Rick Van Nieuwenhuyse | Our Copper Project Has Just $0.15/lb Cash Cost, While Worldwide Average is $1.60/lb

Trilogy Metals is advancing two high-grade, copper-dominant, polymetallic projects in Alaska’s Ambler mining district. The Arctic project’s pre-feasibility study shows an after-tax US$1.4B NPV with a 33% IRR at $3/lb copper and an 8% discount rate. It has a 43Mmt open pit reserve grading 5% copper-equivalent and its cash costs, net of by-product credits, is only $0.15/lb. The Bornite project already has 6 billion lbs copper and 77 million lbs cobalt while exploration is still ongoing. Trilogy Metals is facing numerous potential catalysts over the next year.

Rick Van Nieuwenhuyse is the President and CEO of Trilogy Metals. He has over 40 years of experience in the natural resource sector, including his role as founder, president, and CEO of NOVAGOLD where he led a team that discovered the 40 million ounce Donlin gold deposit in Alaska. Prior to founding NOVAGOLD, Rick was the Vice President of Exploration for Placer Dome Inc. from 1990 to 1997. He possesses years of working experience in and knowledge of Alaska and has managed projects from grassroots discovery to advanced feasibility studies, production, and closure.

TSX & NYSE American: TMQ www.TrilogyMetals.com

Arctic PFS Overview Video: https://player.vimeo.com/video/298282187

0:05 Introduction

2:01 Rick Van Nieuwenhuyse’s background and previous success

4:31 Trilogy’s share structure and who owns the shares

5:40 Trilogy’s burn rate and how the company is funded (South32 partnership)

7:56 Why Trilogy investors are protected against share dilution

9:04 Background on Trilogy’s partner South32

11:05 Trilogy’s liquidation value relative to its market cap

12:14 Overview of the Arctic project’s PFS

17:04 Overview of the Bornite project

20:03 Trilogy’s projects and the environment and native partnerships

21:44 Update on the Environmental Impact Statement for the proposed road

23:45 Upcoming catalysts for Trilogy

TRANSCRIPT:

Bill: You have had much success in Alaska. In fact, I was listening to a recent interview that Rick Rule did with you, and Rick actually commended you and said for the last two decades you’ve made him and his clients a lot of money. How were you able to do that? What company were you working with, and talk about some of your success in Alaska so far.

Rick: Yeah. I’m an exploration geologist by background, and I had worked many years for the major companies, and ended my career with the majors working for Placer Dome as a VP-Exploration. I formed my own company after Placer. I called it NOVAGOLD, and we ended up making a huge gold discovery in Alaska called the Donlin Gold Project. It contains about 40 million ounces of gold, and we’ve managed to move that project all the way through getting our federal permits just recently here.

Very proud of that one. We formed a 50/50 partnership with Barrick Gold. A lot of history and a lot of ups and downs, of course, over that 20-year period, but it’s a 50/50 joint venture with Barrick Gold now, and with permits in hand and looking at building what will probably be one of the largest goldmines in the world when the price of gold gets in a better mood. That’s the history with NOVAGOLD, and of course we spun Trilogy Metals out of NOVAGOLD. Myself being an exploration geologist, me and my team basically came over to Trilogy to work on the Ambler assets, which we now call the Upper Kobuk Mineral Projects. That’s the short history of where we’ve come from.

Bill: And you’re from Alaska originally, aren’t you?

Rick: Yeah, I grew up in Alaska. I’m actually born in Belgium, but grew up in Alaska. I’ve worked all over the world. When I was VP-Exploration for Placer Dome, I literally was in charge of Africa and Asia, so I’ve certainly traveled around the world a lot and got to understand how to do business with lots of different groups. But always had a soft spot in my heart for Alaska, and so we went back up there with NOVAGOLD and now Trilogy, developing what I think is going to be a world class mining district, not just a single property but a whole district.

