Trilogy Metals’ CEO Tony Giardini on 2021 Plans and Why He Just Purchased 375,000 Shares

Trilogy Metals’ (Ticker:TMQ) CEO Tony Giardini provides an update on the company’s progress and plans for 2021. He provides commentary on copper’s recent rally and addresses Trilogy’s recent share price performance. Tony shares an overview of the Arctic project’s feasibility study and discusses the Ambler mining district’s potential. He also offers an analysis of why Trilogy provides value investors an attractive investment proposition. And on that theme Tony stated, “I personally purchased 375,000 shares in the last two months, and I’ll likely be adding to that position in the near term as well, and we still feel that there’s lots of value to be had with respect to the story, and the assets that we have in terms of our interest in the Ambler Mining District.”

0:00 Introduction

0:58 Copper price commentary

3:35 Trilogy’s share price performance relative to copper price

7:16 Arctic Feasibility Study Overview

9:35 Ambler Mining District’s potential

12:26 Trilogy’s projects have no political baggage

14:34 Plans, budget and goals in 2021 for Ambler Metals JV

17:13 Trilogy’s EV relative to the 50% interest in Ambler Metals JV

19:38 Ambler access road approval and next steps

24:28 No near-term financing risk

TRANSCRIPT:

Bill Powers: In today’s episode you are going to be getting an update from Tony Giardini. He is at the helm of Trilogy Metals, one of our sponsors. The website is TrilogyMetals.com to learn more information and the ticker symbol on the big boards in Toronto and in New York is TMQ. Tony, welcome back onto the show. It’s been several months since we had an update, and perhaps we could start off with you providing your commentary on copper. Copper has one of the best six month charts when you look across the commodity sector. What do you think is going on here with copper?

Tony Giardini: Bill, first of all, thanks for having us on the show, and it has been a while. A lots happened at Trilogy so it’d be a good opportunity to update you and the listeners on what’s going on. As you say, copper’s had a great run. I looked at the price this morning and it was over $3.40/lb on the future selling and back down to just below $3.40/lb now. But overall, for the year, it’s up around 20%, 22%, so it’s really performing well.

In fact, after silver, copper is the best performing metal out there. Gold’s come off a bit, but we’re continuing to see very strong performance in copper, and I think there’s a lot of things at play. I think obviously COVID’s had an impact in terms of the supply side, particularly in Peru, and in Chile, in terms of a supply of a metal that’s had an impact. But I think as people are starting to think to the future, and thinking about as we come out of COVID, and the vaccines start to get rolled out, what’s going to happen from a growth point of view, and clearly that’s weighing on people’s mind, and people are looking at the structural deficits within the copper market thinking about what copper demand trends are going to look like, and supply, and those things are all having a big impact in terms of the current swap price.

What’s interesting is if you look at 2021, I just looked at some consensus estimates for 2021, and people are still thinking that copper’s going to stay around $3. In fact, the highest estimate that I saw in the list that I look at, it was Morgan Stanley, which had it at $3.36, which is below the current swap price right now. I don’t think that the market has yet adjusted its view in terms of what people expect for copper heading into 2021, and my view is the future’s very bright for the metal, simply because of those key points that I talked about, which is really the demand side, and this is before you start to factor in changes that are going to be happening in terms of electrification of a grid as we move more away from coal to other sources of a power generation, and you start to look at electric vehicles and how prevalent they become.

You’re in Michigan, and you know what’s happening in the auto space, and I see that Ford’s rolling out their trucks in electric form, and I think a lot more effort’s going to be put into electric vehicles, not just in the US, but everywhere, and for anyone that does a bit of research they’ll see that the amount of copper used in electric vehicles is significantly more than what’s used in gasoline powered, or ICE vehicles. I think the future’s very bright for copper, and we’re very excited about the prospects going forward.

Bill: Tony, as you know in the junior mining sector, especially early-stage exploration companies really need an upward moving commodity price to be able to raise funds, but one of the things you mentioned to me in a previous interview is that with Trilogy you’re not affected in a negative way the near term price movements and the price of copper, because you have funding now for many years, and you’re a medium to long-term play on the price of copper. But with that being said, investors, like myself even, sometimes get inpatient and then we say, “Hey, Copper’s rallying. Maybe Trilogy isn’t moving as much as I would like it to.” Can you provide some color here on this for investors that are thinking in these terms?

Tony: Yeah. It’s a very pertinent question. In fact, I had a call with one of our large investors last week, and that was just a conversation where they were trying to understand what’s happened with the copper moving and the share prices have sort of been languishing somewhat. I think there’s a couple of things at play. I think with the initial copper move investors are looking at some of the larger players out there, so we’re seeing the 52-week highs in companies like Freeport, First Quantum, Lundin, and that’s natural because they have existing copper exposure and they’re focused on those names.

They haven’t really trickled down into the developer names yet, and our expectation is that as that happens and people start to look at Trilogy they’ll recognize a disconnect in terms of where the copper price is, and what our portfolio of assets looks like at higher copper prices. I think that’s one consideration in terms of why we’ve languished somewhat. Secondly, I think the other point is we didn’t have a drill campaign this year, and that’s a big determinant in terms of how people look at the developer space, is they’re always looking for news relative to drill results, how the resource is doing, having something to talk about with respect to expanding the resource.

