SPY Expectations For The Rest Of September

RESEARCH HIGHLIGHTS:

- Over the past 28 years, the SPY has gained an average of 3.45% in 15 of those years; it has fallen by 6.42% in the other 13 years.

- The critical support level for SPY is 332.85. If the SPY finds support at this level then you can expect continued, moderate price increases.

- Prepare for a moderate increase in volatility for the rest of September – watch the VIX.

My research team and I have been pouring over the charts in an effort to attempt to identify any support or weakness related to the increase in volatility over the past 7+ trading days. The VIX is currently at 29.71 after reaching a high of 38.28. We believe the increased price volatility is here to stay – at least through the end of 2020. This means skilled technical traders should prepare for some potentially large and aggressive price swings over the next few weeks and months.

SEPTEMBER 11 AND HISTORICAL PRICE MODELING

As we come to September 11, 2020, and reflect on the 9/11 terrorist attacks, we become more centered on what really matters in life for most of us – family, friends, health, safety, and opportunity. Even though we near a potential rotation in the market, we must never lose focus on these most essential components of our lives. Money, trading, and investing are all things that can be regained and rebuilt. Time, family, friends, community, security, and health are either impossible or extremely difficult to recover, so always keep your eye on the true prize. Now, onto the technical analysis work…

September has traditionally been a moderately weak month of trading over the past 28 years. Over this span of time, 15 of the 28 years resulted in positive price activity on the SPY averaging +3.45%. The remaining 13 of these 28 years resulted in negative price activity on the SPY averaging -6.42%. This suggests that nearly 53% of the past 28 years have resulted in a moderate upside price move on the SPY while 47% of the time, the SPY moved lower by a greater magnitude.

Our data mining application reported the following results for the month of September going back over 28 years of data:

=========================================================

Largest Monthly gain: +8.819999999999993

Largest Monthly loss: -15.420000000000016

Total Monthly Gains: 51.75497000000003 across 15 bars

Avg = 3.45

Total Monthly Losses: -83.43061999999998 across 13 bars

Avg = -6.42

Total Monthly Sum: -31.675649999999948 across 28 bars

=========================================================

Because the negative price activity is larger in scope than the positive price activity, we believe any downside price move in the month of September could be more aggressive, especially given the increased VIX/volatility we are currently seeing. Thus, any big breakdown in the SPY, below the recent lows near 332.85, could cascade into larger price declines.

Be sure to sign up for our free market trend analysis and signals now so you don’t miss our next special report!

The technicals show a bullish trend for the markets with current price weakness to be shallow and weak, however, we remain cautious and a deeper price breakdown could quickly change the trend and our forward expectations. We have been warning for months that 2020 and 2021 should be full of wild price swings and big trends – yet we believe the current upside price trend is still intact and the recent downside price rotation is nothing more than a moderate price correction.

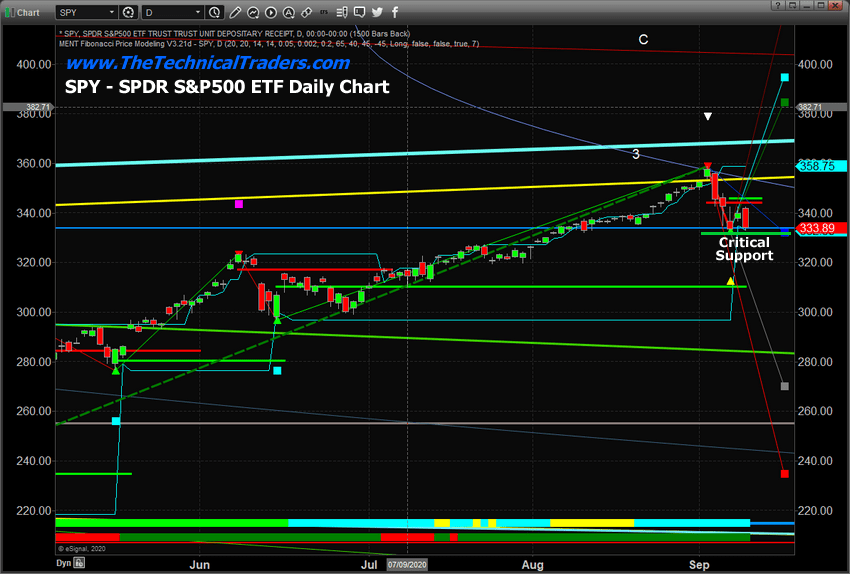

The Daily SPY chart below highlights the current support levels near 332.85 that are critical to continued Fibonacci support. A breakdown below this 332.85 price level suggests deeper Fibonacci support levels may become new targets in the near future. These lower targets are currently near 270.40 and 234.85.

Again, to be very clear, we are still technically in a Bullish price trend from a purely technical perspective. We are cautious of the fragility of this upside/Bullish price trend and believe some price volatility is warranted after the past 5+ months of an upside price rally. Currently, our Adaptive Fibonacci Price Modeling system is suggesting the 332.85 level is critical price support. We need to see this level hold in order for price to recover to the upside fairly quickly.

In summary, be thankful for all that you do have in your life right now as we remember our fallen heros from 9/11. You must also be prepared for a potentially wild September month as historical price activity has shown that September can result in either a moderate upside price move or a much bigger downside price trend. Given the past price rally and the current start to September 2020, watch the support levels closely and be prepared for increased volatility.

If you look back at my past research, you will see that my incredible team and our proprietary technical analysis tools have accurately shown you what to expect from the market days, weeks, and months down the road. Do you want to now learn how to profit from the expected volatility and the big moves that company volatility? If so, sign up for the Technical Trader to get my Active ETF Swing Trade Signals today!

You should also make sure you protect your buy-and-hold or retirement account with our long-term technical bull/bear signals and alerts as to when to buy and sell equities, bonds, precious metals, or sit in cash. Subscribe to the Technical Investor to get my Passive Long-Term ETF Investing Signals to stay ahead of the market and protect your wealth!

Chris Vermeulen

Chief Market Strategist

Technical Traders Ltd.

NOTICE AND DISCLAIMER: Our free research does not constitute a trade recommendation or solicitation for our readers to take any action regarding this research. It is provided for educational purposes only – read our FULL DISCLAIMER here. Visit www.thetechnicaltraders.com to learn how to take advantage of our members-only research and trading signals.