Pursuing High-Grade Scandinavian Silver with Norden Crown Metals’ CEO Pat Varas

Norden Crown Metals Corp. (TSXV:NOCR – OTC:BORMF – FRA:03E) is a Scandinavian explorer pursuing high-grade silver and polymetallic discoveries in prolific historic mining districts spanning Sweden and Norway. Norden Crown aims to discover new economic mineral deposits in known mining districts that have seen little or no modern exploration techniques. The company is led by an experienced management team and technical team, with successful track records in mineral discovery, mining development and financing. In this interview, Executive Chairman Patricio Varas explains Norden Crown’s investment value proposition and how the company plans to advance in 2021.

0:00 Introduction

1:43 Patricio Varas’ pedigree and past successes

4:50 History of Norden Crown and valuation relative to previous financings

9:33 EMX Royalty is a large shareholder

10:54 Sweden and Norway as mining jurisdictions

13:59 Burfjord JV with Boliden

18:54 Gumsberg project: pursuing high-grade silver

25:56 Current drill program results

29:01 Drill results and future financings

TRANSCRIPT:

Bill: I’m Bill Powers, and this is Mining Stock Education. Thanks for tuning in. In today’s show, you will be getting a corporate introduction to a Scandinavian high-grade silver explorer that I invested in back in August through a private placement. This financing was recommended to me by a resource fund manager. And I got in contact with Pat Varas, my guest today, who is the Executive Chairman and CEO of Norden Crown Metals. And I really enjoyed getting to know Pat, as I’ve communicated with him over the last several months. Pat has a record of success and the value proposition in terms of risk-reward for an early stage silver explorer, I found very attractive. That’s why I put my dollars into this company. They’re also a new sponsor, so we’ll be following up with them as drill results come in. With that introduction, Pat, welcome onto the show.

Pat: Thank you very much, Bill. I appreciate it.

Bill: And I’d like for you to share a little bit about your background and past success with my audience before we talk about Norden Crown specifically, please.

Pat: My name is Pat Varas, of course, and I’m a geologist. I’m a geo-scientist. I’ve been doing my craft or running mining companies and doing exploration for about 34 years. I’ve been very lucky in that I have been involved in some world-class discoveries. I have worked for junior mining companies. I’ve worked for some of the biggest mining companies in the world, and I have done everything from exploration to being a mine geologists.

I’ve worked in feasibility studies and development, mine development companies. So, I’ve really seen the whole gambit of projects from inception, from just thinking about ideas and generating exploration projects all the way through to feasibilities and to the point where we’re building mines. And of course, I have also worked in a couple of operating mines. I’ve worked in all kinds of commodities from gold, silver, lead, zinc, copper, potash and diamonds.

I was a project manager in the early 90s of a project that was run by Kennecott, a division of Rio Tinto. And we discovered a very significant, probably the richest diamond mine in North America in the Yukon territory, it’s called Diavik. So, I ran those programs. I also was very fortunate to work with Far West Mining, and we did a global alliance with BHP. And we explored basically their properties, and we found a deposit in Chile called Santo Domingo Sur, which subsequently was bought by Capstone, a mid-tier producer.

It’s a huge copper deposit, about a half a billion tons. And that was sold. The company was sold for what would be about $1.1 billion today. So, that was a very nice transaction for our shareholders. And of course, I’ve also been involved in exploring for things like potash. And we found a big deposit in Saskatchewan in the last company I was involved with. But I’ve been very fortunate.

I’ve had the chance to work in other big mines that are in production today. I explored the Pretivm deposit in my early days. I personally probably drilled about 250, 300 holes in that site. I worked at Galore Creek, and I’ve done exploration literally around the world in about 54 different countries. So, I’ve seen a lot of mineralization and a lot of projects.

Bill: And now you’re at the helm of Norden Crown. Bring my audience up to speed. What’s the history of Norden Crown and what’s the opportunity in terms of the share price today, relative to a lot of your previous financings?