We chose not to have a drill campaign in 2020 because of COVID. We were very concerned about bringing the virus into the native communities where we operate, and it was going to be a truncated season, so we felt that it was best to focus on 2021, so as a result we didn’t have a field campaign, so we haven’t had any results to talk about, even though when we look at our performance during the year in terms of key milestones we’ve had a number of them, as you all know, in terms of a formation of the JV, the record of decision on the road, and the feasibility study that we released earlier this year.

I think those are two of the determining factors. I see it as personally a buying opportunity, and I could tell you that recently there was a large block of shares that traded, and I participated in clearing that block. I acquired 200,000 shares personally, my own cash, and since basically the last two months I’ve added a total of 375,000 shares personally to my own account. I’m very focused on the story, and I’m personally invested, and I think this is a great opportunity to purchase these shares at a price that makes a lot of sense, and particularly the discount to the real value of what we believe Trilogy should be.

Bill: Since we last spoke, as you said, you put out the Arctic Feasibility Study. Could you give us a thumbnail overview of some of the key highlights with that study?

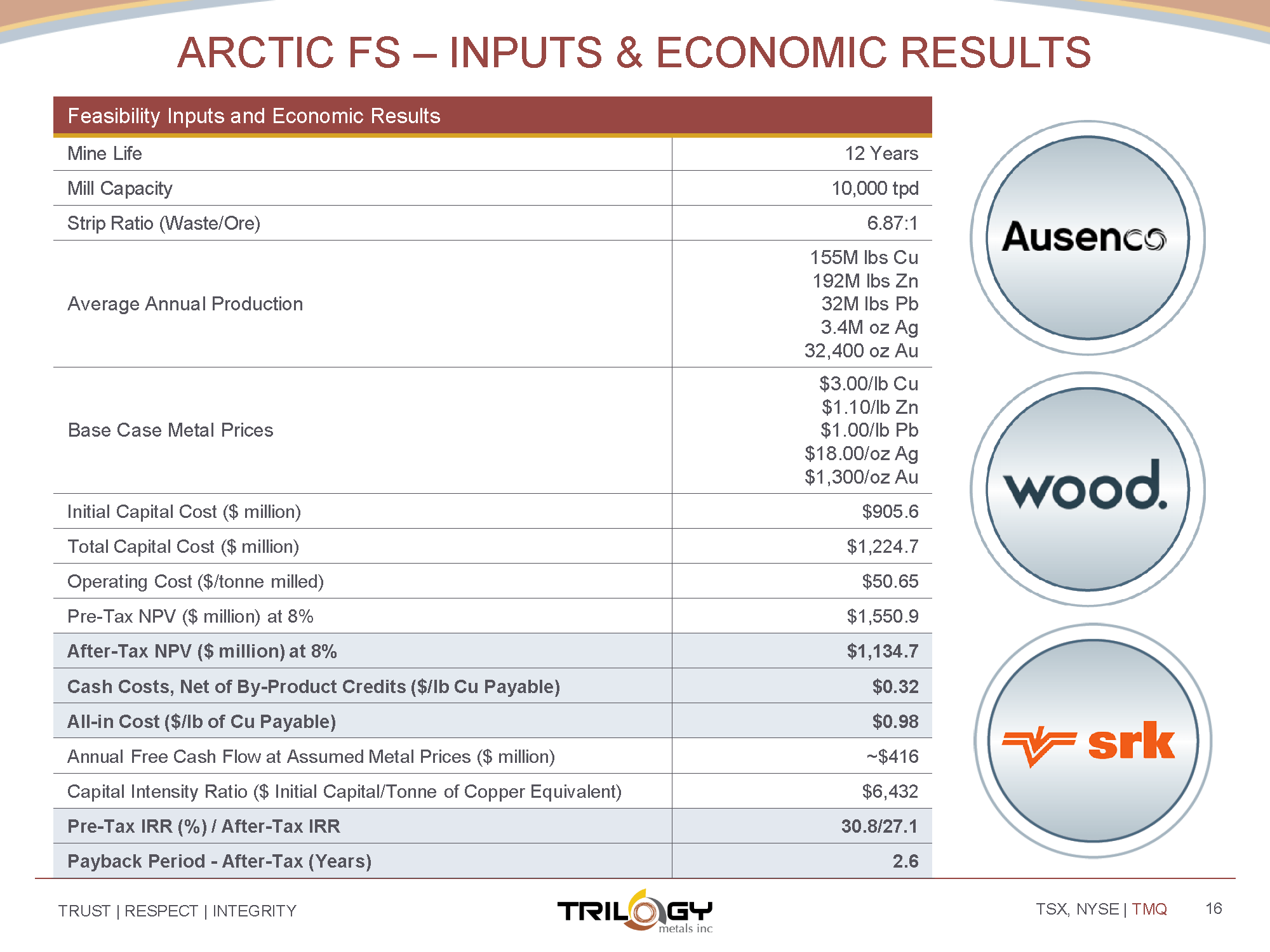

Tony: Yeah. I think we were very pleased with the study. It was a really good result. It came on the back of a PFS that we did in 2018. What we did was we held the base metal prices constant from 2018 and we kept that the same, and what we ended up seeing was an NPV of 1.1 billion dollars on an after tax basis using an 8% discount rate. We saw cash costs after byproduct credits of 32 cents, and we saw an IR of roughly 27%. The other number that I like to look at is called the capital intensity, and that’s the amount of capital that you need to product a copper equivalent ton, and for Arctic it sits at roughly $6,400, which is quite low.

