Gold Discovery Update from Osino Resources’ CEO Heye Daun & VP Exploration Dave Underwood

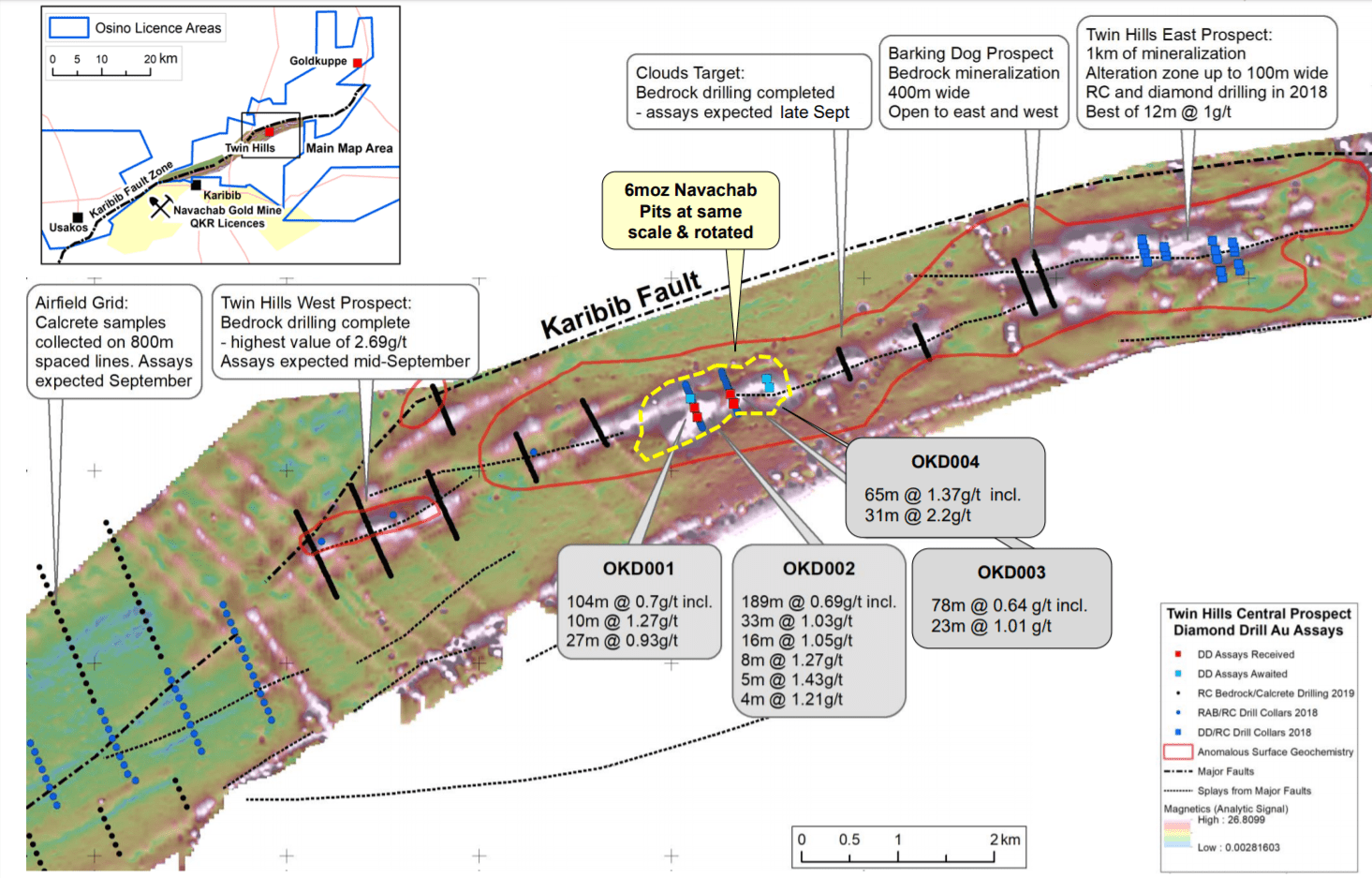

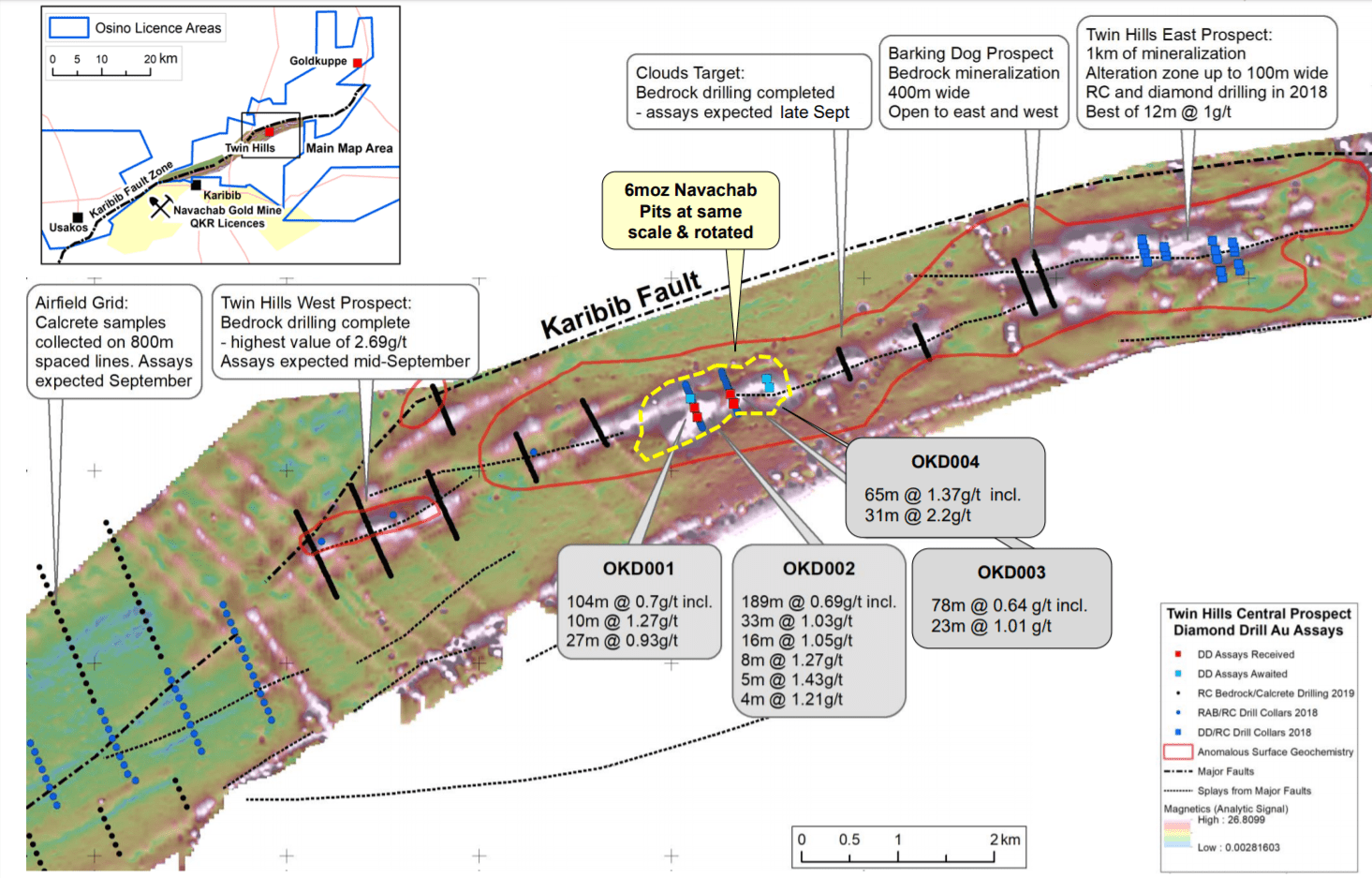

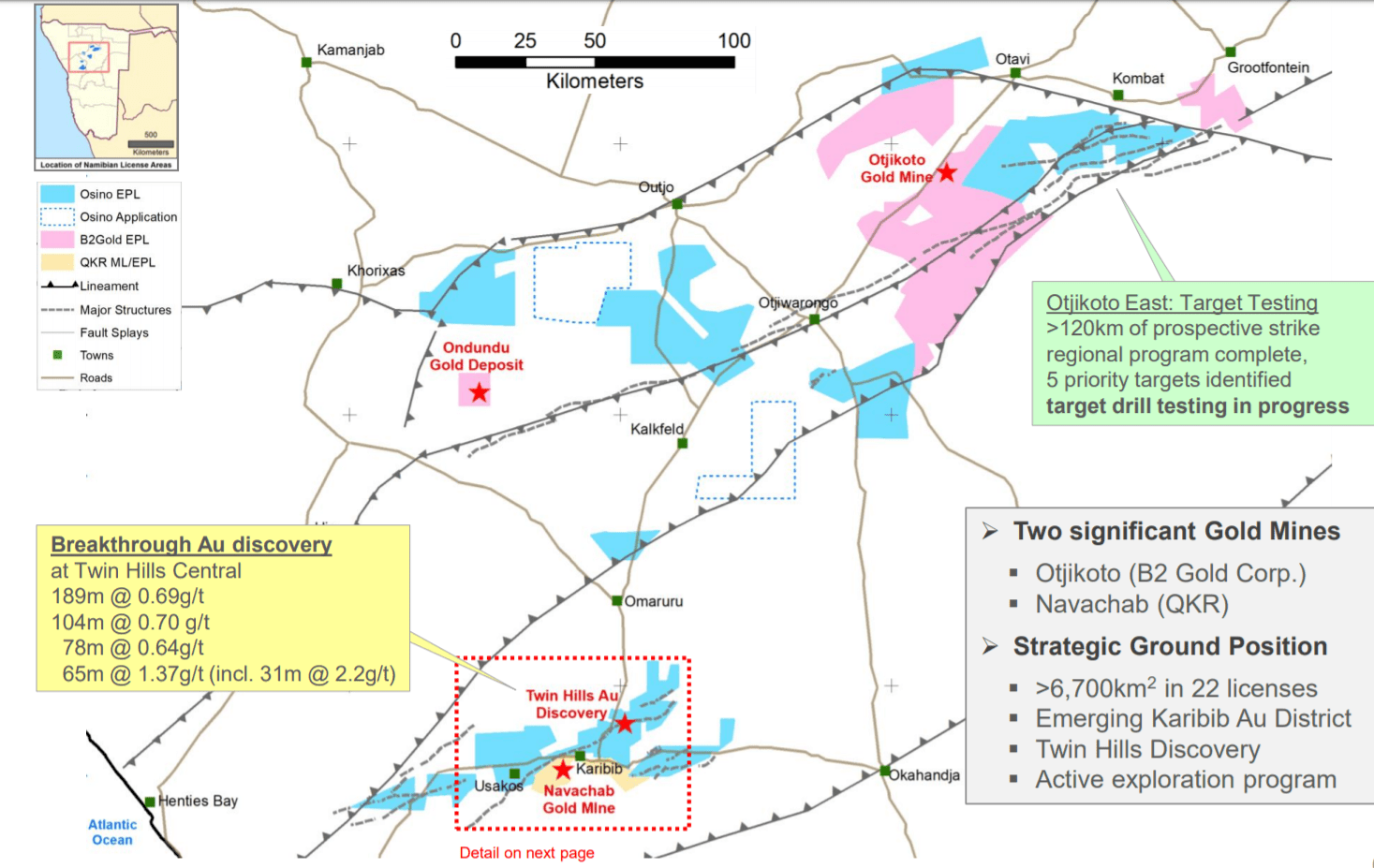

In this interview, CEO Heye Daun and V.P. Exploration Dave Underwood provide an update on Osino Resources’ Twin Hills discovery and the ongoing exploration throughout the company’s land package in Namibia. Twin Hills is an 11km strike, sediment-hosted, hydrothermal gold system with coincident structure, geochem & magnetics in classic orogenic setting (source/pathway/trap). It has large scale potential with significant upside in terms of size & grade.

