Newmont Partners with Gold Terra in Its 5M+ AuOz Pursuit Explains Gerald Panneton

Executive Chairman Gerald Panneton joined Gold Terra (TSXV: YGT OTC: YGTFF FSE:TX0) because he saw the potential to grow the company’s current 735,000 gold ounce resource to over 5 million gold ounces or more. And now major gold producer Newmont also teamed up with Gold Terra in its 5M+ AuOz pursuit. The two companies recently executed an exploration agreement on certain mineral leases and mineral claims adjacent to the former producing Con Mine right next to the city of Yellowknife in Canada’s Northwest Territories. The Con Mine produced approximately 5.1 million ounces of gold between 1946 and 2005 at an amazing grade of 15 g/t, and over widths of up to 100 metres. In this interview, Gerald provides an overview of the agreement with Newmont as well as explains how this transaction benefits Gold Terra shareholders and the advancement of their Yellowknife City Gold Project.

0:00 Introduction

2:06 Newmont executes exploration agreement with Gold Terra

4:04 Two phase agreement with Newmont holding a back-in right

8:11 Prospectivity of land acquired through exploration agreement

9:51 Drilling newly acquired land by January

10:27 How can you speak with such confidence of a 5M+ AuOz discovery that you have not made yet?

13:24 What is more significant with this deal…the land itself or the formal relationship with Newmont?

13:52 Discussing metallurgy

15:46 When to expect the next batch of assays to be released?

TRANSCRIPT:

Bill Powers: Gold Terra just announced an exploration agreement with Newmont in regards to a property right next to the Con Mine there outside the city of Yellowknife. Here to break this down for us is the executive chairman Gerald Panneton. Gerald, welcome back to the show. And could you provide an overview of this deal and explain the significance for my listeners please?