I think we’ve had excellent results in terms of the feasibility study, and what’s happened now is we’ve taken those study results and we’ve passed them on the Ambler Metals, which is a JV company that is overseeing the development of Arctic and really the development of the district. They’re going to be focused on the next phase of development there.

The other thing that I would highlight, we talked about the higher copper prices, and I just looked at our presentation on our website, which you mentioned earlier, trilogymetals.com, and we had a feasibility study presentation that we did when we released the study, and in there we have a chart that just shows the sensitivity of the MPB and the IR to changes in the copper price. At $3.50, which we’re not far from right now, the MPB increases to 1.5 billion dollars, without adjusting anything for gold price or silver increases, so that’s a 36% increase from what we reported in August with respect to using a $3 gold price, and the IR is over 30%.

I think we look at it, and we sit there and say we got a great result at the swap prices that we use, which are below current swap prices, and we think it sets us up very well in terms of how we’re looking at the project going forward.

Bill: And I think a key thing to point out to investors, you mentioned this study, and then the net present value. You also have a Bornite project which is at the study stage, but this district and what you see going on here geologically you’re looking at multiple deposits aren’t you?

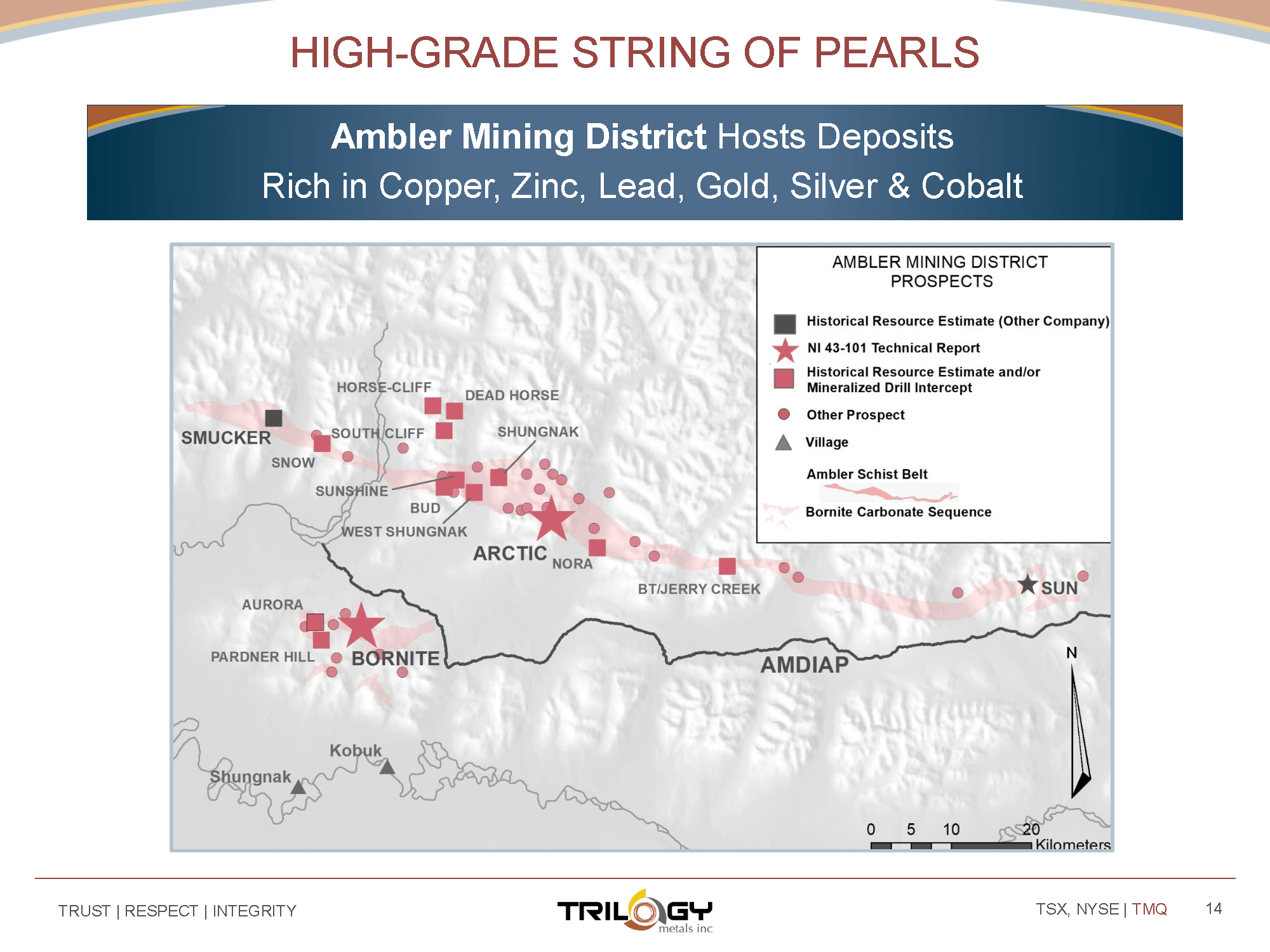

Tony: What’s really exciting about where we’re at, and this is one of the things that we get into the rabbit hole of talking about Arctic because it’s the most advanced project, but the real key to the Trilogy story and the Ambler Mining District is really the opportunity to expand the resources in a number of other deposits.