Heye Daun (CEO & co-founder) has over 20 years of experience with top-tier mining companies and financial groups. As the former President & CEO of Ecuador Gold & Copper Corp. (“EGX”) he was instrumental in the creation of Lumina Gold Corp. through the C$200M merger of EGX with Odin Mining. He is a co-founder of Auryx Gold Corp. and co-lead Auryx through IPO, capital raising, project development to the C$180M sale to B2 Gold Corp. Prior to that he worked for Nedbank Capital and Old Mutual Investment Group. He spent the first ten years of his career with Rio Tinto, AngloGold-Ashanti and Gold Fields, building and operating mines in Africa.

Dave Underwood (VP Exploration) has 26 years of broad exploration experience in Africa and beyond. He spent his formative years with De Beers and Anglo American including 6 years in Tanzania and Kenya, exploring for gold and base metals. The last 12 years he worked as an independent exploration consultant in exploration, target generation, evaluation and due diligence programs for, among others, Newmont, AngloGold-Ashanti, Silver Bull Resources and Roxgold. Commodities include gold, silver, base metals, uranium, manganese and iron ore. Dave is a Fellow of the Society of Economic Geology, and Registered Professional Scientist with the SACNSP.

Link to Osino’s presentation: http://osinoresources.com/wp-content/uploads/2019/09/2019_09-MIF-Osino-Investor-Presentation-v3.01.pdf

OsinoResources.com TSXV:OSI – OTC:OSIIF

TRANSCRIPT:

Bill Powers: Heye, could you offer your comments and what you think is going on in the share price action right now?

Heye Daun: I’ll try my best. Of course, my role as a CEO is to look at fundamentals and the share price. And the share price, I have some ideas and some views on things, but obviously I don’t know everything. What we all know is that the four-month hold period of the 35-cent financing actually ends today, that stock becomes trading today. I think it’s a fairly known issue that this whole four-month hold system is somewhat dysfunctional, I guess, in that, the stock charts generally tends to start trading a couple of days before it becomes free. So we saw that happening. You saw from the middle of last week, we started trading big volumes and the share price came down substantially.

I don’t know who’s selling. All I can tell you is I’m surprised by it. I didn’t expect it because that last 35-cent round was a very limited round. It had, in fact, 25 names in it, and some of those names had a large part of it, including Ross Beaty. There was Paul Stevens out of California, who had a very significant part of it, in fact, almost a third of that financing. And so, I’m surprised at the volume, and, yeah, we didn’t expect it. It’s unfortunate, but I guess it’s also a function of the malaise in the overall market in Canada. I understand that the cannabis trade is just about fallen over, and generally the TSX-venture, I believe, is down just under 20% for the year. So, I think generally speaking, the Canadian market is suffering, and I think we are part of that too.

Bill: I’m going to be speaking to Dave in this interview about the geological aspects of what you’re doing, but on the corporate side Heye, is there any other updates that you can share with the market right now?

Heye: We are doing what we said we would be doing, which is, we are in the process of executing that drill program that we press released. So, we are probably two-thirds through it. We put some results out which were good and we expect more results later this year, and then the final results sometime in January, probably towards the end of January. And then we’ll take a break, basically, to interpret and put it all into perspective and then keep drilling next year. So, I think that’s… In terms of news flow, there’ll be bits and pieces in between. But from a corporate perspective, we are very busy in Namibia. We are very active and our work program is going along as we planned. At some stage next year or so, we will look to do our financing, but that’s not anytime soon. So, I guess in Namibia, it’s business as usual.

Bill: Thank you very much Heye. Dave, I’d like to bring you onto the show, and you were commended to me by another mining CEO who said that he invested in Osino Resources specifically because you were leading up the geological exploration. For people that aren’t familiar with you, can you give a little bit about your background as a geologist?

Dave Underwood: Hi, Bill, thanks. Thanks for that introduction. I’ve been a gold geologist now, probably about 25 years. I started in East Africa and spent six years full-time on the ground with AngloGold, AngloAmerican in those days. And subsequent to that, went out and did consulting to a bunch of companies, including several years with Newmont, and AngloGold, and a whole bunch of other people. During that time, I’ve probably seen a couple of hundred deposits and done due diligence and logged hundreds of thousands of meters of core. I’ve seen a lot of, specifically, orogenic gold deposits, probably more than most. So at this stage, I know what I’m looking for, and I know what a deposit looks like. Let me put it to you that way.

