Rare Opportunity for A World-Class Silver Discovery with Tier One Metals’ Chairman Ivan Bebek

Tier One Metals is a precious metals exploration company that was spun out from Auryn Resources on October 9, 2020. Tier One Metals is currently an unlisted reporting issuer that will be seeking listings in Q1. The Company is focused on creating significant value for shareholders through the exploration and potential discovery of world-class silver, gold and copper deposits in southwest Peru. Tier One is actively planning to complement its existing strong property portfolio through additional precious metal acquisitions in Peru, leveraging off its in-country experienced personnel teams. Tier One Metal’s main focus currently is the 100% owned Curibaya project, which consists of approximately 11,000 hectares and is located approximately 48 km north-northeast of the provincial capital, Tacna, accessible by road.

Tier One Metals is in the process of acquiring drill permits for Curibaya and completing targeting at the project. Initial surface sampling programs at Curibaya have returned numerous high-grade samples of silver, gold and copper over a four-kilometer by four-kilometer alteration system. In this interview Chairman Ivan Bebek provides an update on Tier One Metals’ progress, upcoming developments and overall investment value proposition.

0:00 Introduction

1:40 Silver target on top of a copper porphyry target

6:17 Normal for a precious metals deposit to occur on top of a copper porphyry?

7:51 Project drill permit and plans?

9:50 Acquiring another high-potential project

12:20 New CEO should be appointed in January

13:59 Treasury and financing

15:45 Recent Peruvian political upheaval a concern?

PRESS RELEASE DISCUSSED IN THIS INTERVIEW

TRANSCRIPT:

Bill Powers: Ivan Bebek is the Chairman of Tier One Metals. Ivan, welcome back on the show. You put out a press release recently. Previously last year you were talking about the Curibaya project as a silver-gold target but now you’re bringing up the idea that this could potentially be a big copper discovery. What’s the update, please?

Ivan Bebek: Thanks for having me back, Bill. It’s been a very, very busy 2020 for very good reason for Tier One Metals and the transition that you explained as a reminder, we were Auryn Resources. I was the Executive Chairman of Auryn Resources and our team decided that we had three flagship opportunities that were all stand-alone and they should be… We could unlock a lot of value by separating them to three companies. Tier One Metals was the one company that we were most concerned about because we had these incredible silver grades all over the place on a project called Curibaya as you’ve mentioned. And we didn’t know if there was going to be a potential source of the silver nearby. And we also saw gold and copper and whatnot. When we split the company Fury Gold Mines, great gold company, huge explorer and developer and it’s now finally got its footing.