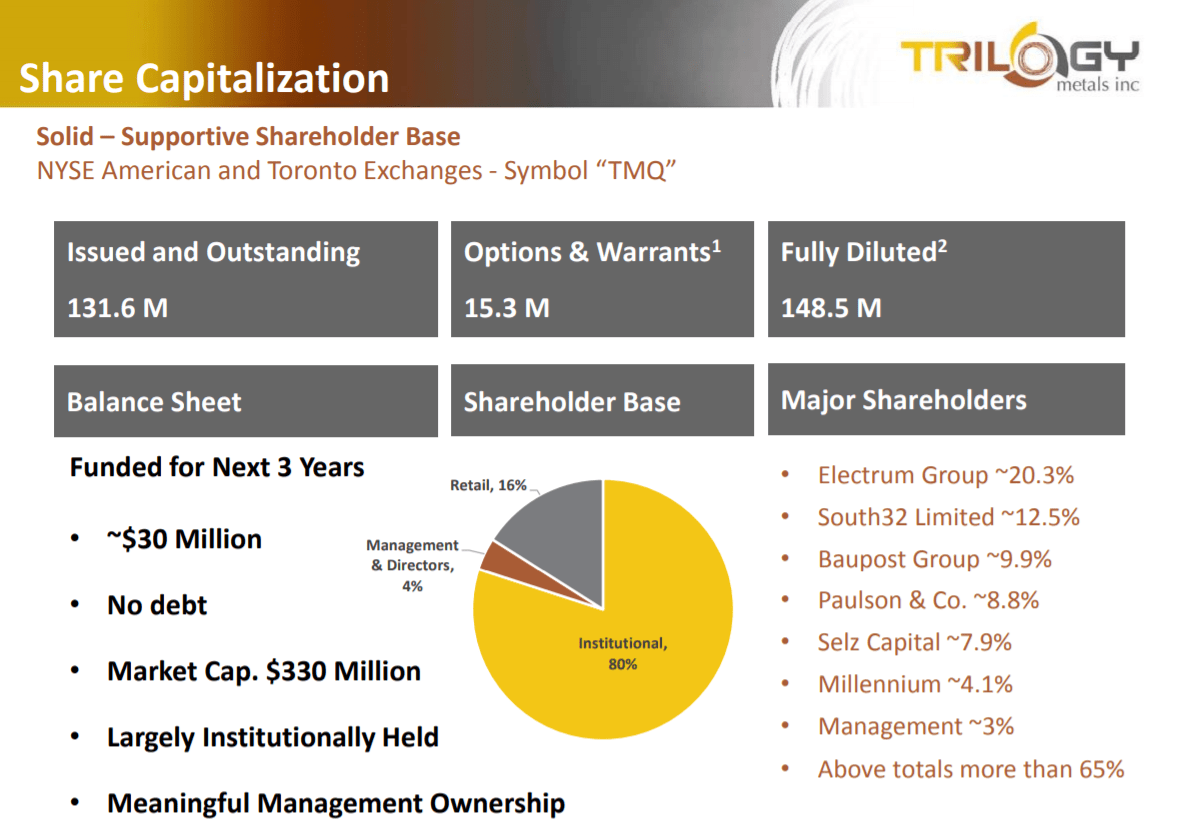

Bill: Let’s talk about your share structure. You have a very strong institutional backing. Can you give listeners an overview of the share structure and who owns the shares?

Rick: Yeah, roughly 135 million outstanding shares, traded in New York and Toronto under TMQ, as you mentioned. We are probably about 70% institutionally-held. Mostly New York funds, some in London and some in Hong Kong. Not much in Canada. About 5% is held by management and directors, with myself owning about 3% of that. And these are shares that I bought in the market. Because these were spin-out shares from NOVAGOLD, of course, I got some of my position from my position in NOVAGOLD, but then I’ve also purchased in the market. About a year and a half ago, I purchased about a million and a half shares in the market. These weren’t gifted or anything like that. We feel well compensated, and we’ve got a strong management team that certainly is well motivated.

