Ken Coleman | 2019 Drill Plans for U.S. Gold Corp’s Keystone Project on Nevada’s Cortez Trend

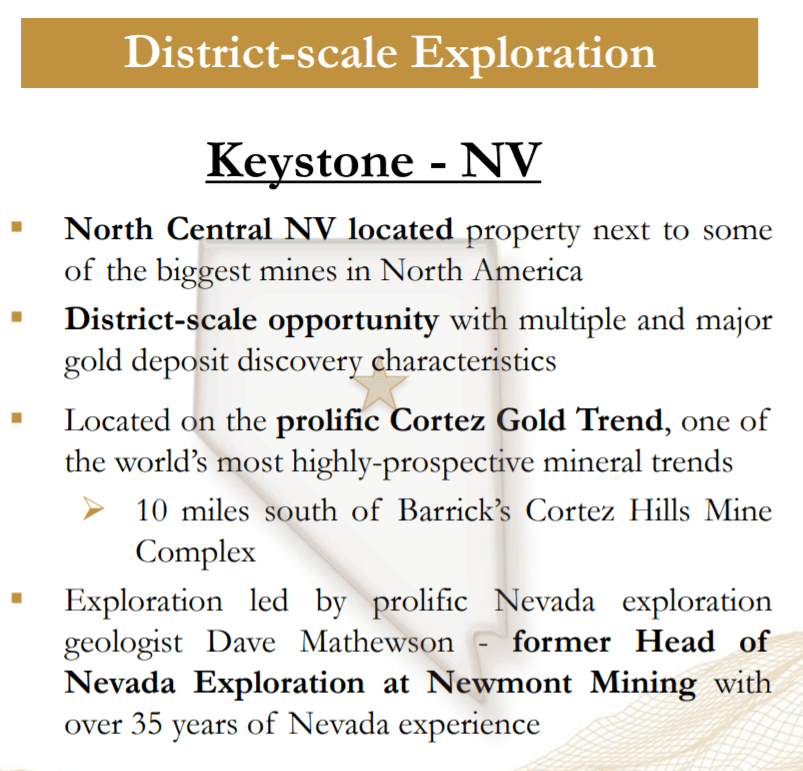

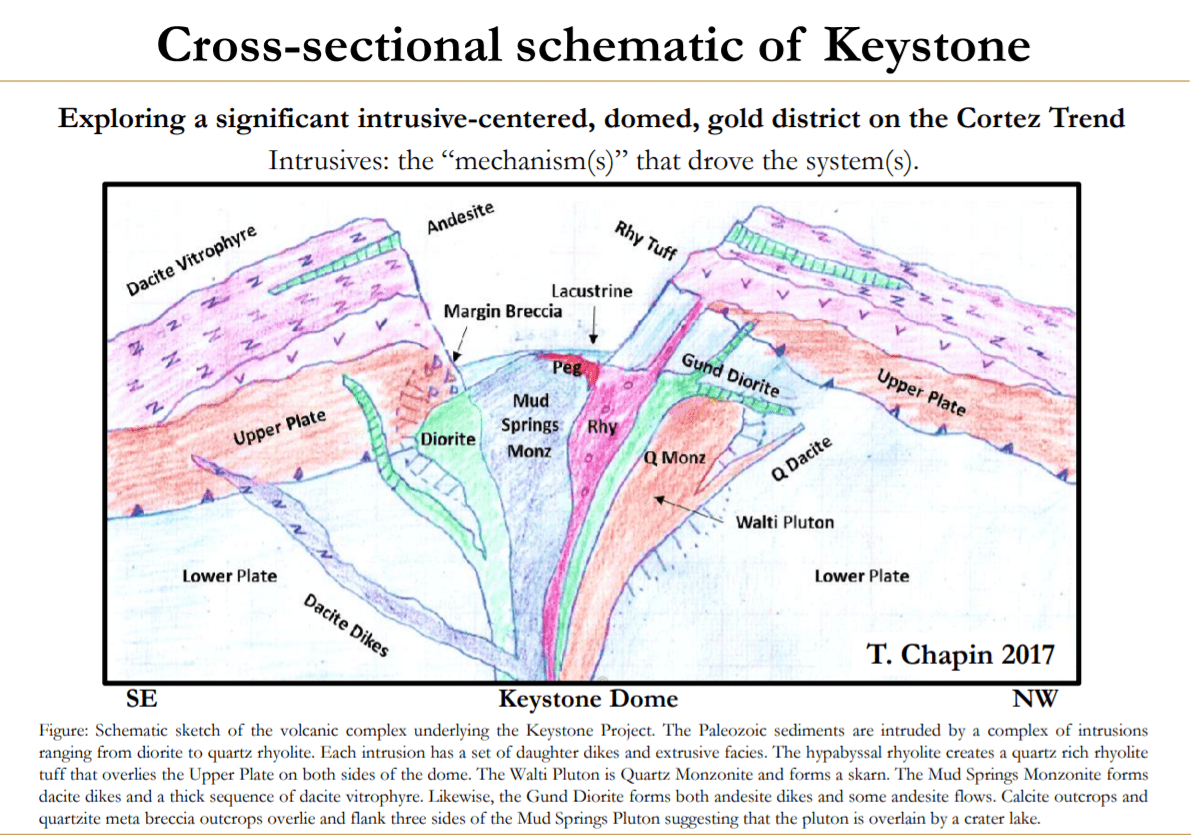

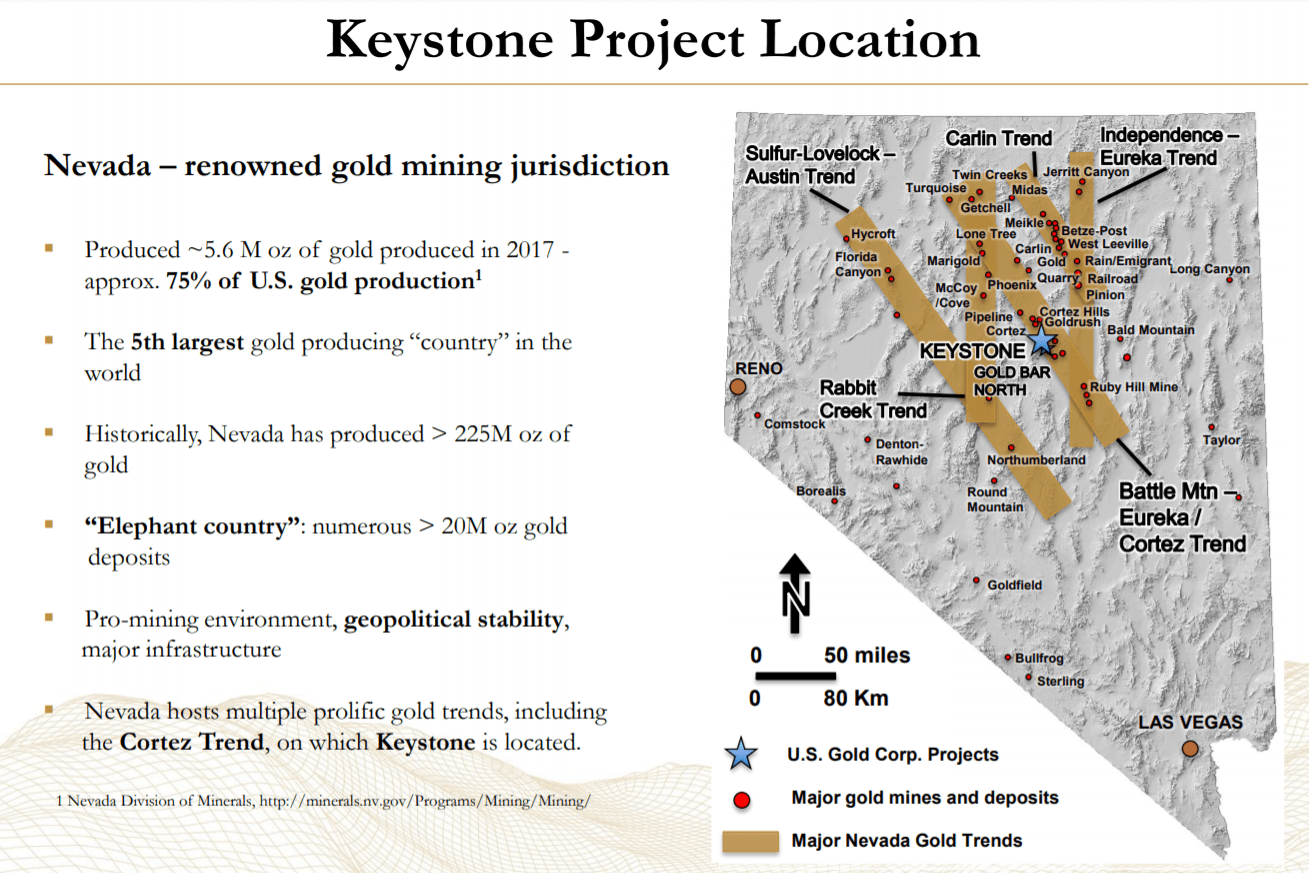

The Keystone project is a Carlin-type gold deposit exploration project located on Nevada’s Cortez Trend, one of the world’s most prolific gold mining trends and home to some of North America’s largest mines. The Keystone project is an under-explored, early-Tertiary (34.1+/-0.7 Ma), complex intrusive-centered, large gold-bearing hydrothermal system developed in domed permissive, lower-plate, carbonate host rocks. U.S. Gold Corp. has consolidated this entire prospective gold Cortez Trend district currently with 20 square miles of mineral rights control. This is the first time in history of the district that both the entire district has been consolidated by one company, and is being evaluated by systematic, comprehensive, model-driven exploration. U.S. Gold Corp.’s work to date on the project has illustrated many similarities between Keystone and some of the major mines on both the Cortez and Carlin Trends in Nevada – with evidence of similar stratigraphy, lithologic characteristics, structure, and alteration – factors important to the discovery of significant Carlin-type deposits.

