Cross River Acquires McVicar Lake Gold Project in NW Ontario

- Company consolidates major land position in the Lang Lake Greenstone Belt

- Several high-grade gold occurrences known

- McVicar project now 3,925 hectares

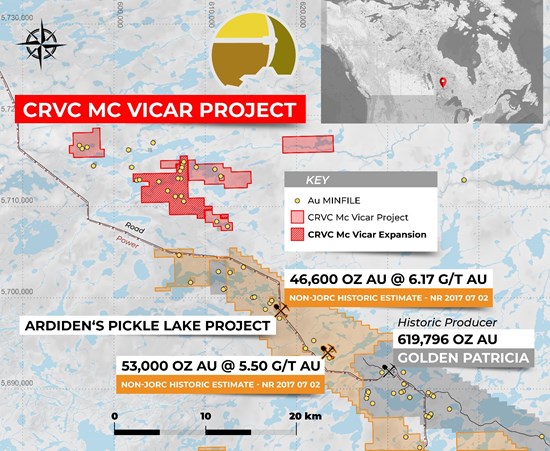

Vancouver, British Columbia–(Newsfile Corp. – November 12, 2020) – Cross River Ventures Corp. (CSE: CRVC) (FWB: C6R) (the “Company” or “Cross River“) is pleased to announce that it has acquired the McVicar Lake Gold Project from Argo Gold Inc. (CSE: ARQ) (the “Vendor“). The 2,304-ha gold property is located in the Patricia Mining Division, approximately 150 km east of Red Lake, and 80 km west of Pickle Lake, in NW Ontario, Canada.

The acquisition consolidates the Company’s dominant land position within the Archean Lang Lake Greenstone Belt (see news release dated November 6, 2020) to over 3,900 hectares. The Lang Lake belt is host to at least 10 early stage structurally controlled gold prospects hosted in a variety of rock types and settings (for a review of the known mineral occurrences on the Company’s claim blocks, see Assessment Report 52O11 SW 2003).

The McVicar Lake claims host the Chellow Vein outcrop, which is a narrow quartz vein that consists of smoky grey to white quartz mineralized with minor pyrite and visible gold. The vein is reported to be hosted within a massive unit of gabbro or mafic metavolcanic rock and is exposed for a strike length of approximately 125 meters and is less than 20cm wide. Limited drill testing below the known showings in the early 1990’s failed to yield significant gold assay values, however, the Cross River technical team believe the Chellow Vein is hosted in a much broader (1-2km wide) high-strain or deformation zone characterized by a series of parallel-trending shears that have not been systematically tested.

Historical results from work by BHP Minerals Canada in the early 1990’s at McVicar Lake returned a series of 34 channel samples that were cut normal to the vein at approximately two meter intervals along the length of the vein exposed in the trenches. The average value of the 34 samples was 28.8 grams-per-tonne (“g/t”) gold (“Au”). Three samples (#1078, #1090, #1096) returned assays of 578.1 g/t Au, 533.5 g/t Au, and 412.5 g/t Au, respectively*.

“This acquisition gives us essentially an entire underexplored greenstone belt in one of the best places in the world for significant gold discovery,” said CEO, Alex Klenman. “The geological setting is reminiscent of some other prolific gold districts in northwestern Ontario. The little bit of historical work by BHP is compelling, and we think by applying newer exploration techniques and strategies the exploration upside is clear,” continued Mr. Klenman.

“Cross River has now created a dominant district-scale gold play that covers the main structural elements of the entire Lang Lake Greenstone Belt,” said Dr. Rob Carpenter, Ph.D. “This unique opportunity will allow the Cross River technical team to gain valuable regional perspective while systematically evaluating targets,” continued Dr. Carpenter.

The Cross River technical team has completed a district-wide structural interpretation of all previous industry and government data sets and believes the key fault trends associated with known surface mineralization remain largely untested. The Company is planning to complete a high-resolution airborne magnetic survey as well as acquire LIDAR imagery in the Spring of 2021 in order to constrain these new structural models. Ground truthing of high priority targets is planned for the Summer of 2021.

Image 1: McVicar Project, McVicar East and the newly acquired McVicar Lake claims (Expansion), NW Ontario, Canada**

To view an enhanced version of Image 1, please visit:

https://orders.newsfilecorp.com/files/7276/68078_8438829f54bb6807_002full.jpg

Acquisition Terms

In consideration for the acquisition of the McVicar Lake Gold Project, the Company has issued 2,500,000 common shares (the “Consideration Shares“) and paid $200,000 to the Vendor. The Consideration Shares are subject to an escrow arrangement from which one-quarter of the Consideration Shares will be released four-months-and-one-day following closing, and a further one-quarter every ninety days thereafter. The Company has also granted to the Vendor a two-percent royalty on returns from the commercial production of minerals from the Project. One-half of the royalty may be re-purchased by the Company at any time for a cash payment of $1,000,000.

The Company is at arms-length from the Vendor. The acquisition does not constitute a “fundamental change” for the Company under the policies of the Canadian Securities Exchange, nor has it resulted in a change of control of the Company within the meaning of applicable securities laws. No finders’ fees or commissions were paid in connection with completion of the acquisition.

The technical content disclosed in this press release was reviewed and approved by Dr. Rob Carpenter, P.Geo., Ph.D., a Qualified Person as defined under National Instrument 43-101. Dr. Carpenter is independent of the Company.

* Chemex Labs analyzed the samples using Fire Assay with an Atomic Absorption finish up to 10,000 ppb Au. Samples with greater than 10,000 ppb Au were re-assayed using Fire Assay with a gravimetric finish and results stated in ounces/ton Au. Assay certificates are included in the report, but no Blanks or Standards used are included.

* Assessment File Report (AFRI 52O11SW9400) from the Ontario Ministry of Northern Development and Mines. Sampling was completed by BHP Minerals Canada Ltd. under the supervision C. J. Waldie in 1993.

* Samples are selective by nature and may not represent the true grade or style of mineralization across the property.

** Golden Patricia Mine – Harron, G.A.2009, Technical Report on Three Gold Exploration Properties Pickle Lake Area, Ontario, Canada. G.A. Harron, P.Eng., G.A. Harron & Associates Inc. Smyk, M., Hollings, P. and Pettigrew, N., 2015. Geology and Mineral Deposits of The Pickle Lake Greenstone Belt. Institute on Lake Superior Geology, May 20-24, 2015 Field Trip Guidebook and Puumala, M.A. 2009. Mineral Occurrences of the Central and Eastern Uchi Domain. Ontario Geological Survey, Open File Report 6228.

About the Company

Cross River is a gold exploration company that is focused on the development of top tier exploration properties in premier mining districts. The Company controls a multiple project portfolio in NW Ontario, Canada, with highly prospective ground in and among prolific, gold bearing greenstone belts. The Company also owns an option to acquire a 100% undivided interest in the Tahsis Property, an early-stage gold exploration property located on Vancouver Island, in the Nanaimo Mining Division, British Columbia. Cross River’s common shares trade under the symbol “CRVC” on the CSE.

On behalf of the Board of Directors of

CROSS RIVER VENTURES CORP.

Alex Klenman

CEO

604-227-6610

[email protected]

www.crossriverventures.com

Neither the Canadian Securities Exchange nor its Regulation Services Provider (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. Actual results could differ materially because of factors discussed in the management discussion and analysis section of our interim and most recent annual financial statement or other reports and filings with the Canadian Securities Exchange and applicable Canadian securities regulations. We do not assume any obligation to update any forward-looking statements, except as required by applicable laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/68078