Spectacular Silver Assays (14,688 oz/ton) from Silver One’s New Project with CEO Greg Crowe

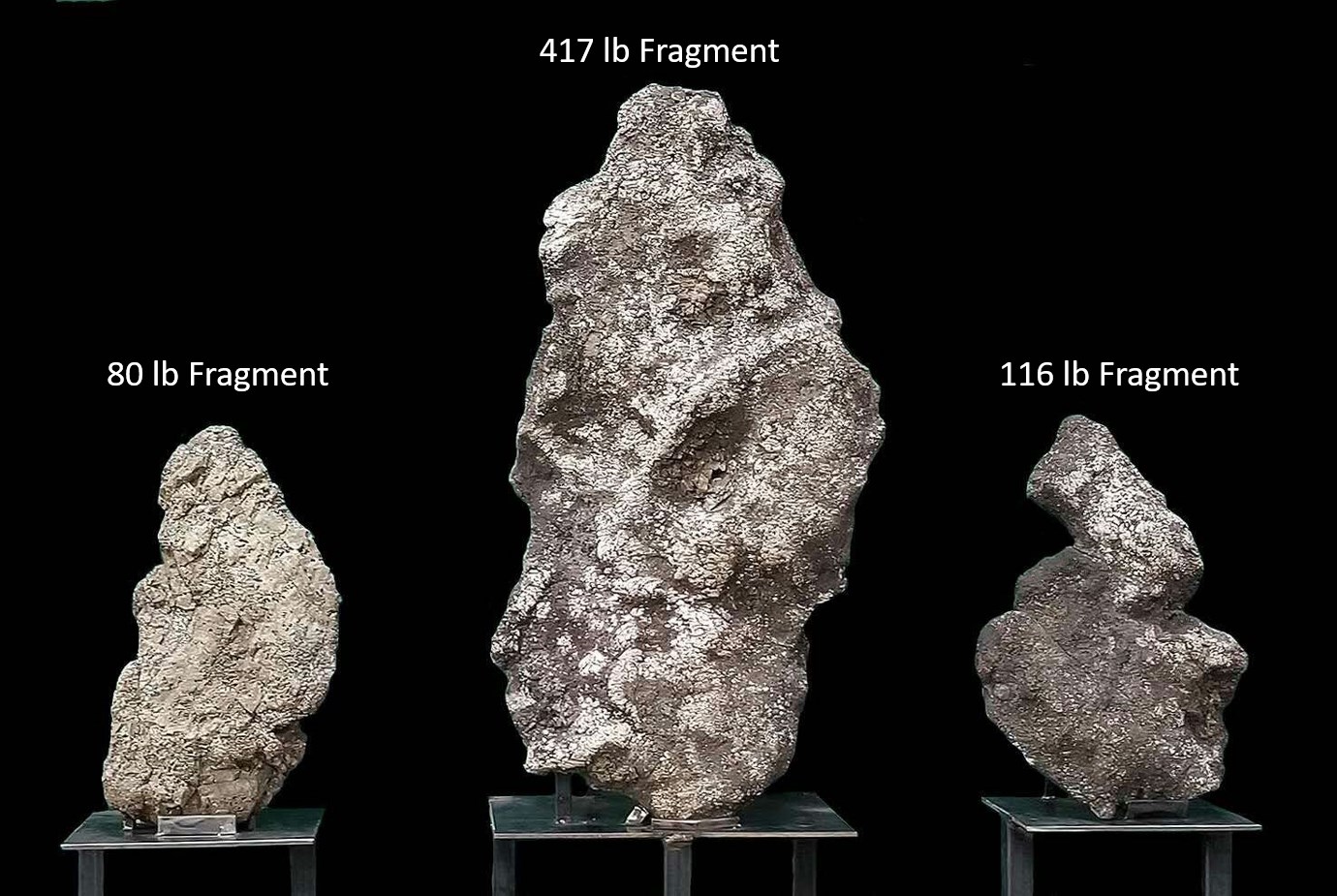

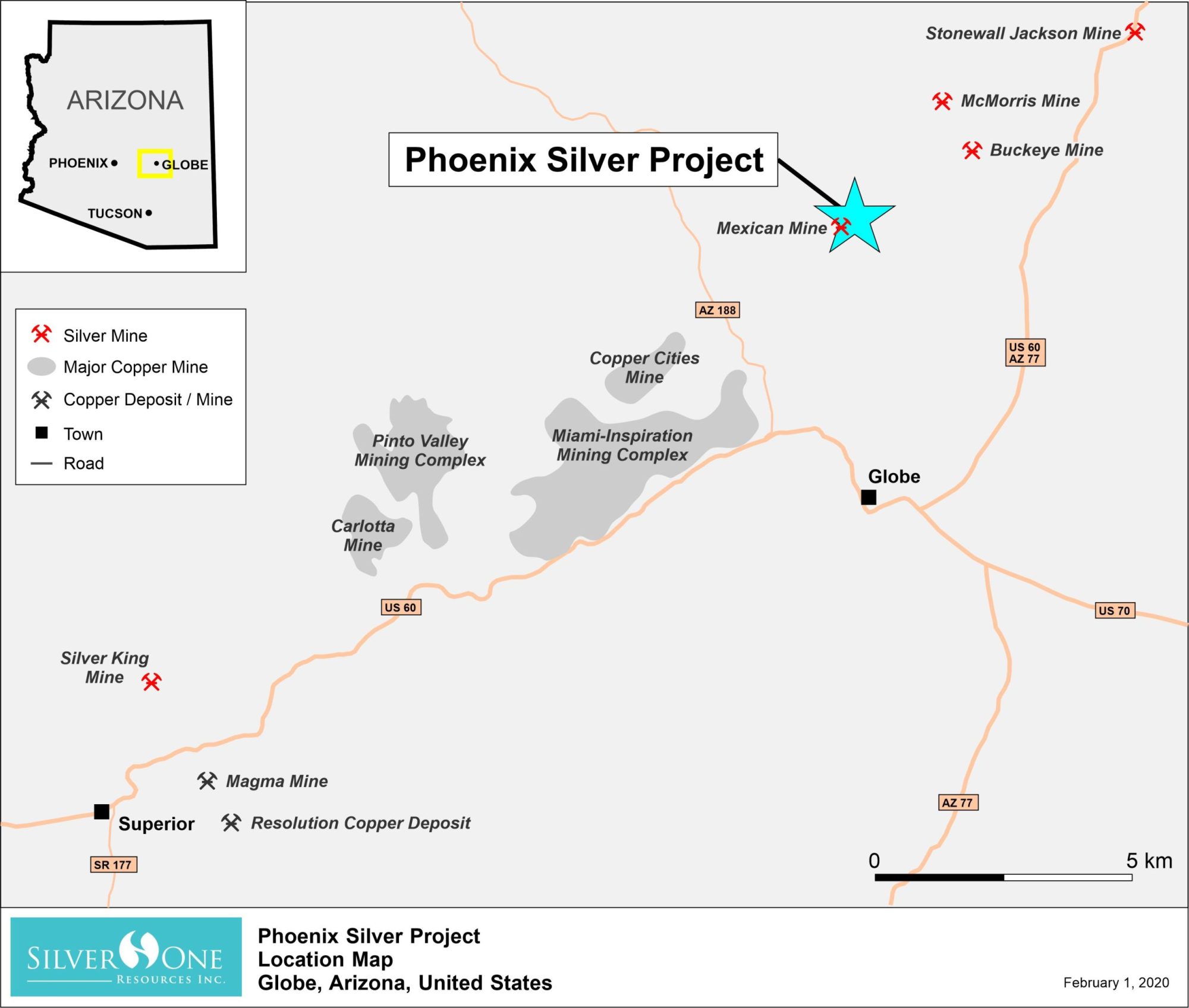

It’s very rare to find large, near-surface native silver vein fragments in first world countries because these countries have already seen so much exploration and mining in the past. But Silver One Resources’ just entered into an agreement to acquire up to 100% of the Phoenix Silver project on which massive native silver vein fragments have been recently discovered. The project is in Arizona within the “Arizona Silver Belt”. One grab sample has returned an amazing 459,000 gm/tonne (14,688 oz/ton) assay result from a 18.7 lb (8.5 kg) native silver vein fragment. Also, discovered was a large 417 lb silver vein fragment that was not assayed due to the desire to preserve the specimen nature of this sample. These silver vein fragments are interpreted to have been transported short distances downslope from partially exposed vein structures and have been found in numerous areas throughout the property. Silver One will begin exploring this project this spring with the hopes of fully uncovering the high-grade silver veins and proving out an economic deposit. In this interview, CEO Greg Crowe discusses the new Phoenix silver project as well as the company’s plans for 2020.

www.SilverOne.com TSXV:SVE OTC:SLVRF FSE:BRK1

0:15 Introduction

1:50 New Phoenix Silver project overview (14,688 oz/ton assayed grab sample)

6:04 Exploration to hopefully prove up an economic silver deposit

8:15 How the high-grade silver vein fragments were found

8:58 Oversubscribed financing closed and now funded for 2020

11:17 Burn rate for 2020

12:30 Upcoming news flow and catalysts

13:09 Final thoughts

Phoenix Project Press Release: https://www.miningstockeducation.com/2020/02/silver-one-to-acquire-100-of-high-grade-native-silver-prospect-arizona/

