Mark Campbell | Aton Resources’ CEO on Financing Opportunity, 2019 Plans, Egyptian Mining Reform & Aton’s Share Structure

In this interview, Mark Campbell, Aton Resources CEO, provides an update regarding the current financing opportunity announced on February 15, 2019 and what the company plans to use the funds for in 2019. Mark also discusses the company’s capital structure and answers investors’ concerns over share dilution. Aton is anticipating acquiring a JV partner after the currently-in-process discussions on Egyptian mining reform are completed. The company plans on using 2019 to further define mineralization at existing projects and to test new targets in preparation to acquire a JV partner.

BEGIN TRANSCRIPT:

Bill: You are listening to Mining Stock Education. Thanks for tuning in. I’m Bill Powers. Well, a couple weeks ago, I caught with Javier Oduña, the exploration manager for Aton Resources, and he updated us on the 50 reverse circulations holes that were completed at the company’s Rodruin project. Just this last Friday, there was a press release from Aton announcing a current financing opportunity, so I gave Mark Campbell, the president and CEO, a ring and asked him to give us an update regarding this financing and what the company plans on doing with the proceeds this year. Mark, thanks for joining me.

Mark: Well, thank you, Bill. Yeah, if I could just give you a bit of background, we’ve got a very extensive work program coming up. We’ve launched a private placement, at the moment a non-brokered private placement, of up to $5 million Canadian. They’re units, so it’s priced five cents Canadian and includes a three year half-warrant at 10 cents.

The reason for the raise now is, as I say, we have a very extensive work program coming up. This includes more drilling at Rodruin, some of it infill, deepening some holes at where they’re still open at depth and mineralization, but also, too, is looking to start drill some more holes and then also go across to the north ridge where we haven’t done any drilling and look at some targets there, so you’re talking somewhere in the neighborhood of about 12,000 meters of drilling there.

Also, too, Bill, keep in mind is that we have quite a numerous number of targets within our exploration license. If you think about it, for the one concessionary that we have, we have a pretty big exploration portfolio, and one of the things that we want to do is go and put in some holes there. These won’t be extensive drilling programs, but what they will do is they will help prioritize these targets better, lead to more understanding of these areas, and therefore increase the value of the overall portfolio.

The great thing about the mining reform which is coming and the fact that they’re doing away with this oil and gas production sharing agreement model and therefore the 50/50 joint venture with the government, which allows us to do one thing that we wanted to do and is that hopefully within the next 18 months to two years attract a larger partner to come in and help JV with us to develop these areas, so we want to have a good idea of what we have there.

For the next year, there’s going to be quite a bit of drilling and similar work that we’ll do, some geochemistry and some more satellite imagery, but predominantly, it’s going to be the drilling.