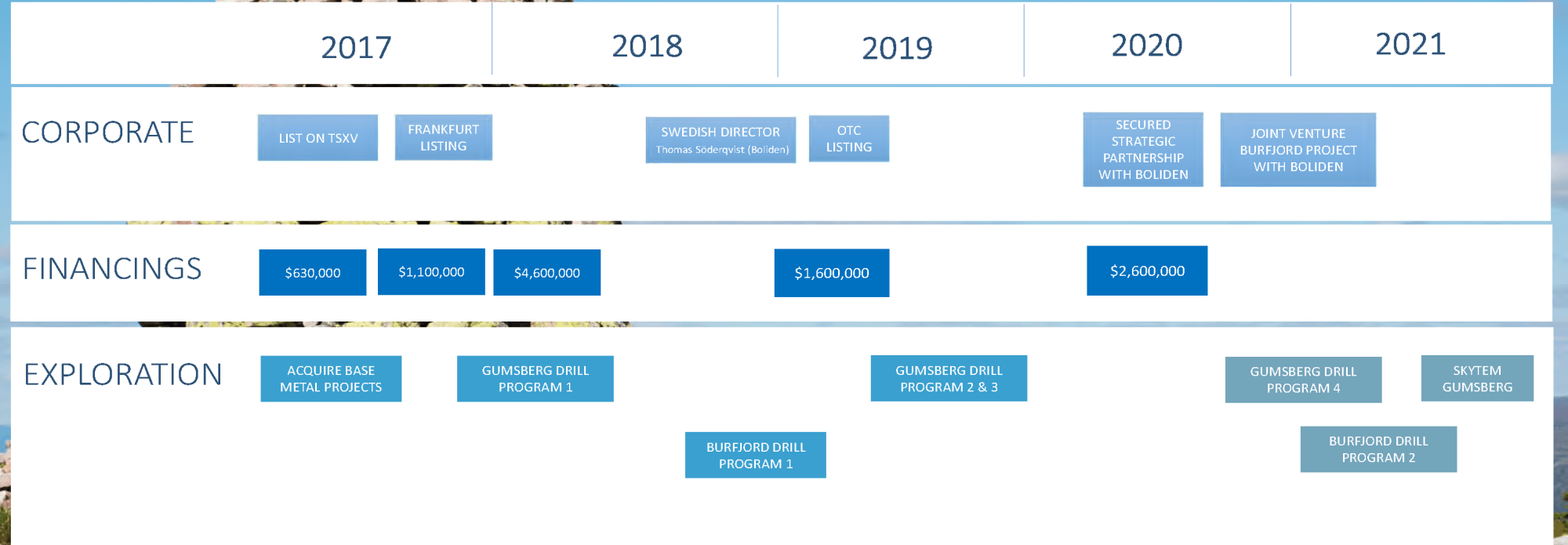

Pat: So, Norden Crown was a company that was started back in 2017. We went public in November of 2017. And I’ve got to say that maybe our timing for going public was maybe not the greatest at that time. Of course, we’ve been on a fairly significant bull run in the Dow Jones, but there was not a lot of interest in junior mining explorers. In some cases, it was because commodity prices were not that attractive.

Silver, even gold. And until basically recently about … I’m going to say until about this past summer, metal prices were very depressed. So, it was very tough to get any attention. And even though we managed to do several financings, our IPO was done at 30 cents. We raised about $4 million or $4.6 million. And then subsequently, we did a couple of other private placements.

But the stock has never … Because of that environment, even though we went out, we did some drill programs, in 2017 we had a fantastic hole at Östra Silvberg, one of our Swedish projects, where we hit what would be the equivalent of over a thousand grams per ton silver. And the market completely ignored it. But it wasn’t … It was because there was no interest in junior mining explorers at that time. We were basically invisible.

So, our stock price basically came down and we ended up doing a subsequent financing. In 2018, we raised a couple million dollars and that was done at 20 cents. And then 2019, we did a smaller financing yet. And that was done at nine and a half cents and for another $1.6 million. But all along, we did drill programs, again, at Östra Silvberg in the Gumsberg project in Sweden.

Then we did a drill program at Burfjord where we hit some interesting copper, and actually led to something that is very important for the company. We ended up doing a deal with a company called Boliden. And I’ll speak more to that in a minute. But I guess what I’m trying to say is because the markets were in such a state and commodities were such that there was no interest in the sector, our stock basically came down.