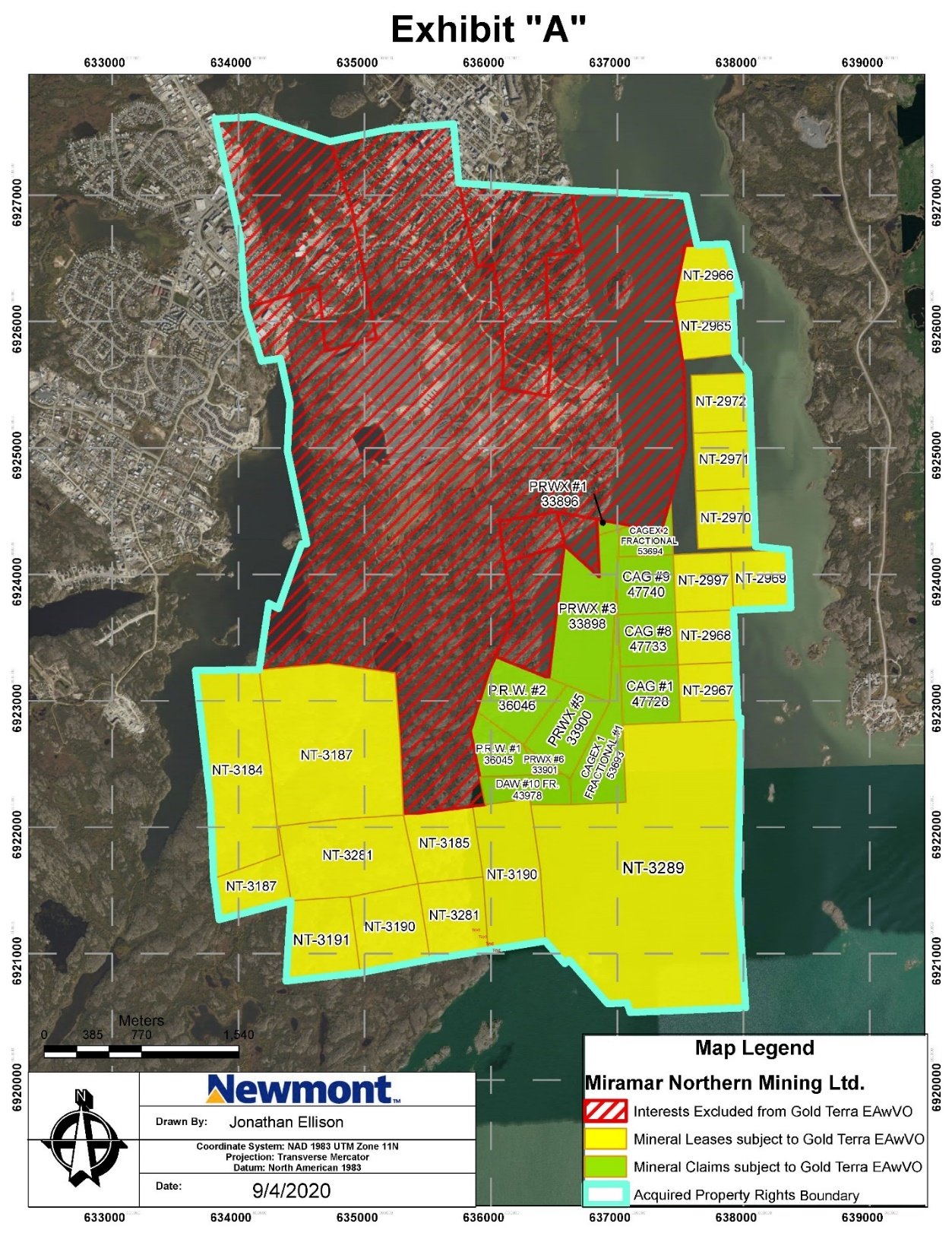

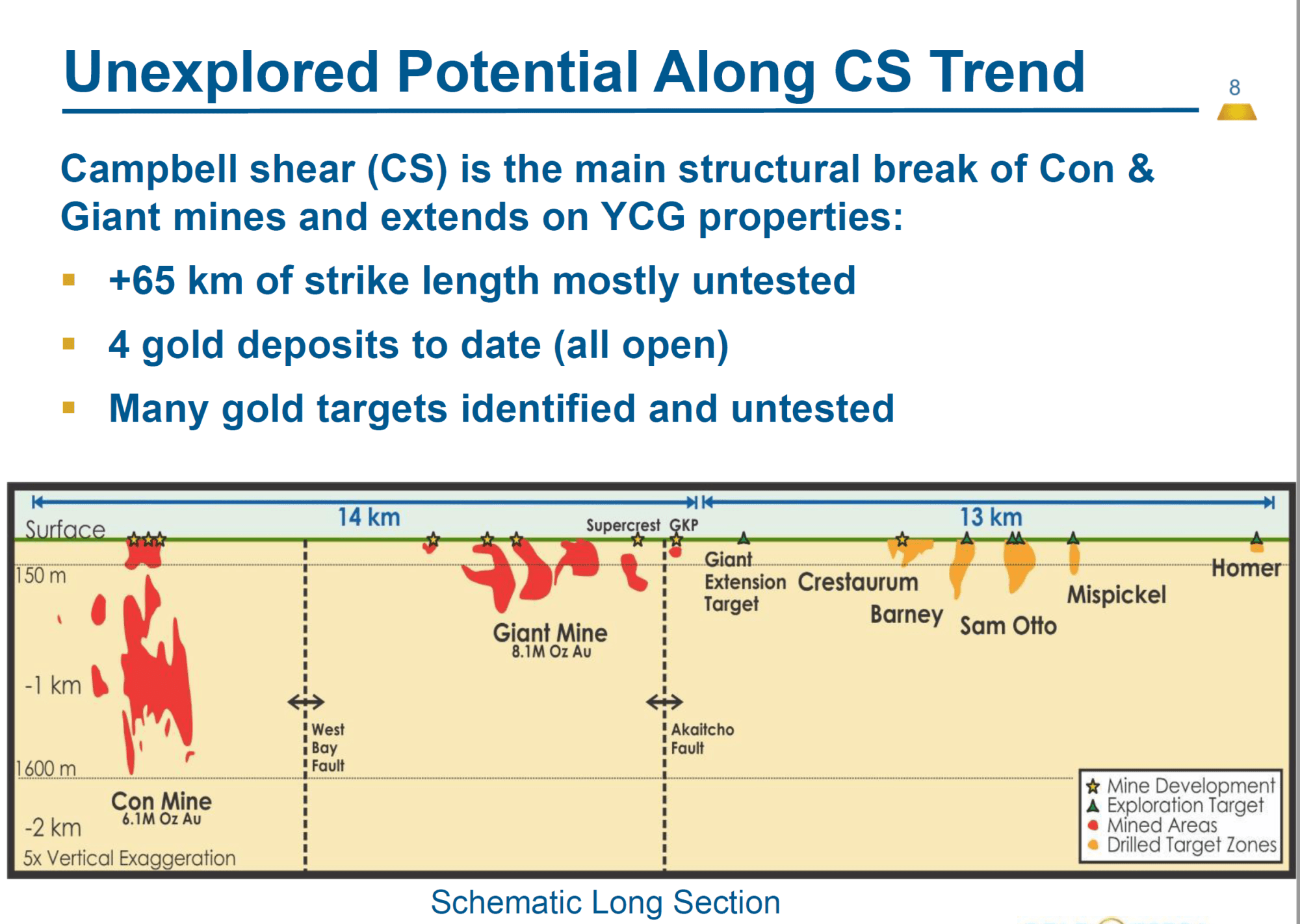

Gerald Panneton: Thank you very much, Bill. It is always important to have the best land to find a gold deposit. And Bob Smith, who I work with at Barrick years ago was one of the best person to say, “Why would you go somewhere else in the boonies to find gold when you can find it right next to a mine? Because there’s already a mine there, there should be more.” And this is no different. Yellowknife is a camp that produce 14 million ounces. And in my mind, we were missing a small part between the Con Mine and our South Belt property, which was the exploration claim south of the mine, between the old mine, which was mined out, down to about almost 5,000 feet, 1,600 meters. There was a gap of about a couple of kilometers, two, three kilometers just immediately south between the mine itself and the South Belt.

And this was very prospective ground. It’s been drilled down to about 200 meters, couple of holes at 600 meters that indicates mineralization. We know the Campbell Shear carries on south of the Con Mine, which produce five million ounces onto these exploration claims and onto our South Belt property. For me, it was key to acquire this small parcel. It may be just two miles long, three kilometers long, it doesn’t matter. It’s a very, very important acquisition for Gold Terra. It secure an area where we feel very comfortable now to drill, on our side, on those Newmont exploration claim, to discover a larger gold deposit.

Bill: It’s a two phase earn-in. Could you go over the two phases and also Newmont’s ability, if you’re successful, to earn back some of the project?

Gerald: Phase one earning is very simple. We have three years to spend $3 million Canadian, which in my mind is very small feat. It’s roughly 12,000 meters, 13,000 meters of drilling. If we drill the area every 100 meters spacing for example, down to five, 600 meters, we will go through this expense very quickly. We have the money in the bank so it’s not a question like, do we need to raise the money? No, we don’t. We just raised money in June, July and we have $7 million Canadian in the bank.

Phase one is just an earning to get the first 30% and also to, do we have a deposit or not? We could walk away and there’s no deposit, but the chances are we will find maybe one million ounces, two million ounces. And we’ve also put in the deal that if I find ounces right to the south of the property within one kilometer, if we find, say, one and a half million ounces or two million ounces, then we’ve earned our 60%. We submit a pre-feasibility study on the ounces and if we find more than five million ounces only on the Newmont exploration, which is a big target, it’s still possible. But just to show how much Newmont respects our exploration experience and our exploration intelligence to approach the project, they want to have a back-in right because they’ve seen what I’ve done before at Detour, take the project from a million ounces and bring it to 15 million.

