Otis Gold Corp: Permit Issue Resolved, Major 2020 Drill Program Upcoming says CEO Craig Lindsay

Otis Gold Corp. President and CEO Craig Lindsay provides an update on the successful resolution of a permitting issue at the company’s Kilgore Project in Idaho. Craig also discusses Otis Gold’s drill plans in 2020 at both the Kilgore and Oakley projects and how the company intends to fund the programs. Furthermore, Craig explains the company’s share structure and how Otis is tightly-held by a number of very committed owners.

Press Release discussed in this interview: https://www.miningstockeducation.com/2019/12/federal-court-confirms-status-of-kilgore-plan-of-operations-2/

Otis Gold Corp. is focused on the acquisition & development of quality precious metal deposits in the Western USA. The company is currently developing its flagship Kilgore Project and exploring at its Oakley project, both of which are in Idaho. Agnico Eagle is a key strategic investor owning 9% of the company and management owns 27.7%. Otis recently announced a positive preliminary economic assessment for the Kilgore project and the company is looking a number of potential catalysts over the next six to twelve months.

www.OtisGold.com TSXV:OOO OTC:OGLDF

TRANSCRIPT:

Bill: Welcome back to Mining Stock Education. Ladies and gentlemen, I am your host Bill Powers. Thank you for tuning in. Well, today we are going to be getting an update from one of our sponsors, Otis Gold Corp and its CEO Craig Lindsay. We last spoke with Craig at the Beaver Creek Conference in September and a lot of positive news has come out regarding the company. When I was looking over the company’s stock chart over the last few years from about the end of summer in 2016 to the beginning of summer in 2018 Otis was trading in that 25 cent to 30 cent Canadian range and then it took a dive and there was some issue with its permit that was granted at its Kilgore project.

There was some contesting with the U.S. Forest Service, not directly with Otis, but more with the Forest Service and then that confined the share price range to that 8 to 12 cent range for about the last year, but there’s been a positive development that has just come out. So Craig is here to update us on that and talk about what that means for the project and for investors. Craig, welcome back to Mining Stock Education and please share with us this update.

Craig: Hey Bill, thanks a lot. I appreciate you having me on today and thanks for that introduction and what you’re referencing is yesterday afternoon we received notice from the U.S. federal court in Boise, Idaho that the lawsuit that was filed by an environmental group against the U.S. Forest Service in connection with their approval of our current exploration plan of operations out at our Kilgore project in Idaho.

This lawsuit was dismissed by the judge last night, so we’ve issued news on that updating the market and it’s a great relief to the company, number one, but just as importantly for the Kilgore project itself, it significantly de-risks the project in this lawsuit that’s been hanging over the project and creating quite a bit of uncertainty amongst investors with respect to how we’re going to be able to move the project forward has been removed. So it’s a great relief for the company. It’s a great relief for me personally and it’s now going to allow us to aggressively move Kilgore forward from an exploration perspective without this cloud hanging over us. So we’re very pleased with the result.