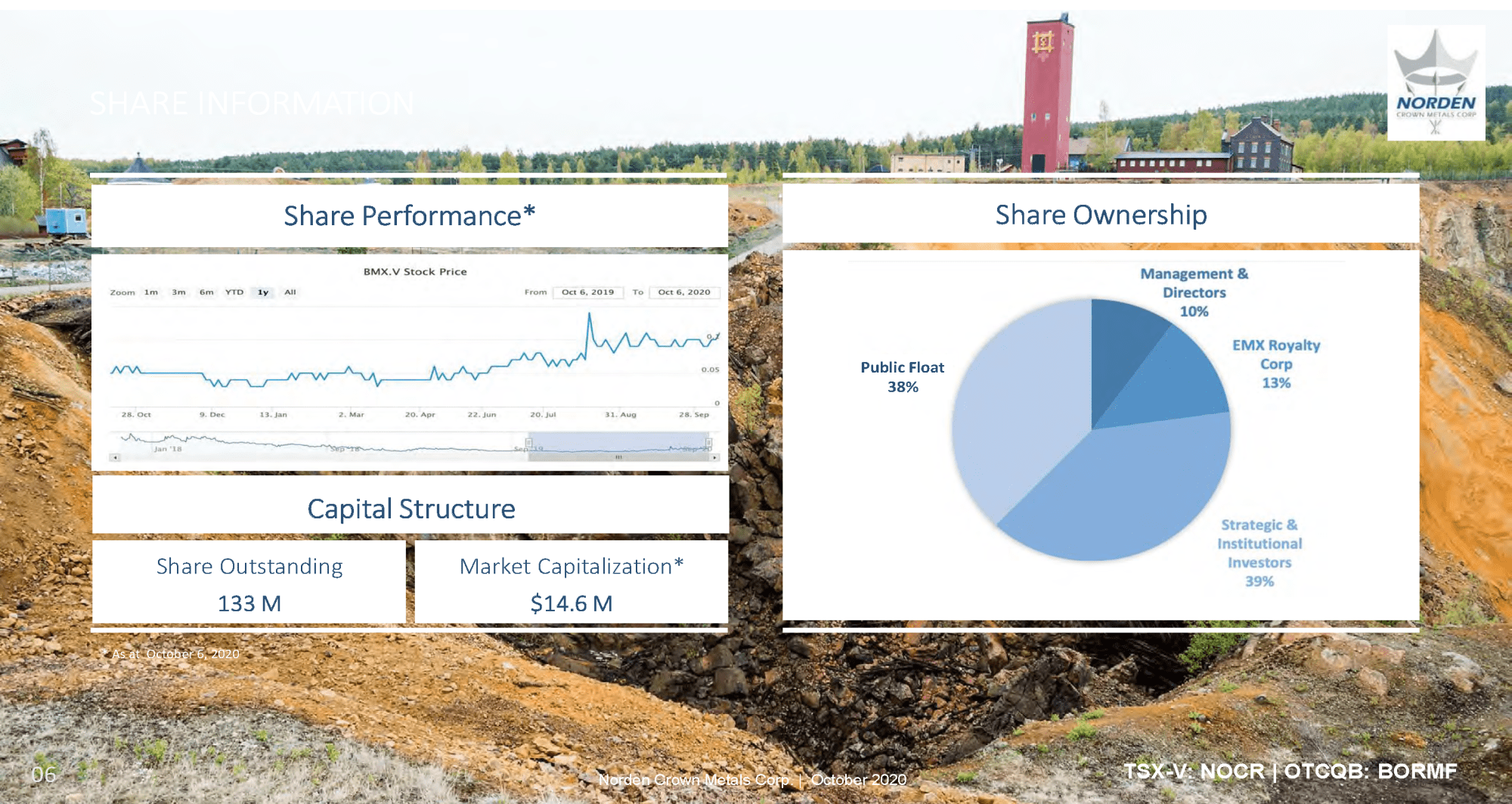

And to the point where we actually became nonactive for about … For several months. Almost a year. And then, of course the summer, everybody … Silver prices, all of a sudden popped up. And some of our previous investors who had seen our results and had invested, they went, “Look, these are great results. This is a good time to go out and finance.” And they actually offered us to lead in some cases in the financing.

Of course, we did a financing recently where actually you participated, Bill, in August. And because it was a very well-priced, I’m talking about five and a half cents, I think it was a fantastic opportunity. It was a great time to get into the stock. And I think that’s where the opportunity lies. I think if you look at where everybody has put in their money, whether you were involved in the IPO at 30 cents, or you’ve done any of the two subsequent financings at 20 cents and a nine and a half cents, I think we’re still a huge, a really good priced investment.

Yeah. And given the kind of grades we’re getting, we … I look at some of our contemporaries and I think the people, investors in the States would know about deals, for example, in Mexico, where they have very high grade silver explorers that have … They have five times, 10 times our market cap on intercepts that are very much the same as what we’re getting in Sweden.

And what I think … And I’ll talk a little bit about the environment in Sweden and why we think it’s a great place to do exploration. But I think the company has a fantastic opportunity or investors have a fantastic opportunity to get a very good deal of these prices.

Bill: Pat, one of the things I liked … And again, I was referred by somebody I thought highly of. So, when they said, “Go into this financing,” that meant a lot to me, but also I saw EMX was a large shareholder of your company, and I have a very high opinion of them and their technical team. What is your relationship with EMX Royalty?