In and around Arctic there is three or four other known deposits that we’ve identified that in total are roughly 35 million tons of resources, not at the same grade, high grade that we have at Arctic, but we’ve already identified roughly 35 million historical tons there. What we’re going to be focused on in terms of a campaign later this year is really doing additional drilling at some of those deposits, so that’s Sunshine, Horse Creek, Center of the Universe, Shungnak, BT. Those are the names that we’ve given to these anomalies that we’ve identified, and we see significant opportunities to extend the mine life.

Right now, Arctic has a 12-year mine life in terms of the feasibility study. If we look at those 34 and a half million tons and we’re able to convert those into resources that can be processed through the Arctic mill we’re talking to at least another 10 years of mine life at Arctic, and obviously that will go a long way to further improving the economics of the development.

You mentioned Bornite, and we haven’t spent a lot of time talking about Bornite. I had one of the geologist in our office come in and talk to me the other day, and he was pointing to a press release that was issued in 2011 when Trilogy was part of Nova Gold at the time, before we had been spun out, and in 2011 we drilled 35 meters at 12% copper at Bornite. We also had 11.8 meters at 7.5% copper. We had a total drill length of 178 meters at 4% copper at Bornite.

People forget about what Bornite is, and in total bornite is 182 million tons of resource at 1.6% copper, which is a very high grade for a copper deposit, so part of our focus going forward will really be to demonstrate the tremendous value that Bornite has as far as not just existing resource, but the potential to expand that significantly. When you look at the share price right now, and I know we’re going to talk about enterprise value, if you look at the share price there’s really no value being attributed to assets like bornite and some of these satellite deposits adjacent to Arctic.

Bill: And I think we should point too, because we’re talking about Alaska, obviously, in the news this last week, was Northern Dynasty. Their share price was cut in half because of a negative ruling on their Pebble project, but there’s no political baggage associated with your project whatsoever is there?