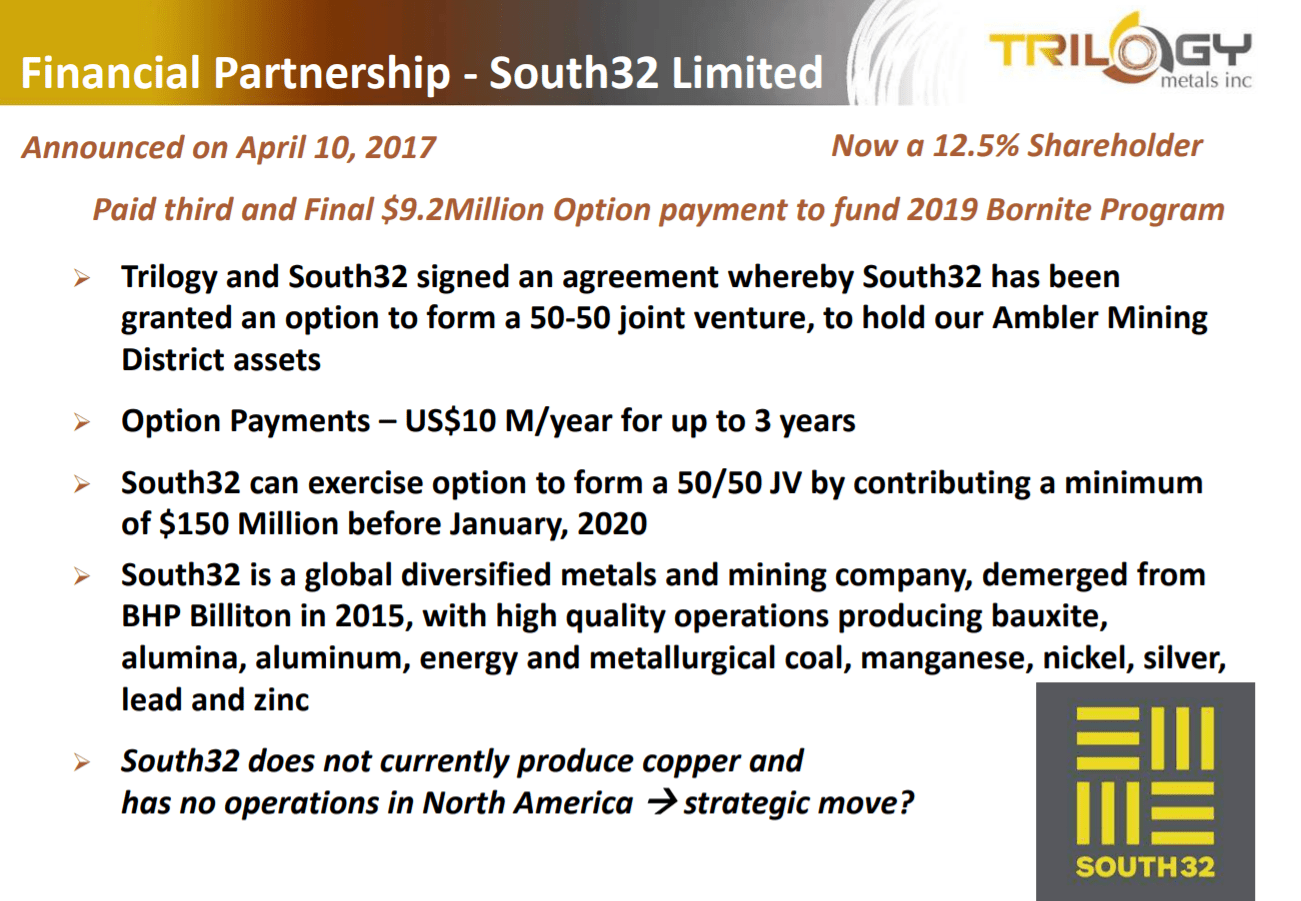

Bill: Let’s talk about your burn rate and how you’re funded. I guess we could start, a good way to do that would be to talk about your partnership with South32?

Rick: Yeah. High level, we’ve got US$30 million of cash in the bank today. We have $10 million, these are all US numbers, $10 million of warrants that are deeply in the money, so those will be exercised sometime between now and July. Early July is when they expire. So that brings you another $10 million. We are spending South32’s money on our $10 million Bornite exploration program. We’ve got sort of three projects we’re working on right now, all in the same area, but we subdivide them.

Bornite is where we’re doing the largest exploration program, roughly a $10 million program. That’s being funded by South32. And then at Arctic, which is the most advanced project, it’s one we’re working on the feasibility on right now, and it’s $7 million to complete the feasibility study by February 2020. That we are funding, so that comes out of the $30 million. And then we’ve got a joint district exploration program that we’ve funded 50/50 with South32 on exploring the rest of the Ambler District. The exploration program there starts with a helicopter survey, electromagnetic survey, which we’re just completing now. Should be completed by the middle of next week, probably. And then we’ll follow it up with a drilling program.

If I kind of add up all the numbers of pluses and minuses, we’ll end the year with probably somewhere in the $23 to $24 million in the bank neighborhood. And of course, at the end of the year, South32 has to make up their mind on an option to form a 50/50 joint venture with us by contributing $150 million, plus matching what we spend at Arctic. So we don’t need to raise any cash until we decide to build a mine.

Bill: There’s a lot of protection against the downside of dilution that investors always worry about.

Rick: Exactly. We don’t really have a need for any additional money. On the assumption that South32 exercises their option, which frankly I can’t believe that they won’t, then the $150 million is more than enough money to complete the feasibility and permitting in Arctic, complete feasibility and permitting at Bornite, and continue to do exploration in the District over the course of the next five years.

Our residual burn rate, if you will, for Trilogy, because we’re spending all of South32’s money at that point on the project, our burn rate for Trilogy is probably less than $3 million a year. That’s what it takes to run the rest of the company, if you will. With the $25 some odd million dollars in the bank at the end of this year, $24, to 25 million, we can run the company a long time on that. So yeah, no need to raise cash until we go decide to build what’s going to be a very, very high quality mine.

Bill: There is an international listenership to this podcast, but the majority of listeners are in Canada and the US and might not be so familiar with South32. Could you talk a little bit about South32 and just how well-capitalized and even profitable they are? Because it seems to me that they would be the logical potential company that would buy out the other 50% of your company if you get to that point.

Rick: Yeah, down the road, certainly that’s a possibility. South32, they were spun out of BHP about four, maybe five years ago now. They generate about a billion and a half dollars of free cashflow a year from operations. They produce a lot of thermal and met coal. They have an integrated aluminum business, integrated manganese business. In fact, I think they’re the largest manganese producer in the world, which of course is an important battery metal. And then they have zinc, nickel, and a couple of other miscellaneous commodities. They produce a lot of things except copper, and of course that’s why they are invested in us. We are developing what is primarily a copper-rich district. Certainly the grades at Arctic and Bornite demonstrate that, that not only are they copper-rich, but they’re high-quality copper projects.

That’s South32’s background. They recently purchased Arizona Mining last year, for I think, US$1.6 billion. That’s a zinc project in Arizona, the Hermosa project in Southern Arizona. So they’ve been quite active. They clearly like the United States as a place, as a destination to do business. I think they like the surety of ownership, the rule of law, and the low taxes. I think all those are reasons why you’re seeing people make big investments like that in the United States right now.

Bill: A question that Rick Rule teaches investors to ask is, what’s your current liquidation value versus your market capitalization? Your market capitalization is around US$330 to $340 million, just as I’m looking at it here on my screen. If you had to sell off your assets, including your cash, what do you estimate the liquidation value of Trilogy is currently?

Rick: I think there’s obviously a variety of ways you can address that. We have $30 million of cash, so there’s a number that’s there. We’ll have another $10 million here at the end of July. I think the other metric that I would point to is the South32 option of $150 million to buy 50%, which says the entire project is worth $300 million. So I think that’s what’s being reflected in our current market cap, is largely the downside’s protected, and then the value that we add with the $150 million that South32 puts in should be accretive to the current value, the current market cap of the company. That’s the way I look at it.

