Namibia Critical Metals – JOGMEC Injects an Additional CAD $1.1M to Expand and Accelerate Drill Program at the Lofdal Heavy Rare Earth Project

HALIFAX, NS / ACCESSWIRE / September 21, 2020 /Namibia Critical Metals Inc. (“Namibia Critical Metals” or the “Company” or “NMI”) (TSXV:NMI) is pleased to announce that Japan Oil, Gas and Metals National Corporation (“JOGMEC”) will provide an additional $1,100,000 to expand and accelerate the current drilling program for the Lofdal Heavy Rare Earths Project (“Lofdal”) in northern Namibia. This additional commitment will increase the Term 1 joint venture expenditure from $3,000,000 to $4,100,000 by March 31, 2021. All references to dollar amounts are in Canadian dollars. This increase in funding allows for an additional 6,000 m of diamond drilling to develop resources at Lofdal as described below.A second rig has been deployed to site in order to maintain Term 1 program scheduling.

Don Burton, President of Namibia Critical Metals stated “Lofdal is a very exciting project and is unique as one of only two primary xenotime deposits under development in the world, the other deposit being Browns Range in Australia. As demonstrated in our Preliminary Economic Assessment[1] Lofdal has the potential for significant production of dysprosium and terbium, the two most valuable heavy rare earths used in high powered magnets. JOGMEC is supporting the security of light rare earth supplies for Japan by applying its financial scheme to Lynas Corporation. We are very pleased to see this additional injection of funds by our joint venture partner which will enable us to further demonstrate the value in Lofdal as a long term, sustainable supply of heavy rare earths for Japan.”

Term 1 Drilling Program Expanded

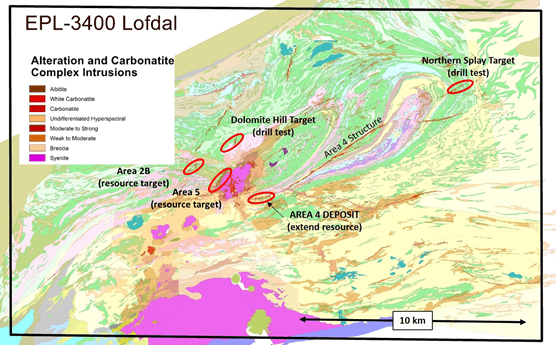

The initial Term 1 budget provided for a total of 7,200 m of resource drilling in Area 4 and 1,500 m of exploration drilling at the Northern Splay and Dolomite Hill to be completed by year end with the primary objective of doubling the resource size in Area 4. Following recommendations to the Joint Venture Management Committee, the drilling budget has been increased to enable resource evaluations in two additional areas – Area 2B and Area 5, and to supplement drilling in Area 4 with an additional 1,000 m of drilling (Figure 1). This additional 6,000 m of drilling will provide for a total of 8,200 m in Area 4, 2,600 m in Area 2B and 2,400 m in Area 5. Both Area 2B and Area 5 have historic drilling and trenching that was carried out by the Company during the period 2010-2012. A second drill rig has been deployed to the project to maintain schedule and drilling will now continue through to March 2021.

Drilling in Area 4 is over 60% completed and on schedule to deliver an updated 43-101 resource estimate in Q1 2021. The Company will now target to include a maiden resource estimate for Area 2B in the same report. In order to meet this additional objective both drill rigs are currently operating in Area 2B to complete that planned drilling before moving back to Area 4 (Figure 2). Drilling in Area 5 will commence in Q1 2021 after which time results will be assessed for inclusion in a separate resource estimate.

JOGMEC Joint Venture Agreement

As previously announced (Company press release January 27, 2020), the joint venture agreement with JOGMEC provides for the two companies to jointly explore, develop, exploit, refine and/or distribute mineral products from Lofdal. JOGMEC has the right to earn an interest in stages following an initial non-refundable exploration commitment of $3,000,000 (Term 1). Subsequent financial commitments may be exercised at the sole discretion of JOGMEC upon completion of each phase with Term 2 requiring a $7,000,000 contribution to earn 40% interest in Lofdal, Term 3 requiring a $10,000,000 contribution for an additional 10% interest in Lofdal after which JOGMEC may elect to acquire an additional 1% interest for $5,000,000. The agreement contemplates completion of a feasibility study for Lofdal at the end of Term 3 and makes provision for JOGMEC to elect to exclusively fund development of Lofdal provided that the Company’s interest will not be diluted below 26%. The additional expenditure of $1,100,000 during Term 1 can be credited towards the Term 2 expenditure commitment of $7,000,000. Please refer to the Company press release of January 27, 2020 for further details.