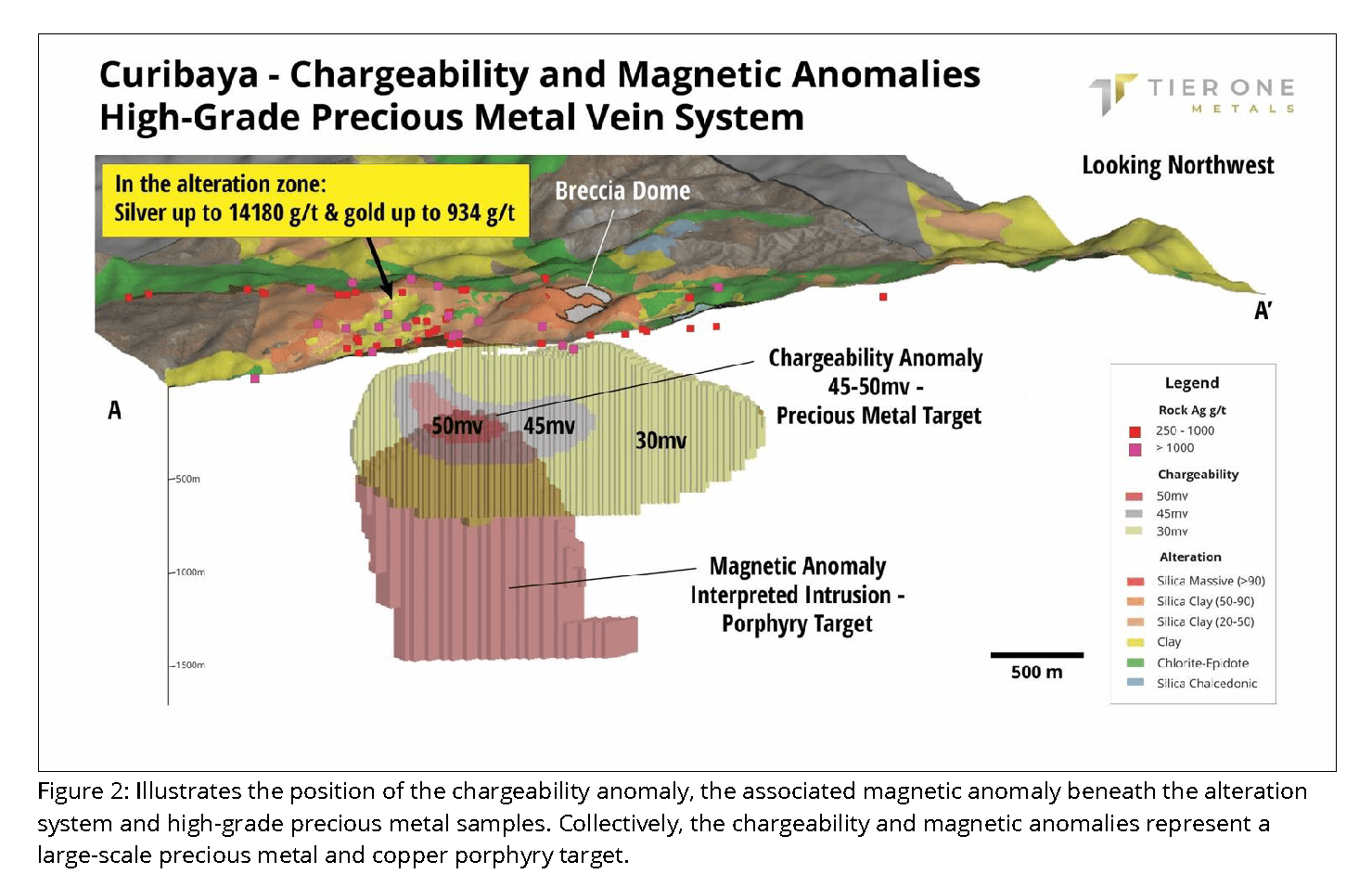

Tier One will be listed in February as our target date to bring the company back to trading. And we promised everybody that once we started the transition October 9th, that we would actually add a ton more value to Tier One before we came back listing. So people could look forward to a really robust performance of Tier One Metals. So the news release you’re referring to that we just put out, we found out what’s potentially the multi-billion dollar answer to the question that was the biggest question. Everybody in the world who have seen our incredible grades from up to 14-kilo silver but multi-kilo silver over a vast area and up to 934 g/t gold but a lot of 2 to 40 gram gold over the same vast area where the silver is alongside some big copper faults that run from 1% to 13.5% copper.

