EQT Mails Letter to Shareholders, Highlighting Strong Financial and Operational Performance under the Company’s New Board and Management Team

-

Urges Shareholders to Vote Today “FOR” All 12 of EQT’s Director

Nominees on the GOLD Universal Proxy Card

PITTSBURGH–(BUSINESS WIRE)–EQT Corporation (NYSE:EQT) today announced that it has mailed a letter

to shareholders reviewing the strong operational and financial

performance delivered by the Company’s new Board of Directors and

management team. EQT’s letter stands in stark contrast with the recent

nominee Q&A published by the Toby Rice Group, which was devoid of facts

and relied on misleading, dated tropes about EQT.

“The comments by the Toby Rice nominees reveal a startling lack of

insight into EQT’s operations and confirm that they do not understand

that a significant transformation has already taken place at EQT,” said

Rob McNally, EQT president and chief executive officer. “Despite having

limited knowledge of EQT’s current operations, it is clear the Toby Rice

nominees are solely committed to pursuing Toby’s vision to control EQT

rather than thoughtfully evaluating the Company’s operations and

exercising independent judgment. Shareholders will be best served by

electing directors that will act only on an informed basis and in the

best interests of ALL EQT shareholders instead of being beholden to one

man and one idea.”

Highlights of EQT’s letter to shareholders include:

-

Since EQT’s refreshed Board and management team assumed control in the

fourth quarter of 2018, they have taken aggressive actions to

transform EQT, optimizing lateral lengths, spacing and operating

cadence, while reducing costs. -

The Company’s ambitious new strategic plan is working, as demonstrated

by the tremendous progress achieved to date:-

45% year-over-year improvement in rig move efficiency (Q1’19 vs.

Q1’18); - 25% reduction in drilling days / 1,000 ft vs. Q4’18;

- 40% improvement in frac crew moves (Q1’19 vs. Q1’18); and

- 70% reduction in completion non-productive time (Q1’19 vs. Q1’18).

-

45% year-over-year improvement in rig move efficiency (Q1’19 vs.

-

EQT is now among the Appalachian Basin’s low-cost leaders. The

Company’s operational efficiency makes it a free cash flow machine.-

EQT has already delivered more than $300 million in adjusted free

cash flow(1) over the past two quarters, and reduced

net debt by approximately $500 million. -

The Company is on track to achieve $300 to $400 million in

adjusted free cash flow(1) in 2019, and at least $2.9

billion of adjusted free cash flow(1) through 2023.

-

EQT has already delivered more than $300 million in adjusted free

-

Strong fundamentals and superior operating results are driving

increased value for shareholders.-

No Appalachian peer has outperformed EQT since the refreshed Board

and management team assumed control following the spin-off of

Equitrans Midstream Corporation from EQT.

-

No Appalachian peer has outperformed EQT since the refreshed Board

The EQT Board recommends that shareholders support the EQT team and

strategy that are delivering results by voting on the GOLD

universal proxy card “FOR” EQT’s 12 highly qualified director

nominees.

The full text of the letter to shareholders follows below:

June 3, 2019

Dear Fellow EQT Shareholder:

Over the last six months, EQT Corporation’s (“EQT” or the “Company”)

refreshed Board of Directors (the “Board”) and leadership team have

significantly improved the Company’s financial and operational

performance and transformed EQT into the premier, pure-play Appalachian

exploration and production (“E&P”) company.

As the Company’s recent

outperformance and last two quarterly results demonstrate, EQT’s

ambitious plan is working. Management is delivering cost savings,

increasing operational and capital efficiencies and achieving aggressive

targets, including substantial increases in productivity, efficiencies

and adjusted free cash flow. As a result, EQT is now among the

Appalachian Basin’s low-cost leaders – enabling the Company to

continue delivering free cash flow growth.

However, notwithstanding the new EQT leadership’s rapid progress, a

group led by Toby Z. Rice and Derek A. Rice (the “Toby Rice Group”)

seeks to take control of the Board at this year’s Annual Meeting of

Shareholders in order to make wholesale changes to our leadership team.

