Massive 17M oz Gold Deposit Primed for Takeover (Scott Hicks from Lumina Gold)

Lumina Gold Corp. was launched several years ago out of mining legend Ross Beaty’s vision to develop a large gold deposit that could be monetized via a sale to a major gold producer during a gold upcycle. The company is on track to fulfill Ross’ vision as it has developed a world-class, massive 17-million-ounce gold resource at its Cangrejos project in Ecuador. Ross Beaty owns nearly 20% of Lumina Gold Corp. The management team of Lumina Gold believes the company offers substantial value to gold investors, not just for its gold ounces in the ground, but also because they have the company primed for a potential takeover which could deliver a substantial premium to shareholders.

Scott Hicks is the Vice President of Corporate Development and Communications for Lumina Gold Corp. Scott was previously an investment banker working with RBC Capital Markets and BMO Capital Markets. He also served as VP Corporate Development and Communications of Anfield Gold Corp. He also currently serves as the VP Corporate Development and Communications of Luminex Resources. Over the last decade he has worked on a variety of equity, debt and advisory assignments while working in Canada and Australia. Mr. Hicks holds a Bachelor of Commerce with Honours from the University of British Columbia.

https://luminagold.com/ TSXV:LUM OTC:LMGDF Lumina Gold Corp.’s presentation

0:15 Introduction

2:15 Lumina Gold’s management team’s successful history

4:07 Overview of 17M AuOz Cangrejos project

8:42 Cangrejos’ CAPEX versus peers

10:21 Making sure Cangrejos advances towards monetization

12:09 Catalysts for 2020

13:32 Optimizing for takeover not adding ounces now

14:10 Treasury and burn rate

14:50 Share structure and owners

16:12 Ecuador as mining jurisdiction

19:02 Recent M&A activity and a future Lumina Gold takeover

20:12 Market Cap versus historic sunk costs

20:47 Addressing possible challenges

TRANSCRIPT:

Bill Powers: Scott, thanks for joining me today. And how about we start by learning a little more about the pedigree of your company’s management team?

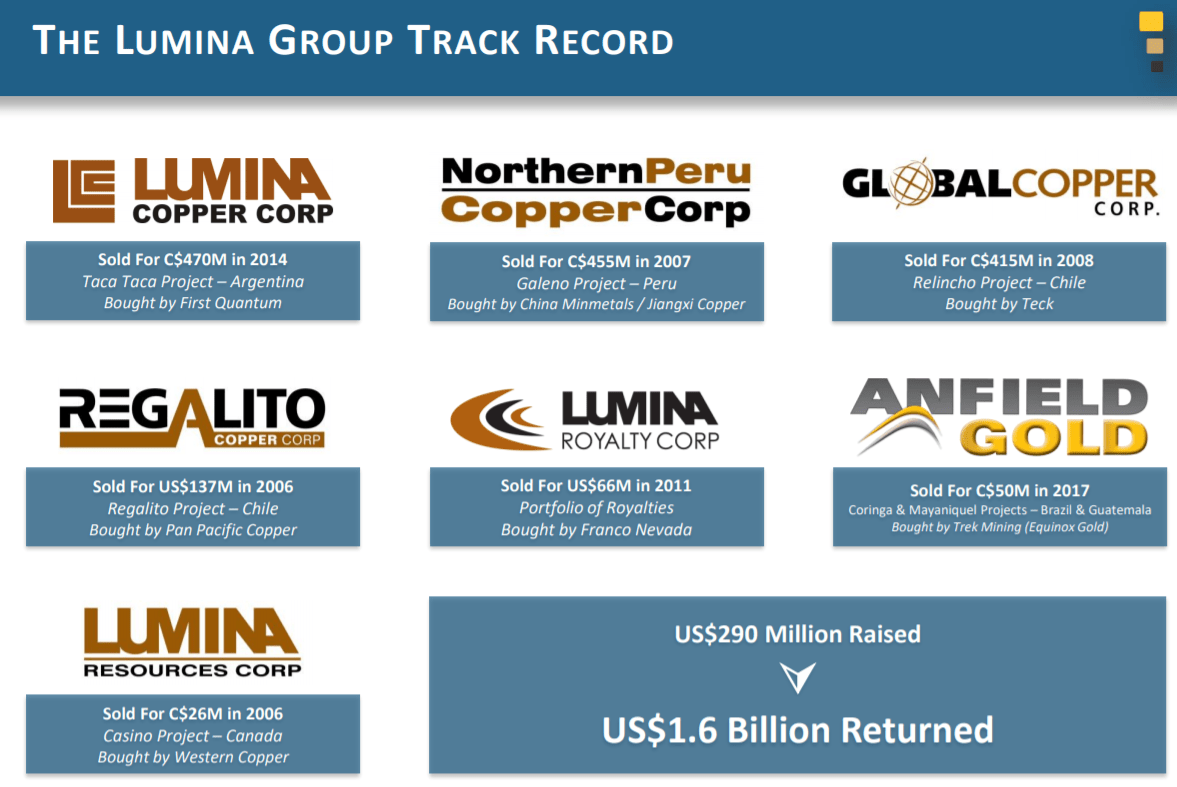

Scott Hicks: Thanks for having me on Bill. Really appreciate it. The Lumina Group here as we broadly call the umbrella group, is a group that was founded by Ross Beaty in about 2002. Our key management here, our CEO, Marshall Koval and our head geologist, Leo Hathaway, have really been working with Ross since 2004 on all the companies that have been managed by the group. The initial companies were put together as a play on copper, and a view that the copper in price was going to increase dramatically, which it did. And through that there was about six different companies that were sold over the years, and a lot of large scale porphyry discoveries, I’d say that’s the group’s bread and butter, if you will. And there was a lot of success through that.