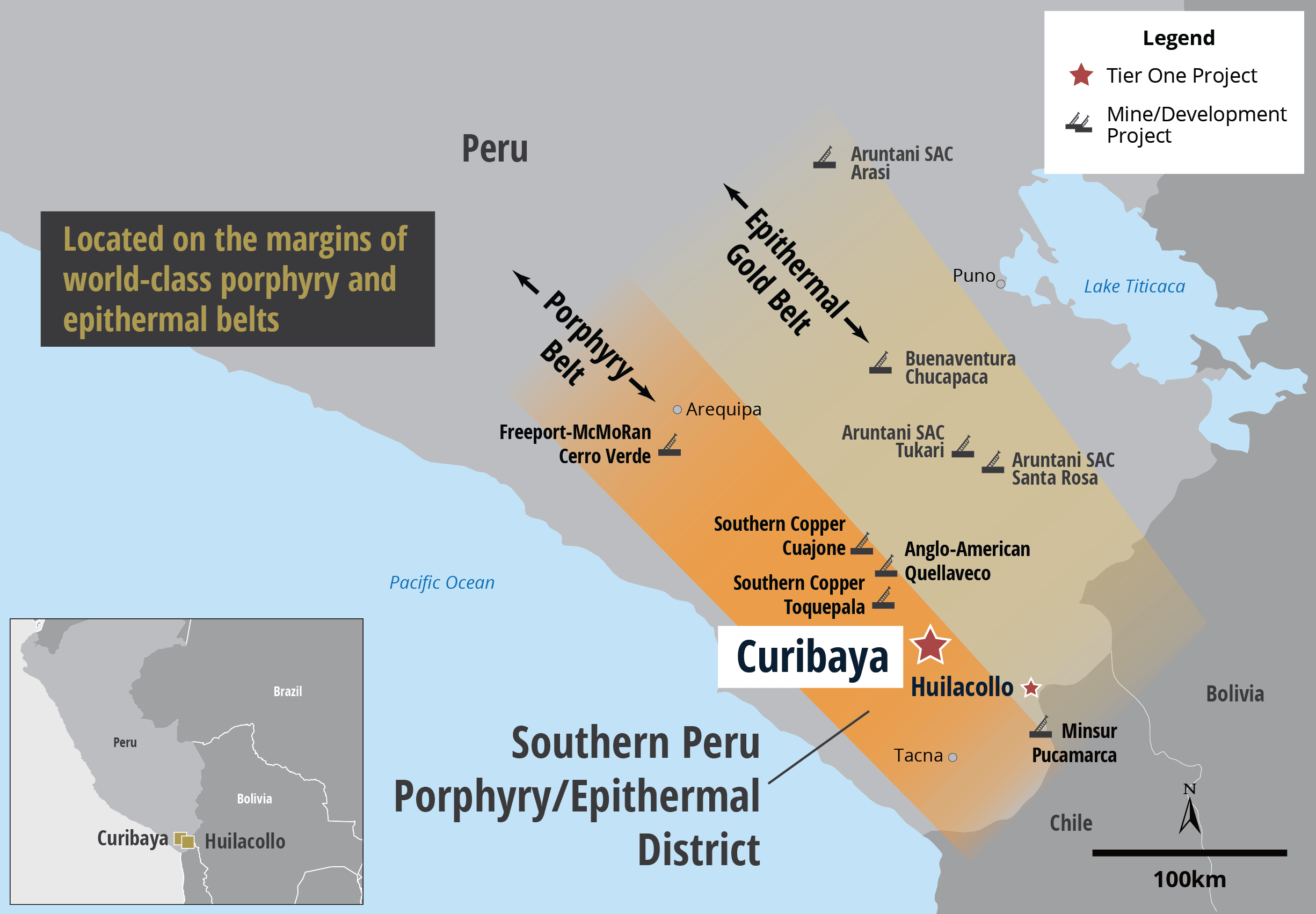

What’s important about Curibaya, what really drew us into it initially is that it sits on the trend in Peru by the coast which is host to some of the world’s largest copper mines that sit next door, Toquepala, Quellaveco, Cerro Verde. So it’s on a major metallogenic belt. But this is important because when you want to make a big discovery or want to go find one, you have to find the address for other ones occur. And in terms of geology, it’s on the same structure, I say would be the best way to explain it, that hosts these other deposits. So we found all this silver, we found this gold and we were just blown away. A lot of criticism came from people saying these thin veins you’re finding with all this ridiculous grade is just going to be smearing on surface. There’s not going to be any source.