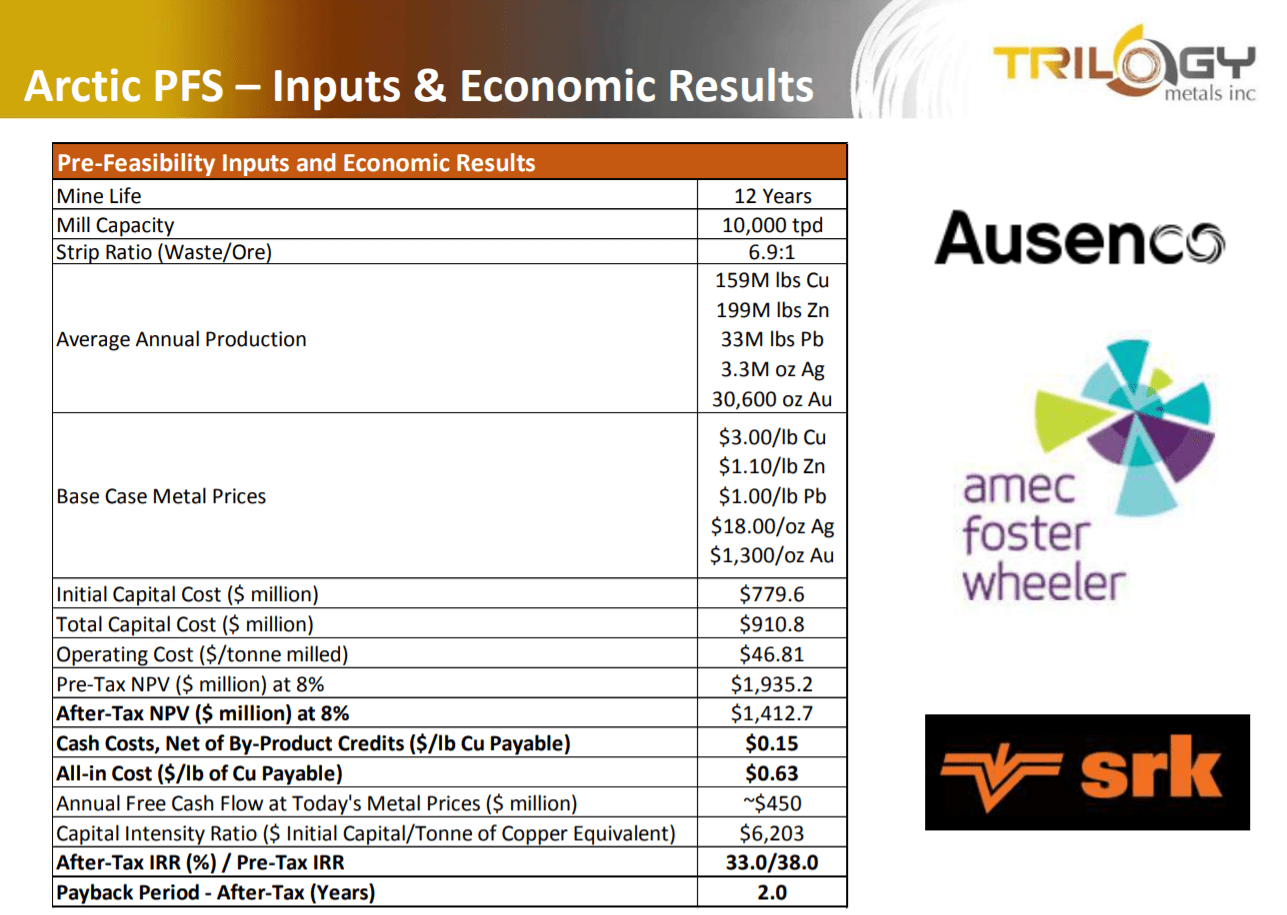

Bill: Could you give us an overview of the Arctic project? Your Arctic project is your most developed project. You did a pre-feasibility study, which you published last year. Give us a snapshot overview. What are the economics there?

Rick: Arctic is a very high-grade copper deposit. Based on the pre-feasibility study results from last year, which was completed by some real first tier engineering companies, Ausenco, Wood Engineering, and SRK. The project NPV on an 8% discount basis, this is post-tax, is $1.4 billion and a 33% IRR. Very solid economics. Basically, the initial capital is about $780 million, so a modest amount of upfront capital. On a dollar per annual ton of copper produced, we’re about $6,000 per ton, whereas the industry averages about $18,000 per ton, so about one-third amount of capital to produce an equivalent ton of copper. Very good position to be in, and certainly in an era when we have sort of the capital constraints that we have in our business.

A couple of other metrics. The cash cost to produce a pound of copper is about 15 cents, net of the byproduct credits. You’re producing about 160 million pounds of copper a year, about 200 million pounds of zinc, 30 million pounds of lead, about 3 million ounces of silver, and 30,000 ounces of gold. It’s a mixed metal production, it’s a polymetallic deposit. We’re producing three concentrates, a copper, a zinc, and a lead concentrate. The copper and the zinc concentrates are getting over 90% recovery and a 30% copper concentrate and close to 60% zinc concentrate. Your lead concentrate, the value of the lead is really in the precious metals. You’re getting paid for both your gold and your silver there. It’s a heck of a project, just very, very high quality. And of course, there’s a whole district there, which we’re exploring, so we know we can find more ore.