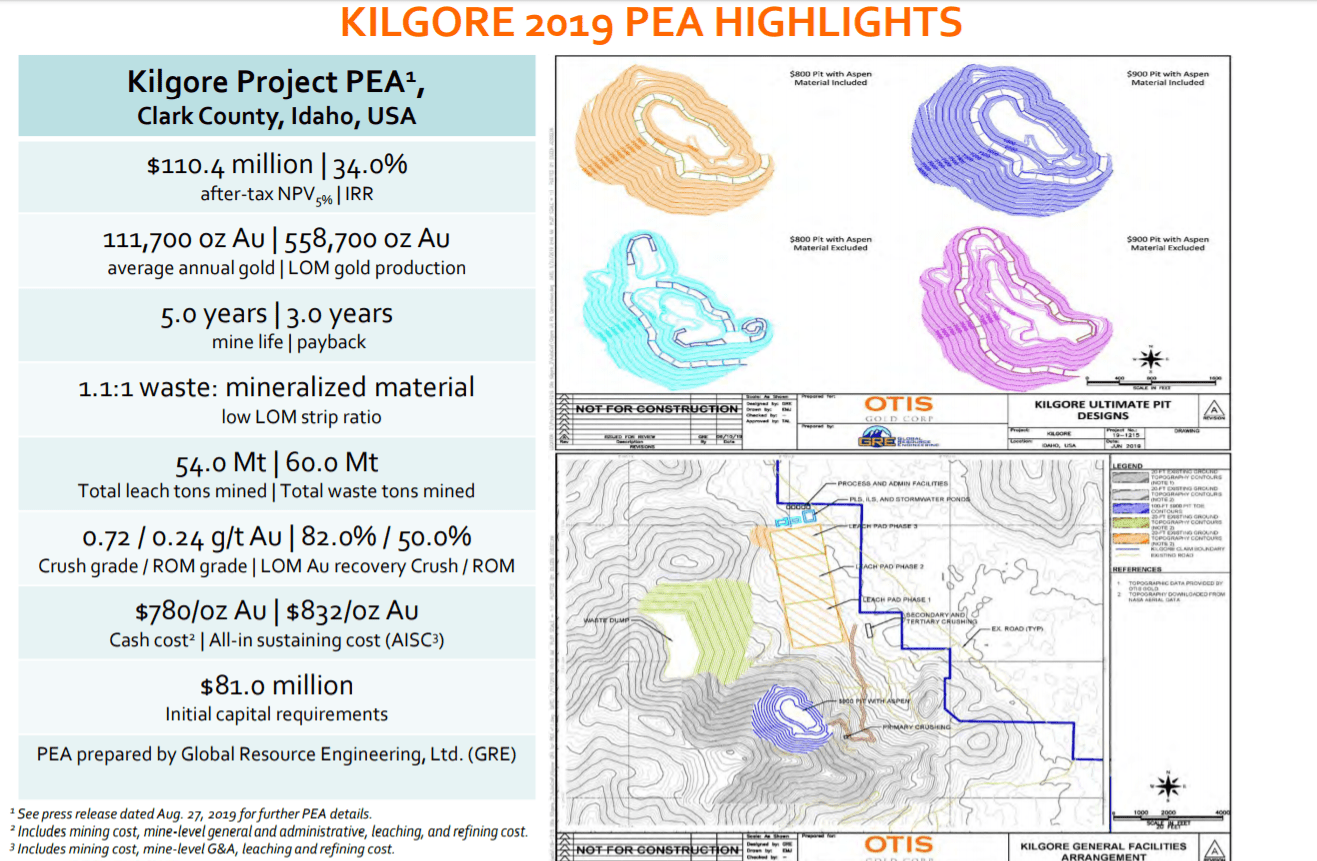

Bill: The market responded positively to this announcement and you were up about 17% or 18% on the day, but you’re still about one third of what you were a couple years ago. Yet the project is more advanced. You put out a PEA a few months ago. Could you bring us up to speed for those that haven’t the story, what are some of the highlights of the PEA on the Kilgore project?

Craig: Sure. Well firstly, just to remind people, Kilgore is located in Southeastern Idaho. It’s a volcanic hosted epithermal gold system on the Northeast margin of something called the Kilgore caldera. It’s got a existing gold resource of just under a million ounces in both indicated and inferred categories. And we’ve taken that deposit and we’ve wrapped around a preliminary economic assessment around the project. And that was announced back in August. And the good news on that is there’s a five-year mine life with production of about a 110,000 ounces of gold a year and at a $1,300 gold price. The net present value of this project after tax is 110 million U.S. Dollars and the IRR on that after tax is 34%. So extremely robust economics on the Kilgore project as it stands today. So when investors are looking at a company like Otis, we’ve got about a $17 million Canadian market cap, yet we’re sitting on a project that’s got an NPV of 110 million U.S. dollars, very strong economics and nothing but growth potential beyond the existing deposit.

And the growth potential of Kilgore frankly has been affirmed by third-party investors specifically two years ago at Agnico Eagle Mines came in and bought just under 10% of the company at 35 cents a share Canadian. So at a significant premium to where we’re trading at right now and for those of your listeners who don’t know Agnico Eagle, they are very well respected and large Canadian gold mining companies with global operations and are really regarded as one of the premier operators in the business. So to have their blessing in the form of a significant investment into our company has been a strong endorsement of the exploration potential that we see out at Kilgore

Bill: Regarding that expansion potential, in October you mentioned that you were drilling 14 holes, those holes were averaging approximately 230 meters in length. What can you share with us now? I know you don’t have the assays back, but what can you share with us about the potential here?

