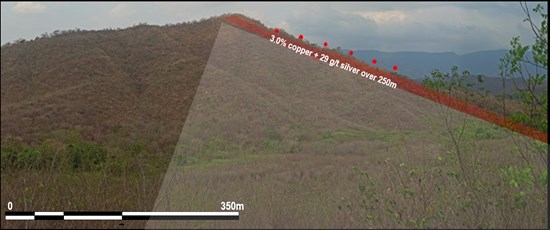

Max Resource Reports 3.0% Copper + 29 g/t Silver Over 250-metres at AM North on its CESAR Project, NE Colombia

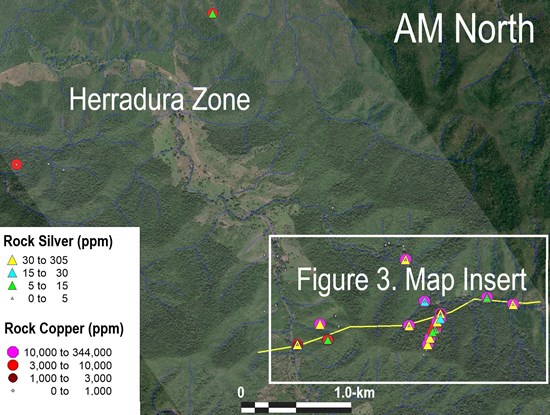

Vancouver, British Columbia–(Newsfile Corp. – October 28, 2020) – MAX RESOURCE CORP. (TSXV: MXR) (OTC Pink: MXROF) (FSE: M1D2) (“Max” or the “Company”) is pleased to report a series of 25-metre representative grab samples collected over 250-metres from the Herradura zone at AM North (refer to Figures 2 and 3) of the Company’s wholly-owned CESAR project:

- 5.8% copper + 51 g/t silver over 25-metres (#875507)

- 5.2% copper + 58 g/t silver over 25-metres (#875503)

- 3.3% copper + 32 g/t silver over 25-metres (#875504)

- 2.4% copper + 23 g/t silver over 25-metres (#875508)

- 0.9% copper + 7 g/t silver over 25-metres (#875505)

- 0.5% copper + 5 g/t silver over 25-metres (#875506)

Each sample was taken from the available outcrop over 25-metre intervals and combined into one sample. The average grade over 250-metres is 3.0% copper + 29 g/t silver. Thickness of the copper-silver horizon has yet to be determined (refer Figures 3 and 4). Max cautions investors composite representative rock grab sampling can be selective.

The Company considers these results to be extremely significant as they clearly demonstrate the persistence of copper-silver mineralization over 250-metres. The angle of the slope and the dip of the copper-silver horizon appears to be closely parallel, meaning the mineralization crops out at surface. The absence of visible copper oxides (malachite or azurite) in these samples indicate the dominant copper mineral is likely chalcocite which carries a higher (80%) copper content.

The CESAR AM North copper-silver mineralization is interpreted to be stratabound, hosted in fine-grained clastic sediments: sandstone and siltstone. The general strike of the AM North copper-silver mineralization is 245 degrees with a shallow dip to the NW. CESAR’s AM South copper-silver zone occurs 40-km SSW of AM North along the same mineralized trend.

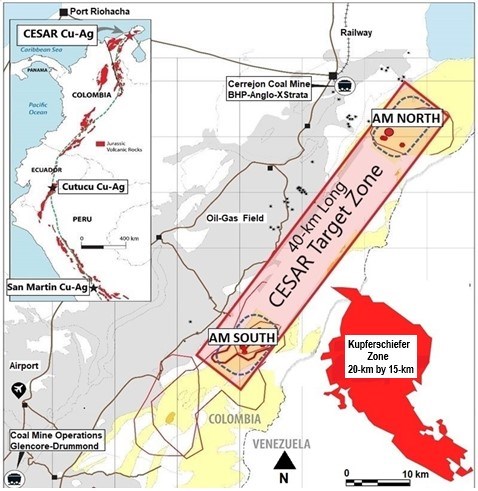

The Company believes the stratabound copper-silver mineralization at CESAR is analogous to the European Kupferschiefer deposits, Europe’s largest copper source, with production in 2018 of 3 million tons grading 1.49% copper and 48.6 g/t silver from a mineralized zone of 0.5 to 5.5-metre thickness. Source: The Kupferschiefer Deposits and Prospects in SW Poland: Past, Present and Future by dmpi.com, September 27, 2019.