We believe that Toby Rice is singularly focused on installing himself as

CEO and irresponsibly packing the Board and management team with his

friends and family, which would disrupt EQT’s strong momentum and be

value-destructive.

We urge you to vote for EQT’s refreshed Board and leadership team, which

are already achieving strong results for our shareholders, by voting

today on the GOLD universal proxy card “FOR” EQT’s 12 director nominees.

THE NEW EQT IS DELIVERING INDUSTRY-LEADING FREE CASH FLOW

Since EQT’s refreshed Board and management team assumed control in the

fourth quarter of 2018, we have taken decisive and aggressive steps to

transform EQT. We set out to optimize lateral lengths, spacing and

operating cadence – while reducing costs – and, while there is more work

to do, we have made tremendous progress to date:

— 45% year-over-year improvement in rig move efficiency (Q1’19 vs.

Q1’18);

— 25% reduction in drilling days / 1,000 ft vs. Q4’18;

— 40% improvement in frac crew moves (Q1’19 vs. Q1’18); and

— 70% reduction in completion non-productive time (Q1’19 vs. Q1’18).

Our rapid progress in improving EQT’s operational efficiency has

re-positioned the Company as a free cash flow machine. EQT has

already delivered more than $300 million in adjusted free cash flow(1)

over the past two quarters, and reduced net debt by approximately $500

million, positioning the new EQT as an industry free cash flow leader.

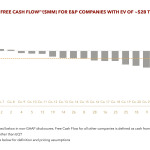

Over the last two quarters, EQT has outperformed 26 of 27 comparable

U.S. E&P peers in terms of free cash flow generation. We also expect EQT

to deliver $300 to $400 million of adjusted free cash flow(1)

in 2019, which is forecasted to be higher than 90% of EQT’s peers based

on IBES consensus estimates. (Please refer to Chart 1.)

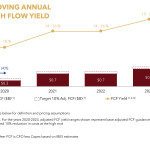

Building on progress to date in 2019, EQT is on track to deliver $2.9

billion of adjusted free cash flow(1) – representing 60% to

70% of our current market capitalization – over the next five years.

Further upside is expected from the Company’s Target 10% Initiative,

under which we expect to realize significant additional cost savings.

These cost savings will come from areas including materials and services

sourcing and contracting, additional water logistics and process

improvements, commercial portfolio and scheduling optimization and

further elimination of operational redundancy.

If fully realized, the Target 10% Initiative is expected to further

raise EQT’s 2019 to 2023 cumulative adjusted free cash flow by $500

million to approximately $3.4 billion.(1) Your

Board and management team are confident we have the right team in place

and are taking the right steps to maximize shareholder value. (Please

refer to Chart 2.)

STRONG FUNDAMENTALS AND SUPERIOR OPERATING RESULTS ARE DELIVERING

INCREASED VALUE TO SHAREHOLDERS

Despite a difficult market, including commodity price headwinds, EQT has

significantly outperformed peers’ total return to shareholders,

demonstrating that the market is appreciating – and rewarding – the

decisive actions taken by EQT’s Board and leadership team.

In fact, no Appalachian peer has outperformed EQT since the refreshed

Board and management team assumed control following the spin-off of

Equitrans Midstream Corporation in November 2018.

The Company’s remarkable progress underscores that the EQT Board and

management team are embracing constructive disruption when it will yield

improved results. EQT has successfully implemented tangible and

significant changes that are responsibly and meaningfully driving

performance improvement and value creation at EQT. (Please refer to

Chart 3.)

THE RICE TEAM HAS NEVER GENERATED

POSITIVE FREE CASH FLOW

In contrast to the new EQT’s Board’s and management team’s proven

ability to deliver results, the Toby Rice Group does not have experience

running a company with EQT’s scale. In fact, Rice Energy never produced

positive annual free cash flow while operating as a public company. Instead,

Rice Energy burned through approximately $5 billion of capital from 2012

through the third quarter of 2017.