Pat: Well, at EMX, yeah, they’re very important to us. We are a strategic investor. The projects were originally generated by EMX, and their model is to generate projects. And then, what they do is they vend them to people that explore and they basically retain an interest. And in their case, they’ve been very much supporting our story. They have participated in every one of our financings, not just the EMX as a company, but also some of their principles, and even some of the exploration people.

We benefit from having Eric Jensen, who is their general manager and one of the people that generated these projects. He’s head director of our company. So, they’re very vested. They’re very involved in everything we do. And I think they’ve been a fantastic supporter of our ideas and our exploration programs, for sure.

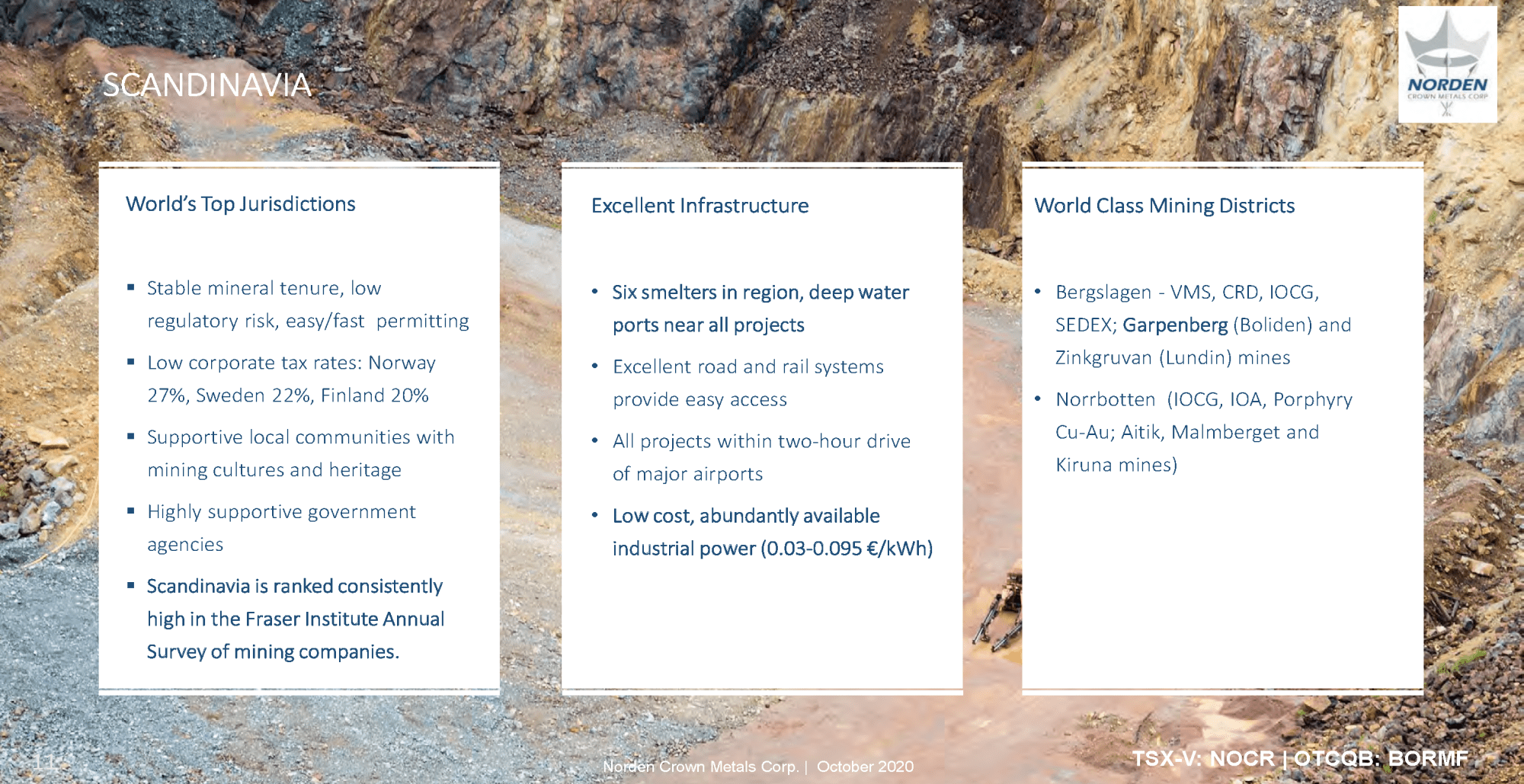

Bill: This is my first time investing in a Scandinavian company. So, talk to us about Sweden and Norway. What should we know in terms of permitting, accessibility, speed, cost of drilling, things like this please?