TRANSCRIPT (edited for readability and clarity):

Bill Powers: Silver One Resources just released a press release about a new project in Arizona with some stellar results that make you look twice at those pictures in the press release and here to talk about it with me Silver One’s president and CEO Greg Crowe. Greg, please break down for us this press release that you put out today.

Greg Crowe: Thanks Bill. We’ve been looking around at other silver opportunities and we happened to come across one in Arizona, which is right next door, of course, to Nevada. So it’s not that far away, but what we like about it is there are some spectacular vein fragments, and I say they’re vein fragments because they’re very angular and they have this inter-growth of crystals that suggest that they haven’t been transported very far. Most of the property is covered by overburden, but these vein fragments, one of them that was assay returned a spectacular 459,000 grams per metric ton (14,688 oz/ton). So that is a phenomenal return. That was from about just an under 20-pound sample.

It was just lying under the overburden on the surface. Another one came back, it was 417 pounds. Probably one of the world’s largest solid pieces of silver. Now what intrigues us is this property is set just on the outer margin of an extremely prolific producing copper camp with giants such as BHP, Rio Tinto, Freeport-McMoran, Capstone, all mining in that particular area. It’s just east of Phoenix near a small town called Globe, which is a big mining center. Also the brand new resolution copper deposit, which is a joint Rio Tinto BHP project. It occurs in this camp and that thing boasts about 1.78 billion tons of mineralization at 1.53% copper. It’s going to take another 10 years to bring it into production, but it’s a huge camp. These silver deposits that some of them historically were mined in the late 1800’s lie just on the outer margins of this big copper camp.