At the time, Rice Energy was an emerging growth company that prioritized

drilling its best acreage to boost short-term production volumes. Now,

Toby Rice wants shareholders to believe that he can not only operate a

company that is substantially different and much larger, but also

deliver free cash flow at EQT – something he never achieved at Rice

Energy.

Simply put, the new EQT is focused on free cash flow generation – an

area in which Toby Rice has no experience.

We think the Toby Rice Group’s claim that it can deliver an incremental

$500 million in free cash flow from EQT’s plan is fictional and not

credible. This claim is not supported by facts and is undermined by

their own historical operating results.

In contrast, EQT’s Board and management team are focused on delivering

returns and free cash flow and are already delivering strong results.

Under the new Board and management team, we are confident EQT will

continue to outperform its Appalachian peers.

We believe the choice is clear:

| ✔ |

Support the EQT team and the strategy that is delivering positive |

||

| ✖ |

Give up control of EQT to the Toby Rice Group, which is deeply conflicted and promises unrealistic free cash flow targets despite NEVER having generated positive free cash flow at Rice Energy. |

||

PROTECT YOUR INVESTMENT BY SUPPORTING THE EQT BOARD AND MANAGEMENT

TEAM, WHICH ARE SUCCESSFULLY DELIVERING OUTSTANDING RESULTS

Your vote is extremely important. EQT’s independent nominees are aligned

with the interests of EQT shareholders, and we believe they are better

suited to continue to oversee EQT’s successful transformation. A vote

for EQT’s 12 director nominees on the GOLD

universal proxy card is a vote to support the ongoing successful

execution of EQT’s proven cash flow plan and future value creation.

We urge you to vote today by telephone, internet or by signing,

dating and returning the enclosed GOLD

universal proxy card in the postage-paid envelope provided.

On behalf of your Board of Directors, thank you for your support.

Sincerely,

THE INDEPENDENT MEMBERS OF THE EQT BOARD OF DIRECTORS

| If you have any questions, or need assistance in voting |

|

your shares on the GOLD universal proxy card, |

|

please call EQT’s proxy solicitor: |

| INNISFREE M&A INCORPORATED |

| TOLL-FREE at 1-877-687-1866 (from the U.S. or Canada) |

| Or at (412) 232-3651 (From Other Locations) |

|

Please discard and do NOT vote using any white proxy cards you may |

About EQT Corporation:

EQT Corporation is a natural gas production company with emphasis in the

Appalachian Basin and operations throughout Pennsylvania, West Virginia

and Ohio. With 130 years of experience and a long-standing history of

good corporate citizenship, EQT is the largest producer of natural gas

in the United States. As a leader in the use of advanced horizontal

drilling technology, EQT is committed to minimizing the impact of

drilling-related activities and reducing its overall environmental

footprint. Through safe and responsible operations, EQT is helping to

meet our nation’s demand for clean-burning energy, while continuing to

provide a rewarding workplace and support for activities that enrich the

communities where its employees live and work. Visit EQT Corporation at www.EQT.com;

and to learn more about EQT’s sustainability efforts, please visit https://csr.eqt.com.

EQT Management speaks to investors from time to time and the analyst

presentation for these discussions, which is updated periodically, is

available via the Company’s investor relationship website at ir.eqt.com.

Cautionary Statements

This communication contains certain forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934, as

amended, and Section 27A of the Securities Act of 1933, as amended.

Statements that do not relate strictly to historical or current facts

are forward-looking. Without limiting the generality of the foregoing,

forward-looking statements contained in this communication specifically

include the expectations of plans, strategies, objectives and growth and

anticipated financial and operational performance of the Company and its

subsidiaries, including guidance regarding projected adjusted free cash

flow and anticipated cost savings. These forward-looking statements

involve risks and uncertainties that could cause actual results to

differ materially from projected results. Accordingly, investors should

not place undue reliance on forward-looking statements as a prediction

of actual results. The Company has based these forward-looking

statements on current expectations and assumptions about future events,

taking into account all information currently available to the Company.

