being taken out by Barrick in 2007 because of the Cortez hills discovery. So 25 year process, but we think well with the effort.

Bill: So Dave Mathewson obviously saw something that he wanted in Keystone, but for those with maybe a little more skeptical perspective, they might say, “Well, didn’t Placer Dome already explored this already?” What would be your response to that?

Luke: Placer Dome, according to all our records that we see, did not put in a very extensive exploration focus towards it. Cortez Hills was the most common sense one for them to focus on because they already had the Cortez mine, they head Pipeline, both of those projects are about 10 miles north of us. And their additional land holdings off of those two mines spread to the south and they recognized very early on that they had the right setting, they had all the right rocks, they obviously already had two very significant gold deposits, that they would start looking along the structural corridor that is within the Cortez mine and start looking for offshoot mineral deposits.

What they ended up finding was probably the heart of that district in the Cortez Hills deposit. I mean, it’s a known 25 million ounce deposit today and there are estimates by outsiders, Barrick doesn’t do a lot of disclosure in that regard from my view anyway, I could be wrong, but that there’s a lot more upside to that. And then beyond the Cortez Hills deposit, of course, they’ve now made four or five other significant discoveries within that land package.

Bill: When Dave Mathewson and you look at Keystone, what are some of the features that makes this so prospective?

Luke: Well, we’ll go back to Dave’s quote about it being “Railroad on steroids.” What you look for, these districts, how they’re generated is, 30 plus million years ago, it was a very active geological area. You had magma bodies that were pushing up through the bottom of the earth’s crust, through these big cracks such as what’s known as the Carlin Trend. A way to our northwest of course, was a 50 mile long crack in the earth’s crust. It allowed magma to seep up through that crack. And in doing so, that magma forced lower plate rocks that are usually thousands and thousands of feet deep, forced them up towards the surface and then ultimately infused those rocks with gold deposits. So all along the Carlin Trend, there’s four windows known on the Carlin Trend, and Railroad and Gold Standard Ventures, of courses, is one of those.

Well, on the Cortez Trend, it’s an identical type of setting. You’ve had this crack in the earth’s crust. It allowed this magma to force these domal uplifts of lower plate rocks. So what Dave’s referring to when he says he feels that Keystone is “Railroad on steroids”, that’s due to the fact that at Railroad we were hunting one particular limestone lower plate rock formation known as devil’s gate limestone, that exists throughout the project. But ultimately, it’s about a 200 to 300 foot formation of limestone that you hope to intercept somewhere close to a fluid bearing structure and look for gold deposit within those key areas. Well, at Keystone we have stacked formations similar to that ilk of rock that devil’s gate type limestone environment, but to the tune of thousands of feet of stacked limestones.

So when you get into the right structure, hopefully the right fluid bearing structure, you’ve got four or five different candidates of host rock within your stratigraphy that any or all of them could be permissive host of a gold deposit. So you are looking for massive swaths of gold within an environment like that. And the other thing that that was pretty prevalent to us at Keystone that we’d have since proven with some of the work we’ve done, both through our drilling and some theses is done by graduate students, et cetera, is that not only was there just one magma source that fed the Keystone district that we own, but there was as many as five intrusives. And we believe that over three different periods, there was activity within those intrusives that could have led, any one of those pulses, could have led to a really significant gold deposits. You’ve got three kicks at the can as it were in terms of the intrusive interaction within these lower plates that have been brought up close to surface so that we can economically, viably explore them. And then ultimately, hopefully once we get into a deposit, develop them.

Bill: So, where are we at this year in 2019? What are some of the key catalysts and when will you bring in the truth machine out to Keystone to test some of these theses?

Luke: Well, we’ve had the truth machine obviously on the project for about 18 months, but it’s a very, very strict model-driven approach to this style of exploration. A junior can blow their brains out drilling holes, willy-nilly all over a 20 square mile project like this because these gold deposits are not massive and in their footprint, and I’ll touch on that in a bit, they’re actually quite contained, especially in the Cortez Hills type environment, the deposit the way are looking for.

These are actually plumes of feeder essentially where you’ve had a very enriched zone of fluids being forced directly up through these rocks along a fault. So they’re contained and relatively small in size Cortez hills, as I said, 25 million plus ounces is actually about a 500 foot diameter plume of brecciation that contains that gold mineralization. So you could spend tens upon tens of millions of dollars and not necessarily make a discovery if you went in there and just drilled on by gut or by a potluck type approach. Instead, what we have to do is we do very extensive, initially we did scout drilling, the scout drilling was just to tell us, is it even worth going about all the other methods we need to do to find a gold deposit?