Pat: So, Scandinavia is sort of become a bit invoked. There’s a lot of people that are starting to go to Scandinavia to do exploration, and there’s a lot of reasons for it. Some of the most important reasons is that they have incredible infrastructure. They have a very significant network of roads, highways, railway systems, power supply. They have some of the lowest power in Europe.

They have hydroelectric power because of all the hydroelectric dams on some of the fjords and things like that. But something that people don’t know is that there’s a lot of mining in Scandinavia. Sweden, for example, has been … It’s basically a long historical miner of metals. In Scandinavia that are about six smelters, which when you think of the area that it covers, that Scandinavia covers, you compare it to Canada, in Canada we only have two smelters and we’re still considered a mining country.

So, Scandinavia, Sweden, Norway, Finland, they have a lot of smelters. And the reason for that is that they do have some significant mines. Sweden has some very large mines. Kiruna, which is an iron mine, is the largest iron mine or underground iron mine in the world. They have big open pits, like attic and they produce copper. They also produce all kinds of polymetallic districts. The Skellefteå (sp?) District, the Bergslagen district.

Bergslagen district where a lot of the polymetallic mines and world-class polymetallic mines occur, that’s where we are at, and there’s big operators. Lundin operates the Zinkgruvan mine, which has been in production for a hundred years.

Boliden, one of our partners in Norway, actually has a mine in the area about 30 kilometers from our Gumsberg project, where they have well over a hundred million tones of polymetallic. Led, zinc, silver reserves. And what’s most interesting is most of those reserves have only come about in the last 10, 15 years when they’ve been doing some exploration in old … They were basically exploring there for a long time and they were running out of reserves.

So, they had a real concerted effort to continue to explore these systems. And their systems are very much like what we’re exploring. They paint, they swell. There’s pods, there’s all kinds of things. But you do have to do a lot of exploration and drilling. But they run a very efficient mine, and it’s one of their big producers as well.