Bill: And the payback period is only two years.

Rick: Yeah, it’s two-year. You’re generating $450 million of free cashflow a year, so the initial capital at $780 million, you pay that back in less than two years. Your sustaining capital and closure costs are another $60 million each, so they’re not big numbers. It’s not a big mine. It’s a modest-sized mine. It’s a 10,000 ton a day operation, which is not small, but it’s not a big huge low-grade porphyry that are running in the 100,000 plus. It’s one-tenth the size of those. Just the grade makes you produce a fair amount of metal.

Bill: And your base case metal prices, you use $3 copper. Copper as we talk about $2.72/lb. What would the payback period be if we were looking at $2/lb copper?

Rick: Your payback period would go up to about three and a half years. There are very few copper projects in the world today that would make any money at $2 copper. The cash cost is almost $1.60/lb on a worldwide average, and then when you put in your sustaining costs and your all-in costs, you’re over $2/lb. So very few mining operations would be making money at $2 copper in today’s world. This one would. It would double your payback period, but on a copper basis, you’d still have $1.85/lb of margin.

Bill: And we’re talking about the economics and talking about this project verbally, but I’ve actually seen this project through the technology you had at the PDAC, where I put on the headset and the virtual reality gaming software, flew over the deposit. It’s actually an open pit deposit, isn’t it?

Rick: Yeah, the virtual reality is pretty cool. You really get a sense of the layout of the project and th e scale of the project. It is an open pit, and that’s, I think, what’s somewhat unique of this type of deposit geologically. Typically it would be an underground mine, or at least most of it would be underground, but it’s in a geometry where it actually dips with the hillside, so we’re able to just kind of take a scallop off the hillside and mine it with an open pit which is very advantageous. It’s a much better open pit mine than it is an underground mine. You could mine it underground, but it would cost more and over a longer period of time. So from a net present value basis, you’re much better off going with the open pit.

e scale of the project. It is an open pit, and that’s, I think, what’s somewhat unique of this type of deposit geologically. Typically it would be an underground mine, or at least most of it would be underground, but it’s in a geometry where it actually dips with the hillside, so we’re able to just kind of take a scallop off the hillside and mine it with an open pit which is very advantageous. It’s a much better open pit mine than it is an underground mine. You could mine it underground, but it would cost more and over a longer period of time. So from a net present value basis, you’re much better off going with the open pit.