And then more recently, Ross had a view in 2013, 2014 that gold was at a cyclical bottom, and he wanted to put together some large-scale gold deposits that would do well and flourish in a bullish gold market. I’d say that we’re just now starting to see all these predictions come to fruition as we’ve traded up from the $1,200 to $1,500 level here. And it’s really the same technical team that’s working on these new large-scale gold projects. And that’s what we have in Lumina Gold and what we have in our sister company Luminex Resources, and those two companies are focused in Ecuador.

Bill: The flagship project that you have for Lumina Gold is your Cangrejos project. How about you give us an overview, a high level overview of this project and what are some of the key features?

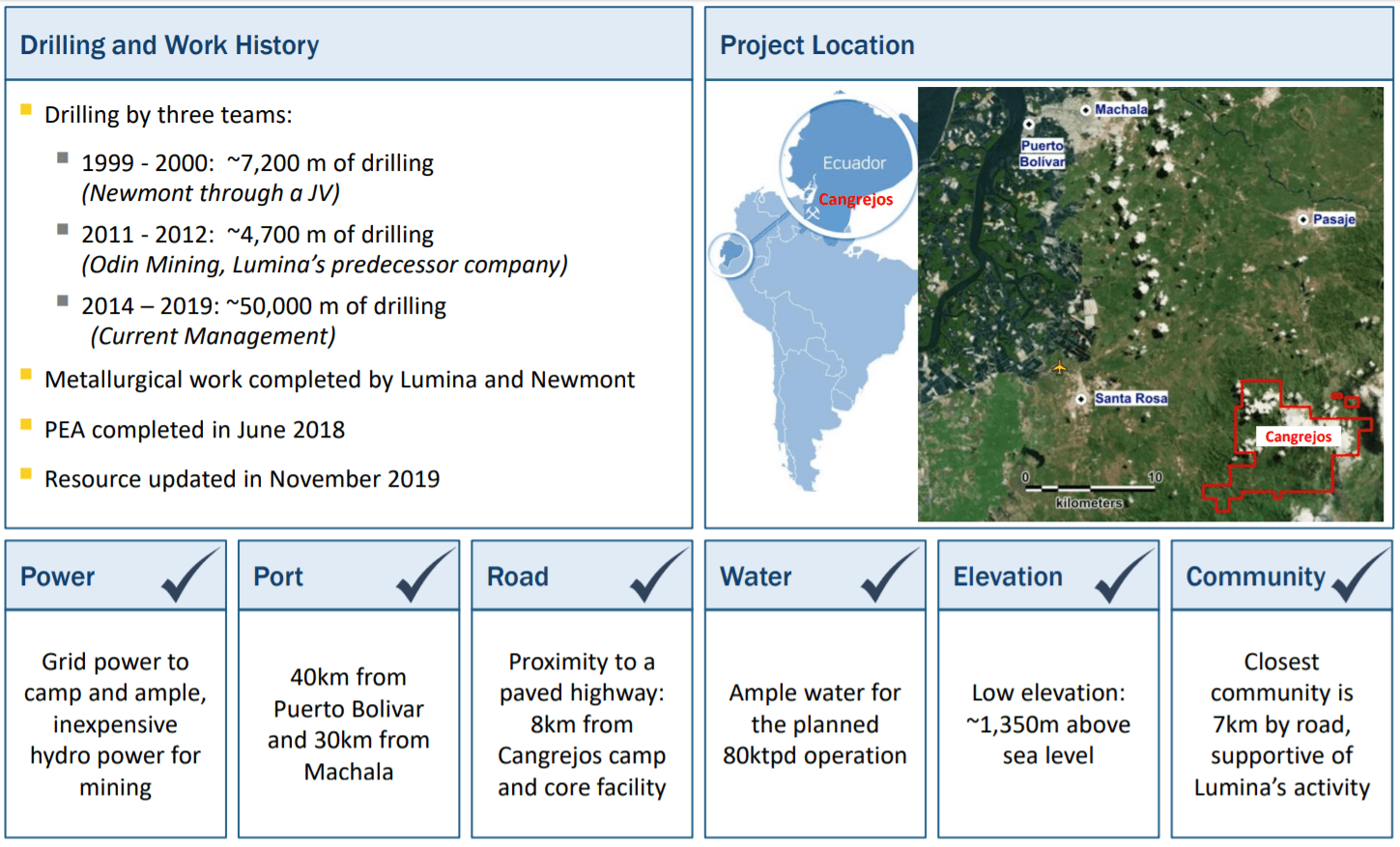

Scott: When we actually initially started working on this project, it was in two pieces, the mineral rights, and it was an old Newmont project that they had drilled back in the late nineties, early two thousands. If you recall gold had dropped to $200, $300 an ounce type levels back then. And Newmont really pulled out of their exploration in peripheral countries, and then it had been returned to the two owners at the time. So we acquired majority ownership in our predecessor company Odin, in 2014, through a financing. And we had about half of the Cangrejos project, and we did some drilling on that half. And then in 2016 we acquired the other half of the mineral concessions, and put the whole thing together.

We started drilling the second half in 2018, and that’s an area we’ll talk about later, which is the second deposit on the property that… But they’re very close together and really will be developed as one mine. So we’ve now been working on the project since 2014. We’ve drilled about 50,000 meters at the project. We’ve put out three resource updates, and one preliminary economic assessment, over that time period. The project itself is down in Southwest Ecuador, very close to Machala, very close to the coast and the port. The area has excellent infrastructure. You can fly in to a small town called Santa Rosa on a normal commercial flight. You can be at the project at the camp in just over an hour.