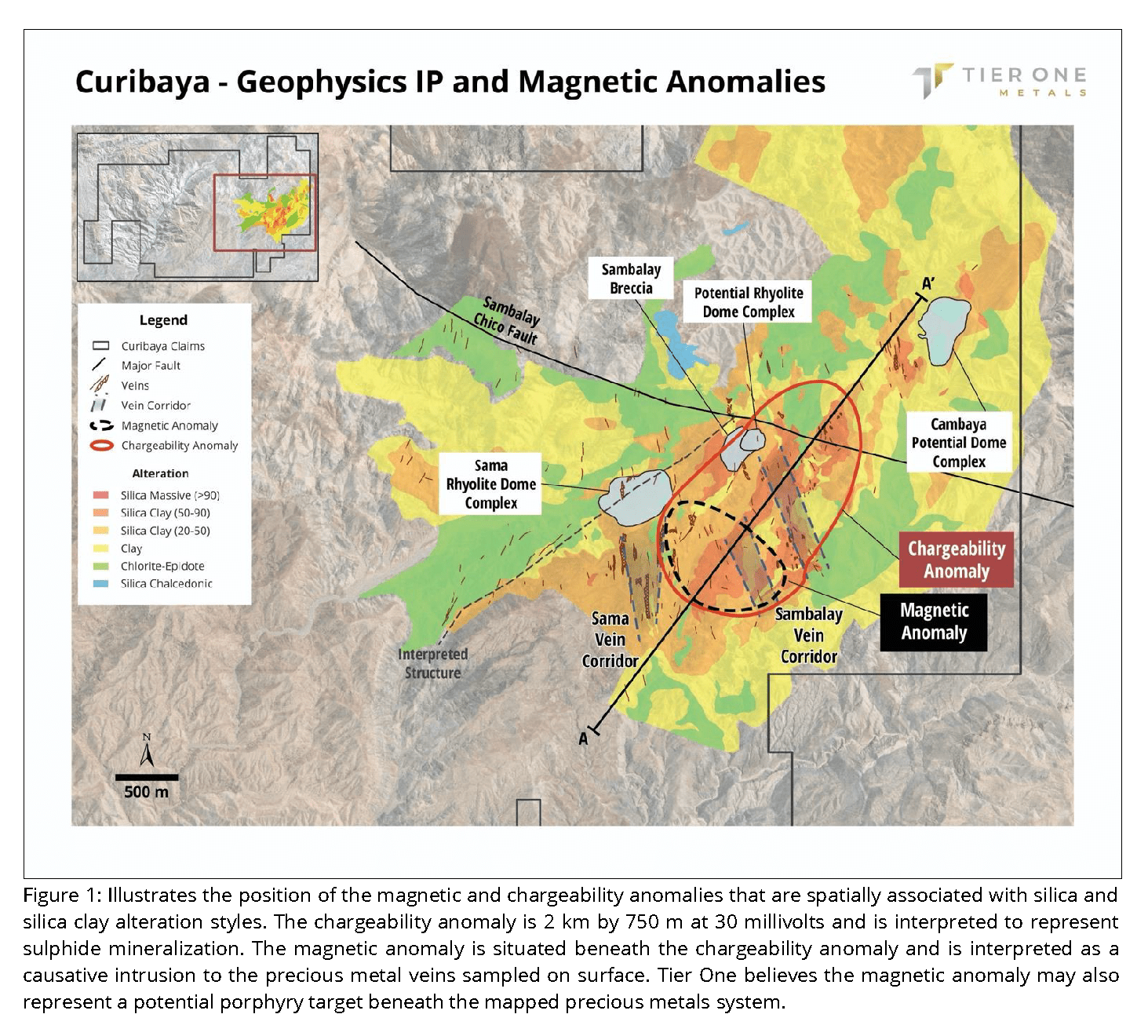

And that was a good criticism until we did what’s called geophysics. We put some electrical and magnetic currents into the ground to see if we could find a target underneath all that silver, gold and potentially copper. And it came out as a 15 out of 10 for me. We were blown away. This project, every time we went to it, we found more multi-kilo silver, more high-grade gold and it’s now turned the corner and we see a massive precious metal target right under surface. It goes from the surface down to about 500 meters and then a massive potential porphyry discovery sits underneath it, an intrusion. And this is really paramount because let’s start with the silver potential that’s predominantly silver and some gold in it. If we’d got onto a world-class silver discovery, we’re really curious of what the grade’s going to be because there’s so much multi-kilo silver above this big signature that could be a potential deposit.