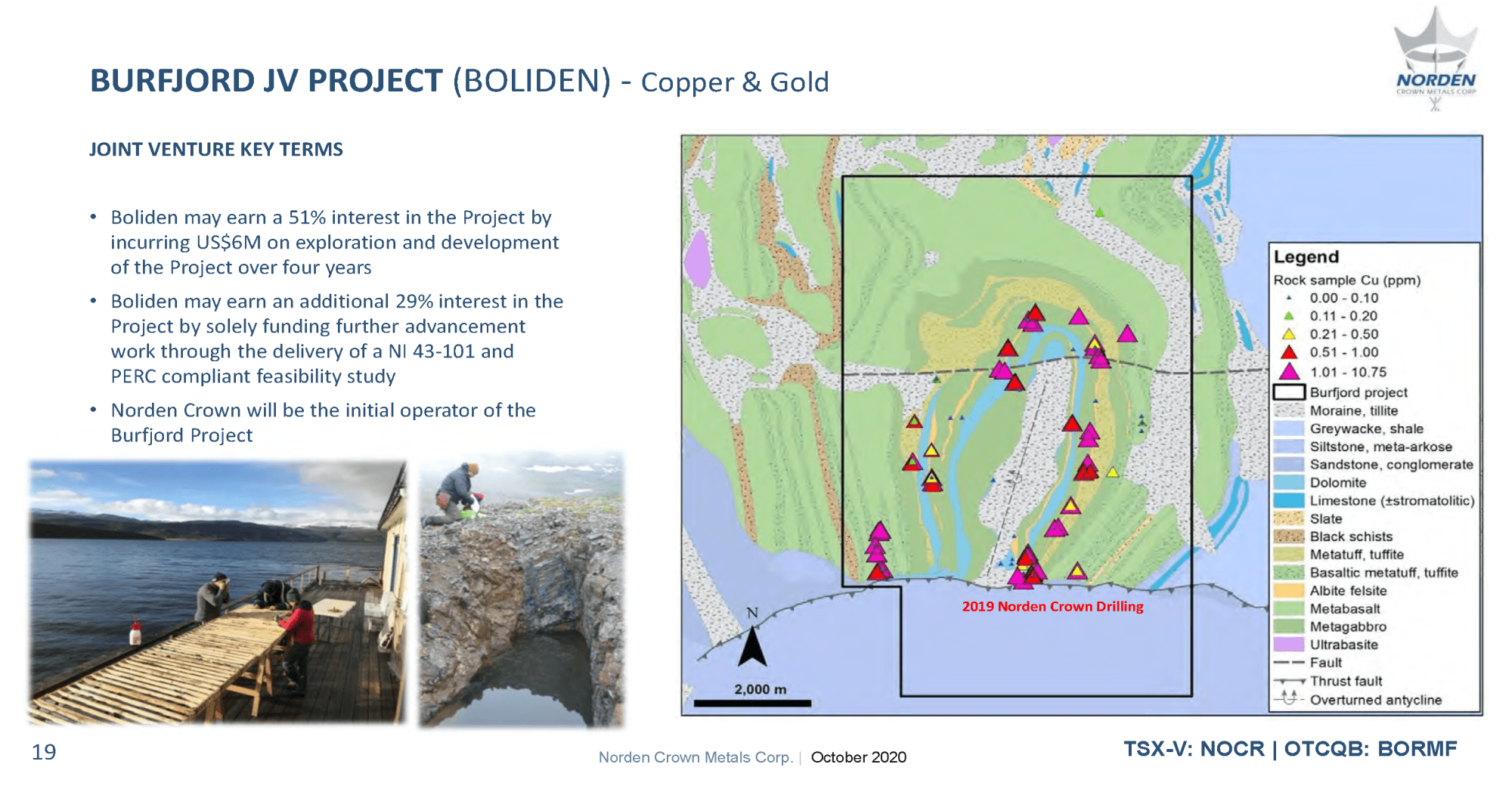

Bill: So you have a JV with a Boliden, which is a major minor there. Talk to us about this Burfjord project. What is the opportunity here for investors and what is your JV partner spending on this project?

Pat: So, yeah, Burfjord. We’re pretty excited about Burfjord. And I think it’s really important for shareholders. I’ll tell you why. When you’re looking for things like the type of deposits that we’re looking for there, they’re called iron oxide copper gold deposits. And IOCGs, they are more of a … When you’re looking for those deposits, you’re looking for large deposits.

You’re talking bulk. A hundred million tons plus kind of deposits. And those kinds of deposits are very drill intensive. You need basically some deep pockets. The last time I looked for these kinds of deposits was when we had that strategic alliance with BHP and where we found the Santo Damingo sewer deposit in Chile. It’s exactly the same kind of thing that we’re looking for here.

There is a region up there. The world-class Kiruna deposit is in the same geologic region as our Burfjord project. So, there is potential for those large tonnage kind of deposits. Now, last year we secured an agreement, a joint venture with Boliden because they looked at our results and they felt that they showed the potential. They came to the project, we showed them around.

We showed them that there’s extensive alteration throughout the property and a lot of copper is evident on surface. When you chip around the rocks and whatever is exposed, you can find a little bit of copper everywhere. So, we ended up doing a deal with them where they’re going to spend the next four years, they’re going to explore and spend about $6 million to earn a 51% interest.

Now, for a junior explorer, that’s important because we basically went with a concept, an idea that we could find this kind of deposit or explorer, or have a project that has good potential to find one of these types of deposits. And they feel that, or at least I think they felt that, “Yes, there is that potential in our project,” but they also recognize that we have a little bit of expertise because we’ve had experience looking for these types of deposits in the past.

And so, they will allow us to actually run the projects. We were going to be the operators until they earn their 51% interest. But it allows the company to basically continue its exploration. We’re going to have drilling. We’re planning about 7,500 meters of drilling this year, probably starting, I’m going to say around the spring. We’re going to do a little bit of geophysics sometime in February.

But basically, we’re going to be busy. We’re going to have news. We’re going to have activity. We’re going to have results. And I’m not going to have to worry about having to go out and race on money for that project. And for a junior, that’s really important, to be able to continue to put out news and do work. And we’ll be busy ourselves because we’ll be running the programs. But it’s all been funded by Boliden.

Now, Boliden in this really important because, like I said, they’re one of the most important, if not, the most important miner in the region. They own five of those six smelters and they have operating mines in Finland. They have operating mines in Sweden. And of course, for them, finding something in Norway where they also have a smelter, I think is really important.

They basically get a lot of feed from other parts of the world as well. I know that some of the Irish mines feed some of their Norwegian smelter. But they’re important because they have the ability to run mines and build mines. And ultimately, that’s what we want to do. That’s our exit strategy, is we show the potential, we define or we find a deposit, and then we basically pass it on.

So, Boliden at Burfjord, if we do find a deposit that looks of interest or that is economic, they will have an option to also bring it from that discovery stage through to the point where we’re doing a feasibility study. And if they deliver a positive feasibility study, we will basically get them an additional 29%. So at the very end, they spend the money and we could be left with a 20% interest on what would be a very significant deposit.