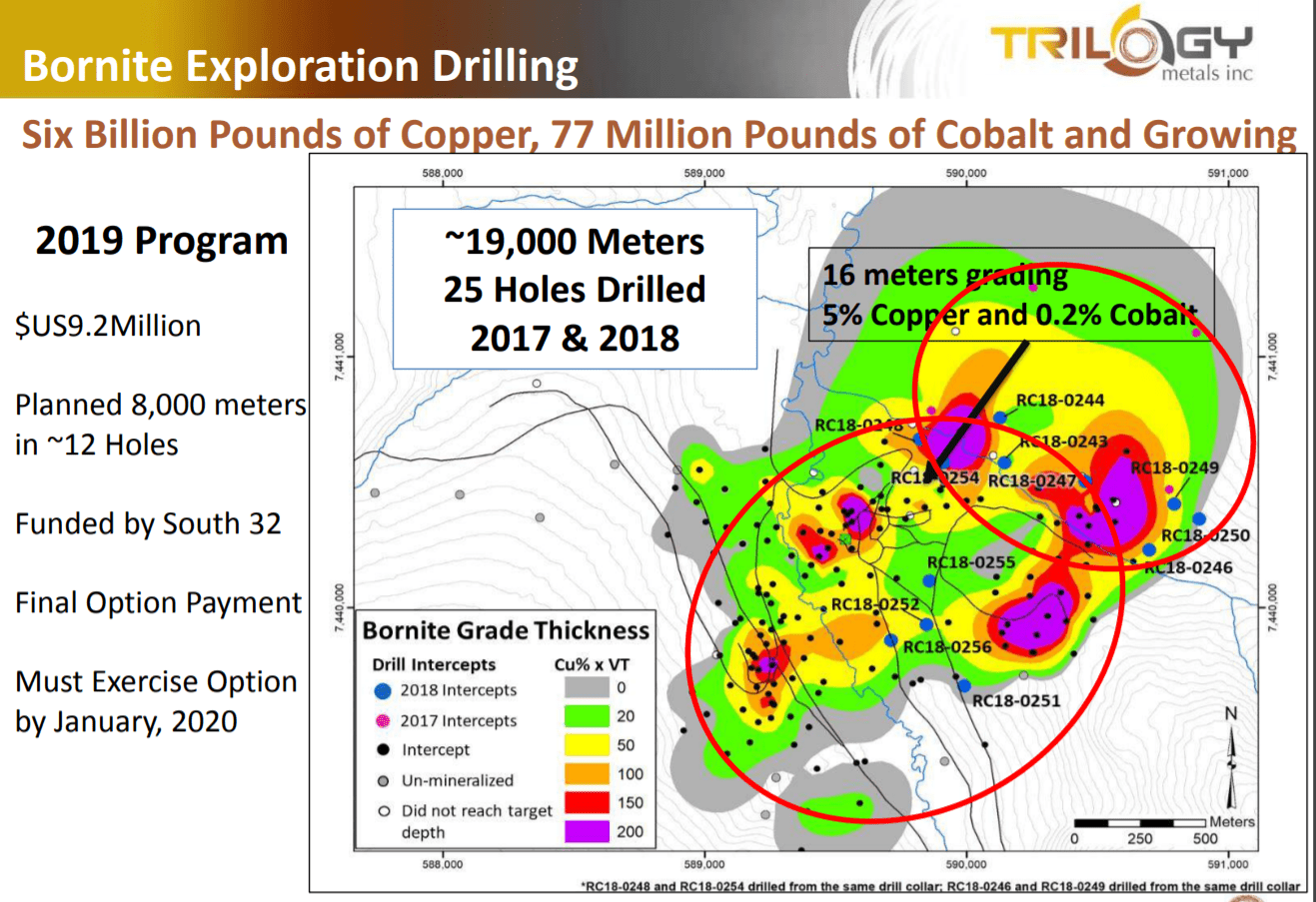

Bill: You mentioned that you’re doing a lot of exploration at the Bornite project. Can you give us an overview of the Bornite project? What’s happening there, and what pounds in the ground do you have right now?

Rick: Bornite, we’ve been spending exploration dollars from South32 for the last two years, and again we’ll repeat that this year, for a total of $30 million, and this is an option payment, basically, that they’ve paid to us as part of the deal that we signed with them going on three years ago now. Again, the option is that they maintain the option by spending the dollars, and they have the right to form a 50/50 joint venture by contributing $150 million and then matching what we’ve spent at Arctic.

What we have discovered to date, and this is before the expenditures from South32 on Bornite, what we had spent money on previously was developing a resource of about 6 billion pounds of copper and 77 million pounds of cobalt. It’s a different geology than Arctic. We’re dealing with a carbonate replacement style deposit here. It’s also very good grade. We’re looking at 1% in the open pit. We have about 125 million tons outlined in the open pit at 1%, and then the ore body continues where you would mine it with an underground mine at a higher cutoff, obviously, and the resources there are 58 million tons of 3% copper.

That’s prior to the $30 million that we’ve spent on it, and at the end of this year’s program, we’ll tally up all the drilling, which will be over 30 holes, probably about 30, close to 35 holes that we’ve drilled since the resource was updated. This has been a combination of infilling holes and step-out exploration holes. We certainly expect to improve the overall resource, both in terms of the quality of inferred versus indicated, but also in terms of size as well. It’s a much bigger scale project than Arctic, almost an order of magnitude, but a very, very exciting project in its own right.

1% open pit copper is about twice the grade of that being mined on average around the world today in open pits, and a 3% underground grade is a better grade than Arctic, in terms of copper. So very, very high-quality project in its own right. Just a little earlier stage, so I think it’s probably five years behind Arctic, in terms of its development profile, but very exciting.

Bill: Rick, avid resource investors that are listening to us now know of Northern Dynasty’s issues there in Alaska and the resistance to the project due to environmental issues with that project. Are there any such things occurring with your projects, and what would be some things that keep you up at night?

Rick: I mean, we’ve really mitigated a lot of the risks here by having a business partnership with an Alaska native corporation. It’s called NANA. They own the Red Dog Mine. It’s operated by Teck. I think currently that’s a 65/35% joint venture, with NANA increasing their ownership up to 50% in the next several years. That mitigates a lot of the issues around developing a project. When you’re partnered with a native corporation who specifically selected their land for mining, and that’s really the history here, when the Alaska natives settled their aboriginal rights and title settlement with the federal government, they had the right to select land.

Of course, the federal government and the state government took all the land with the potential for oil and gas. That was the first thing that happened, so the next opportunity for the Alaska natives to select land meant that the oil and gas was gone. It was about minerals, and so they selected these lands specifically for mineral development. That makes for a good partnership, and NANA has a lot of history, because of the 30 years of operation at Red Dog, so an excellent partner. And that frankly is one of the big differences with the other project that you mentioned, Pebble.

Bill: And your road, that’s one of the key things you’re looking at right now. The approval for your road to your project?