While the Company considers these expectations and assumptions to be

reasonable, they are inherently subject to significant business,

economic, competitive, regulatory and other risks and uncertainties,

many of which are difficult to predict and beyond the Company’s control.

The risks and uncertainties that may affect the operations, performance

and results of the Company’s business and forward-looking statements

include, but are not limited to, those set forth under Item 1A, “Risk

Factors,” of the Company’s Form 10-K for the year ended December 31,

2018, as filed with the SEC and as updated by subsequent Form 10-Qs

filed by the Company, and those set forth in the other documents the

Company files from time to time with the SEC.

Any forward-looking statement speaks only as of the date on which such

statement is made, and the Company does not intend to correct or update

any forward-looking statement, whether as a result of new information,

future events or otherwise, except as required by law.

NON-GAAP DISCLOSURES

Adjusted Free Cash Flow

Adjusted free cash flow is defined as the Company’s net cash provided by

operating activities less changes in other assets and liabilities, less

EBITDA attributable to discontinued operations (a non-GAAP supplemental

financial measure defined below), plus interest expense attributable to

discontinued operations and cash distributions from discontinued

operations, less accrual-based capital expenditures attributable to

continuing operations. Adjusted free cash flow is a non-GAAP

supplemental financial measure that the Company’s management and

external users of its consolidated financial statements, such as

industry analysts, lenders and ratings agencies use to assess the

Company’s liquidity. The Company believes that adjusted free cash flow

provides useful information to management and investors in assessing the

impact of the Company’s ability to generate cash flow in excess of

capital requirements and return cash to shareholders. Adjusted free cash

flow should not be considered as an alternative to net cash provided by

operating activities or any other measure of liquidity presented in

accordance with GAAP.

The table below reconciles adjusted free cash flow with net cash

provided by operating activities, the most comparable financial measure

calculated in accordance with GAAP, as derived from the Statements of

Condensed Consolidated Cash Flows included in the Company’s report on

Form 10-Q for the quarter ended March 31, 2019 and in the Company’s

report on Form 10-K for the year ended December 31, 2018.

|

Three Months |

Three Months |

Total | ||||||||||

| (Thousands) | ||||||||||||

| Net cash provided by operating activities | $ | 871,287 | $ | 530,866 | $ | 1,402,153 | ||||||

| (Deduct) / add back changes in other assets and liabilities | (223,934 | ) | 261,216 | 37,282 | ||||||||

| Operating cash flow | $ | 647,353 | $ | 792,082 | $ | 1,439,435 | ||||||

| (Deduct) / add back: | ||||||||||||

| EBITDA attributable to discontinued operations(a) | — | (118,934 | ) | (118,934 | ) | |||||||

| Interest expense attributable to discontinued operations | — | 19,452 | 19,452 | |||||||||

| Adjusted operating cash flow | $ | 647,353 | $ | 692,600 | $ | 1,339,953 | ||||||

| (Deduct): | ||||||||||||

| Capital expenditures attributable to continuing operations | (476,022 | ) | (558,351 | ) | (1,034,373 | ) | ||||||

| Adjusted free cash flow | $ | 171,331 | $ | 134,249 | $ | 305,580 | ||||||

| (a) |

As a result of the separation of the Company’s midstream business from its upstream business and subsequent spin-off of Equitrans Midstream Corporation in November 2018, the results of operations of Equitrans Midstream Corporation are presented as discontinued operations in the Company’s Statements of Condensed Consolidated Operations. EBITDA attributable to discontinued operations is a non-GAAP supplemental financial measure reconciled in the section below. |

||

The Company has not provided projected net cash provided by operating

activities or a reconciliation of projected adjusted free cash flow to

projected net cash provided by operating activities, the most comparable

financial measure calculated in accordance with GAAP. The Company is

unable to project net cash provided by operating activities for any

future period because this metric includes the impact of changes in

operating assets and liabilities related to the timing of cash receipts

and disbursements that may not relate to the period in which the

operating activities occurred. The Company is unable to project these

timing differences with any reasonable degree of accuracy without

unreasonable efforts such as predicting the timing of its and customers’

payments, with accuracy to a specific day, months in advance.