They said, “Well, if Gerard is looking after that, we want a back-in right just in case.” And then so they did. But the back end right is five million ounces. And of that is very important, so we earn our 30%, we finish a feasibility study. Are we going to find two, three or five or six? Drilling will tell. It’s not going to be taking three years or seven years like the deal is. The deal is over seven years. But in reality, we can accomplish that over the next two to three years. And we have the money so we can do so. And the back-in right, if we find five million ounces, it’s a bonus for both. It’s a win win situation. Newmont feels good about being protected and we feel good because if we find five million ounces, we end up with two, Newmont end up with three, we get all our expense reimbursed. We get a bonus on a per gold basis found. It’s a good deal.

Bill: You referenced your success with Detour Lake and how that came into that buyback that Newmont wanted. Would you say your reputation and past success allowed you to even get before Newmont and negotiate this deal, but at the same time kind of worked against you because they anticipate your success?

Gerald: Probably there’s a respect in our industry for people to put mines in production. I’ve done three so far, two with Barrick and with Detour Gold. Yes definitely there’s a respect of people that do it, choose the right property and can do it again. And even when I was working with NewCastle Gold, it was a great experience because it was a great project. It got merged with another company and it’s got a good potential. I go for a very good project only, and I like the challenge of making it even better. But in the end of the day, investor wants to see if we can find more gold and I’ve done that many times and it’s a project that can really, really give us this opportunity to the north of the Con Mine and Giant Mine in our north belt we have a great potential for the Campbell Shear, for the Crestaurum high-grade target.

And now with the south, we’re putting the puzzles together. Now I feel more comfortable about not just drilling the Newmont claim that we just acquired, or we have an option to acquire. It’s also about the South Belt. Now I feel comfortable about if I find something I have also the ground to the north. This fills in the puzzle and complete the puzzle and will allow us to drill without looking on beyond our shoulder. And of course, Newmont, yeah. It plays both ways. They believe I can find something so of course they want a back-in right, which is fine. It’s a good back-in right for them and it’s a good one for us too.

Bill: How would you describe the prospectivity of this land that you just picked up relative to your existing land package that you already had? Is it more perspective, I guess is what I’m asking?

Gerald: Yeah, no, it’s a good question. Why do you acquire more ground? I’m going to say something, It’s not necessarily maybe the best example, but say five million ounces of fire. It’s a big fire. And we control 70 kilometers of that trend where there’s a fire in the middle, the Giant and the Con Mine on the Campbell Shear. We have great, great extension of the deposit south and north, but now we just got closer to them. It allows us, that 5% more land that we just acquire on our package is so close to the fire, that it’s even better because usually, it’s like we said, when we find gold or when there’s our mine, there’s always smoke.

There’s a fire somewhere, well, you’re going to see smoke. When we find gold, quartz vein on surface, that means that there’s smoke and maybe there’s a deposit somewhere. But when you look at every gold camp, Timmins is two big deposit. Val-is one big deposit, Sigma-Lamaque, the Bousquet camp where it is the LaRonde mine and the Bousquet Mine, one big camp. There is always a big camp like Red Lake, for example, is also another one. Does it means that you cannot find any more gold around the camp? It’s possible, but usually a deposit could be 20, 30, 40 million ounces. And I think the Campbell Shear has all the characteristic to offer multiple million ounces discovery along the Campbell Shear and our target, like you said, it’s to get beyond five million ounces.

Bill: And you will be drilling this, the press release said this year, will this be an in addition to the 10,000 meters you already announced?

Gerald: Yes. The likelihood is that we are going to be completing the Crestaurum drilling during the fall. And depending on success, will carry on next winter. But as soon as we have a chance, we will add a drill to start drilling. Can we start running this fall, November, December? It’s a possibility. We’re looking into the access of starting to drill the Newmont ground this fall. But at the latest, we will be drilling this property in January. It’s already into access.

Bill: Gerald, I’d like you to address some feedback that I get from listeners of my show. In the past, when I’ve interviewed mining executives, I’ve had a listener email me and say, “Bill, we’re talking about exploration and the executive you spoke to spoke as if the discovery already occurred when it hadn’t.” You come across as so confident. You’ve done this before. You know you will find at least five million ounces, but if you’re speaking and you’re sitting down with a skeptical investor that’s posing to you what I just said, that you’re speaking as if the discovery has already happened, how would you answer such a person?

