It’s Go Time for Gold! Next Stop $2,250

RESEARCH HIGHLIGHTS:

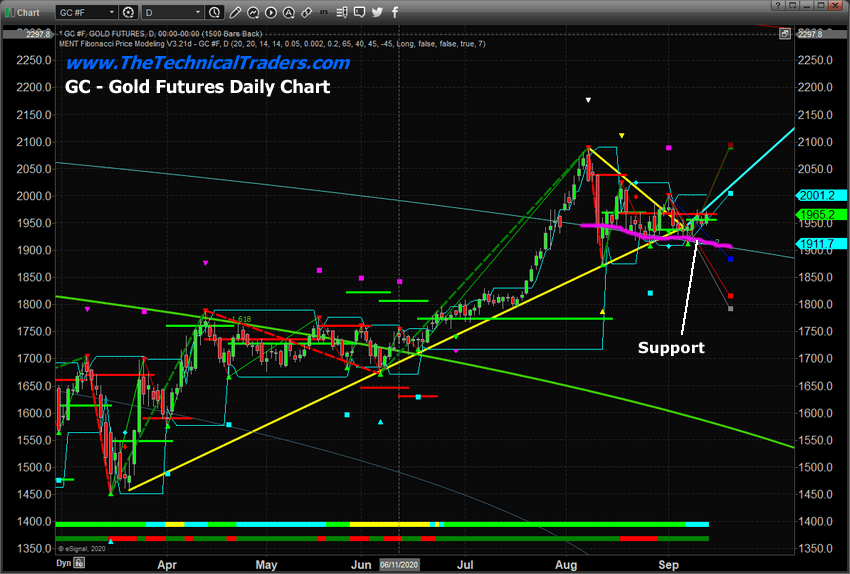

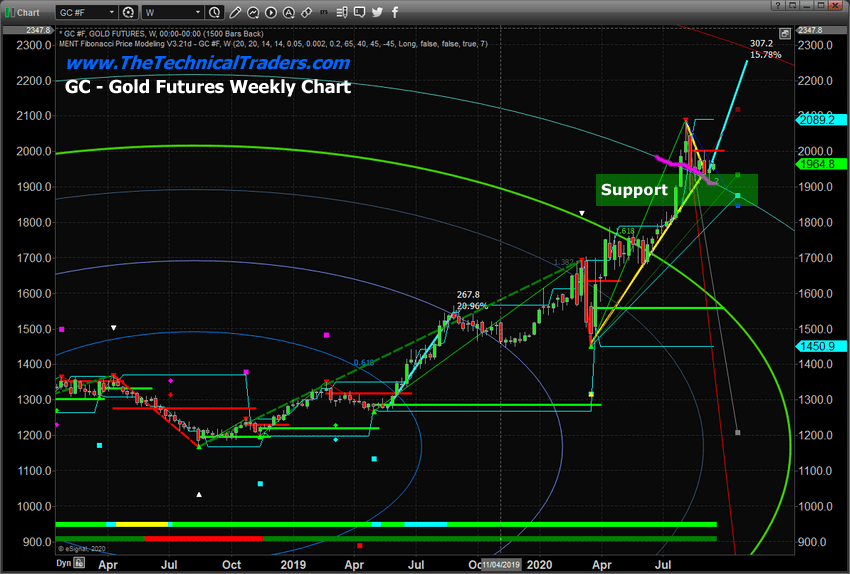

- Gold Pennant/Flag formation is now complete and setting up new momentum base near $1,925.

- Our Adaptive Fibonacci Models suggest support will prompt new Gold rally to $2,250.

- The rally in Gold will continue to extend higher over the next 4+ weeks.

- The US Dollar may move lower and/or the US stock market may break recent support to prompt this new rally in Gold.

If you are a follower of my research, then you know I follow gold and silver closely. I believe Gold has completed a Pennant/Flag formation and has completed the Pennant Apex. Further, a new momentum base has setup near $1,925~1,930, near the upper range of our Adaptive Fibonacci Price Modeling System’s support range. My team and I believe the current upside price move after the Pennant Apex may be the start of a momentum base rally targeting the $2,250 level or higher.

MOMENTUM BASE SHOULD PROMPT +15% RALLY IN GOLD

We believe the current momentum base in Gold, near $1,925, will prompt a move higher that will initially target $2,100, then breach this level and attempt to move to levels near $2,250 fairly quickly. My research team and I have called nearly every upside price move over the past 6+ months, clearly and accurately describing the “measured moves” in precious metals. Please take a moment to review some of our earlier Gold research posts:

August 4, 2020: REVISITING OUR SILVER AND GOLD PREDICTIONS – GET READY FOR HIGHER PRICES

July 13, 2020: GOLD & SILVER MEASURED MOVES

April 25, 2020: FIBONACCI PRICE AMPLITUDE ARCS PREDICT BIG GOLD BREAKOUT

This Daily Gold chart above highlights our Fibonacci Price Amplitude Arcs, suggesting support is sloping downward near $1,915 right now. We believe the momentum base that is setting up after the Pennant Apex is just starting to build upside momentum. We believe the rally in Gold will continue to extend higher over the next 4+ weeks. This aligns with our Fibonacci Price Modeling System’s support range on the Weekly chart, which we will look at shortly.

The Weekly Gold chart, below, highlights the Pennant/Flag formation in YELLOW together with the Fibonacci Price Amplitude Arc support levels (in MAGENTA). Additionally, we’ve drawn a LIGHT GREEN rectangle through the support range identified by our Adaptive Fibonacci Price Modeling System. We believe this support range will continue to act to support the momentum base in Gold and push Gold prices higher once the upside momentum gains strength. Our upside price target is more than $300 higher than the current price levels. We believe the next upside price leg will target $2,250 or higher.

It is likely that this move in Gold will be associated with moderate risk factors related to the US Dollar and/or the US Stock market. We believe a lower US Dollar and/or a weakening US stock market that breaks recent support will lick start this new rally in Gold. Now is the time to really start to pay attention to how the US stock market holds up after the deep downside price rotation over the past 2+ weeks, and start positioning for a gold rally.

We are actively trading gold and have positions in this precious metal. If you would like to ride my coattail with my trade alerts and my pre-market videos where I walk through the charts every day before the opening bell, then take a look at the Technical Trader, my Active ETF Trading Newsletter. If you have any type of retirement account and are looking for signals when to own gold, equities, bonds, or cash, be sure to become a member of the Technical Investor, my Long-Term Investing Signal Newsletter.

Chris Vermeulen

Chief Market Strategist

Technical Traders Ltd.

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only – read our FULL DISCLAIMER here. Visit www.thetechnicaltraders.com to learn how to take advantage of our members-only research and trading signals.