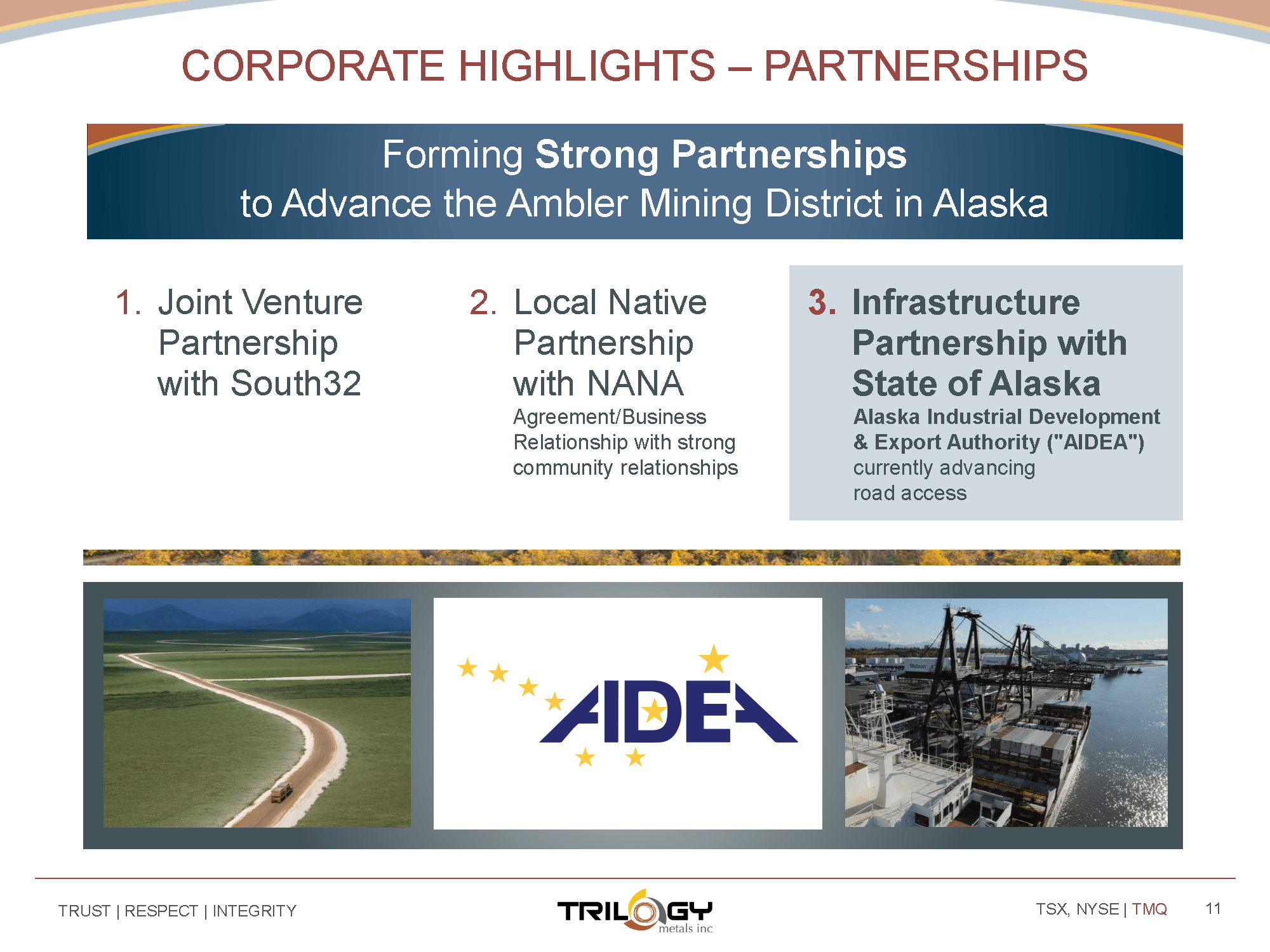

Tony: None whatsoever. We don’t compare ourselves to other companies operating in Alaska. Our focus is really on the Ambler Mining District, and we think there’s a couple things that differentiate us. One, is we have Native Corporation as a partner, that’s NANA, so we’re very closely tied to NANA, and the Northwest Arctic Bureau which is the assembly that oversees the villages in the district.

We’re very in tune with what’s happening in those communities, and we engage with them on a regular basis, and we believe we have the support of those communities, as well as NANA in terms of advancing the project as well. I would also point your listeners to the Department of Transportation press release that was issues after the record of decision came out on the road, and in that press release you’ll see that all of the politicians within the state of Alaska whether at the Senate level, at Congress, or the governor all were very positive about the potential of opening up the Ambler Mining District through the development of the road.

And we believe that regardless of whether there’s a new administration in Washington there’s been a key indication that there’s a need to have domestic sources of key metals like copper, like zinc, like cobalt, and those are right down the center of a fairway for the Ambler Mining District because those are the metals that are there.

We feel we’re in a really strong position to advance our projects. We feel we have the support of NANA and the native communities where we operate. We feel that the state is there, and we think we’re in a very strong position vis-à-vis where we’re gong. And as you pointed out, we’re well-funded. So right now, we’re in a position where at the Ambler Metals level we likely will have sufficient funds to fund our programs and development out to 2024, 2025 possibly.