The Kupferschiefer deposits, yielded 40 million ounces silver in 2019, almost twice the production of the world’s second largest silver mine (World Silver Survey 2020). Max cautions investors that the presence of stratabound copper-silver mineralization at Kupferschiefer is not necessarily indicative of similar mineralization at CESAR.

“While the geometry of the outcrop exposures indicate that the copper-silver horizon appears to be close to paralleling the slope, we are extremely encouraged to see the distribution of copper-silver mineralization that continues along 250-metres of the horizon,” said Max CEO Brett Matich.

“The Max in-country field team continues to make discoveries, further substantiating our Kupferschiefer-style geological model for CESAR, as we significantly expand the CESAR mineralization working towards our goal of a major Kupferschiefer copper silver deposit,” he continued.

“With the price of copper increasing to a rebound two year high of US$7,000 per ton in October, the importance of the CESAR copper-silver project also increases, so we have implemented additional measures to significantly increase our land position within this key copper-silver basin,” he concluded.

Figure 1. CESAR location map

To view an enhanced version of Figure 1, please visit:

https://www.miningstockeducation.com/wp-content/uploads/2020/10/66963_e7b2aaf6f43ef8b5_001full.jpg

Figure 2. AM North – Herradura Zone

To view an enhanced version of Figure 2, please visit:

https://orders.newsfilecorp.com/files/3834/66963_e7b2aaf6f43ef8b5_002full.jpg

https://www.maxresource.com/images/news/20201028_figure1.jpg

https://www.maxresource.com/images/news/20201028_figure2.jpg

This reconnaissance representative grab rock sampling conducted by the Max field crew allows the Company to identify mineralized intervals that are later followed up with mapping and systematic chip channel sampling. This approach has established the priorities for Max at CESAR to be: surface geochemical sampling, structural mapping, seismic data interpretation and logging of the oil-gas drill hole core chips.

Copper-silver mineralization at the Herradura zone is of a stratabound/Kupferschiefer type with mineralization hosted in fine-grained sediments: sandstone and siltstone. The mineralization is mainly represented by chalcocite and copper oxides malachite and azurite. Based on field observations and mineralogical studies, it is expected that at shallow depth copper oxides (malachite and azurite) grade into copper sulfide, mainly chalcocite (80% copper content).

Figure 3. AM North – Herradura – 3.0% copper + 29 g/t silver over 250-metres

To view an enhanced version of Figure 3, please visit:

https://orders.newsfilecorp.com/files/3834/66963_e7b2aaf6f43ef8b5_003full.jpg

https://www.maxresource.com/images/news/20201028_figure3.jpg

Figure 4. Herradura Landscape – 3.0% copper + 29 g/t silver over 250-metres

To view an enhanced version of Figure 4, please visit:

https://orders.newsfilecorp.com/files/3834/66963_e7b2aaf6f43ef8b5_004full.jpg

https://www.maxresource.com/images/news/20201028_figure4.jpg

QUALITY ASSURANCE

All samples were shipped to the ALS Lab sample preparation facility in Medellin, Colombia. Sample pulps are sent to Vancouver, Canada for analysis. All samples are analyzed using ALS procedure ME-MS41, a four-acid digestion with ICP finish. Over limit copper and silver are determined by ALS procedure OG-62, a four-acid digestion with an AAS finish. ALS Labs is independent from Max. Max is not aware of any other factors that could materially affect the accuracy or reliability of the data referred to herein.

CESAR COPPER-SILVER PROJECT – COLOMBIA

The wholly-owned CESAR project in north east Colombia lies along a 120-kilometre sediment-hosted copper-silver belt, that resembles the Kupferschiefer in Poland. The CESAR region enjoys major infrastructure. Mining operations include Cerrejon, the largest coal mine in Latin America, jointly owned by global miners BHP Billiton, XStrata and Anglo American (Figure 1).