Furthermore, the Company does not provide guidance with respect to its

average realized price, among other items, that impact reconciling items

between net cash provided by operating activities and adjusted operating

cash flow and adjusted free cash flow, as applicable. Natural gas prices

are volatile and out of the Company’s control, and the timing of

transactions and the income tax effects of future transactions and other

items are difficult to accurately predict. Therefore, the Company is

unable to provide projected net cash provided by operating activities,

or the related reconciliation of projected adjusted free cash flow to

projected net cash provided by operating activities, without

unreasonable effort. Projected 2019 adjusted free cash flow is based on

average NYMEX natural gas price (April to December) of $2.79 per MMbtu

as of March 31, 2019. For the period 2020 through 2023, projected

adjusted free cash flow is based on average NYMEX natural gas price of

$2.85 per MMbtu for Henry Hub and ($0.45) local basis.

EBITDA Attributable to Discontinued Operations

EBITDA attributable to discontinued operations is a non-GAAP

supplemental financial measure defined as income from discontinued

operations, net of tax plus interest expense, income tax expense,

depreciation and amortization of intangible assets attributable to

discontinued operations for the three months ended December 31, 2018.

The table below reconciles EBITDA attributable to discontinued

operations with income from discontinued operations, net of tax, the

most comparable financial measure calculated in accordance with GAAP, as

reported in the Statements of Condensed Consolidated Operations included

in the Company’s report on Form 10-K for the year ended December 31,

2018.

|

Three Months Ended |

||||

| (Thousands) | ||||

| Income (loss) from discontinued operations, net of tax | $ | (163,911 | ) | |

| Add back / (deduct): | ||||

| Interest expense | 19,452 | |||

| Income tax benefit | (31,575 | ) | ||

| Depreciation | 22,243 | |||

| Amortization of intangible assets | 4,847 | |||

| Impairment of goodwill | 267,878 | |||

| EBITDA attributable to discontinued operations | $ | 118,934 | ||

Important Information

EQT Corporation (the “Company”) filed a definitive proxy statement and

associated GOLD universal proxy card with the Securities and Exchange

Commission (the “SEC”) on May 22, 2019 in connection with the

solicitation of proxies for the Company’s 2019 Annual Meeting of

Shareholders (the “2019 Annual Meeting”). Details concerning the

nominees for election to the Company’s Board of Directors at the 2019

Annual Meeting are included in the definitive proxy statement. BEFORE

MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS OF THE COMPANY

ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE

SEC, INCLUDING THE COMPANY’S DEFINITIVE PROXY STATEMENT AND ANY

SUPPLEMENTS THERETO, IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION. Investors and shareholders can obtain a

copy of the relevant documents filed by the Company with the SEC,

including the definitive proxy statement, free of charge by visiting the

SEC’s website, www.sec.gov.

Investors and shareholders can also obtain, without charge, a copy of

the definitive proxy statement, when available, and other relevant filed

documents by directing a request to Blake McLean, Senior Vice

President, Investor Relations and Strategy of EQT Corporation, at [email protected],

by calling the Company’s proxy solicitor, Innisfree M&A Incorporated,

toll-free, at 877-687-1866, or from the Company’s website at https://ir.eqt.com/sec-filings.

(1) Non-GAAP financial measure, see disclosures for

definition and pricing assumptions.

Contacts

Analyst inquiries:

Blake McLean – Senior Vice President,

Investor Relations and Strategy

412.395.3561

[email protected]

Media inquiries:

Michael Laffin – Vice President,

Communications

412.395.2069

[email protected]