But the scout drilling was key for us to understand, what is the stratigraphy, or what are these stacked up rock hosts hopefully, that exist on the project or don’t exist on the project? So we basically took a four corners approach with a scout drilling program that is drill each four corners of the project and then drill some areas within the center of the project and get a feeling for what we’re dealing with with rock type. So we spent quite a bit of time and money, even pre-going public, just understanding what is our environment, what kind of rock host do we have? And we’re really excited obviously, as you’ve heard through Dave’s analogy, with what we found through that process. So then you still take a real step back and you have to think, “Right, well how does this all tie together?”

How are we going to find within this correct stacked host environment, how are we going to find the hot spots of where mineralization should occur? And that’s a combination of geophysics, and our prime use of geophysics is what’s known as gravity. We look for differences in rock densities over thousands of points of electrical interaction. Basically sending pulses down through the rocks and they’re measured back to the ground station in nano seconds. You look for differences within the timing of those returns. And ultimately if you’ve got a lineal passageway whereby 20 feet to your left you’re getting a certain signature back, and 20 feet over to your right you’re getting a different signature, one can assume that that’s two different densities of rock. That being, you have some fault and either a down drop or an uplift and that fault is usually a fluid conduit.

So we look for all these structures, we spend a lot of time doing that, we’re still performing gravity on the project today to tighten up that understanding. So we look for structural corridors or a fluid corridors and conduits and then geochemistry. At surface, we do thousands upon thousands of essay samples with rocks and soils. And we’re looking for indications of these gold deposits because the gold is locked up very tightly in these gold deposits. But there are transient pathfinder minerals within them such as arsenic and antimony and barite and different things that do leach out of the deposits. But you can find them enriched in the soils and the rocks up and away from the main deposit. So what you want to look for is enriched areas of pathfinder minerals overlaid by some structural corridor rolling through and now you know that you near to what could be a very hot spot and a high probability target area for a gold deposit.

Bill: So will there be reverse circulation drilling later this year to test some of these targets?

Luke: Yes, there will. Because one thing that I think possibly was a little bit of frustration for our early stage investors is part of this process, when you own a 20 square mile project in Nevada, when you own it through lease, but ultimately the Bureau of Land Management have control of that area of land in terms of what you can or cannot do without being properly bonded and properly set up and having all the right environmental assessments and archaeological studies, is you have to compile all of that information and send it off to the BLM, and they then evaluate whether you can go on and do an extensive exploration program. If you’ve got all sorts of archeological finds and if you have some protected animal environment or any of these things that can occur in that part of the world, they don’t want you to serving those areas and you’re pretty much hamstrung and you can’t go and explore and you can’t develop.

So that was about a two and a half year process for us to compile all that information and get it over to the BLM and then await their approval. So the little bit of exploration work we did, the little bit of drilling we did was in areas where we could get approvals for slight disturbances on the project. Then thankfully at the tail end of September of last year, which is unfortunately right towards the end of our drilling season, but we were finally given full approval by the BLM through what they call a plan of operation to now be more aggressive with our exploration undertaking. That is, we can start to put in roads into key target areas that we really wanted to explore. We really wanted to drill test, but we just didn’t have the permitting to do so at the time. So it’s a big undertaking, but very happy to report that we do have that in hand now.

Bill: It’s crucial as early stage gold speculators that we understand these timeframes. Otherwise, we can get frustrated quite quickly. When you were at the helm of Gold Standard Ventures, what was the timeframe from when you started to explore to when you actually made that first big discovery hole?

Luke: Well, I better correct you there because I’ve never officially been at the helm of Gold Standard. I was very much joined at the helm in terms of my involvement to build the company to bring the asset to the company, et cetera. But at the helm certainly was held by, of course, CEO and the directors and managers of the company. I remained actually with Gold Standard very similar role to what I have with U.S. Gold Corp. today, which was a co-founder of the company.

I made the push to acquire the asset. I used my capital at the time to acquire the Railroad Project. I funded the company, I helped market the company, I helped bring in key sections of the company such as the Pinion sections of Railroad, which is now the real value driver over at Gold Standard. And likewise, at U.S. Gold Corp., that’s my involvement. I was pivotal to obviously raising the capital, bringing in the Keystone project alongside Dave Mathewson. Dave Mathewson is the one person who deserves all the credit for tying together the Keystone district. I think maybe comparatively over at Railroad, myself and John Awde probably wore that crown for tying together that district. So my role within the company has been to bring all of the key ingredients together, which is the right project, the right management and the funding, the capital, all important capital.