Gerald: In exploration, depending on your property, your project, your location, your proximity to a mining camp, there is two types. There’s remote and there’s close to a mining camp. When you’re remote, sometime it’s very difficult, but the discovery could be very good, but it needs to be very big because you have new infrastructures. In the case of Yellowknife, your discovery could be smaller, but better because there’s already infrastructures. There’s a big, big difference between remote versus camp. If you’re in a mining camp with infrastructure, very different. You can rate the chances of finding five million ounces, depending where you are. I would say that when you go in remote area, you could find one, but your chance are maybe one out of a 1,000. In Yellowknife, I consider my chance of finding five million ounces, one out of two. 50% chance.

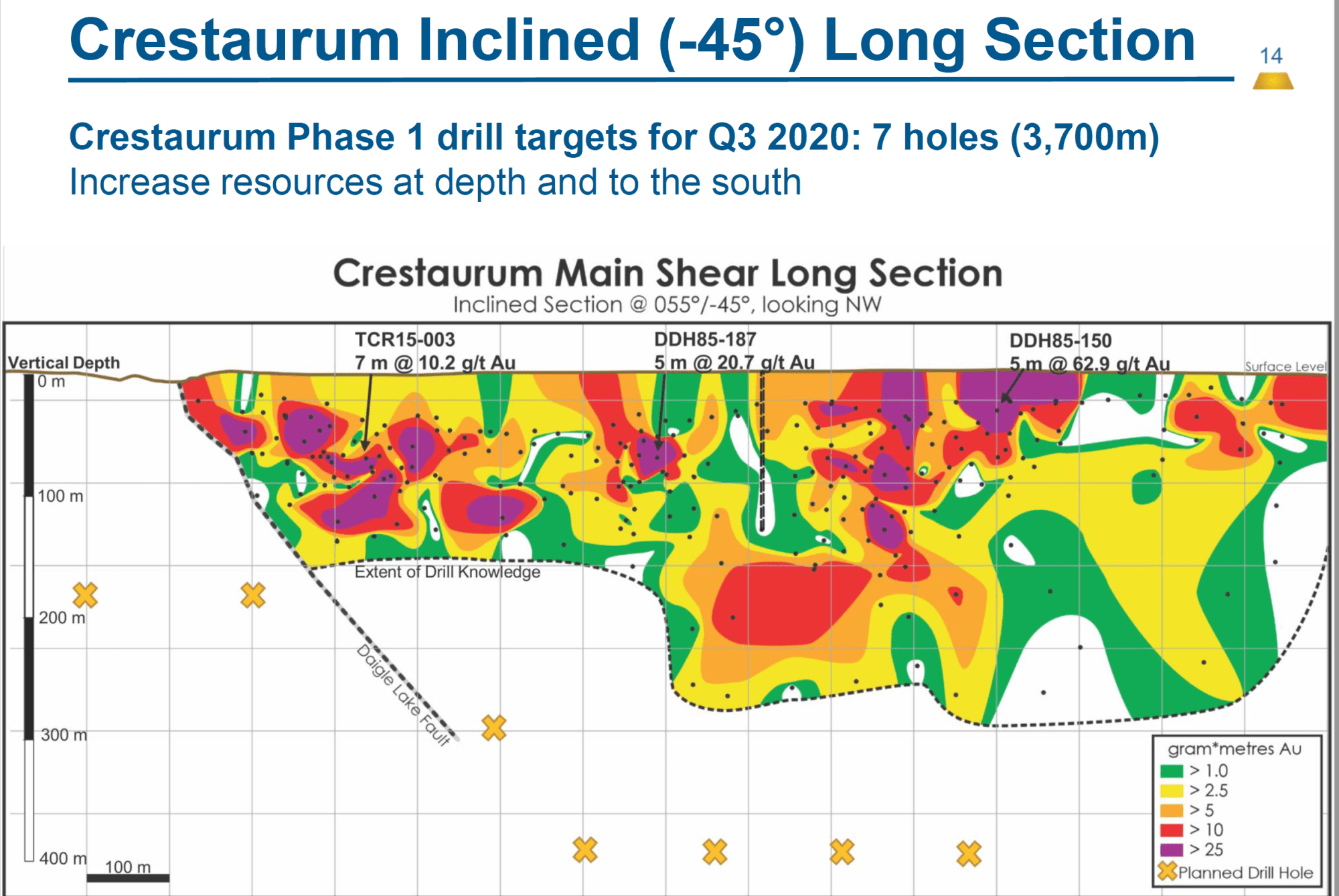

We currently have three quarter million ounces and we know we can increase those ounces at Sam Otto and Crestaurum, no question. Does it have the potential for five million ounces? I don’t think so. I don’t think Crestaurum or Sam Otto does. Sam Otto, maybe a million, maybe a million and a half. Crestaurum, maybe a million ounces, maybe two. Drilling will tell. But what I’m trying to demonstrate in the Campbell Shear in Yellowknife, what are my chance of finding five million ounces? And with the Newmont claim acquisition, earn-in option, we have increased our chances for a couple of million ounces, but what’s more important, it completes very well with the South Belt where we do have a chance. In June we release a press release that shows eight grams over eight meters, roughly. Exactly six, seven kilometers south of the Con Mine on the Campbell shear. Drill at minus a 100 meters elevation. There’s no drilling below, very shallow drilling done in 1961…60 years ago. Has never been follow up since then.

When you look at the chances of Gold Terra finding a few million ounces and maybe five and maybe more in Yellowknife, these are very excellent. And that’s why when I join the company in October, that was following my due diligence on the company, on the asset, I really like the potential. I really feel we can create value for the investors on this story, and we just need to execute and my time for executing and make that discovery is over the next two years.

Bill: With the execution of this deal, if you were given a binary choice, what was more significant, the relationship, to form a relationship with Newmont or the actual land acquisition itself?