Bill: Heye said to me in our first interview that you guys have experienced more success in this initial drill program at Twin Hills than you expected. Can you talk about how difficult it is to make a discovery, and what was your reaction to those initial results?

Dave: Yeah, well, that’s certainly true. All the time that I’ve been kicking around Africa, I’ve seen very, very few brand new discoveries. Most of the time, companies chase off to artisanal miners or try and rebadge things that were discovered a long time ago. It’s been said many times by many smart people that if we want to find something big and something new, you’re going to have to look undercover, something that’s never been walked over before, or you’re going to have to go to jurisdictions that have never been looked at before. And what we’ve done here is we’ve made a significant discovery, completely hidden and undercover. And I think that’s why we’ve been able to do that because we’ve taken the route that other people haven’t taken before us.

Bill: When you compare the Twin Hills discovery to its analogs, other deposits geologically or developmentally, what can you share with us here?

Dave: Well, I think probably through a combination of really good geology and a fair dose of luck. When we did our first drill program, five out of the first seven holes hit really good mineralization. And I think that’s something that doesn’t happen very often. What we have been doing is comparing our discovery with the discovery of the Otjikoto Gold Mine, which sits a couple of hundred kilometers along strike in the same rocks. And we’ve been looking, for example, at their first 20 drill holes and how many hits did they get and how many misses, and comparing our success rate with their’s. We’re doing every bit as well as they did. In fact, we’re probably doing slightly better than they did upfront. So, I would say we’re very comfortable with what we’ve achieved so far.

Let’s be honest, it’s every exploration geologist’s dream to make a discovery. So, when you poke seven holes through thick calcrete cover and five of them come back with good mineralization, it’s a very exciting day.

Bill: What further reflections do you have on the phase one drilling that you just concluded here at Twin Hills?