But the one key difference I think between what we’re trying to achieve here at U..S Gold Corp. to maybe Gold Standard is, with Gold Standard we were, as I mentioned earlier, we were going through the ’08, ’09 down cycle. We went through another down cycle through 2012, ’13, ’14. So it was a very, very dilutive process for all of us. I have to laugh when I get shareholders yelling at me about dilution within the company. Nobody wants to dilute less than I, when I’ve cut the hide checks at the beginning when no one wants to check. The last thing I want to do is watch my percentage ownership in the company just get smashed. So we’ve been very cognizant of that at US Gold and that’s why we have such an amazing share structure today.

Only 17.8 million shares out compared to well, over 300 million I believe, now with Gold Standard. So we’re cognizant of that. We want to keep a very, very tight share structure because when we do get into discovery, you’re going to see fireworks and that’s going to be huge return for shareholders because of that tight share structure versus a very diluted share structure. It seems to move the market capitalization abruptly, but on a per share basis, you’re left scratching your head going, well, that wasn’t the return I was hoping for.

Bill: Could you give us some comparables of Nevada gold discoveries in recent years that maybe in your mind, you’re comparing the potential of Keystone to?

Luke: Yeah. Again, of course we’ve got a point to Gold Standard, that’s the obvious one. Market cap wise, you saw a $15 million shift to near a billion dollars Canadian at one point in time, but in the share price shift, that’s literally the stock going from around 50 cents to around about four dollars high. So what’s that, 800% multiple or so? I think the best example probably because their share structure’s a bit better, but more importantly, I had the luck of just great market timing, would be Fronteer Gold. And Fronteer gold co-owned a project called Long Canyon. They got into a really nifty discovery in a new district quiet far west, about 60 or 80 miles west of the Carlin Trend. And through that discovery, very early into that discovery, all the majors started showing a lot of interest.

So there was a very competitive environment in Nevada. Everybody wants into Nevada. You’ve seen Barrick with trying to divest out of Nevada previously with what I did down in Argentina/Chile where spent close to nine billion dollars developing an ore body down there only to basically turn around and walk away. People recognize now that the best jurisdiction on the planet to own a gold mine, to be in production is Nevada. So because of that, discoveries lead to these very, very big premiums. So the Fronteer gold discovery ended up becoming a 2.3 billion dollar takeover of that junior. That was, I think a 10 or 12 dollar stock by the time that was taken out by Newmont, from around a 30 cent share price when they first started exploring it.

That was the returns we’re all looking for really. We want that lottery ticket for a big return. And that’s what I think the style of district we have in Keystone would tie very nicely to those massive returns if we get into discovery. Because you own the entire district, which means a big mining company can come in, they can develop, but they can also make sure that no one’s on their heels. They can find additional deposits and any infrastructure that they already own within that larger jurisdiction can come into play and really cut down their capital costs. So Newmont, Barrick absolutely, but we’ve seen the amount of investment that Goldcorp has put into the juniors in Nevada lately, we know that Goldcorp was trying to align itself, obviously with Newmont to some degree. There is a multitude of mining companies, gold mining companies, in particular that really won inroads into Nevada. So discovery on a project like Keystone would be lights out for US Gold.

Bill: Yes. Keystone truly offers the blue sky potential. But one of the things I like about U.S. Gold Corp. is that you also have fundamental value established in the company already in your Copper King project. But before we talk about Copper King, I just want to mention for those that don’t know, U.S. Gold Corp. trades on the Nasdaq, which is very unique for gold exploration company to be trading on the big board there under the ticker USAU and it’s an extremely tight share structure. Right now, only 19.3 million shares out with a market cap about $17 million the day we’re recording this interview. Copper King is in Wyoming. There’s already a preliminary economic assessment done on this that net present value comes in at $178.5 million. I did the math, just some rough calculations this morning, Luke, and the current valuation per share, your shares are trading at about 1/11th of that NPV. Would you say that’s an undervalued right now?

Luke: I always caution myself about saying, what is or isn’t undervalued or reasonably valued because the argument of course back to you is always, well, the market’s never wrong. But statistically and comparatively to our peer group, that asset is trading at a far rated discount than anything that there is. I invite your listeners to please go to our website, which is www.USGoldCorp.gold. There is a very good presentation that shows some of those comparables and some of the valuation metrics that are used on some of our peer group. And yeah, I think that it’s grossly mispriced within even this gold environment right now. I think, as you said, we’ve got just over about a 17 or 18 million dollar market cap, maybe not even right now with an asset like that. It’s a real meat and potatoes foundation asset that’s sitting in their company right now and valued where it is. Yeah, there’s a real proposition for, I’d say more upside than downside. How about we put it that way?

Bill: And your inputs for the preliminary economic assessment there, you used $,1275 gold in $2.80 copper. And as we record this interview, gold’s at $1,315 and copper is at $2.88. So, that NPV obviously would be higher with those inputs.