Figure 1 – Geology of the project area showing the location of the Area 4 deposit, exploration drill targets at the Northern Splay and Dolomite Hill, and additional resource targets at Area 2B and Area 5

Figure 2 – Close spaced resource drilling in Area 2B with two drill rigs. Drill operations at Lofdal are contracted to Gunzel Drilling

About Namibia Critical Metals Inc.

Namibia Critical Metals Inc. holds a diversified portfolio of exploration and advanced stage projects in the country of Namibia focused on the development of sustainable and ethical sources of metals for the battery, electric vehicle and associated industries. The two advanced stage projects in the portfolio are Lofdal and Epemebe (described below). The Company also has significant land positions in areas favourable for gold mineralization.

Gold: At the Erongo Gold Project, stratigraphic equivalents to the sediments hosting the recent Osino gold discovery at Twin Hills have been identified but not yet sampled. Soil surveys are progressing over this highly prospective area.

Tantalum-Niobium: In addition to Lofdal, the Epembe Tantalum-Niobium Project is also at an advanced stage with a well-defined, 10 km long carbonatite dyke that has been delineated by detailed mapping with over 11,000 meters of drilling. Preliminary mineralogical and metallurgical studies including sorting tests (XRT), indicate the potential for significant physical upgrading. Further work will be undertaken to advance the project to a preliminary economic assessment stage.

Copper-Cobalt: The Kunene Copper-Cobalt Project comprises a very large area of favorable stratigraphy (“the DOF”) along strike to the west of the Opuwo cobalt-copper-zinc deposit. Secondary copper mineralization over a wide area points to preliminary evidence of a regional-scale hydrothermal system. Exploration targets on EPLs held in the Kunene project comprise direct extensions of the DOF style mineralization to the west, sediment-hosted cobalt and copper, orogenic copper, and stratabound manganese and zinc-lead mineralization.

Earlier stage projects include the Grootfontein Base Metal and Gold Project which has potential for magmatic copper-nickel mineralization, Mississippi Valley-type zinc-lead-vanadium mineralization and Otjikoto-style gold mineralization. Detailed interpretation of geophysical data and regional geochemical soil sampling surveys are under way.

The common shares of Namibia Critical Metals Inc. trade on the TSX Venture Exchange under the symbol “NMI”.

Donald M. Burton, P.Geo. and President of Namibia Critical Metals Inc., is the Company’s Qualified Person and has reviewed and approved this press release.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information please contact:

Namibia Critical Metals Inc.

Don Burton, President

Tel: +01 (902) 835-8760

Fax: +01 (902) 835-8761

Email: [email protected]

Web site: www.NamibiaCriticalMetals.com

The foregoing information may contain forward-looking information relating to the future performance of Namibia Rare Earths Inc. Forward-looking information, specifically, that concerning future performance, is subject to certain risks and uncertainties, and actual results may differ materially. These risks and uncertainties are detailed from time to time in the Company’s filings with the appropriate securities commissions.

[1] Preliminary Economic Assessment on the Lofdal Rare Earths Project Namibia dated October 1, 2014 authored by David S. Dodd, B. Sc (Hon) FSAIMM – The MDM Group, South Africa, Patrick J.F. Hannon, M.A.Sc., P.Eng. and William Douglas Roy, M.A.Sc., P.Eng. – MineTech International Limited, Canada, Peter Roy Siegfried, MAusIMM (CP Geology) and Michael R. Hall, B.Sc (Hons), MBA, MAusIMM, Pr.Sci.Nat, MGSSA – The MSA Group, South Africa. The PEA should not be considered to be a pre-feasibility or feasibility study, as the economics and technical viability of the Project has not been demonstrated at this time. The PEA is preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves. Furthermore, there is no certainty that the PEA will be realized.

SOURCE: Namibia Critical Metals Inc.

View source version on accesswire.com:

https://www.accesswire.com/606975/Namibia-Critical-Metals-JOGMEC-Injects-an-Additional-CAD-11M-to-Expand-and-Accelerate-Drill-Program-at-the-Lofdal-Heavy-Rare-Earth-Project