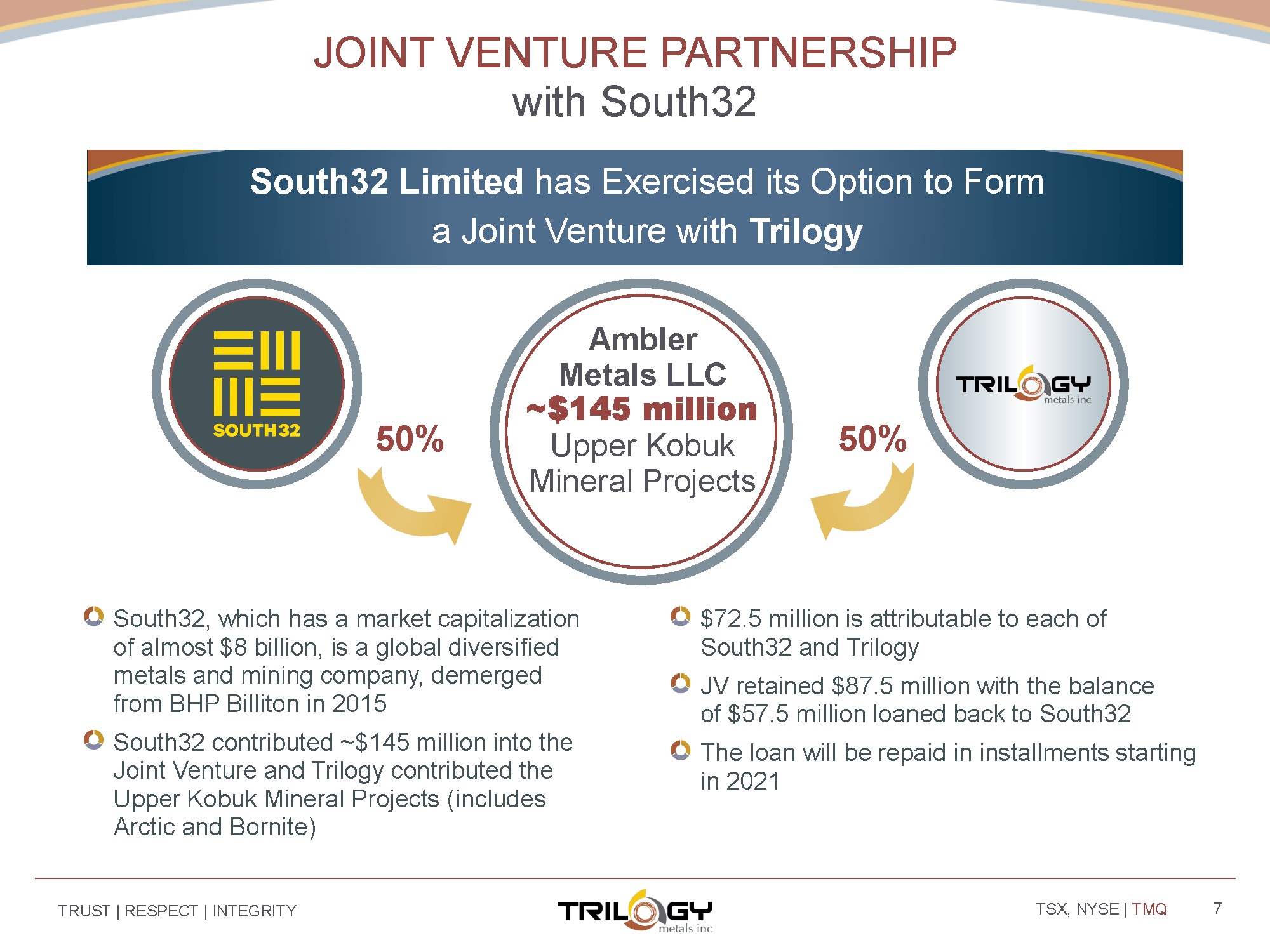

Bill: And you’re well-funded because of your partnership with South32. Could you talk to us with this partnership with South32 for the Ambler JV? What’s your plans, budget, and goals for the upcoming year?

Tony: It’s progressing, and it’s a timely question we just released through a press release that indicated our budget for next year is 27 million dollars. That includes 7,600 meters of infield drilling at Arctic, 7,000 meters of exploration drilling at other targets. We’re going to be advancing engineering activities further with respect to the study work that Trilogy had done. As I’ve indicated, we’ve taken that study, we’ve provided it to Ambler Metals. Ambler will start to look at that, and they’re going to be focused on water management, tailing management issues, and really allowing us to advance the engineering further so we’re in a position to start the permitting process sometime next year.

And the permitting process is really the key factor in terms of moving this project forward to an investment decision, so the sooner we get the permitting process underway the more quickly we can get to a point where we can make an investment decision on the project. All of that is going to be hand and glove as far as this budget goes for next year, and the benefit of the relationship with South 32 is that South32 effectively funded 145 million dollars into Ambler Metals. We’re well-funded for the next four years at least, possibly five.

It puts us in a strong position to conduct exploration in the district where in the past we haven’t had the financial resources to be able to do that, and we can also advance the development of Arctic and start to think about some of the other opportunities in the district as we go forward. It’s really an exciting time for us, and we think that we’re uniquely positioned to be able to advance these projects in a very measured fashion that demonstrates how valuable these assets are. I think one of the things that people lose sight of is people talk about higher grade deposits being 1.7% copper, and when we look at Arctic on a standalone basis it’s over 4% copper coolant, so we’ve got some very great deposits up there. We’ve got a great partner in South32, and we feel like we’re going to hit the ground running for next year.

The last point that I’d like to make Bill is just on COVID. We’re obviously very focused on COVID protocols for next year to ensure that we operate safely at the camp and within the community, so we’re putting those in place now so that when we start the field program and the season for next year that we’ll have all of the checks and balances in place, whether the vaccines have been distributed or not at that point.

Bill: Tony, for the value investors that are listening to us, what is your enterprise value relative to your 50% interest in the Ambler joint venture with South32?

Tony: That’s a great question. Market cap’s roughly right now 250 million dollars based on current share prices, US$1.75. If you strip out the cash, we’ve only used a small portion at the JV level, so when we take our JV stake and the cash that sits at the Trilogy level that’s roughly 13 million, so in aggregate that’s 85 million dollars, so it implies an enterprise value of 165 million dollars for our 50% interest in Ambler metals, or the Ambler Mining District.

How do you benchmark that against the underlying values that we’ve talked about? If you look at Arctic on a standalone basis, and we just adjust for copper price, we don’t adjust for gold or silver, we’re talking about a 1.5 billion dollar MPB, which means that on a 50% basis we would have 750 million dollars of that. If you want to look at it a little differently, and say, “Well, how does it compare to what South32’s invested?” South32 has invested over 200 million dollars so far to earn their 50% interest, 200 million comprises 145 million in cash, they invested 30 million dollars in exploration expenditures over a three-year time period, and they own 11.5% of the stock which they bought in the open market.