So what did we find here? We’ve got this project. We know there are vein systems striking East-West, and the projection of those vein systems occur just up-slope from where we’re finding these huge big silver fragments which we interpret to be pieces of the vein that have spalled off and rolled downhill. So our job is to go on to this project, which we have the right to acquire 100% of. If you read the news release, you’ll see the terms there. Big payments are pushed back to the third and fourth year. So it gives us time to explore it. And if we’re successful, then finding the source of some of these big vein fragments, then this could be a very, very rich vein system that we would move rapidly to develop it and possibly exploit.

Bill: If a skeptic was listening to us speak today and reading the press release, could they say to themselves, “Yeah you have this big chunk of silver here, but that doesn’t mean that you’re going to find anything economic.” What would be your response to that person?

Greg: There are never any guarantees in life in anything apart from, of course, death and taxes, but quite frankly it’s like any other exploration level project. You never know until you drill things off. Our goal is to explore it. We’ve structured our deal where for the first couple of years the payments are not that onerous. We get to go in and we get to explore. This is a prime opportunity. It is extremely rare, if not totally unheard of, to find pieces of silver lying on the ground. Particularly in developed countries like Canada and the United States where a lot of exploration has already taken place. This is an ignored silver camp and yet these fragments are still there waiting to be found. They obviously came from a source and if that source is nearby and on the property, we will do our best to find mineralization in-situ that we’ll be able to develop.