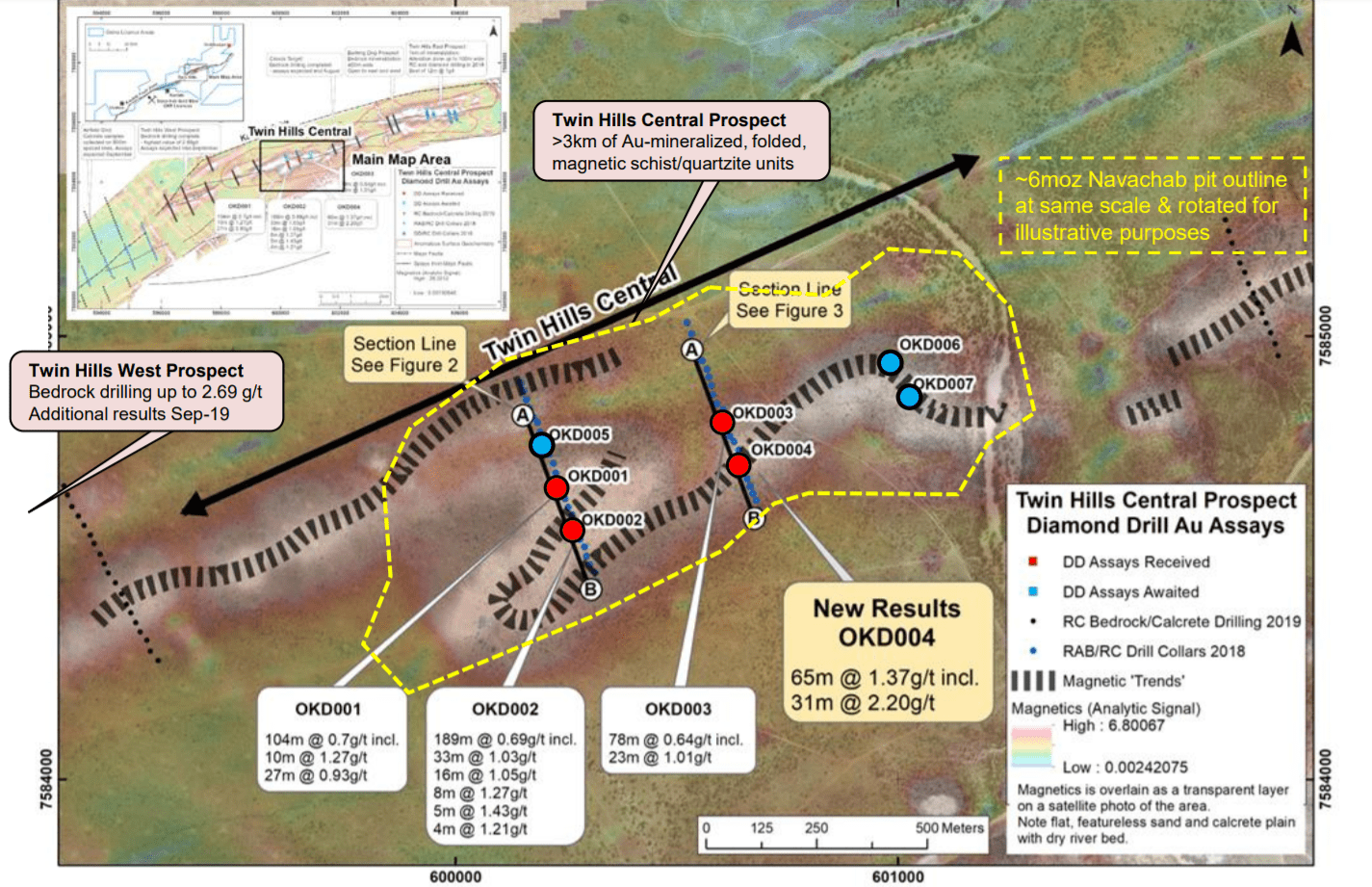

Dave: I think in phase one, as I say, five of the seven holes hit mineralization, and I think two things stand out. Our first two holes hit very thick mineralization. One is 148 meters thick and the other is 241 meters thick. These are very unusual numbers for orogenic gold systems. The grade of that halo is really low. It’s sub-one gram, but it’s an enormous thickness of mineralization we have.

And then within that real really thick halo, we started picking up some high-grade material. So in the fourth hole, we picked out a zone that contained 31 meters of 2.2 grams. And we have subsequently picked that out in a couple of the holes or hit it again in a couple of later holes. So, it’s a high-grade shoot within this very large low grade system, and that’s how these sedimentary-hosted gold systems seem to work. That’s how Otjikoto works, that’s how many others work. And we’d expect to pick up more of them as the drilling intensifies.

Bill: What can you say about phase two and what should investors look to in order to determine if this phase two program is successful?