In total, South32’s paid 200 million dollars in excess, so if you compare that to the 165 there’s still a 35 million dollar discount to what South32 has already paid, and we know that South32 has had the benefit of doing significant due diligence in terms of the assets. When you think about those things, and it doesn’t even factor in a dollar, not even a dollar for the upside associated with the bornite deposit, which is significant, and those other satellite deposits that I mentioned earlier, which we expect will increase the mine life going forward.

We think there’s a strong value proposition. As I said earlier, I personally purchased 375,000 shares in the last two months, and I’ll likely be adding to that position in the near term as well, and we still feel that there’s lots of value to be had with respect to the story, and the asset that we have in terms of our interest in the Ambler Mining District.

Bill: And a key milestone we should note is the approval of your road, the 211 mile Ambler Access Road. When will you be able to start building that?

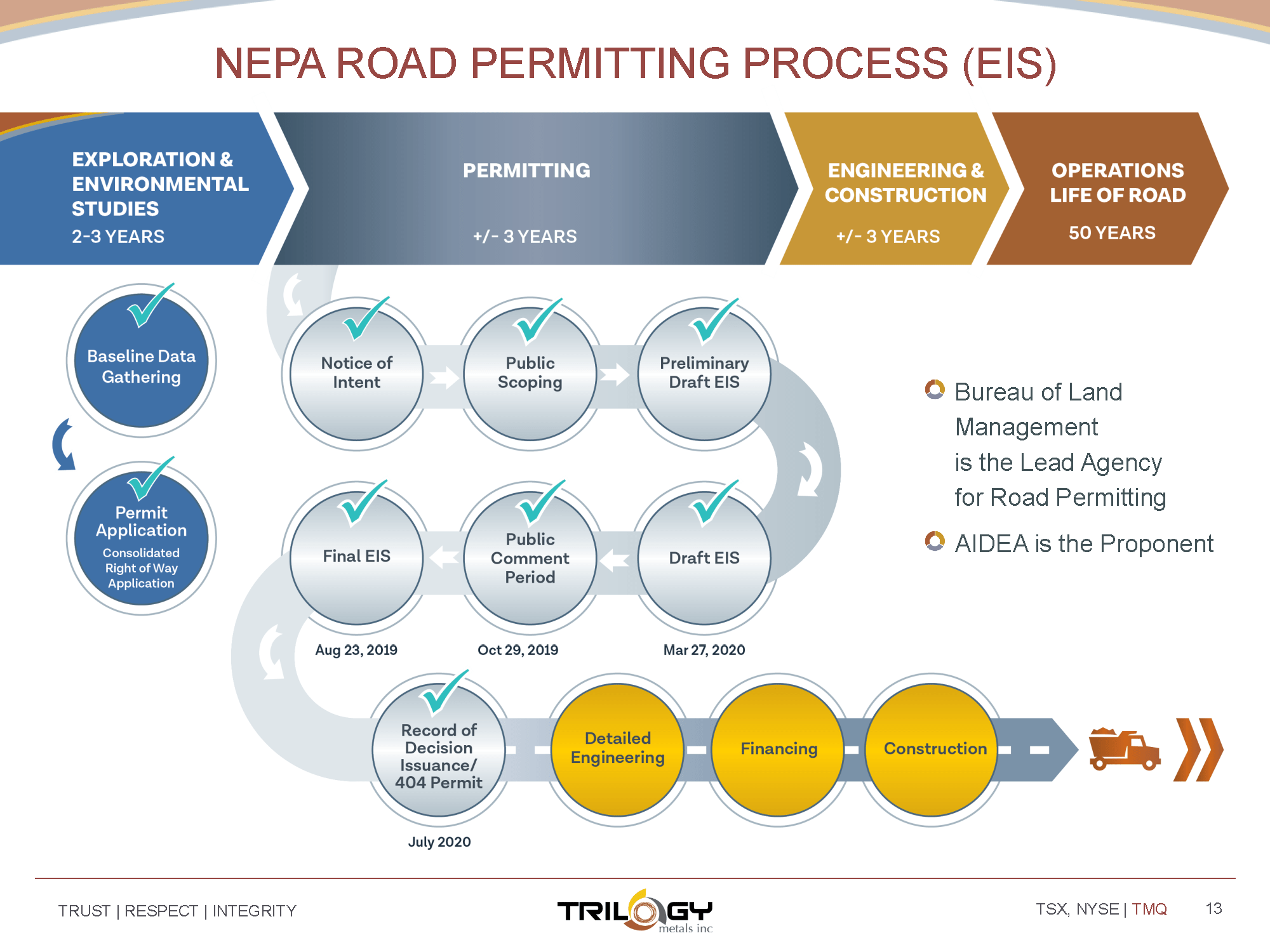

Tony: That road, the record of decision was received by AIDEA from the BLM, so the way the road actually works, and it’s very much modeled on how Red Dog West developed, and Red Dog is the largest sink mine in the world, it’s also in the northwest part of the state. Coincidentally, NANA is a partner in the Red Dog mine, it’s on NANA land, and we’re very much modeling ourselves on Red Dog.