We’ve got hydro-power to site, we’ve got water. It’s not a high elevation project. You’re only at about 1300 meters. So unlike a lot of these big Ande’s porphyry systems you’re lower down so you don’t have those challenges. And there’s no communities directly on the deposits. So, very positive from a social perspective, and our dealings with the surrounding community over the years, which the nearest towns about seven kilometers away from the project. So, it ticks a lot of the boxes that usually people get hung up on in these large scale projects.

Bill: Scott, tell us a little more about this project in terms of the resource and what were some of the highlights of the initial PEA?

Scott: So, when we first got the second half of the project, that really allowed us to put out an initial resource and that was about 4 million ounces of gold. So, a fairly large project, conventional, open pit, and at that point the drilling had gone about 300 to 400 meters deep. And that was our initial resource. We started drilling deeper at the project and we found a higher grade zone underneath that initial resource, and that allowed us to over double it in late 2017, so that took us to about 8.8 million ounces of gold at the project, and just over a billion pounds of copper. And that really was a game changer from our perspective. And we knew we’d gone onto this huge, huge system at that point.

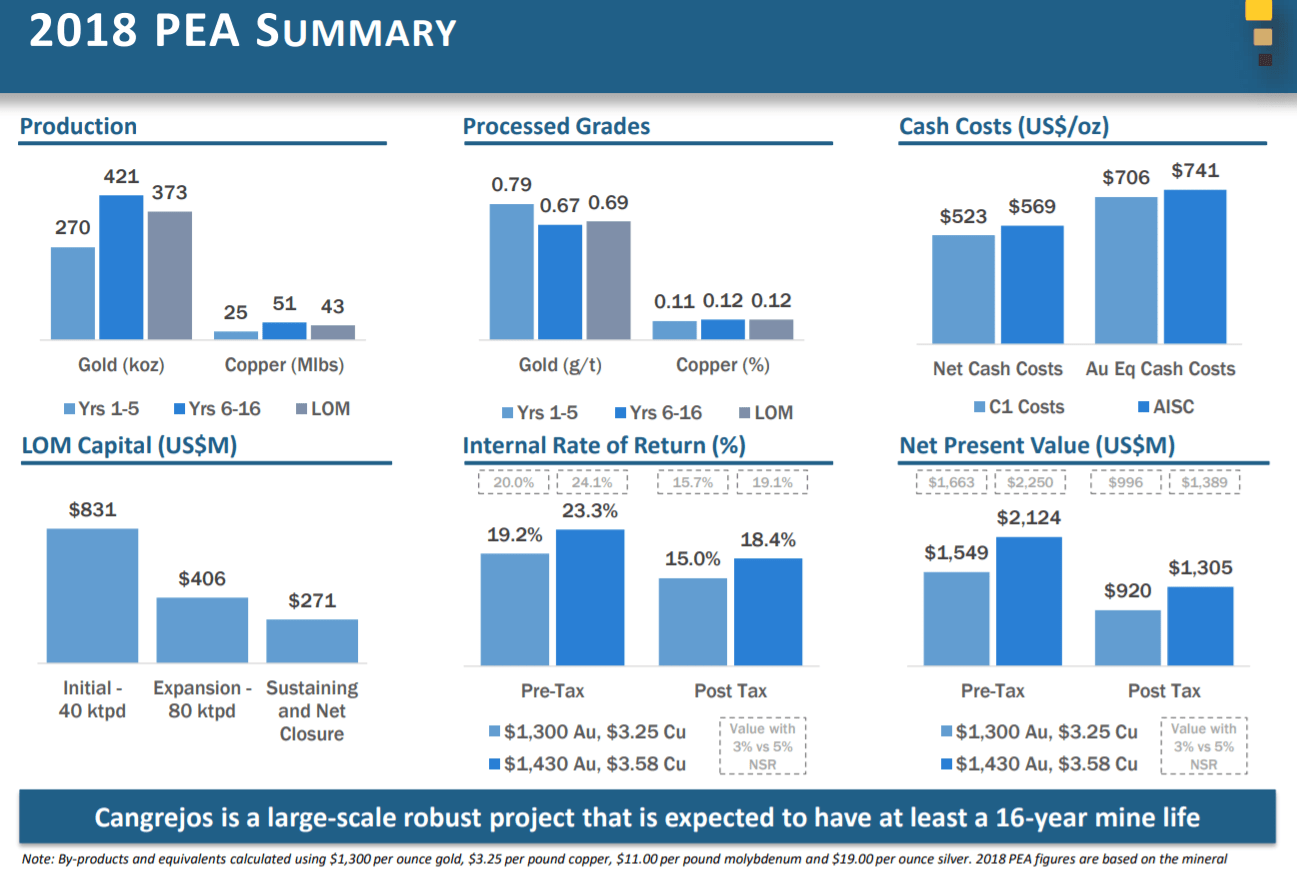

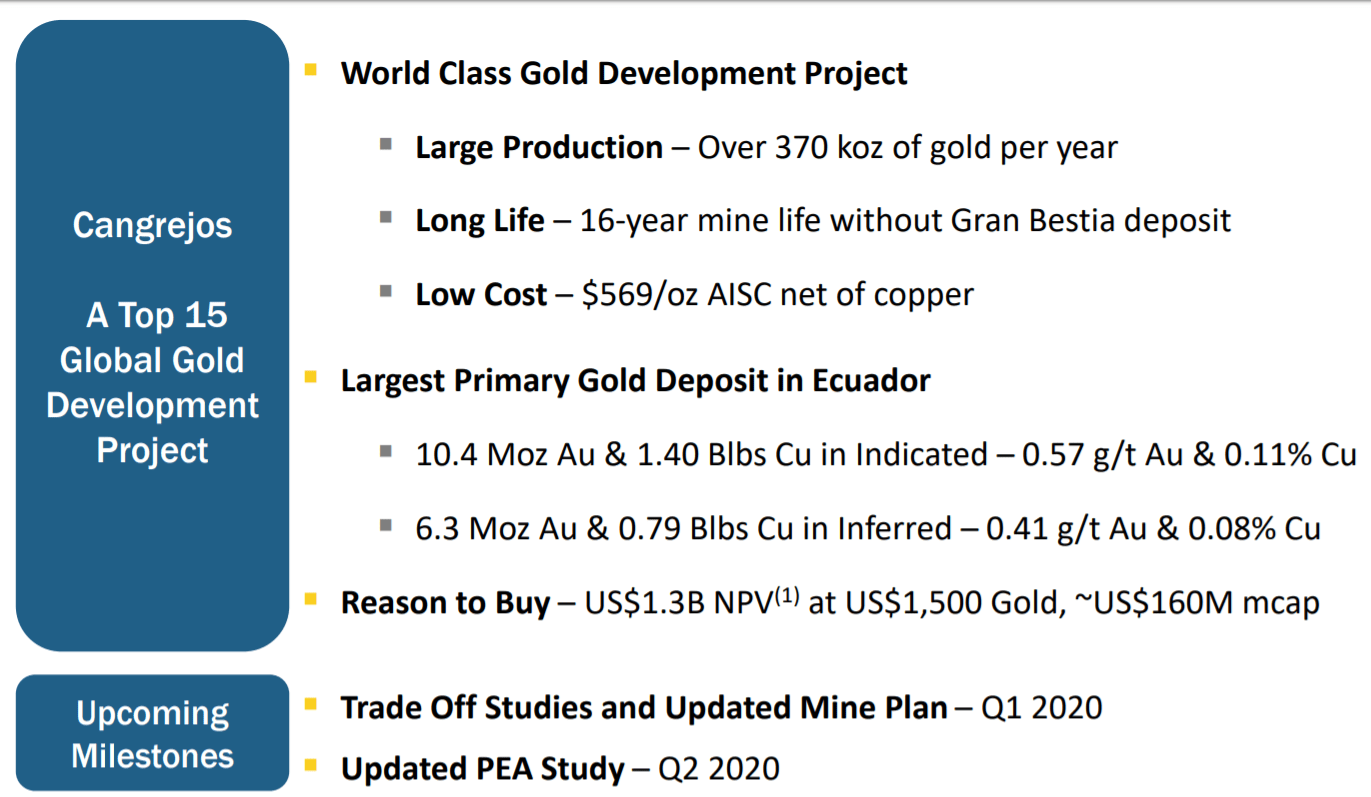

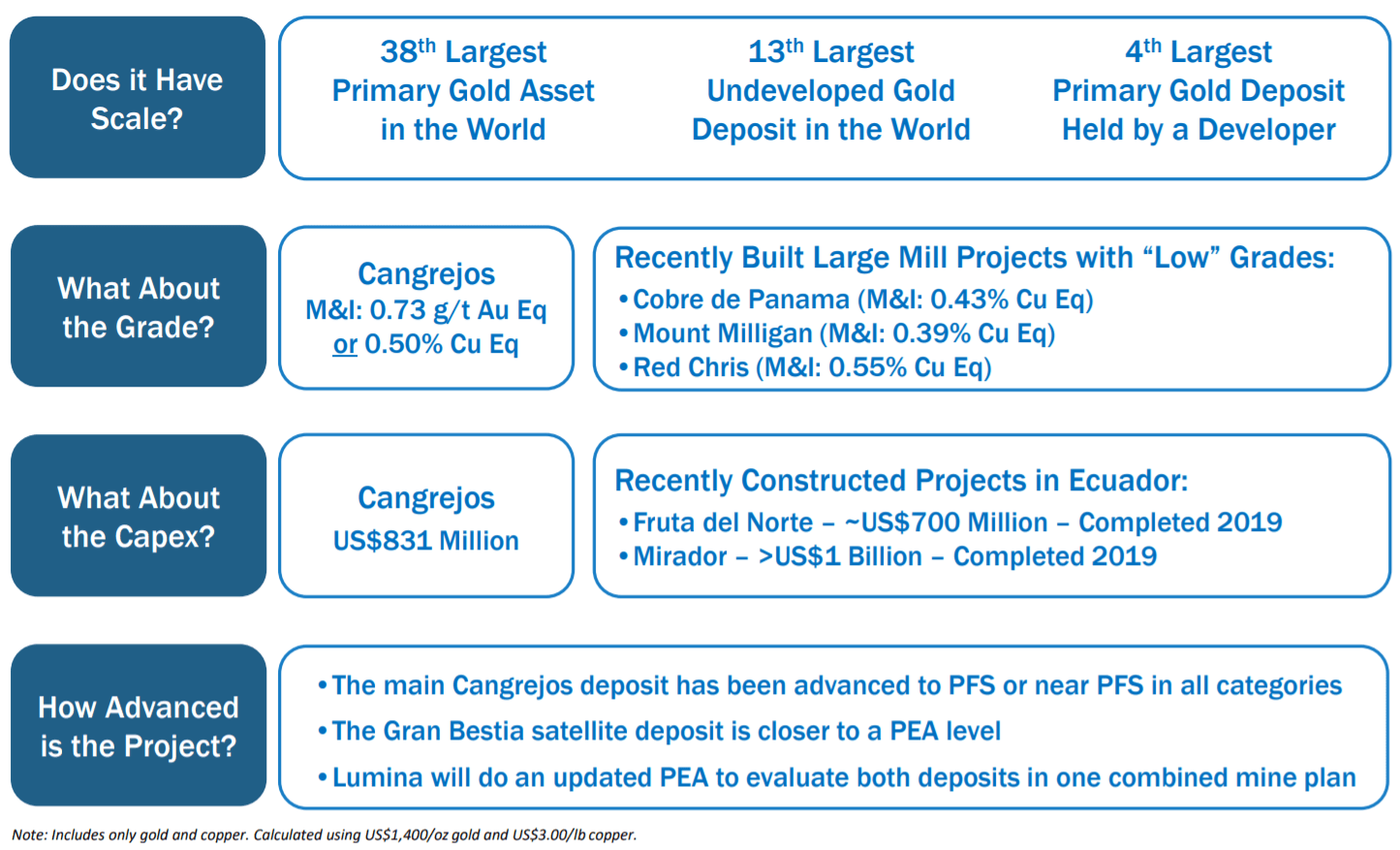

We did a PEA on that resource, the 8.8 million ounces, and what that outlined is really a project that would be a top 15 development project globally, by size of production. A project that could produce on average about 370,000 ounces a year of gold, and about 50-ish million pounds of copper a year as a byproduct. And at that point, that was really before we’d even started to explore the second half that we acquired in 2016. And subsequent to that, we’ve now drilled that side of it and once again doubled the resource. So right now we’re sitting at 17 million ounces of gold, and over 2 billion pounds of copper at the project.

Bill: That’s a massive project. How does the Capex with your current study compared to other projects of this size?

Scott: We took a phased approach and we tried to keep it reasonable. There’s several large scale projects out there that have… Whether it’s a four or five, $6 billion Capex. And our view was those aren’t the type of projects that are getting built in this environment. We started out with a 40,000 ton per day operation in the PEA, that you could build for about US$830 million. And we viewed this as an approachable project for a mid -tier, or a major gold producer. And then after that you would use cashflow from the mine to step up to that 80,000 ton per day level. And then at that point you’d be producing over 400,000 ounces of gold a year.

And this is the type of project that your Barricks, your Newmonts are looking for, where they can get that large-scale production out of one asset, and not having to piece together two or three smaller assets to get that half million ounce of production level. So, the Capex would be very good when compared to other large-scale open pit milling projects, because of the infrastructure I mentioned previously. So, you’re only 40 kilometers from a deep sea port, you don’t have to build a giant man camp, you can bust in your labor. A lot of different things like that help out on the infrastructure side.

Bill: Mark Bristow, the CEO of Barrick, has gone on record saying he wants in projects at least a half a million ounces of gold per year production for at least 10 years. So as I was going over your presentation, this project is headed in that direction. But Scott, as you know, one thing that happens with a lot of these large projects is they can get stuck for a period of years, even decades. What are you doing to make sure that this project doesn’t just stay stagnant for years on end?