The Keystone project is a Carlin-type gold deposit exploration project located on Nevada’s Cortez Trend, one of the world’s most prolific gold mining trends and home to some of North America’s largest mines. The Keystone project is an under-explored, early-Tertiary (34.1+/-0.7 Ma), complex intrusive-centered, large gold-bearing hydrothermal system developed in domed permissive, lower-plate, carbonate host rocks. U.S. Gold Corp. has consolidated this entire prospective gold Cortez Trend district currently with 20 square miles of mineral rights control. This is the first time in history of the district that both the entire district has been consolidated by one company, and is being evaluated by systematic, comprehensive, model-driven exploration. U.S. Gold Corp.’s work to date on the project has illustrated many similarities between Keystone and some of the major mines on both the Cortez and Carlin Trends in Nevada – with evidence of similar stratigraphy, lithologic characteristics, structure, and alteration – factors important to the discovery of significant Carlin-type deposits.

Ken Coleman is a geologist with extensive experience in Nevada. Ken joined U.S. Gold Corp. from Barrick Gold Corporation where he was a mine geologist at the Goldstrike Mine. Prior to Barrick, Ken was a consulting, mine and project geologist for Battle Mountain Gold, Comstock Mining and Victoria Gold. Ken brings deep exploration and geological experience to the U.S. Gold Corp. team. He has been a member of the Geological Society of Nevada since 2005.

TRANSCRIPT:

Bill: You are in Elko, Nevada, and your focus, is on the Keystone property. Let’s start with you giving us a little background on this property itself? What is the history of exploration on this Keystone property?

Ken: All right, to begin with in the, I’d say the late 1960s, Newmont was the first company really active in recent time at Keystone. There was some historic mining there before at the historic Keystone mine, it was for silver, lead, zinc, and some skarn deposits, but 1960s looking for gold started with Newmont, they did some drilling kind off the range front, nothing really in the mountain range. And then up into the 80s things really started going. Placer, and some various other little companies were involved, looking for shallow oxide gold, shallow holes, less than 200 feet; working on up into the 90s.

Anyway there was several other companies involved in the land package was kind of fragmented, they were in there looking around. They didn’t find a whole lot, but we ended up with about 240 holes on the property, at the end of the early 2000s, when a company called Placer Dome now Barrick was in there. 2005, 2006, and they drilled on five holes, it’s kind of an interesting thing, on the very north west end of the property, and on the south end. These five holes were, two of them were the only first two deep holes drilled on the property, but they didn’t really test it. That’s kind of the overall.