Bill: Yeah. And then, you also have the blue sky potential at your Gumsberg project, which you are drilling right now. So, bring us up to speed of what’s the prospectivity here? The drills are turning? When could we expect results and what would be good results for this project?

Pat: Yeah. So, Gumsberg is exciting because it’s high grade. It’s high-grade led, zinc, silver. And particularly those silver grades, they are … Like I said, they’ll rival any silver project in the world in terms of the grades. We’ve done three drill programs on the Gumsberg project. There are several prospects on the Gumsberg project, which is also really important because it’s not like it’s a one bullet type of a deal.

We’re talking the Östra Silvberg, the Vallberget, the Loberget, and then the Fredriksson, which is something that I’d like to talk a little bit more. But we have all of these prospects that look very, very good. And we know they were old mines. These mines were in production. There’s historically since the twelve hundreds.

The Östra Silvberg deposit, which obviously Silvberg means silver, it was a silver deposit. And it was mined up until about the 1600s. And it was the largest producer of silver in Europe at that time. Now, that deposit has workings that go down to about 200 meters in depth, but it’s never been really explored further down below that.

We ended up doing a bit of test drilling a couple of years ago, and we ended up finding a deposit just south of it, which is brand new. The old timers didn’t recognize it because it didn’t come to surface. It starts basically at about 50 meters below surface, and then it blossoms and it becomes a mineralized deposit. So, some of what we’re doing is we’re trying to test that on its periphery in this drill program and see if we can expand the mineralization.

But let’s not forget that this is just one part of what could be multiple parts. If you look at the Garpenberg deposit that Boliden runs, it’s about 30 kilometers east of us. That deposit is very similar to this. It has many deposits, and they start on surface. And they don’t look like much on surface because the actual footprint is very small. But they go down to over a kilometer in depth, and there’s multiple of these deposits.

Now, we have a very similar environment here. The Vallberget, the Loberget, we’ve done some drilling there. We’ve had some results. It’s a very interesting area because the trace of the deposits in the area are over three kilometers. So, there’s lots of drilling that we can do there. The other project, and we’re actually going to be moving there probably in the next week or two, because we’re really excited about testing the Fredriksson deposit.

It’s called Fredriksson Gruva. It was actually a little mine. It was mine back in the mid 70s, by what we hear are some fellows that ran a construction company, they were hunting in their area and they saw these things popping out on surface, all these mineralizations. So, they mined it. They did some tests mining. Did about 21,000 tons of mining. And then eventually, they did a little bit of drilling.

They drilled only to a depth of about a 100 meters, just in the area of that little open pit. And eventually, they went underground. They mined another 45,000 tons. And I believe that metal prices collapsed, and so they basically stopped the mining. But it was never tested, that depth. Another operator drilled nearby and drilled a couple of holes to about 250 meters down in depth.

And we’ve done some modeling recently, some 3D modeling and with some of the maps that we were able to acquire from the miners that were there in the 70s. We’ve been able to put a model, and it looks like it’s wide open and that we’re going to find lots of continuous mineralization from these old little mine workings all the way down to at least 250 meters, because we know the mineralizations there from some of these other historical holes.

So, we want to get in there and test that, the area between those holes and basically prove. Again, all of this is proof of concept, how these things continues. How far can we follow them? What kind of grades are we going to get? And we know that the grades in this region are excellent. In most departments and most areas, you’re trying to build tonnage often because if the grades are not so fantastic, at least if you build tonnage, then you can run a much larger operation. That type of thing.

We know that we have grade here. So, for us, it’s not a matter of finding. Like I said, ultimately, we’re going to have several deposits just like there exists at the Garpenberg mine. There are going to be a million tons, two million tons, five million tons, but they will all form part of the mining complex. And that’s the goal. So, if we can show that we do have multiple deposits, multiple bodies below some of these old workings.

If you walk on surface, you’ll be able to see all kinds of old workings there. Pits and a little dumps of material. And you’ll see. You’re able to pick up rocks of massive, massive silver and zinc. Let’s not forget that for them, the zinc in the earlier days, it was just a waste because they didn’t know what to do with zinc.

Zinc is one of those metals that they didn’t really discover what to do with it until probably the early 1800s. So, before that, zinc was not a metal that miners were interested in. So, you can see a lot of that kind of material on surface. And we do have very high grade silver, but we also have very high grade zinc as well.

Bill: And so, the plan here is you have, is it 3,500 meters right now that you’re drilling? And when should we expect those scout hole results to come back?

