Red Pine Extends Minto Mine South Zone Discovery; Highlights Include 13.72 g/t Gold Over 4 Metres Including 40.15 g/t Gold Over 1 Metre

TORONTO, Dec. 18, 2017 (GLOBE NEWSWIRE) — Red Pine Exploration Inc. (TSX-V:RPX) (“Red Pine” or the “Company”) announces results from seven holes drilled in the Minto Mine South Zone (“MMSZ”) at the Company’s Wawa Gold Project. The drill holes were part of Red Pine’s 20,000 m drilling program that was completed earlier this fall.

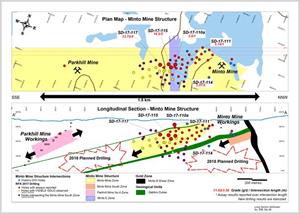

Figure 1

Plan map of recent drill results in the Minto Mine Structure and longitudinal section showing drilling intersections between the former Minto and Parkhill mines

Red Pine Exploration Inc.

Highlights of 2017 drilling program in the MMSZ

Red Pine Exploration Inc.

- High-grade gold mineralization of the MMSZ continues to extend south towards the Parkhill mine (current strike length of 375 metres):

• SD-17-115 contains 14.2 g/t gold over 2 metres and 2.22 g/t gold over 2 metres;

• SD-17-117 contains 13.72 g/t gold over 4 metres.

- Discovery of Stockwork Mineralization around the MMSZ:

• SD-17-110A contain 0.43 g/t over 32.3 metres (Figures 1, 3);

• SD-17-111 contains 5.14 g/t gold over 1 metre;

• SD-17-117 contains 1.22 g/t gold over 30 metres including 29.9 g/t gold over 1 metre.

Quentin Yarie, President and Chief Executive Officer of Red Pine stated, “Our on-going drilling program in the Minto Mine area is consistently discovering new zones of mineralization. We are expanding the high-grade Minto Mine South Zone toward the historic Parkhill Mine (average grade 14.81 g/t) to the south. We believe additional zones of mineralization remain to be discovered, both in the Minto Mine South Zone and into the newly discovered Minto Mine Stockwork. We will carry on drilling in the area in 2018 and we expect that our results will continue to validate our exploration model.”

MMSZ vs Minto Mine Stockwork

The Minto Mine Stockwork is a complex system of structurally controlled tensions veins forming a “halo” around the MMSZ. Host rocks in the shoulders of the tension veins are weakly to moderately altered with sericite, silica and disseminated pyrite and pyrrhotite. The true thickness of the quartz veins forming the stockwork typically ranges from 10 centimetres to 1 metre.

Table 1. Highlights of the 2017 drilling results in the MMSZ

| Hole | From (m) | To (m) | Length (m)* | Gold (g/t) |

Gold Zone | ||||

| SD-17-114 | 134 | 135 | 1 | 2.59 | MMSZ | ||||

| 137.8 | 139.8 | 2 | 3.57 | ||||||

| SD-17-115 | 104.6 | 116.9 | 12.3 | 2.96 | MMSZ | ||||

| Including | |||||||||

| 108.9 | 110.9 | 2 | 14.2 | ||||||

| 113.9 | 115.9 | 2 | 2.22 | ||||||

| SD-17-117 | 126 | 130 | 4 | 13.72 | MMSZ | ||||

| Including | |||||||||

| 127 | 128 | 1 | 40.15 | ||||||

*Assay results reported over intersection length. In the Minto Mine South Zone, for SD-17-115 and SD-17-117, the intersection length is estimated to be >55% true width, for SD-17-114, the intersection length is estimated to represent >45% true width

Table 2. Highlights of the 2017 drilling results in the Minto Mine Stockwork

| Hole | From (m) | To (m) | Length (m)* | Gold (g/t) |

Gold Zone | |||

| SD-17-111 | 54.9 | 55.9 | 1 | 5.14 | Minto Stockwork | |||

| SD-17-110A | 93.4 | 125.7 | 32.3 | 0.43 | MMSZ + Minto Stockwork | |||

| Including | ||||||||

| 96.4 | 97.4 | 1 | 3.07 | |||||

| 122 | 123 | 1 | 3.8 | |||||

| SD-17-117 | 126 | 190 | 64 | 1.44 | MMSZ + Minto Stockwork | |||

| Including | ||||||||

| 126 | 130 | 4 | 13.72 | |||||

| 160 | 161 | 1 | 2.39 | |||||

| 182 | 183 | 1 | 29.9 | |||||

| 189 | 190 | 1 | 2 | |||||

Additional drilling is required to estimate the true width of the Minto stockwork.

Minto Mine Discovery Area

Red Pine’s drilling in the Minto Mine area continues to test the southern extension of the MMSZ and the existence of a network of quartz tension veins (stockwork) consisting of numerous mineralized quartz veins above and below the MMSZ. Drilling results in the MMSZ now extend the high-grade mineralization over a strike length of 375 metres.