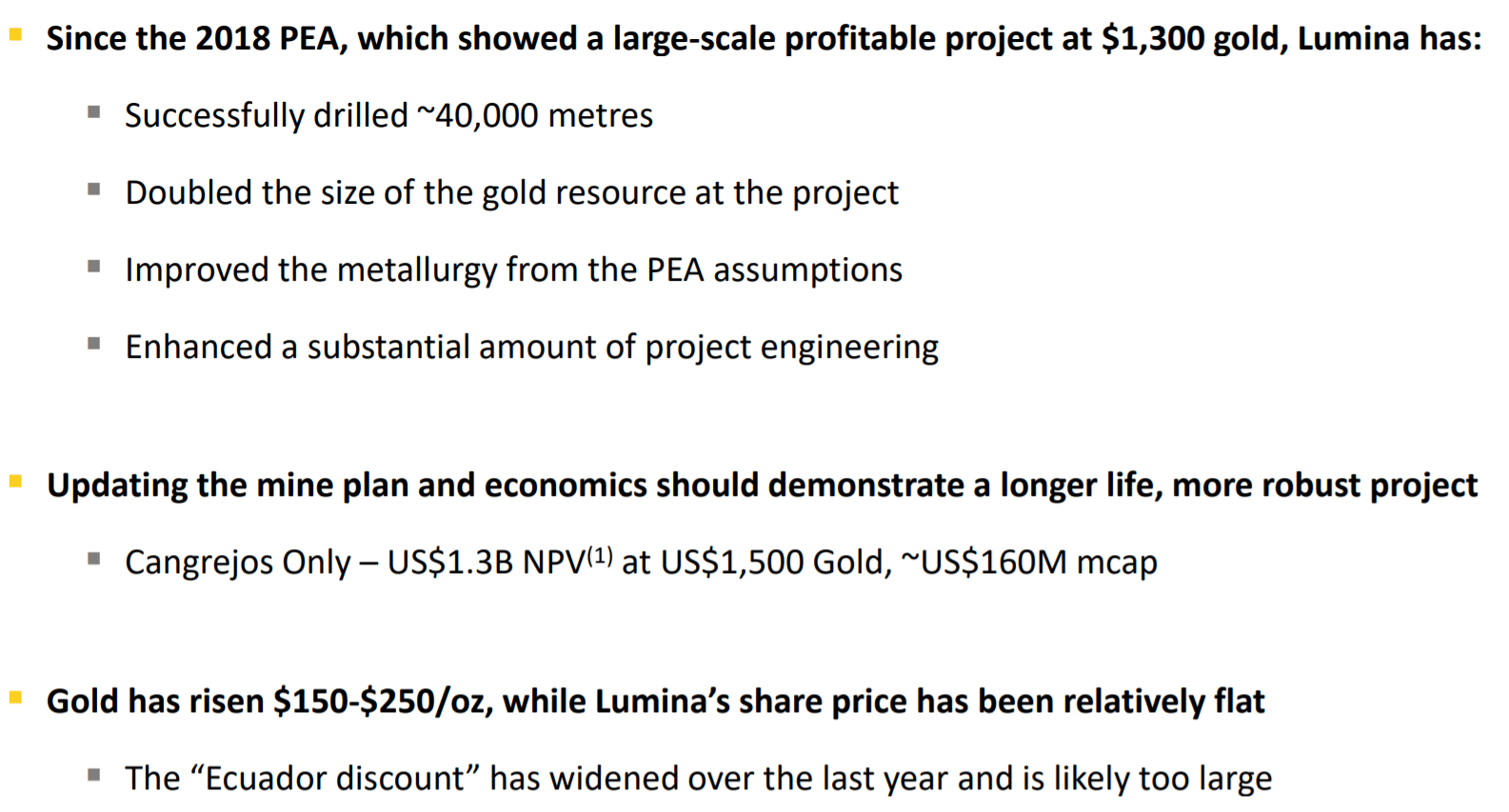

Scott: Yeah, great question. So, we wanted to make a project that worked at that $1,300 gold level. That was our focus. The original PEA outlined a project that works at $1,300. It had about a 15% IRR, which for this scale of project is good. You’ll see some of these smaller underground projects that you can build for less Capex and yeah, they might have a high IRR, but they’re done their mine lives in six to eight years. Whereas this is a project that in our PEA showed that it would last at least 16 years. And since we’ve doubled the resource again, we now think we have a mine that will go for somewhere in that 25 to 30 year range.

And when you’re at these large-scale companies, that’s what you want because you want a mine that’s up and running, and is exposed to the cycles. And you want that production leverage for when you hit a good run in gold. And when you look back historically that’s how all these producers have really made their money, is just having these mines operating when you hit these peaks in the cycle. And that’s something we think that you find at Cangrejos here, and it ticks those boxes for the large-scale guys.

Bill: Your team is not new at monetizing these assets. So, you’re paying attention to the gold cycle as you referenced. What would be the catalyst for this year, when investors look at Lumina Gold and the Cangrejos project, what are the catalysts that they should be looking for?

Scott: A lot of the work we’re doing right now is really refining the mine plan, refining the flow sheet that’ll be news that we have out in the next month or so here. And then really going into this updated PEA that’s going to come out in April or May of this year. And that’s going to demonstrate this extremely long life project with very large scale production. And that’s the key catalyst for the year.

We viewed last year the new resource as an important catalyst to understand how much we had there. And on the back of that and the de-risking work we’d done at the project, we now feel comfortable going out and talking to other corporates because we have a better understanding of what we have there. Whereas previously we didn’t really want to do that because we were still doing that exploratory work. So right now, Marshall and the team are really focused on de-risking the key technical elements that might hang up a buyer and then driving the project towards a monetization event.

Bill: So at almost 17 million ounces of gold, the goal would not be to increase another million ounces of gold in the resource?

Scott: No, that’s not the current goal. I mean, we stopped the drilling late last year and we picked a cutoff that we would use for the resource and use for the PEA study. You could definitely keep going to the Northwest. You could easily probably add several million ounces more if you kept drilling in that direction. But we viewed that we have a large enough project right now, and we really want to focus on the economics and the things that are going to be important to a buyer.

Bill: What about your treasury and burn rate? You just raised C$9 million. How long will that last you with what you have planned for this year?

Scott: This study we’re undertaking, some of the engineering work right now would be a couple million dollars, in that area, of budget. And then continuing other de-risking work at the project, so we’d anticipate that that gets us well into 2020, and through most of the year. And obviously the management team, as we dual track de-risking in it, and talking to other corporates we’ll look to hopefully have that be the last dollars that get put into the company here.