Bill: And the district, it was not one consolidated district, and there was not one systematic approach to exploration like US Gold Corp is doing right now?

Ken: That is correct. It was split between a lot of different operators, and so they by necessity could only work on their particular claim blocks. So, US Gold was able to do that and actually apply, not only new models and new ideas, but apply it to an entire district. And that’s the scale of these magmatic related carlin-type systems, they’re large. They are large district scale systems, and so exploring them on a small claim block doesn’t help you very well. So, we could do that.

Bill: Dave Mathewson as you know referred to this project as the best pre-drilling project that he’s seen in his career. You’ve been in Nevada for quite some time, what are some of the key features that really stand out with this project, relative to your previous experience?

Ken: Two major ones stood out, when I first looked at this property with Dave, is the size of the structural systems that are present at Keystone, the structural systems are wide. They are through going, and those are very important for bringing the fluids from deeper in the crust, up into the upper parts of the crust. And then, the variety of intrusive’s, which we’ve now obtained more information on through a master of thesis, but those intrusive’s and the variety of compositions that you can see at the surface mapping, there’s a long lived magmatic vent there, that brings the heat and allows the circulation of the fluids in the rocks, and that’s borne out by just the abundance of alteration of a lot of different varieties that you can see on the property. That’s one of the more altered pieces of ground I’ve walked across.

Bill: And this is downtrend from Cortez Hills too, about 10 miles if I recall correctly?

Ken: It’s actually about 16 miles from Cortez Hills, to the heart of Keystone. And we’re about 12 miles to the north west of Gold Bar. We’re right between two meaningful areas along the Battle Mountain Eureka gold belt.

Bill: Company’s been on the project, has it been about three years?

Ken: Yeah, it’s been three years. Really got started in 2016, did some initial deep core drilling, which had never been done on the property, since the 1960s. And that was important, that core drilling gave us some information of the rocks at depth, which there really wasn’t any information; to compare it to other properties in the district, especially to Cortez to the north.