Red Dog had an arrangement with AIDEA where AIDEA built the road, and financed the road, and they entered into a tolling arrangement for the use of the road and the port. Our model is exactly the same, except we’re just focused on the road and not a port, and with the record of decision. BLM issued that to AIDEA. That was the final permit in the process. The next step now is to focus on detailed engineering.

We have an existing MOU with AIDEA on funding a portion of the detailed engineering. It’s not a significant portion. It’s only a million dollars. They anticipate the detailed engineering to cost about 70 million dollars of which we’ve indicated we would be prepared to fund half of that, 35 million dollars. We’re in discussions with AIDEA to advance that memorandum of understanding and move that forward, so the next step would be to get that nailed down. From there, we’re also looking at a tolling arrangement which would set out what the financial obligations would be for the Arctic deposit as a starting point, because the idea behind the road is that it’s there to support the development of the district, so it won’t just be the Arctic Mine, but in time they’ll be other mines that will be developed there.

It could be bornite. It could some which is privately owned. It could be Smucker which is owned by Teck. It could be other deposits that are found by other parties that are developed. When we’re looking at our tolling arrangement it’s really with respect to the Arctic Mine. In the FS, in the feasibility study that Trilogy produced, we assumed that we would pay 20 million dollars in tolls a year to AIDEA for use of the road, so over a 12-year mine life, let’s assume 240 million dollars, if we’re able to extend that mine life through those other deposits once they’re permitted and processed through Arctic we would be looking at let’s say a 20 plus year mine life in which case the tolls that would be paid to AIDEA would be roughly 400 million dollars.

Those are the next steps in terms of a road development are, get this MOU completed, so that we can start to move forward on the detailed engineering, start to look at the tolling arrangement, and seeing how the road syncs up with the permitting process, and when construction of the road would actually need to being, because it really has to be aligned with the permitting process to allow us to move forward.

It’s important for people to understand that we need the road, but we need the road when the mine has been constructed. We don’t need it sooner than that, because at the end of the day we need to get supplies and materials into the area, but that could be done via ice road or via barging those supplies up there, so the road doesn’t need to be there tomorrow. It needs to align with when the mine’s going to be commissioned and operating, because that’s when we need to transport concentration.

It’s an ongoing process. We’re having a strong, good relationship with AIDEA. AIDEA’s obviously a state agency, and they’re thinking about the impacts to the state in terms of the future revenues and the ability to see the district opened up, and we believe that we’ll get to a reasonable agreement with them as we work through the discussions.

Bill: And one note on the 35 million that you would potentially contribute, would that be like a prepaid toll essentially?

Tony: Yes. It would be a prepaid toll, or it would be set off against the tolling arrangements, and it really demonstrates in our mind our commitment to advancing the project. We believe, by the way, that we’re demonstrating that every single day when we spend 27 million dollars next year, and we’ve already spent 150 million dollars, or has been spent in the district over time on exploration, so we think we’ve already demonstrated wholeheartedly how serious we are about moving forward.

The other thing to point out Bill is that 35 million dollars would come from Ambler Metals LLC., so it wouldn’t be funded by Trilogy per se, but it would come out of that 145 million dollars, and we factor that in when we’re looking at our timeline, and how long that cash is going to last us so that it still would factor in that we would be roughly 2024, ’25, in terms of the cash that we would have at the Arctic level.

Bill: So, there’s no dilution concern for investors here with Trilogy metals, at least for a few years.

Tony: No. We’re in a great position. We’ve got roughly 13 million dollars in cash on the balance sheet at a corporate level, and we’ve transferred a number of our employees that were in Alaska now into the Ambler Metals LLC. Our expenses have been a bit higher this year because we formed the LLC., and so we had to have professional fees associated with the formation of that. We also completed the feasibility study, so we paid for those expenditures.

We’ll start to see the run rate on our cost come down as a result, on our G&A come down as a result, so we feel like we’re in a strong position. As I said, when I look at the story we’ve got the benefit of having high-grade deposits in a great jurisdiction in Alaska. The picture behind me, by the way, is the Dalton Highway, which runs though the state. The Ambiat would tie into this road, and this is what takes you to Anchorage and the port that’s there.

We’re in the great state of Alaska. We’re well-supported in terms of the support that we have in the state. There’s a great workforce there. There’s a rich mining history, extractive industry, that’s there. I think we’re very well-positioned. We’re well-funded. We’ve got a great partner in South32. We’ve got a great relationship with NANA. We’re developing a strong relationship with AIDEA. We think things are looking very positive for us, and we’re convinced that this is a great opportunity for shareholders to come into this story, particularly given the fact that we’ve underperformed a bit on the copper pricing copper looks at to move substantially there.

Bill: Trilogy’s website, as I mentioned in the introduction, is trilogymetals.com, and the ticker symbol again is TMQ, in Toronto, and New York on the big boards. Tony, I really appreciate the update. Thanks for coming on today’s show.

Tony: Bill, I appreciate the time, and I want to wish everyone happy holidays. Happy Thanksgiving in the US, and I look forward to providing future updates on our activities in Alaska and in the Ambler Mining District. Thanks for your time.