Pat: So, we’re in the middle of this drill program. Obviously, we’re going to need to process the core and do the core logging and sampling, and so on and so forth. It is the middle of this month. Basically, the middle of December. So, I don’t expect we’ll start seeing any results until early in the in the new year. Probably not until January.

And to be honest, I’m not really sure how efficient the labs are right now with COVID and all these kinds of things. I think we should be able to get results fairly quickly, but everything seems to be working a little bit slower these days.

Bill: So, when those results come back, obviously they need to be interpreted. And then, what would be the plan in terms of moving the company forward in 2021 with your treasury and future financings? Can you speak to this place?

Pat: Absolutely. We’re basically … The way that our junior markets work, we go, we raise some money, then we do a bit of work. We prove the concept and we basically have to come back to the markets and say, “Listen, we’re onto something. Here’s some results. Here’s some positivity. I want to continue to prove these concepts, drill some more, raise some more money.”

These deposits never … They need a lot of investment. The reality of thing for investors is that you need probably $20 million, $30 million, $40 million for exploration money before you actually define something that is going to be brought into a feasibility project, feasibility study. Unless you’re extremely lucky and you find an amazing hole that encourages operators to either take you over or that type of thing.

So, yes. We are going to need to go back to the markets, raise more money. And a lot of it has to do with timing, because people … We had a bit of a nice window back into summer when we did our last financing in August. There was a very good window. Lots of financings were being done. But today, gold prices have come down a bit. There’s probably a quarter of the financings going on right now.

So really, it’s a market dependent environment. We will likely … Well, we will need to raise more money because we want to continue to drill. We have all of these prospects. They all need a lot more drilling that than what we’re able to do right now. These things are drill intensive. You will find more pods, but you will miss.

These deposits will have a few hits and then you’ll hit an area where the mineralization pinches, and then you have to step some more. Step out to continue to chase mineralization and find another part. So, those are the kinds of things that we have to be ready for. But I also think that there’s going to be lots of encouragement. We really feel that there’s going to be some nice hits.

We’re going to show that there’s continuity at Fredriksson where you’re going to need lots more drilling to continue to show that you can grow these deposits to a point where they become attractive to a potential buyer. Another group that might want to buy the deposit or buy the company. Then we started looking for an exit strategy. But it’s all … I think it’s all going to create some value.

Bill: Okay. In the Burfjord project, that’s going to be having some drill results over the next month as well? Not just the Gumsberg project, right?

Pat: Well, that’s it. I think that’s the beauty of it, is we’re doing this work. And as a company, we’ll need to raise money so that we continue the work at Gumsberg. But even if markets are really bad and we can’t raise money, we’re still going to be busy at Burfjord, because Boliden is funding that entire work. All the programs or the land payments. That’s all going to be maintained by Boliden over the next four years.

So, we’re going to have results. I think that’s one of the reasons we’re going to have … Basically, this is a good place to put your money in because we’re going to have continued exploration. We’re going to continue to put results and proof to concepts and maybe build some deposits. And with some luck, we’ll have a discovery and maybe Boliden says, “Okay, this is great. Let’s just take over the whole company,” or, “Let’s just pay for all the mineralization. And we take over the deposit.” But we’ll be busy. We’ll be working one way or the other.

Bill: So, there’s at least two paths to an increased share price for the potential investors listening to us through these two projects?

Pat: Absolutely. So, yes, we could have some success at Gumsberg, and we’re going to have two areas are going to be drilled. One of the things I would love to do is raise some money so that I can fly an airborne survey at Gumsberg, because I can guarantee you that these areas that we’re working, they’re not the only targets. There may be even better targets there, because there are areas that are depressed, swampy. You can’t really see anything on surface.

And that may be the areas where the big deposit might be. Who knows? But there’s so much potential in that property. And it’s evidenced by all the workings everywhere. You really go to surface and you can see them everywhere. But even if those deposits … If the markets are not great, we’re not able to raise some money, we’re still going to be busy because we’re going to still be working and developing the Burfjord project with Boliden.

So, I think it’s exciting times for us. We’re going to be … Like I said, we have two drill programs going. We’ll have another one in the new year. Results, news releases. We’re going to be an active company for sure.

Bill: In the website, again, like I mentioned in my introduction is nordencrownmetals.com. It trades in Toronto, in the States and OTC, and also trades in Frankfurt for the European listeners. Linked to all those, the website and the ticker symbols is in the show notes. We’ll be following up with the company as drill results come in. So Pat, really appreciated touching base. And thank you for providing this overview for my audience.

Pat: Thank you for having me. I really enjoyed this. Thank you so much.