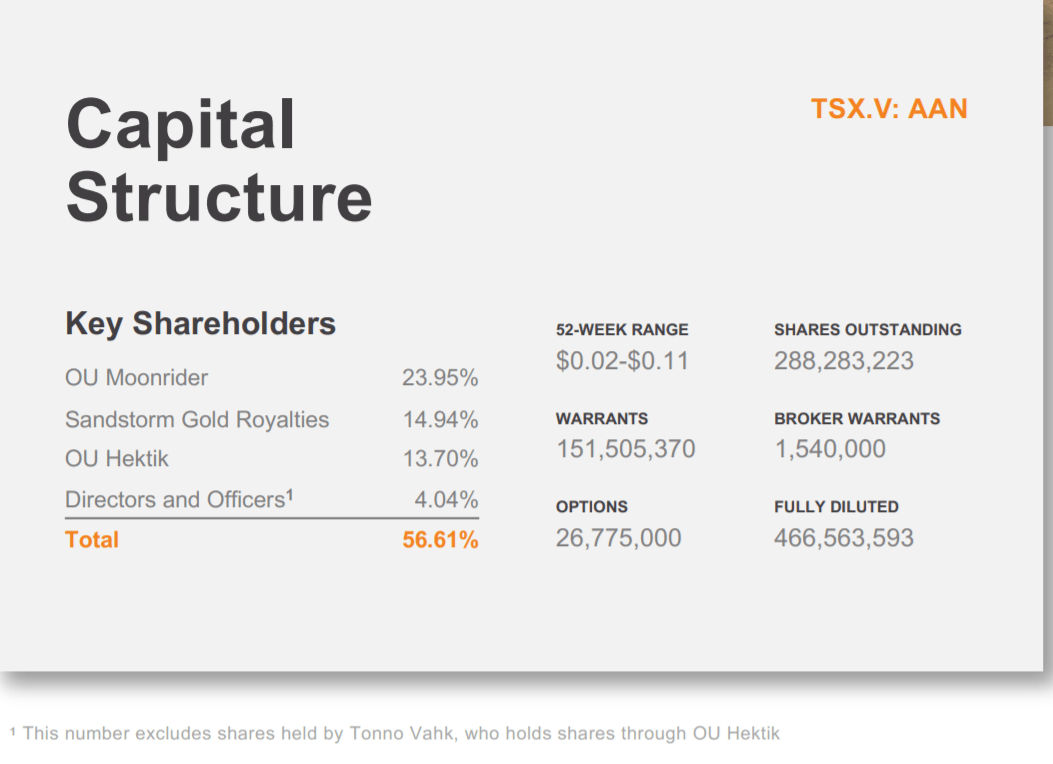

Bill: So the JV partner which you’re planning for, that would obviously prevent further shareholder dilution, but the capital structure is something I’d like you to address. I’ve had listeners of this podcast write into me saying, “I like what Aton’s doing. However, there’s a lot of shares outstanding.” We’re looking at 288 million shares out fully diluted, with all the warrants and options, about 466 million shares out. Can you address the capital structure, please?

Mark: Sure. That’s a very legitimate question and it’s one that I get asked a lot. If you look at the exploration business, it is a user of capital. We don’t produce baby food. We don’t have any sort of income that allows us to go and use revenue and to use capital internally generated to progress our business, and therefore, if you look at the capital structure, 56% of it is tightly held. A lot of that is that you have to have some strong longterm investors and supporters.

We always want to see more investors. We think that we have a lot to offer, but at the same time, to do the work, we have to raise the money, and that’s why we try and do it as efficiently, systematically, and as quickly as we can, but while keeping very low our admin costs. So 80% plus of what money we raise goes into the ground, goes into the project, which is very crucial.

The other reason that we are very transparent and put out fairly long-winded and detailed press releases is that let’s face it. We’re all in this together. My shareholders are who I work for and they are the ones who are effectively our real partners, so it’s important, I believe, to treat them as partners.

When it comes to dilution, unfortunately, that’s a fact of life, but I have a very clear idea on how I look at dilution. Getting rid of dilution is not rolling back the stock. It’s not not raising capital. Getting rid of dilution is building value into the company. By building value into the assets, by building value into the company, the value goes up. That reduces dilution in the long run, and yes, it’s not very attractive a lot of dilution, but it is the nature of the beast and building that value.

If you look at Bill Gates, in 1980, he owned effectively 100% of Microsoft. Today, he owns less than 8%. My question is which would he rather own? I think that it is a legitimate question, but to accomplish the goals that we need to accomplish to build that value four our shareholders into the business that they’re invested in, we need to be able to access capital. We need to be able to employ that capital systematically and effectively and hopefully move what we have here along faster.

Unfortunately, mineral exploration is a long-term proposition, but nonetheless, we feel that we are gaining, that we are moving in the right direction, that we have at Rodruin a potentially large bulk mineable target, and it is just incumbent upon us to go and produce the results that our shareholders want to see.

Bill: Your key shareholders, I’m looking here at your presentation, make up about 56% of the outstanding shares. Sandstorm Gold Royalties, who listeners of my show will know, owns about 15%, and then Moonrider owns about 24%. Could you share with listeners who is Moonrider?

Mark: Well, Moonrider and Hektik are investors, and I think most people know, are investors who come out of Estonia, and they have been cornerstone investors of us in the long-term and very supportive, and they will continue to be so. Sandstorm, again, you all know Sandstorm, and they, too, are supporters. As I say, having some long-term investors, because it is a long-term proportion, is very important for a company like us.

Bill: Anything more upcoming for the company, Mark? I know you mentioned to me you’re gonna be at PDAC. Are there any other shows or locations you’re going to be at if investors want to catch up with you?

Mark: Not at the moment. We will be at PDAC. The Egyptians are planning to be there as are Wood McKenzie and the European Bank of Reconstruction Development and all those who are separating mining reform in Egypt and opening up the country to mining investments, so it’s an important time for us, and certainly we’ll be there and certainly happy to meet with anyone to come by and ask any questions.

Bill: If you’re not going to be there and you’d like to get in touch with Mark either for inquiring about participating in this non-brokered private placement or with any other questions, Mark, could you please share your contact info?

Mark: Yeah. You can get me on [email protected].

Bill: All right. Well, thank you, Mark, for this update, and we’ll be talking to you again.

Mark: Well, thank you for calling, Bill, and I really appreciate the time to talk.