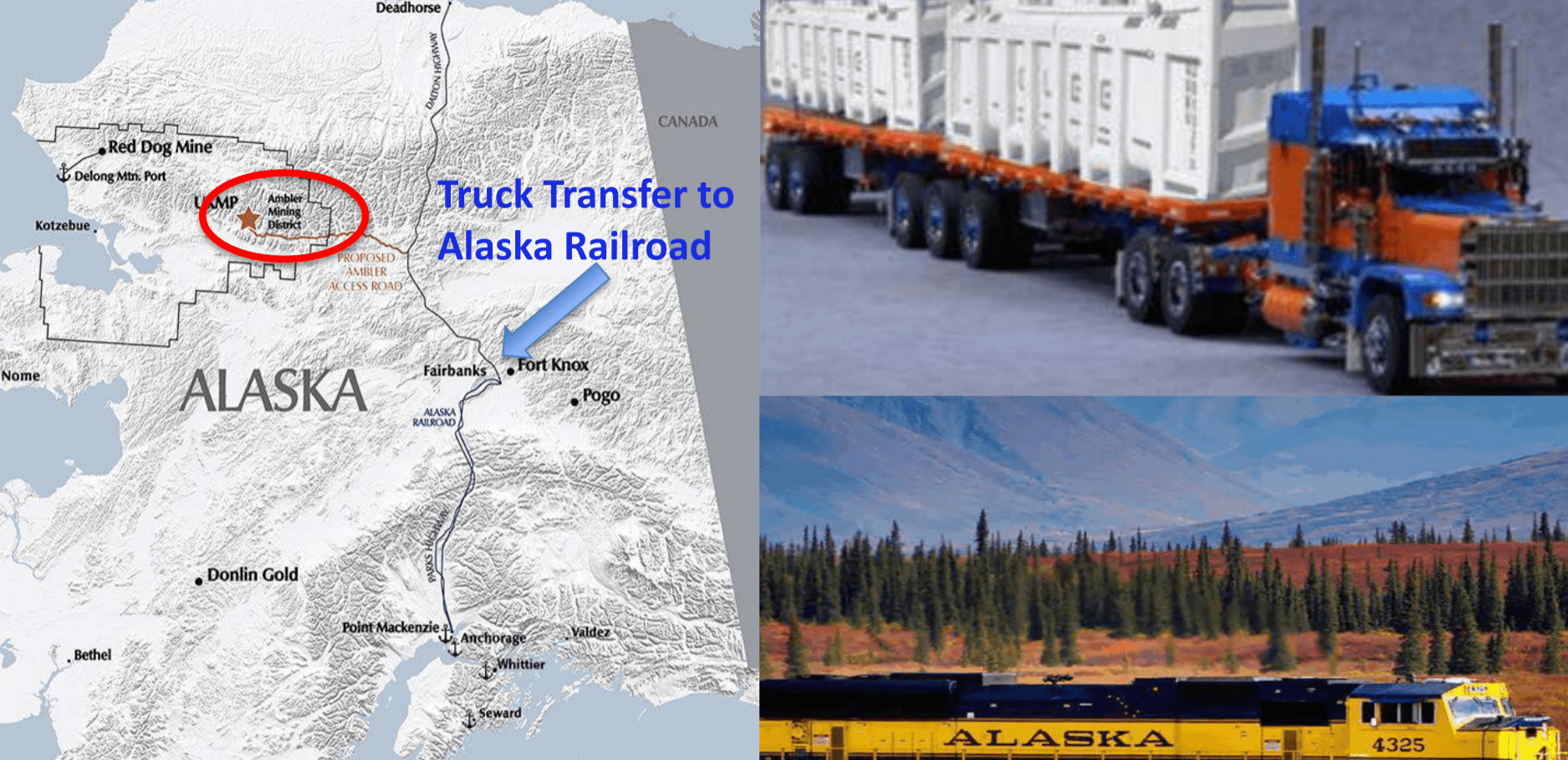

Rick: Yeah, and we just had a great update yesterday. This project is in the middle of nowhere. We’re about 200 miles from the existing infrastructure in the State of Alaska, which is the Dalton Highway. This is the highway that goes between Fairbanks and the oil fields in the North Slope of Alaska. The state has proposed, through a group called the Alaska Industrial Development Export Authority, essentially a state-owned infrastructure bank. Their job is to build infrastructure through public-private partnerships. They’ve been working on the permitting of the road for the last several years, and just yesterday the Bureau of Land Management, which is the lead federal agency from the federal permitting side, issued the dates for completion of the draft EIS (Environmental Impact Statement), which is July 19th, with a 45-day comment period, and EIS to be finished by the end of October.

So it’s nice to get those timelines finally settled. They’ve been working, of course, on putting the draft EIS together, and then you know it’s going to be done when they put a date out like that. We’re very excited to see the draft go out. Obviously, we’ll be providing our own comments, as will NANA and the other stakeholders. We’ve been working hard behind the scenes to explain to everybody what the road is about and how we can operate in a similar fashion that Red Dog’s been operating for 30 years without having any substantial impacts to caribou or the fish or the environment, both air quality and water quality. Mining has a pretty good track record in Alaska, and we can certainly be able to address the concerns in a manner where we’re minimizing any impacts to the environment.