Important highlights and exploration activity on multiple fronts:

- AM North forms 11-kilometre long zone of stratabound copper-silver mineralization that is open along strike and down dip. The zone also contains a high-grade area with varying intervals grading 4.0 to 34.4% copper + 28 to 305 g/t silver (July 29, 2020). Two bulk samples extracted from each end of the 1.8-km discovery horizon, returned 9.4% copper + 79 g/t silver and 3.5 % copper + 29 g/t silver (May 21, 2020);

- The AM South zone occurs 40-km SSW of the AM North zone. The AM South zone extends over an area of 4-kilometres by 4-kilometres, and remains opens laterally. The cumulative strike length of the open-ended AM South horizons exceeds 6.4-kilometres, returning highlight values of 6.8% copper and 168 g/t silver from 0.1 to 25-metre intervals, suggesting these horizons could be of significant size (October 7, 2020);

- Fathom Geophysics is currently interpreting geophysical data funded by the Company in collaboration with one of the world’s leading copper producers;

- Geochemical and mineralogical research programs by the University of Science and Technology (“AGH”) of Krakow, Poland are ongoing. AGH will bring their extensive knowledge of KGHM’s world renowned Kupferschiefer sediment-hosted copper-silver deposits in Poland to the CESAR project;

- Ongoing structural analysis of the CESAR project and interpretation of seismic data is being conducted by Ingeniería Geológica Universidad Nacional de Colombia (“IGUN”) in Medellín, in conjunction with the Max field team;

- Max has entered into three non-exclusive confidentially agreements regarding the CESAR project: the first with one of the world’s leading copper producers, a second with a global mining company and a third with a mid-tier copper explorer;

- Planned work: logging and XRF analysis for copper of available drill core from historical oil and gas drilling in the western portion of the basin;

- Continue to expand the landholdings along the 120-kilometre-long CESAR copper silver belt;

- Our in-country field team is conducting on-going prospecting, rock sampling, expanding and confirming the continuity of widespread copper-silver mineralization.

RT GOLD PROPERTY – PERU

The RT Gold property consists of two contiguous mineral concessions covering 1,983 hectare and sited along the Condor mountain chain of northern Peru, within the Cajamarca Metallogenic belt, 760-km NW of Lima in the District of Tabaconas. Max has rights to acquire 100%; the option requires yearly payments of US$300,000 over four years and exercise of the option requires an additional US $3,000,000 payment on or before the fifth anniversary. The Vendors will retain 2.5% NSR.

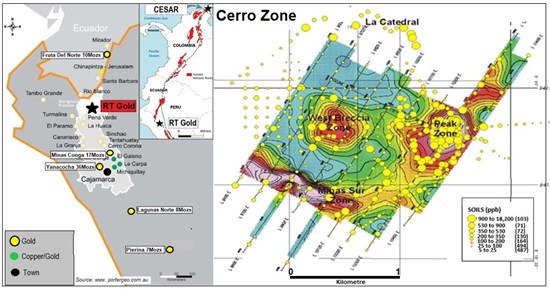

Figure 5. Source: NI43:101 Geological Report Rio Tabaconas Gold Project for Golden Alliance Resources Corp. by George Sivertz, Oct.3, 2011

To view an enhanced version of Figure 5, please visit:

https://orders.newsfilecorp.com/files/3834/66963_e7b2aaf6f43ef8b5_005full.jpg

This geological belt extends from central Peru into southern Ecuador, and hosts a number of world class gold deposits, including Fruta Del Norte (10Moz), Minas Conga (17Moz), Yanacocha (36Moz), Lagunas (8Mozs) and Pierina (7Mozs). Presence of mineralization at Yanacocha, Minas Conga, Fruta Del Norte, Lagunas, and Pierina is not necessarily indicative of similar mineralization at RT Gold. Source: www.portergeo.com.au

Two distinct mineralized systems occur within the RT Gold property: the Cerro Zone, a bulk tonnage gold-bearing porphyry, and 3-km to the NW, the Tablon Zone, a gold-bearing massive sulfide zone. The last field exploration was conducted a decade ago.