Bill: One of the pictures in the press release shows a 417-pound fragment. I understand this native silver fragment contains up to 70% native silver? That’s just amazing.

Greg: The only thing you can say for that is, and I have to qualify this, is up to 70% native silver. That was not determined by an assay. That was determined by what we refer to as a specific gravity measurement and the reason for that is this is a specimen quality fragment. In order to keep it in its pristine state it its entirety, and this is still held by the owners. This is not held by Silver One. It did come from the property. What we need to do is make sure that we find the source of that type of mineralization because it wouldn’t take many of those to build up ounces of silver.

Bill: How was it found? What’s the story here?

Greg: There’s some prospectors who kind of have held the property for a while and they were kind of out on the property. They found a couple of small little pieces and they thought, “Oh, there might be more here.” So they went back and they brought some metal detectors and they started looking around and they uncovered some of these nuggets. So they went and they did a deal with some people that I know and then we ended up doing a deal with them to acquire a hundred percent interest in the project.

Bill: You just closed a nice financing. Can you break that down for us and then talk about how you’re going to use those funds to explore this project as well as your other projects?

Greg: This was a totally oversubscribed financing. It started out fairly small, but it kind of grew as investors called in and they wanted a piece. So we did decide to increase the size of this financing. In essence, what started out is around C$1 to 1.5 million, actually closed on January 20th at C$5.2 million. That financing was done at 25 cents with an attached half warrant at 40 cents. We also secured the interest of our largest shareholder, Eric Sprott, who came in for about C$1.5 million of that C$5.2 million. So we have a good treasury right now. What we plan on doing is move forward.

We’re continuing to drill the Candelaria project (127M AgOz historic resource). So as we get results in, we’ll be issuing that news over the coming weeks and months possibly. In terms of the other very high grade prospect that we have in Eastern Nevada (Cherokee project), we’ll be doing some work there this year. Then of course in this new acquisition we want to get in and do some evaluation. Probably the first steps we’re going to take there are to go and do some surface work trying to really prospect the whole project because it’s never really been gone over with a fine tooth comb. On top of that we’d probably do some geophysics and some detailed geochemical work and see whether we can find the trace of those veins and if we are fortunate, we’ll be able to find some in situ mineralization that will be extremely exciting.

Bill: So the drills could be turning after you do the geophysical and the ground survey regarding the Arizona Phoenix Silver project?

Greg: Possibly. That might be later this year. It might even be next year. We’ll just see how fast things develop and whether lady luck allows us to find a zone worth drilling.

Bill: So what would be your burn rate for investors wanting to know how far this C$5 million will take you?

Greg: Our burn rate, G&A is probably about US$1M a year. All right. Property payments, et cetera, et cetera. The actual exploration that we’re doing, we’re probably spending another several hundred thousand on the completing the drill program at Candelaria. We have not set a budget for the exploration on the Eastern Nevada Cherokee project just yet. We’re going to review that. We’re still waiting on all of the final last things to come in from the sampling that we did up until Q4 of last year. Then on top of that, I look at probably spending upwards of about $400,000 or $500,000 on the new prospect in Arizona. Then of course if we do come up with some interesting results and we want to drill, then we’ll increase that. So I think we got another, if we stretch our dollars, et cetera, we’ve got another a couple of years’ worth of treasury left in the account.

Bill: Over the next few months are you going to have most of your press releases coming out of Candelaria?

Greg: Well certainly coming out of Candelaria, but if we get some good results on this Phoenix Silver project, I want to move as quickly as we can in terms of starting to do this. So we might see in a couple of months some news coming out of this project as well. Eastern Nevada Cherokee project, we will get some results coming out of that based on last year’s sampling. The weather’s a bit inclement right now, so we’re not going to get back in there for another two to three months before we start some work down on that project again. So that’ll be pushed back into Q2, Q3.