Craig: Well, was just a little program. We actually only got 11 holes down out of the 14 that were initially planned. They were reverse circulation holes. The average is about 230 meters in length. And the idea with this project was to do some step out drilling off of the deposit to help see, to really help define the limits of the existing deposit and hopefully expand the deposit. So we’re looking forward to getting some results back on that. They should be out in January. So that project took about two months to get those holes down. Major Drilling out of Elko, Nevada did the drilling for us and they did a great a great job on the drilling. And we’re looking forward to getting some news out on the act in the new year.

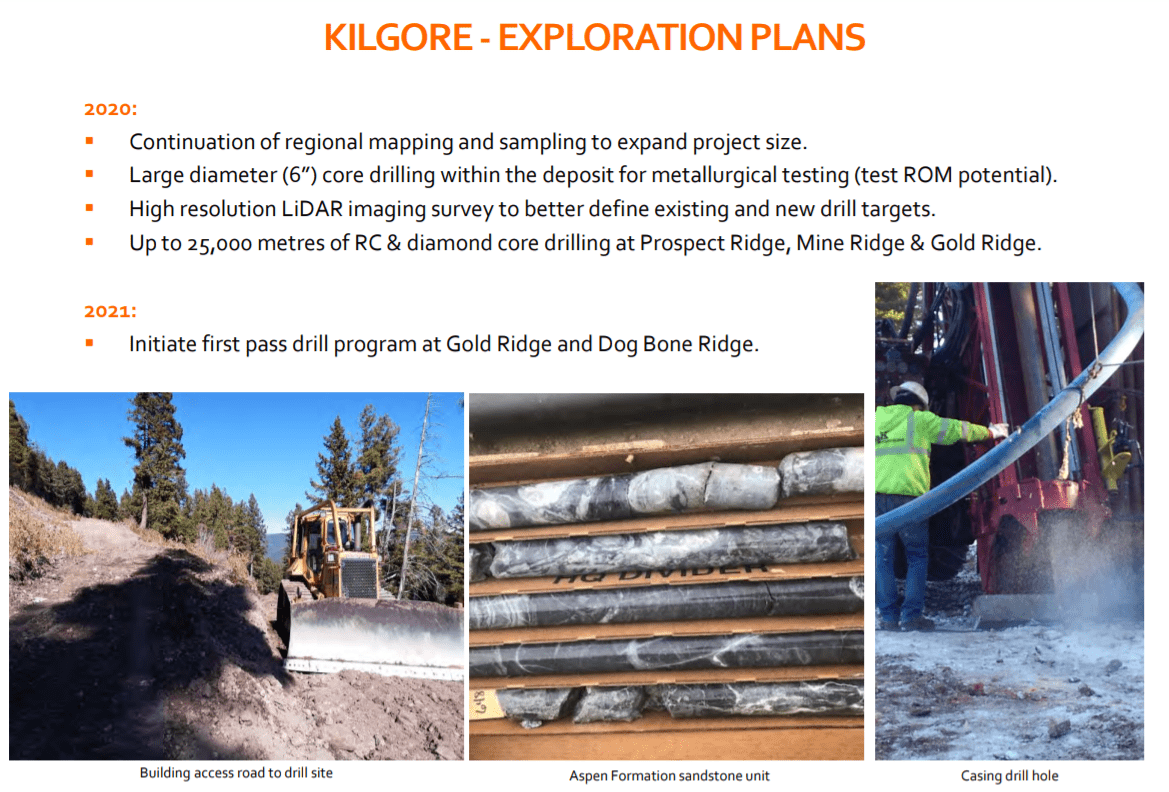

Bill: And then that was the first phase of a larger drill program. What are the plans for Kilgore and also your Oakley project in 2020.