In hole SD-17-117, the composited intersection that includes the stockwork and the MMSZ contains 1.44 g/t gold over 64 metres. This is indicating that a close spatial association between the Minto Stockwork mineralization and the Minto Mine South Zone can result in broad zones of gold mineralization. Additional drilling will be necessary to confirm the geometry of the Minto Stockwork.

Results for 26 boreholes in the Minto Mine South Zone are still pending. The zone remains open at depth and along strike (>1km) to the south. Five (5) additional drill holes are currently planned to further define its strike length and down-dip extension.

Wawa Gold Project Background

The Wawa Gold property package consists of over 5,500 hectares and hosts several former mines with a combined historic production of 120,000 oz gold1. To date, the largest gold deposit on the property is the Surluga Deposit, which hosts a NI 43-101 Inferred Resource of 1,088,000 oz gold at an average grade of 1.71 g/t (using a 0.5 g/t cut-off) contained within 19.82 million tonnes2.

Since December 2014, Red Pine’s exploration work has involved the ongoing sampling of 42,000 m of historic core that was never sampled by previous operators of the project, and aggressive drilling campaigns. To date, the Company has completed over 31,000 m of drilling and made four discoveries along the extension of the Surluga Deposit: the Surluga North Zone; the Hornblende-William Zone; the Minto Mine South Zone and; the Grace-Darwin Zone. These are part of the Wawa Gold Corridor, a gold-mineralization zone that extends for more than 5 km.

Red Pine’s on-going drill program is designed to potentially expand the size of the existing inferred gold resource and connect the other zones of gold mineralization along the newly-discovered Wawa Gold Corridor. Two drills are currently operating non-stop- one is targeting the Surluga North discovery while the second drill is targeting the Minto Mine South Zone discovery.

The Company is well positioned to fund its share of the Wawa Gold exploration program.

As such, the sampling and drill programs are expected to continue in 2018.

To View Figure 1. Plan map of recent drill results in the Minto Mine Structure and longitudinal section showing drilling intersections between the former Minto and Parkhill mines please visit: http://www.globenewswire.com/NewsRoom/AttachmentNg/9767037c-b914-4f1e-ba68-68b029453d44

To View Figure 2. Highlights of 2017 drilling program in the MMSZ please visit: http://www.globenewswire.com/NewsRoom/AttachmentNg/3eb3cafb-8f83-46cf-b9e2-9f67bf769731

On-site Quality Assurance/Quality Control (“QA/QC”) Measures

Drill core samples were transported in security-sealed bags for analyses to Activation Laboratories Ltd. in Ancaster, Ontario. Individual samples are labeled, placed in plastic sample bags and sealed. Groups of samples are then placed into durable rice bags and then shipped. The remaining coarse reject portions of the samples remain in storage if further work or verification is needed.

Red Pine has implemented a quality-control program to comply with best practices in the sampling and analysis of drill core. As part of its QA/QC program, Red Pine inserts external gold standards (low to high grade) and blanks every 20 samples in addition to random standards, blanks, and duplicates.

Qualified Person

Quentin Yarie, P Geo. is the qualified person responsible for preparing, supervising and approving the scientific and technical content of this news release.

About Red Pine Exploration Inc.

Red Pine Exploration Inc. is a gold and base-metals exploration company headquartered in Toronto, Ontario, Canada. The Company’s common shares trade on the TSX Venture Exchange under the symbol “RPX”.

Red Pine has a 60% interest in the Wawa Gold Project with Citabar LLP. holding the remaining 40% interest. Red Pine is the Operating Manager of the Project and is focused on expanding the existing gold resource on the property.

For more information about the Company visit www.redpineexp.com

Or contact:

Quentin Yarie, President & CEO, (416) 364-7024, [email protected]

Or Mia Boiridy, Investor Relations, (416) 364-7024, [email protected]

1Mineral Resource Statement, Surluga-Jubilee Gold Deposit, Wawa Gold Project, Ontario, SRK Consulting (Canada) Inc. (effective May 26, 2015)). The report is available on www.SEDAR.com under Red Pine’s profile.

2NI 43-101 inferred resource of 1,088,000 ounces of gold at a 1.71 grams per tonne (g/t) using a 0.40 g/t gold cut-off grade for pit-constrained and 2.50 g/t gold cut-off grade for underground-constrained resources, contained in 19.82 million tonnes open along strike and at depth. The Cut-off grades are based on a gold price of US$1,250 per once and a gold recovery of 95 percent (Mineral Resource Statement, Surluga-Jubilee Gold Deposit, Wawa Gold Project, Ontario, SRK Consulting (Canada) Inc (effective May 26, 2015)).

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This News Release contains forward-looking statements. In some cases, you can identify forward-looking statements by terminology such as “may”, “should”, “expects”, “plans”, “anticipates”, “believes”, “estimates”, “predicts”, “potential” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions and involve known and unknown risks, uncertainties and other factors that may cause our or our industry’s actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements.

Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this news release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law.