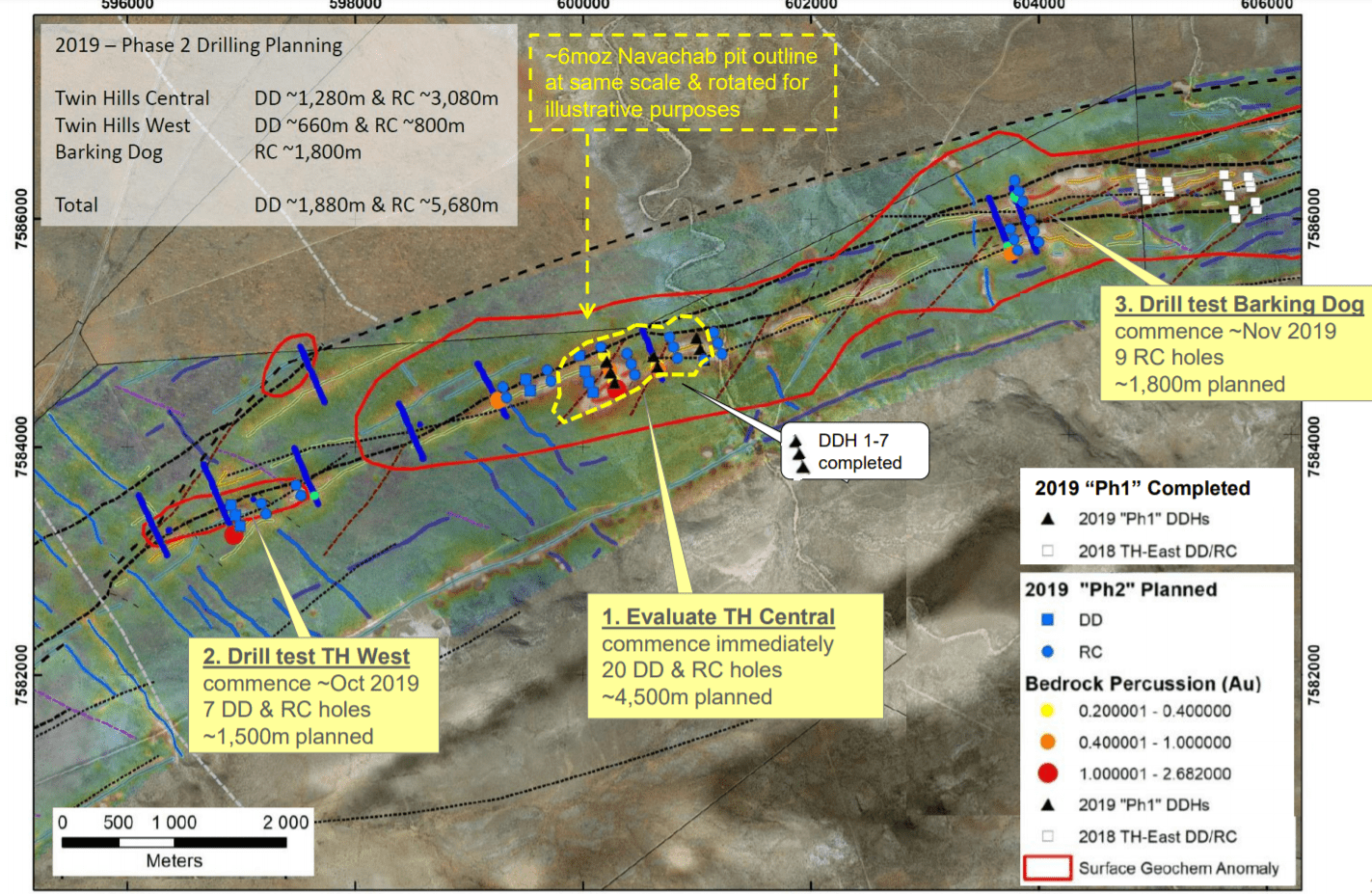

Dave: So in phase two, we’re trying to do three things. It was to prove the continuous nature of the mineralization to find out what the continuity is like. So, that’s really the infill drilling. And that first press release we put out was really the first part of that infill drilling. Then we want to do the step-out drilling, which will extend the strike length of the ore body that we’ve discovered. We have 800 meters striking to data, and these other holes, we’ll take that out to over a kilometer.

And then the third thing we wanted to do was test a couple of the other prospects within the Twin Hills cluster at Clouds, Twin Hills West, and Barking Dog. And so far we’ve done 30 holes. We’ve got 41 holes planned, and we’ve completed 30 of them. And, we’ve received results back for eight so far. So, there’s a good deal of results to come back

Bill: And those results will be before the end of the year, I would expect?

Dave: Not all of them. No. The drill program will continue to the Christmas break, and may actually continue over into early into next year. The reason why it’s going to take a little longer than we thought is that we’ve converted some of the RC holes into diamond holes because it’s a complicated system, it’s structurally complicated and we need as much information as we can get. So, we’ve decided to use a little more expensive drilling and try and get the best information possible. So, we’ll continue slightly into next year. I’d say by the end of January, we’ll have all those results back.

Bill: When the phase two results start to come back and you’re analyzing it as the VP of exploration, what would be some just stellar high-grade shoots, grades, and intercepts that you’d want to see?