Craig: Kilgore itself, I mean this little program that we did is really a base hit using a baseball analogy and we’re looking for triples and doubles next year. Maybe home runs in that we’re going to be knocking out in between 20,000 and 25,000 meters of drilling next year. So we’ve got 60 plus holes planned and it’s going to be not just step-outs off of the deposit, but we next year are going to be looking for the second and third deposits that we think are out there at Kilgore. That’s why Agnico put their money into the company. That’s what investors should be excited about is that the exploration potential above and beyond the million ounces that we’re sitting on right now. So next year is going to be an exciting year for this company. And we’ve brought on a fellow by the name of Alan Roberts, who you’ve met before Bill, but Alan’s a great explorationist, very strong technical skills.

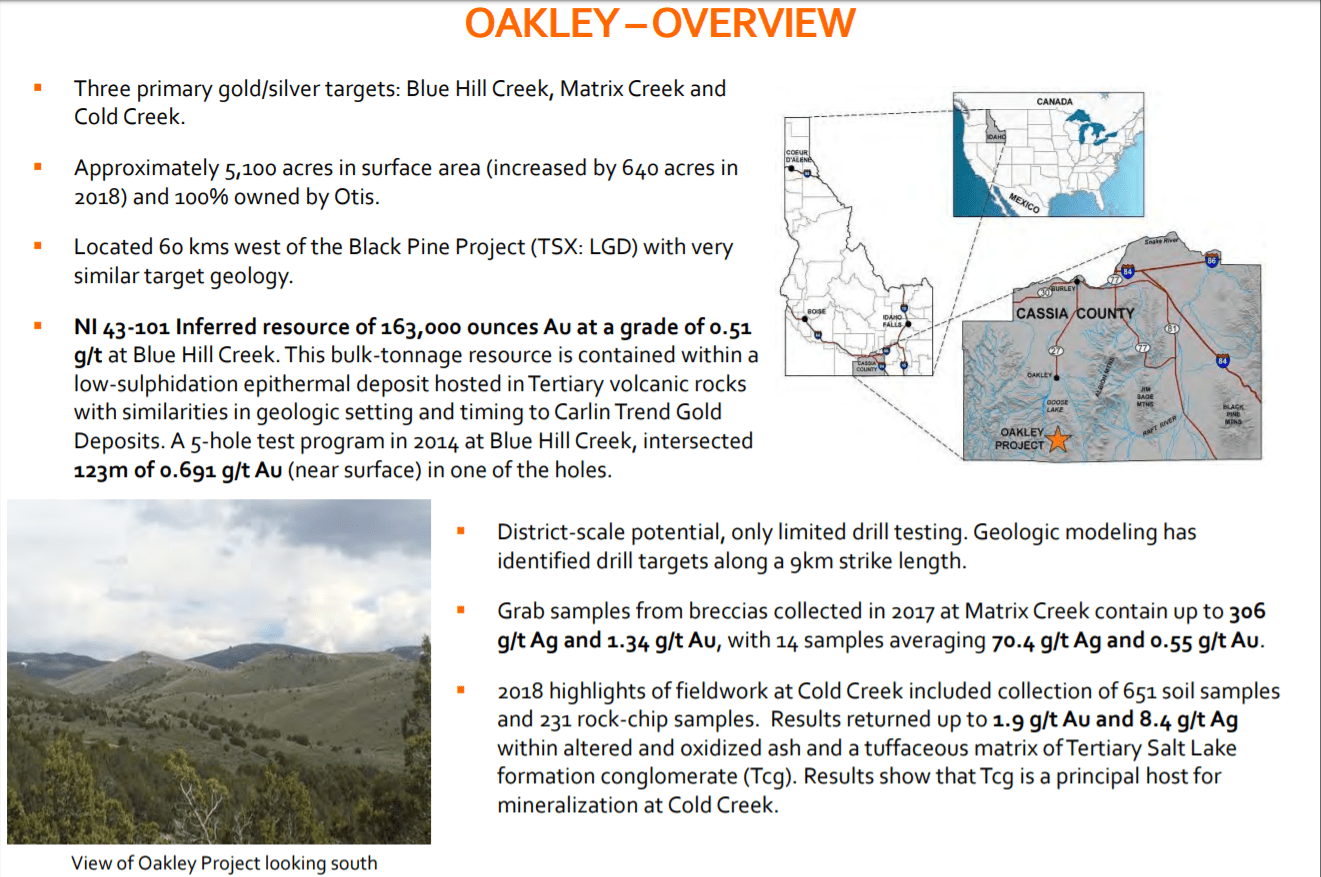

He’s run lots of large exploration programs and he’s exactly the type of guy that you need to run the type of program that we’ve got planned next year at Kilgore. So it’s got to be a critical year, I think, next year in terms of the development cycle of the Kilgore project. So that’s exciting. And then we’ve got a second project that you mentioned Oakley. It’s another gold project right on the border between Idaho and Utah and it’s just immediately North of a very well-known past producing silver mine called the Vipond Mine.