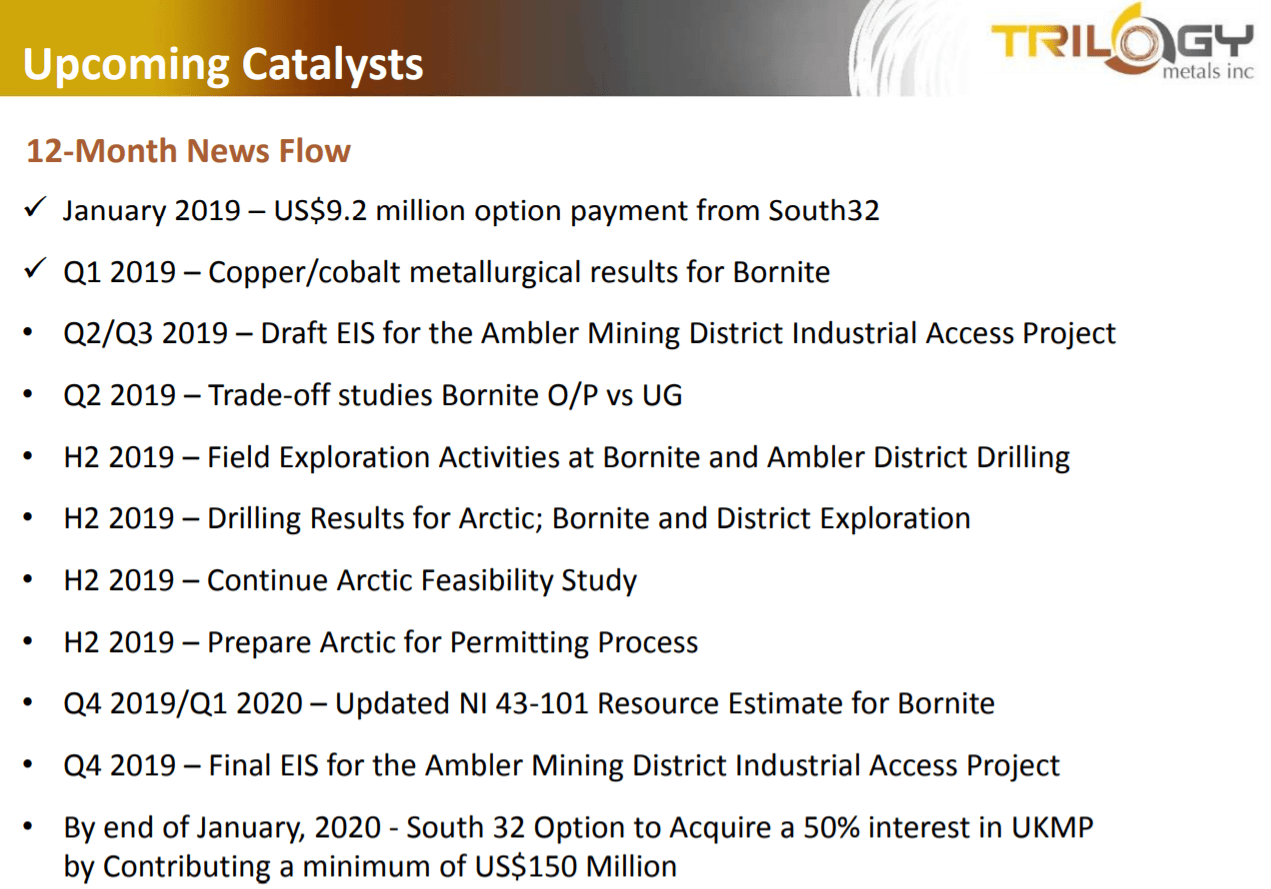

Bill: And the approval for the road, the environmental impact statement for the road, that is obviously a huge catalyst within the next year. What would be some other key catalysts or value drivers for the company as we conclude?

Rick: Yeah, the road EIS is a huge value driver. I mean, it clearly just opens up the district. The other big drivers, I think the next big one is really the South32 option decision to put the $150 million in the joint venture company treasury, and that’s the next spend for the next five years, basically. That’s why we don’t need to raise any additional funds, and so no further dilution necessary until we decide to build a mine. So those are the two big ones.

Obviously, we’re doing a fair bit of exploration this year, so we’ll have updated exploration results for Bornite, clearly, both drill results and then a resource update and probably next year a preliminary economic assessment on Bornite, so we can give the market a value metric for Bornite. We’ll be exploring in the district, which I’m really excited about. We’re just completing a helicopter EM, electromagnetic survey of the entire Ambler District. It’s about 100 kilometers in length. We know we have a dozen other known prospects, VMS projects out there, volcanogenic massive sulfide projects. But the EM survey is going to light up, no doubt, a number of other new targets that will present themselves. So we’ll have about a $2 million drilling exploration program and some results out on that as well this year. And of course, finishing up the feasibility at Arctic we think is another huge value driver.

So lots of news flow this year. There’s certainly a lot of potential catalysts, and as I said, the big one, the record decision, is when you get your approval from the federal government to build the road, and then of course the South32 option. Those are the two big drivers.

Bill: Trilogy Metals trades, as I mentioned, in New York and Toronto under the ticker TMQ. To learn more, you can go to Trilogy’s website at trilogymetals.com, and I encourage you to go there. On the home page, at the bottom right, there is a video, an overview video. You’ve heard our discussion today, but you can actually see it visualized through computer animation, both the Arctic Deposit and how the company, through their pre-feasibility study, has laid out how they will process and then transport the ore. It gives you a great overview, and if you’re new to mining investing, you want to go to Trilogy’s website and watch the video, just because it will teach you the process, and it’s just a perfect depiction of the outcomes of the pre-feasibility study that was completed last year.

Check out the company. Great projects, copper dominant. I expect a rising copper price, but you’re also exposed to cobalt, lead, zinc, precious metals, a great partner, lot of exploration upsides. Trilogy has a lot going for them. Well Rick, I appreciate you giving us the overview, and I look forward to catching up and getting some updates from you later in the year.

Rick: Well, perfect. Bill, thanks so much, and yeah, we’ve got a lot going on this year, so we’ll look forward to updating you and your audience on Trilogy’s efforts to advance the development of the Ambler Mining District.