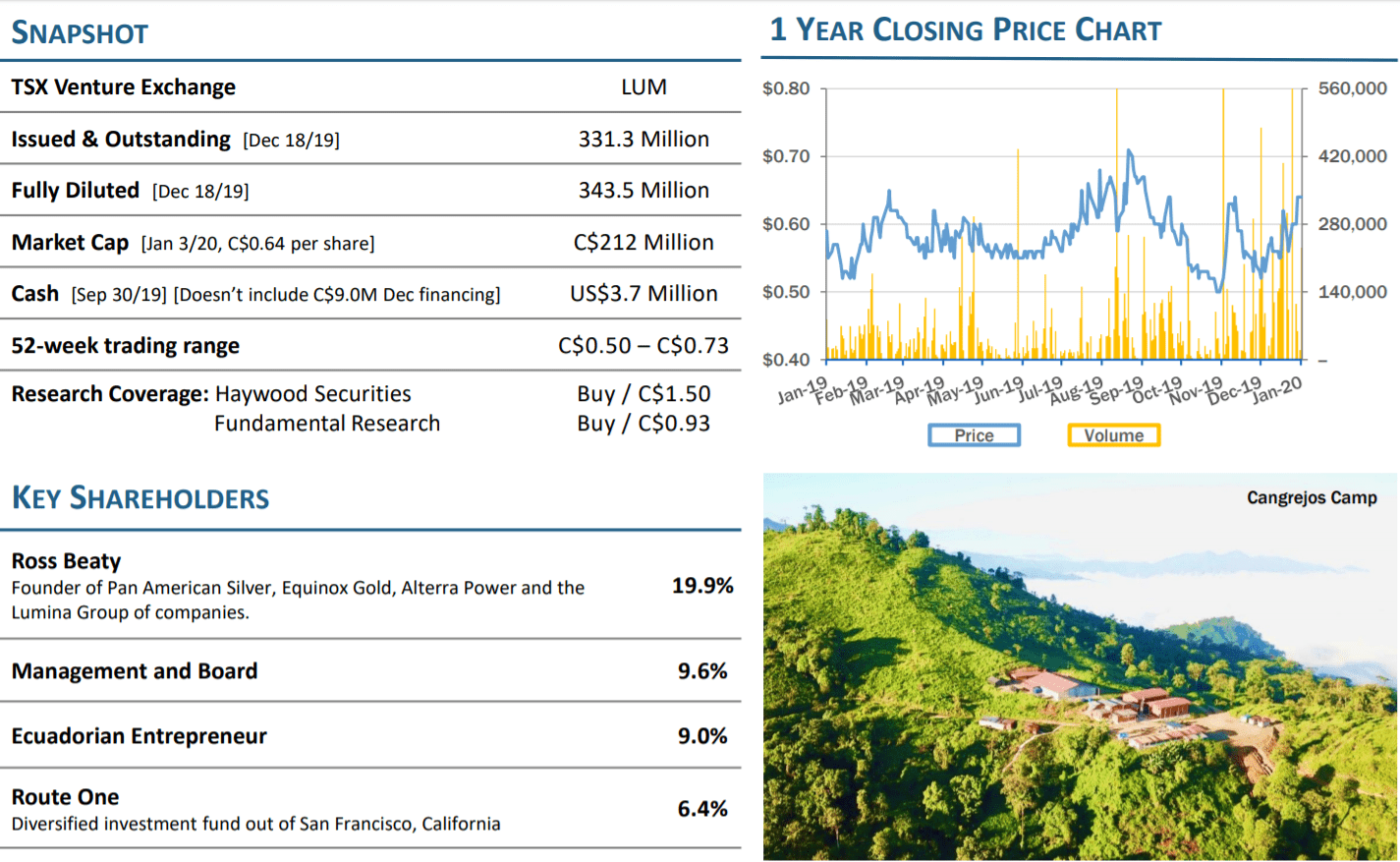

Bill: So we’ve talked about Ross Beaty as being a key cornerstone shareholder. But what more can you tell us about who owns the shares? And also I’m looking here, you have over 300 million shares outstanding. Could you address the share structure too please?

Scott: So between Ross, management and the board, that would be approximately about 30% of the shareholdings. We have an Ecuadorian entrepreneur who’s supported the group over our time in country, that’s at about nine. And a large fund out of San Francisco called Route One that has about 6%. So, that’s about almost half of the ownership of the stock. Issued and outstanding shares right now, we’re at about 330 million shares outstanding. Fully diluted about 343 million. No warrants right now. And all of our past financings have not had warrants attached to them.

It’s the nice thing about having obviously Ross as a cornerstone investor is it helps dictate a fairly tight discount for a company this size in this stage. And obviously keeps warrants out of the mix, which is nice. Our trading range over the last 52 weeks has been about 50 cents to 73 cents Canadian. We’re sitting at a 64 cents as we’re talking today.

Bill: What about Ecuador? Ecuador has had its highs and its lows. It seems to be on an upswing. I’m sure that this is an objection or concern you get from investors. For my listeners, what can you share about the jurisdiction of Ecuador?