What’s exciting about Oakley there is an existing NI 43-101 compliant resource from about 160,000 ounces, so we’re not starting from zero. We have 100% interest in the project, very light royalties on it and nothing but exploration potential out there. Alan’s done a great job putting that project together in terms of doing a bunch of work on the ground, most of that soil and rock sampling and that has identified a bunch of new target areas at Oakley. We’ve expanded the land position at Oakley quite significantly and our plan for Oakley is to advance that likely via a joint venture. So we’ve been out marketing Oakley to potential partners over the past six months. We’ve got quite a bit of interest in the project and I’m not in a position to announce anything on that at this point, but the plan is to join venture and use other people’s money to advance Oakley.

Bill: So with the financing for next year, possibly come coinciding with a potential announcement of a strategic partner?

Craig: That could be. Certainly we’d like to get some of this good news out. We’ve got some good news out with the the court case being resolved, number one. Number two, getting some drill results out and potentially getting some news out on wrapping a story around how we’re planning to advance Oakley. Those three things I think are going to generate quite a bit of interest from a market perspective and it’s going to allow us to finance ourselves.

And generally for your listeners, January, February typically are very good months to finance in the gold space. There’s a big show called the PDAC in Toronto at the beginning of March and if you’ve spent any time around junior natural resource markets, you’ll know that it’s generally a fairly good idea if you’re financing to get it done before PDAC. There’s generally quite a bit of activity in Vancouver where I’m based. There’s a show called AME Roundup in January and pretty much everyone who’s anyone in the industry is in town and there’s usually a lot of activity that happens around Roundup.

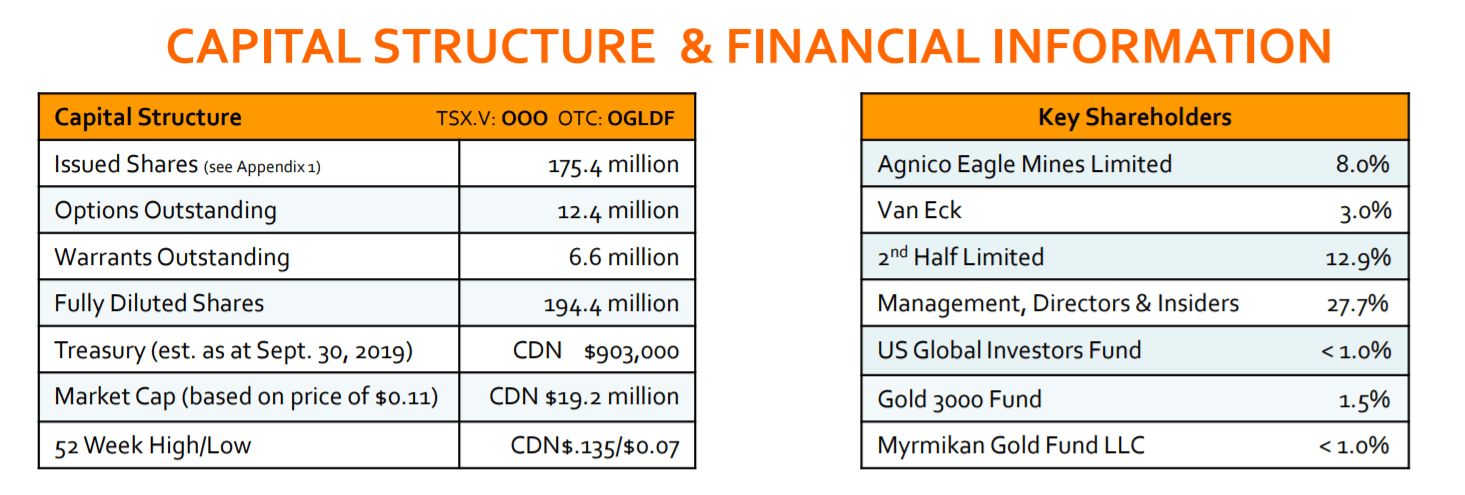

Bill: When you’re financing, you’re also issuing shares. Craig, one question I had from a listener is regarding your share structure. Currently there is 175.4 million issued shares, fully diluted shares comes in at 194.4 million. You’ve been around for about 10 years. Can you address your share structure please?