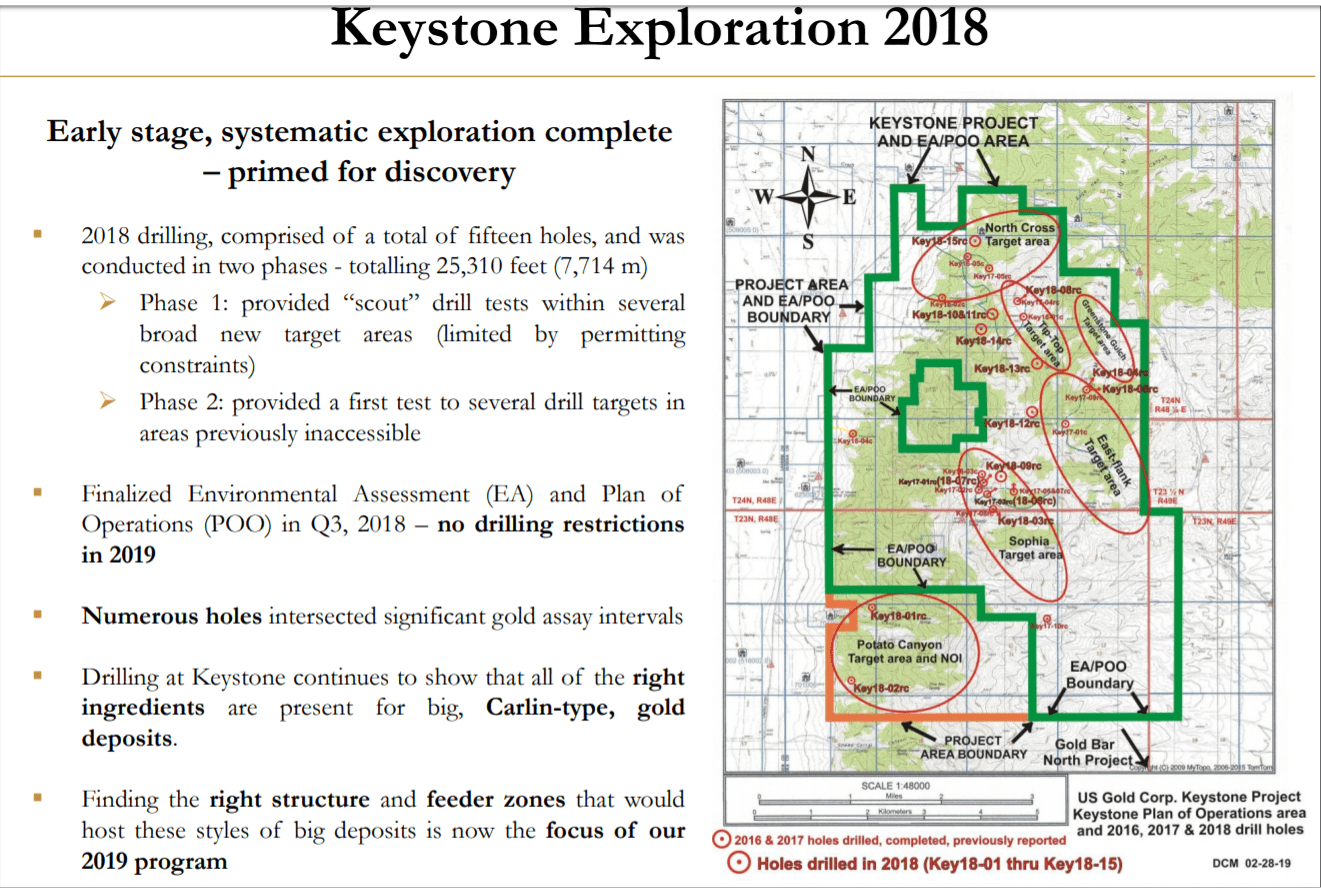

Then 2017 and 2018 started doing RC drilling to more spread out on the 20 square mile property package to kind of get points scattered all about and really get a subsurface understanding of the host rocks and any alteration present. Which really helped sight some of the holes, you don’t just throw a hole out, there’s a reason; even with the scout drilling.

Bill: So, last year you did the scout drilling, what was the significance of that and what information did that provide that was crucial to outlining this year’s drill program?

Ken: Well, last year’s drilling was in two phases, so earlier in the summer we drilled eight holes, and we were really confined to the notice of intents that we had in place, we didn’t have our plan of operations approved yet. And so, we pretty much drilled some angle holes off of existing pads to get a better understanding of the orientation of structures that were encountered, carrying gold, and pathfinder elements, and things of that nature. Those were helpful in designing the phase two program, when we finally received our plan of operations approval in late October. We drilled another six holes after that, and those were much more targeted specifically in two areas that were priority, what we call Sophia and another area we call Tip Top.

And Sophia and Tip Top both have received historic drilling in the past, all of it shallow, less than a thousand feet. They were there, there was indications gold and rocks, pathfinder elements, and rocks, and soils; alteration all over the place. So, you know, we did the deeper drilling, but right off of our first hole for phase two was Key 1809RC in the Sophia target, and that hole, that’s kind of one of my favorite holes so far that we’ve drilled. But we lost that hole at 1605 feet, in a 20 foot wide void, it’s an open space, 20 feet wide; 1600 feet.

Well, above that we drilled about 350 feet of oxidized, brecciated, horse canyon, and comus formation rocks. With anomalous gold, arsenic, anemone, mercury, thallium, across the board, but all of these elements much higher than any of the previous drilling we’ve done. Especially the thallium, the thallium was 380 PPM, which is a pretty significant number. Thallium is intimately associated with gold mineralization in these Carlin type systems, including at Cortez Hills. It’s one of the several elements that best correlates. It was pretty exciting in that it’s oxidized below a pretty thick sequence of comus rocks that were altered to skarn. And we had a 20 foot intercept of I think 1.18 grams of gold bearing skarn, in that whole… In the comus something we hadn’t encountered before. And that gives us encouragement for another model we’ll be pursuing with 2019 drilling, looking for skarn.

Bill: With the information from the scout holes, do you feel like you’re on the edge of a potential mineralization, or how did that help further determine this years drilling? This hole that you just mentioned?