Secondly, the porphyry idea was always there because we’re on a belt with these big porphyries that’s copper and gold. And we all know copper’s gone through $3.60/lb a pound I think yesterday. And it’s on its trajectory to do incredibly well over the next decades to come. I couch that by saying this is just the start of copper demand that’s going to drive the copper price over the next few decades. And I think it’s going to be one of the most precious metals on the planet for that reason. So having that opportunity to have both massive silver and gold discovery on top of a massive porphyry really gives Curibaya and Tier One shareholders the chance of getting the whole enchilada, the whole kitchen sink. You get it all. You get potentially a world-class precious metal discovery as well as a world-class porphyry. And so it’s going to be one of the most exciting projects that I’ve ever been part of alongside the other companies that we’ve created to drill and see what the potential results might be in the coming year.

Bill: Ivan, when companies go after big copper porphyry targets, is this idea of a precious metals target on top of a porphyry deposit, is this unique? Could you explain to us a little bit about the history and how other companies approach this?

Ivan: Sure. Our technical team is a series of former global experts from Newmont since they’re geoscientists that worked at the largest mining company in the world and they’ve held very senior positions with that company on the technical side.The feedback here has been normally when you come across a porphyry target, the precious metal system has eroded away and you get the tail end of a precious metal system. And maybe part of your porphyry target is eroded away. In this case, Bill, we have the full system has been preserved. We have an entire precious metal system that’s not been eroded away and we have a full porphyry target as well that’s not been eroded away.

So it gives us something that is very unique to sea. And the other thing that’s unique about what we’ve seen in our geophysics, usually your precious metal system is one or two kilometers above the porphyry target. The fact that ours actually overlap and touch each other is incredibly positive because it would incur a lot better economics having the porphyry so close to surface. Obviously you don’t want it to be too deep or else economics can get threatened, right? But in the end of the day from a geological model, we’re looking at something that is classic but it has the advantage of not having any erosion and the full system being preserved, which means more ounces, more silver, more gold if it’s there and much more porphyry

Bill: Twofold question, is this 100% drill-ready? And then the second part is would the approach be to drill a deep hole straight through what you anticipate to be the precious metals deposit into the potential porphyry copper deposit?

Ivan: Yeah, so in terms of that, let’s talk about that for a minute. And there’s two types of performing investments. There are silver stocks and then there are all other mining stocks and silver stocks or silver discoveries generally trade at a multiple, that’s usually double the PE multiple of a gold company or gold discovery. There’s a lot of leverage in the silver price. It could easily go to 50 or 100 dollars an ounce. It’s used for industrial purposes. It’s being used in the green world and the electric cars and batteries as well. So it has a huge outlook in terms of performance but we’re going to first start targeting the high-grade silver. And because we are so curious and a big porphyry could be worth multi-billions of dollars, we are going to drill a few deep holes. My advocacy towards the targeting is I want to see two or three big holes that go right through the precious metal system, right into the potential porphyry underneath it.

And that would give us an incredible return on investment off the first few holes if it’s there and truly in the business of finding these things, the discovery potential of a drill hole is huge. You can either find the hints that you’re into a big system or you can find the glory hole where the stock goes from $1 to $10 basically overnight. We’re going to drill both of those types of holes right out the gate. And so we’re really excited. You asked where drilling’s at. We expect to have our permit in January. That’s well on its way. And then once we have the drill permit, you apply for the start of work. It’s a formality once you have your drill permit and that would put us able to drill it in late March, early April. Once the raining season lifts, we should be able to turn drills and start to reveal the potential in this project.

Bill: Ivan, as a speculator in a one project, junior miner exploration company? There’s a lot of risks if you don’t hit so what are you doing to mitigate that risk for myself as a Tier One Metals investor?