Craig: That’s something I love to talk about, Bill the fact that there are investors in a junior mining space are asking way better questions than they did 10 years ago. It’s really good to see how well-educated people are and certainly a share structure is a critical part of any company and it’s something investors should be looking at closely. And yes, we’ve got 175 million shares issued and outstanding and fully diluted at about 194 million as you stated. And some people think that’s getting up to the top end of where you’re comfortable with. One of the things that I can say to address that issue, and again that’s a great question, is the fact that our top 10 shareholders own 40% of the company almost on the nose. So we’ve got a highly-concentrated level of ownership in the company. I mean you typically don’t see that with juniors that have been around for 10 years.

It’s usually a much broader distribution of ownership. Some of those investors are some of the best names that you’ll want to find in in the gold space. Specifically, I’ve mentioned Agnico Eagle they own, just under right now, about just under 9% of the company. We’ve got a large shareholder, a high-net worth individual in the UK that owns 14% of the company. Myself and another director own together over 10% of the company between the two of us. VanEck associates out of New York, a very well known player in the gold space, owns just under 3% of the company.

So we do have some good institutional shareholders. We’ve got strong sponsorship in the form of Agnico Eagle. And just as importantly, management directors and insiders own a large position in the company. And if you’re an investor, one of the things that I find most surprising is companies that are led by boards and management that have very, very little ownership interest in the company. They typically will take their compensation in the form of their fees and also in the form of options only. They don’t have cold, hard cash into the company and our board and management does, and that’s a real differentiator,

Bill: I believe if I recall correctly from our previous conversation we’ve had that this last financing you did with around a million dollars, that was primarily people that currently own the company, wasn’t it?

Craig: Yes. They were mostly almost all existing investors. We did have one fund out of Europe who participated in the last financing that was a new investor. The rest of the folks were all existing investors topping up.

Bill: Well, there has been a little more excitement as of recent with the gold price and the junior gold stocks. You’re in Vancouver and you’re leading a junior gold company. What do you see from your vantage point, Craig?

Craig: Well, it’s a good question Bill. The last year has been, I was going to use strong language, but I want, it’s been really difficult for guys like me, not just the past year, the past couple of years it’s been really, really soft in the space. The big markets have been rolling people have, I don’t know what it is, but one of the things is, if I can earn 15% to 20% putting my money in S&P 500 stuff, why would I put money into high-risk junior stocks that could go to zero. I mean that’s just the reality of it. That said, the price of gold has strengthened, so we’re in that $1450, $1500 range U.S. That’s generated a lot more interest in the gold space. We’re starting to see M&A at the, with the large-cap goal companies and the mid-cap.

We’ve also seen some development company deals that have been announced. And so that is starting to demonstrate some revived interest in the gold space. And typically the juniors are the last ones to start getting some joy or love from investors. So I think that’s on the horizon. And I think there’s generally just a lot more jump in people’s step these days. People are excited about 2020. I think as a stock promoter, and at the end of the day that’s what I am, We all get excited about the prospect of a new year. But I truly think we’re fundamentally moving into a much stronger market for these junior companies such as Otis. And another thing that investors really like, yes, when they start taking flyers on some of these higher risk juniors, there’s been a trend towards people investing in safer jurisdictions.

And with Otis, you certainly have that. Our projects are on the U.S. Property ownership issues are almost nil. They’re very friendly from a regulatory perspective. Mining it’s well supported, particularly in the mining-friendly States in the Western part of the United States where most of the exploration and development is done. So people like the jurisdiction that we’re in. And so I think we’re going to have a really exciting year and we’ll know soon enough because we’re only a couple of weeks away from what I think is going to be a pretty exciting year for juniors.