Dave: The sort of shoots that we want to see would be similar to what we hit in OKD4 in the fourth drill hole in the first phase. So, we’d want significant widths in the two to three gram range, I would say. These sedimentary hosted gold deposits are generally not high grade, but they are generally… they can become really large, as Heye mentioned, and within them we’ll find these high-grade shoots. So yeah, we’d want more of the same. We’d want big wide intercepts, and then we’d want to discover further high-grade shoots, which would be north of two grams over 20 to 40 meters, let’s say.

Bill: I’m looking at your presentation right now on page nine, there’s an overlay of a nearby mine, the Navachab pit, which is a 6 million ounce open pit. I know it’s early and this is a forward looking statement, but do you still think Twin Hills Central has the potential to reach that size of a resource?

Dave: That’s a good question. It’s too early to say that. Twin Hills Central definitely has multi-million ounce potential, but I think it’s not just about Twin Hills Central. We have the continuation at Twin Hills West, we have the Clouds and the Barking Dog. Overall, that has potential to be really significant. That really could get us up to that five or six. If you look at Navachab, it’s not just one pit Navachab is several pits, which have been mined over the years. And that’s kind of what we have. It would probably be several different pits within a very tight cluster.

I think also, it’s good to remember that Navachab has been in production for 30 years, and their discoveries have been incremental. Their initial discoveries, I think, was 800,000 [gold] ounces. When they first built the mine, it was based on 800,000 ounces. Now, as you say, it’s up to 8 million, so that’s real incremental discovery. It’s brownfields drilling over the years.

Bill: With the first-pass drilling that has commenced at Twin Hills West, Barking Dog and Clouds, these are separate targets in your land package, why did you choose these specific locations to do this drilling?

Dave: Initially, when we did our chemical work, those areas lit up with our surface geochemistry. We then embarked on a bedrock sampling exercise, just taking a percussion drill rig and drilling through the calcrete to the bedrock and sampling the top of the bedrock on fence lines. Those areas then lit up with the bedrock drilling. So, that’s really honed us in to those areas. And also, as it turns out, as you can see from some of those diagrams, those areas also are magnetically anomalous. It’s both factors; it’s geochemistry and the magnetics.

Bill: Dave, what more should investors know about the current programs that are occurring right now in your land package?

Dave: Well, we’ve embarked on significant geochemical sampling programs in other parts of our land package, and those results are being released as we go. What we’re looking to do… We’re building a pipeline of projects in Namibia. We have a very significant land package, and the Twin Hills is obviously our most advanced. But we have then several other licenses where we’re doing first-pass sampling and then first-pass drilling, and trying to build this pipeline of projects going forward.

Bill: So, we’re looking at a district-scale play. This isn’t just one deposit that we’re developing, although Twin Hills is the central piece right now, but it’s actually a massive land package that you’re exploring.

Dave: The Twin Hills falls into what we call our Karibib District where we have basically staked most of this Karibib basin. And that in itself is a significant land package consisting of about eight or nine licenses. But then we also have two other significant land packages and we’ve got a total of 23 licenses spread out over the whole Damara Belt. So we have Twin Hills at a real camp scale and that sits within the Karibib Gold District, which includes the Navachab Gold Mine and several other prospects. And then we also have what we might term real greenfields packages further apart.

Bill: Dave, one more thing before you go. Can you talk about the cost of drilling in Namibia relative to the results you’re able to present to the market versus other places in the world?

Dave: Well I think that we have a really, really big advantage in Namibia in that, in general, costs are fairly low. And in particular, we are getting RC drilling at the moment for about CAD$40 a meter or less. And diamond drilling, we’re paying between $80 and $100 a meter, which is significantly less than you’ll get elsewhere. For example, give you an idea, in my last project in West Africa, we were paying $300 a meter for diamond drilling. So yeah, very cheap to operate.

Bill: Yes, that’s one of the best value per dollar opportunities for gold speculators. You get the most results per dollar spent. Osino is a gold discovery progressing towards a development play. I am a shareholder. Website, again, is osinoresources.com. You can find it under the ticker OSI and the TSXV, and under the ticker in New York, OSIIF. Dave, I really appreciate you coming on Mining Stock Education and giving us an update. Thank you very much.

Dave: Thank you, Bill.