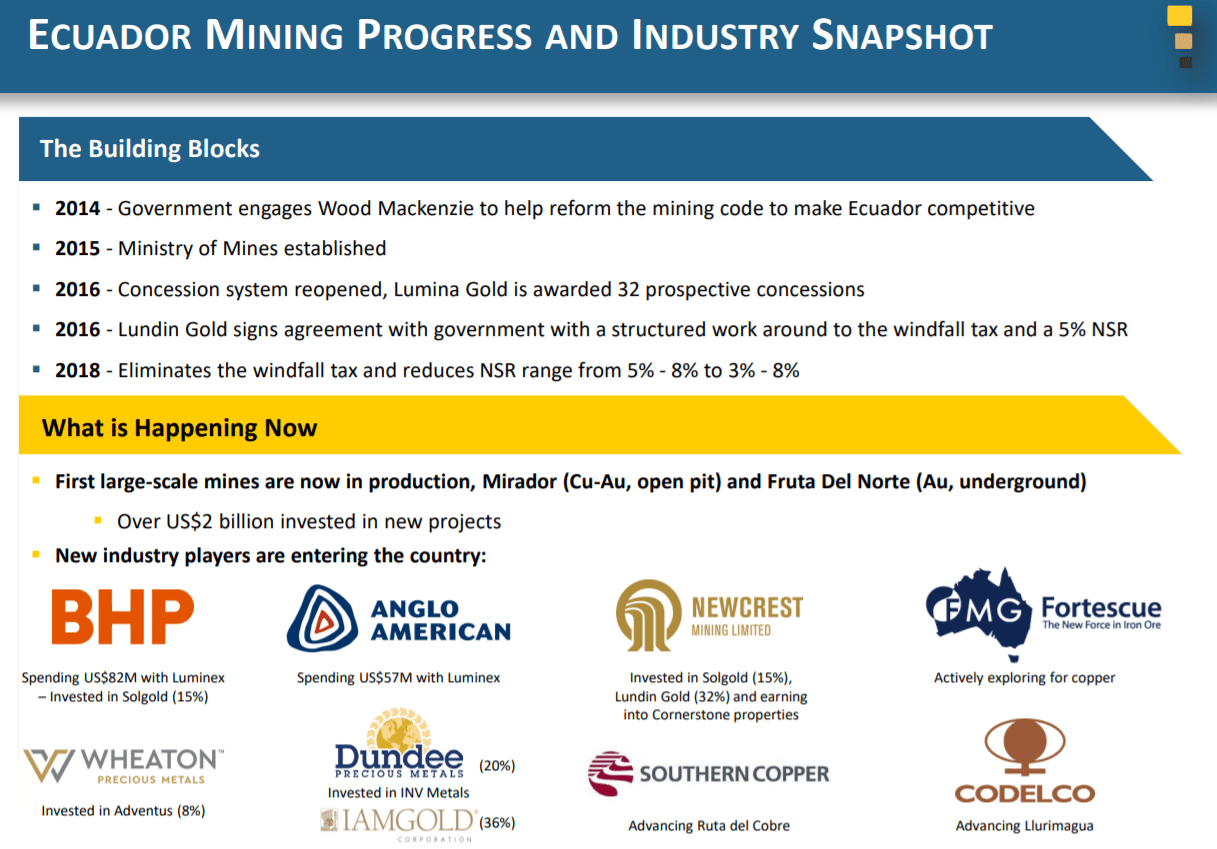

Scott: Over the last five years the government has worked fairly hard at improving the mining environment there, and that really started with them engaging Wood Mackenzie, bringing in an outside consultant to look at how to reshape the mining laws. A lot of your viewers or listeners might have remembered Kinross being a player back in the day, that exited the country, and that was really under a different regime, a different time. And so much has changed since then. So, they’ve simplified the tax system, they got rid of a very punitive windfall tax. They’ve opened up the concession system to new exploration. We’ve seen two large scale mines get completed there late last year. So, the main gold project that was completed is Fruta del Norte, a large underground gold deposit and they’re now shipping concentrate and dore from the site.

And then we’ve also seen the Chinese build a large copper gold porphyry there. And this is in the Southeast of the country, over by the Peruvian border. And that project is called Mirador. So they are now shipping copper concentrate out of there. And that would be a similar scale project to what Cangrejos will become eventually, as far as tonnage and throughput. So having seen these two projects permitted, built and now producing is a massive positive for the country. And in that specific province where those projects are, we’ve seen huge increases in economic activity and GDP. Lundin Mining is very focused on community and buying and sourcing things locally, and having a large local labor force. So these are all things that are helping Ecuador realize that mining is positive for the country.

And also, very different from the oil and gas that they used to be based on. And still oil is a big part of the GDP. But these are… It’s realizing that it’s not just dollars leaving the country right away. It’s a bigger knock on impact in the communities and all the supporting infrastructure for these mines that will go on for years and years and years. And that’s something that the government has been championing. And also differentiating between the illegal mining that’s happened in the country in the past with small artisanals versus these larger, more responsible companies that are coming in and taking a long-term view and a more socially responsible approach.

Bill: In terms of potential buyers of the project, considering the jurisdiction of Ecuador, we did see recently that the Chinese miner did make that offer for Continental Gold in Columbia. Is there any related takeaways we could take from that regarding your project here?

Scott: I think some of the M&A we saw late last year was really positive for what we’re looking to do. I mean, we saw on the production side and obviously in a Western jurisdiction, we saw a Detour get taken out. Which I think showed the larger companies are valuing these big, large scale assets that have the production potential. And then second to your question, we saw Continental get taken over and I think I view Columbia as a similar jurisdictional risk to Ecuador, and depending on which parts of the country you’re in, potentially maybe even riskier. So it was good to see that happen, and really people taking a view that this is an area for growth in Latin America.

Bill: The market cap of Lumina is about $210 to $215 million, Canadian, approximately right now. What are the sunk costs you have sunk into this company and project?

Scott: So, Newmont would’ve spent probably something in the order of about $5 million historically. And then our group has raised approximately, I’d say, something in the order of $70 million, Canadian. And that’s all gone into those projects over the years. So, somewhere in that $70 to $80 million sunk cost type range.

Bill: As you look forward this year, you mentioned some catalysts and goals of the company, but as you know, and as you have experienced I’m sure, things don’t always go the way we want. So what would be some key things that you could foresee that would be one of the most possible hiccups, and what would you do to address it?

Scott: I think it’s important for your listeners to understand that Ecuador is just like every country. It’s complicated and there’s different areas and obviously different local governments. And fortunately our projects in both Lumina and Luminex are in, what we view as excellent areas of Ecuador. Most of the country is moving towards being mining-friendly. There’s some different headlines you might see out of a specific province that none of our projects are in where they’re a little bit more against mining. And we’ve seen some headline risk out of there. In October, they tried to increase fuel prices in the country and take away the fuel subsidy. So we saw 10 days of unrest, and at that point in time, for example, our stocks traded down fairly significantly, but our projects weren’t affected at all. The work continued at site. There was no real issues from our perspective. And as soon as the fuel subsidy got put back in place, everything righted itself basically immediately.

So, in these jurisdictions there is that potential for headline risk, but we view the long-term trends as positive. And even taking that fuel subsidy period as an example, that was really the government trying to fix their budget deficit. And when you step back and you think about it, that is an area where if they can’t fix it on the cost side, they have to fix it on the revenue side. And how are they going to generate revenue? Well, it’s going to be through economic growth. And we view mining as a very key way for them to do that.

So, it’s really at a macro level, understanding that. And then I think the other thing you always have to be mindful of is your local communities, your local CSR. We do a fair bit to get ahead of that. We do a lot of work in the nearest town, whether it’s school programs, reforestation programs, building greenhouses for the community. Hiring out of the community is very important. So it’s really doing as much as you can on that side to get ahead of potential issues that might hang you up when you go to advance, permit and build these projects in the future.