Cerro Zone

The Cerro Zone hosts several known mineralized zones (Peak, West, Breccia and Cathedral) with anomalous concentrations of gold in rock and soils:

- Structures assaying 0.1 to 62.9 g/t gold, hosted in mineralized wall rock returning gold values of 0.5 to 1.0 g/t gold;

- Soil geochemistry for gold in the Cerro Zone has outlined a 2.0-km by 1.5-km gold anomaly, open in all directions grading from 0.1 to 4.0 g/t gold;

- Soil geochemistry for gold is coincident with IP chargeability;

- The Cerro Zone has never been drill tested.

Tablon Zone

The Tablon Zone is located 3-km NW from Cerro and hosts numerous gold-bearing massive to semi-massive sulphide bodies over a 150-metre by 450-metre area, within a larger 1.0-km by 1.5-km area of anomalous gold soil and rock geochemistry. A total of 33 holes were diamond drilled in 2001 at Tablon with highlight intersections of:

- RT-03 returned 50.0 g/t gold over 0.7m from 62.2m;

- RT-06 returned 3.1 g/t gold over 21.4m from 9.1m;

- RT-11 returned 5.3 g/t gold over 17.1m from 12.0m;

- RT-13 returned 8.8 g/t gold over 25.4m from 13.4m;

- RT-21 returned 5.1 g/t gold over 19.5m from 1.5m;

- RT-22 returned 4.9 g/t gold over 14.1m from 40.1m;

- RT-25 returned 13.0 g/t gold over 36.1m from 33.0m;

- RT-26 returned 7.0 g/t gold over 6.0m from 0.0m;

- RT-29 returned 18.0 g/t gold over 16.4m from 34.9m, includes 118.1 g/t gold over 2.2m from 42.0m.

Intervals are core lengths not true widths, which are unknown at this time. Source: NI43:101 Geological Report Rio Tabaconas Gold Project for Golden Alliance Resources Corp. by George Sivertz, October 3, 2011.

The Max technical team is currently reviewing and digitizing proprietary data for subsequent interpretation for target generation. A program of field verification by the Max in-country team: mapping, surveying and sampling is scheduled to follow. Concurrent with the verification program, the Company will be initiating drill permitting.

ABOUT MAX RESOURCE CORP.

With its successful exploration and management team, Max Resource Corp. is advancing both its stratabound Kupferschiefer type CESAR copper-silver project in Colombia and its newly acquired RT Gold, gold porphyry and massive sulfide project in Peru. Both have potential for the discovery of large-scale mineral deposits attractive to major partners.

Tim Henneberry, P Geo (British Columbia), a member of the Max Resource Advisory Board, is the Qualified Person who has reviewed and approved the technical content of this news release on behalf of the Company.

For more information visit: https://www.maxresource.com/

For additional information contact:

Max Resource Corp.

Tim McNulty

E: [email protected]

T: (604) 290-8100

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release

Except for statements of historic fact, this news release contains certain “forward-looking information” within the meaning of applicable securities law. Forward-looking information is frequently characterized by words such as “plan”, “expect”, “project”, “intend”, “believe”, “anticipate”, “estimate” and other similar words, or statements that certain events or conditions “may” or “will” occur. Forward-looking statements are based on the opinions and estimates at the date the statements are made and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those anticipated in the forward-looking statements including, but not limited to delays or uncertainties with regulatory approvals, including that of the TSXV. There are uncertainties inherent in forward-looking information, including factors beyond the Company’s control. There are no assurances that the commercialization plans for Max Resources Corp. described in this news release will come into effect on the terms or time frame described herein. The Company undertakes no obligation to update forward-looking information if circumstances or management’s estimates or opinions should change except as required by law. The reader is cautioned not to place undue reliance on forward-looking statements. Additional information identifying risks and uncertainties that could affect financial results is contained in the Company’s filings with Canadian securities regulators, which filings are available at www.sedar.com

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/66963