Gerald: It’s always good to have a good partner and a good relation, no question. But the land was the target. As I was acquiring three kilometers of some of the best land in Yellowknife, very close to the fire.

Bill: Now you have this large land package. How should investors view potential metallurgical issues? I know that this is early on, it sounds like we’re talking about multiple deposits here and doesn’t the metallurgy vary significantly so there could be potentially different processing plants you would need?

Gerald: There’s two types of ore on the Campbell Shear. They really is free milling quartz veining, late mineralization that is unable to recover with normal gravity CIL, which is very, very easy to do. And there is some refractory ore with arsenopyrite that will need to be treated separately. But at the end of the day, we’re far from that, I think the most important thing is Yellowknife is a high grade camp, that mined gold between a grade of 15 to 20 gram gold or roughly half an ounce to .7 ounce per toned. It’s very rich. And usually the richness of the deposit allows you to pay for some of the challenge you may have on metallurgy and recovery. The camp has recover gold over 90%, even in the refractory ore. There is no challenge to be there. We’re not talking about a big deposit.

I learned my lesson very well at Detour that building a huge project, low grade and raising one and a half billion to build it, was a very high challenge. And is the reason why I focus on the high grade. Our focus in Yellowknife is a high grade because we know that the capital investment to develop a mine, even if you have two processes to do is a lot more easier than building a huge mill, which treats 60,000 tonne per day. There’s no question that high-grade smaller mill, smaller footprint, no open pit, look it’s much better to be underground on high-grade than it is open pit low grade.

Bill: Investors can expect consistent drilling from Gold Terra, but I know that there’s already anticipation of the first batch of assays from your Crestaurum drilling. Can you give us an idea of when we could expect the news release on that?

Gerald: I think you should expect as early as October, some result on we started doing on August 15, every hole takes a week drill. You can figure it out. We’re drilling the deposit at 400 meters elevation. We want to show that the extension of the deposit goes beyond the 200 meters drilled before and we’re going to move the drill on the 600 meters hole following the first four, 400. We feel that yes, result will be coming probably in early, early October within the next two weeks from now…two, three weeks from now.