Luke: I was going to say this, some other inputs as well that we’re working feverishly on in the background, that we feel that could really adjust those numbers too. And that is previous work done on the project that a lot of those drill holes we used full this PEA weren’t assayed for some key minerals that are locked in that mineral deposits such as a silver and zinc for example. And we think there’s about a 30% under-valuation on the per ton rock within the Copper King deposit. We think that those credits, because they are not included in the PEA, probably have that rock price about a 30% discount to it.

And also in addition to that, we conducted a small drilling program, that is all we had to do last year, just to test some of the lateral boundaries of the deposit. That is, is the deposit fully drilled or is there upside to it? And low behold, we found some great step out drill holes that would fit in nicely to the core of this deposit in terms of from a production profile. So we think that there’s probably at least 30 to 50 percent upside to the deposit in terms of its size. And again, significant additional value to unassayed inputs.

Bill: How does the state of Wyoming feel about this project?

Luke: Look, the feedback we’ve got is almost to the point of them pushing us towards a development decision. They need the employment, they want the employment of course. The other beauty of Wyoming, I will add as well is, it’s actually state-run or state-controlled these mining situations that being that it’s not federally run by the Bureau of Land Management. Within the state of Wyoming, these decisions are made. So we’ve been getting all the right language from the state of Wyoming for us to be able to go ahead and advance this project. Obviously, there’s a lot of permitting similar to that plan of operation that we are to take care of in Nevada through mine permitting process. It would be even more extensive at Copper King, but the typical environmental impact studies, archaeological studies, et cetera. But, all in all, we’ve had great feedback from the state of Wyoming and even an indication from them that they would be interested in helping fund the capex of putting this into production. So for them, it’s just a plus, plus.

Bill: In Wyoming, isn’t there less federal regulation in terms of permitting mines? Don’t you deal more with the state than the federal government in that jurisdiction?

Luke: Yeah. Exactly. I was leaning towards that but just went off on a tangent. But absolutely. Instead of dealing with the Bureau of Land Management, we would be dealing with the state government and again, they’re pretty proactive. They want to see development, they want to see advancement, they want to see employment. It would be a great poster child for them, Wyoming to have another mine in production. There was a lot of coal production in Wyoming back in the day. There’s still is coal production in Wyoming, but they want to see some general interests from explorers and developers, and they want to see that infrastructure, and they want to see their state flourish. They want to be a producer.

Bill: As I mentioned at the outset, I own shares in U.S. Gold Corp. and want to see it succeed. It’s also sponsor of this show. To learn more, you can go to USGoldCorp.gold. U.S. Gold Corp. trades on the Nasdaq, which again, is very unique for a junior exploration company. The ticker there is USAU. Luke, as we conclude, is there anything else investor should be aware of a with U.S. Gold Corp. in 2019?

Luke: Well, we are working a lot of things behind the scenes, which I’d love to share with you all, but of course, that’s not how we work in a very regulated exchange environment. We need to obviously execute and make things public as they come along. But our plan of attack is we’ve achieved a huge amount of things over at Keystone that being, of course, really understanding the stratigraphy, the lithology, which is also the aging of the rocks and the aging of these systems. We’ve done more and extensive geophysics and geochemistry. We feel that we’ve got two or three high prime candidate targets. Look, a term we used to use a lot at Gold Standard was a halo. You know, you’re on the halo of a gold system. You’re on the halo of deposit. We really feel like we’ve just drilled right close to or on the edge of some really significant systems.

There’s been anomalous gold throughout almost all the holes on the project, which is very key because if there wasn’t gold in the system, looking for a gold deposit would be very challenging. So look, for follow-up drilling at Keystone, look for us to obviously look to advance Copper King because look, when we bring that through permitting, which is a relatively inexpensive undertaking for us as a small company, but as we bring it through permitting, every milestone that we made through that permitting process is going to add huge amounts of value to that deposit from the viewpoint of, hey, if US Gold doesn’t have the cash in its genes to go about developing the project on its own. Well, other than obviously as I mentioned, interest from the state of Wyoming, there are a lot of interested parties, mid-tier producers, copper and gold producers who would love to team up on a project like this. It would minimize dilution for us as a company. So there’s a slew of different opportunities for us in 2019 that we’re exploring, but a lot of catalysts I feel can really add value to us in a hurry here in this oncoming drilling season.

Bill: Luke, I appreciate you coming on the show and giving us an update, and I look forward to touching base and bringing you back on over the course of 2019 to give us updates.

Luke: Yeah, I look forward to it too, Bill. There’s so much more to discuss, so anytime. Thank you and thank you to your listeners for taking the time today.