Ken: That’s kind of the feeling I’m getting, is we’re potentially near something important. Those levels of trace elements such as thallium, arsenic and mercury with thick intervals of 100 to 200 PPB gold, that’s a common thing, it’s no guarantee, but it’s a common thing when you’re around a near. And as are these open spaces of voids. We have a collapsed stretch of form that opens up a lot of space from the dissolution stuff. So, it appears that we’re close to what could be the right thing. It has all of the right signatures, there are no guarantees of course, we have to put more holes in it.

Bill: With this year’s drill program, when can we expect the rigs to start turning, and what more can you tell us about this year’s program?

Ken: Right now Keystone is just finally starting to dry out, we’ve been inundated with about three weeks straight of rain for the last three weeks, and it just dried out in the last couple of days. Fortunately Nevada dries out pretty quickly, but anyway we’re looking at least another month out before we could possibly begin drilling. And we’re looking at a modest program somewhere in the neighborhood of a similar thing that we did last year, 10 to 15 drill holes. Of course, we get onto something and everything changes. This is an iterative process, we drill hole to hole. Some of the targets we’ll be drilling, we have multiple holes proposed but we’ll drill them one at a time, so we have time to analyze the data we get back; and properly place these holes. It’s 20 square miles, it’s a big area, it’s going to take an iterative direction to get to where we need to be.

Bill: Yeah, you really need focused drilling. I remember in my last interview with Luke Norman, he essentially said you can drill yourself out of business quite quickly on this big of a property, unless you’re really focused in your targeting.

Ken: That’s correct and that’s really the drilling we’re doing this year, is all targeted, we’ve figured out several high quality targets, including Sophia and Tip Top. But several of them have no previous historic drilling, all of the indications are there…good structure and good alteration, intrusive’s, everything we need to see at surface. Now we need the third dimension and put some holes and test it. Rarely do you ever come up with discovery on first hole test and targets, it’s usually an iterative process and not just for us, for even the majors. That’s the history of big discoveries is it takes a lot of drill holes, persistence from management, from the geologists who are working on the projects, and the investors who put up the money.

Bill: So, this would be reverse circulation drilling and to what depth do you plan to drill these holes?

Ken: Yeah, this will be all RC drilling, we’re planning 1500 to 2000 foot maximum drill holes. You start pushing beyond that and you really need some pretty high grades to make things economic, but yeah 1500 to 2000 feet is reasonable, that’s the plan idea. If we get into something, we’ll come back with core, but we can drill three RC holes for the cost of one deep core hole. At this point in time it makes the most sense, it’s the best use of investor dollars, you want to get the maximum amount of information for the minimum amount of cost.

Bill: Best case scenario, when could these results come in? Are we looking at September, October?

Ken: If we start drilling mid July, we’ll be looking at mid September before we actually have results in hand and have time to analyze them and figure out what we’re doing from there.

Bill: And then, as you mentioned, if you hit some mineralization and you see something good, you could then still schedule a core drill program this year potentially?

Ken: If warranted, if warranted and if we have the resources to do so, it’s really a matter of that. The resources we have now to do RC, is all we can do. If we come across something pretty good, we’ll have to probably go to the market and get more people interested, which I absolutely hope happens. And yeah, get core, because core gives you a lot more information, orientations of the structures, and breccias and things of that nature. And it verifies what you’re looking at.

Bill: Ken, as we conclude here, what would be considered success? When we’re talking about what’s going to be in the reverse circulation drill holes? Talk to me about grades or depths. What are some things that investors should look for as a result of this drill program?

Ken: What I would consider success is, a decent drill intercept, either of meaningful thickness, 25-50 meters of 1 to 2 grams, or more importantly even 10-20 meters of greater than 10 gram gold. That would be success in my mind, and I think investors would like that. We come across something 40-50 meters of 1 to 2 grams, that’s something that’s pretty common on the halo of these large gold systems and then it’s a matter of vectoring in to where the higher grade is.

Bill: And this project is early on, so conceptually are we potentially looking at an open pit, that then goes underground at the base of the pit? Is that potentially what you’d be conceptualizing at this point?

Ken: We’re drilling deep, so we’re looking at all avenues, it’s really going to be dependent upon what we drill into. We’re using geological models and concepts, as opposed to how we might possibly mine this. That was how the property was attacked in the past looking for shallow oxide open pit stuff, we’re not constrained by that. We’re looking for gold deposits, whether it can be mined at the surface or at depth, it’ll depend on what we drill.