Ivan: Great question. And as I said earlier in the interview, we weren’t sure if Curibaya is going to be there because we knew what was on surface and we did not know what the targets would be subsurface. So it came out way better than we thought. It is truly the best case scenario. And it represents a world-class flagship opportunity for discovery but that we didn’t know. So we went out hunting for more projects because if you know our group well and our former Newmont Global Exploration Team, we like to build portfolios to mitigate the risk of discovery and give you as an investor multiple chances at that lottery type of return you can get from a world-class discovery. So the gentlemen have found a world-class opportunity further up the coast and we are working on acquiring it as I’m talking to you.

Now, we hope to have it complete in January and announced. This was going to be the flagship. And it rivals the interest of Curibaya and how prospective Curibaya is. I will save the rest for a press release where we can show you why. And most importantly, the technical team came to me and said it’s ranks as the top three things they have seen in their careers by virtue of opportunity for a world-class discovery. So something else that’s going to be just as intriguing or even potentially more as Curibaya will be in the company, it’s going to be a little bit further behind with the drill bit. But while we drill Curibaya, you’ll hear a lot of news about the surface sampling there and the targeting and it’ll give us a chance to drill it on the backside of whatever we drill at Curibaya.

So we’re going to have at least two world-class exploration swings in Tier One Metals coming out the gate. We plan to start trading in February. That will be the first opportunity for people who don’t own any shares to get some but there’s a lot of news Bill, between now and when we resume trading. And that acquisition is one of the announcements that would be pretty significant. And what else you’re going to hear about? You’re going to get a bit more details on the Curibaya target and why we are so high on it and why we think it could be as good as I’m advertising here. And then you’re also going to see us talk about the second asset and we are going to outlay the plans for 2021 and introduce you to a CEO that we plan to appoint to the company in early January.

And for that role, we looked for somebody with a strong capital markets background and we found somebody that I’ve known since I was in elementary school. So long relationship, a lot of trust, a lot of integrity, this gentleman is at the top of his career in the brokerage side, his business has just taken off and through convincing effort but him recognizing not just the opportunity that we represent in Tier One and what might be added to Tier One Metals but more so to work with the team. The team we have assembled is truly world-class in terms of our technical team. And that’s really the key to go make these once in a lifetime type of discoveries. So this gentleman will come in and we split the company into three.

We now have three companies. I’m the Chair of Fury Gold Mines. I’m the Chair of Tier One Metals. And I’m the CEO of Sombrero Resources. I’m very, very, very comfortable with capital markets have raised a tremendous amount of money and helped monetize with a great team of partners our successes but the one place where I wanted us to have more strength was to have somebody that could come in and help with the share price performance, help with the financing abilities to raise and strategize and build really strong shareholder base going forward. So he’s joining us in January. I can’t wait to introduce them to you and the rest of the investors. I look forward to a very, very adequately staffed team both on the technical side as well as on the capital markets finance side as well.

Bill: Tier One Metals I believe has about 4 million Canadian dollars in the bank. With Sombrero and the relaunching this coming year of Sombrero Resources, you talked about maybe taking on a partner and capitalizing that company further before you relaunched trading. Could we expect something similar with Tier One or are you just going to keep the treasury at $4 million for right now?

Ivan: Well, no, definitely going to need money to drill. And we do plan to do a raise between now and when we resume trading and that raise will probably come towards the end of January sometime. Once we get the next five press releases out, the story is going to be a lot stronger than it is today, even though I think it’s spectacular on our last press release. And I’ve been offered a lot of money, more than we need from that first initial announcement because the opportunity is being digested as it’s a one-off, once-in-a-lifetime swing at silver and porphyry. For us, we are going to be very strategic. We’re going to look at all of our options. Some of the announcements that are going to come out in January are going to intrigue by no question some of the major mining companies.

Do we look for a partner at that time? Do we do it internal? We’re going to make the best decision as large shareholders of our company that’s going to benefit our shareholders. So if that involves a major mining company coming in as a partner provided there’s interest at some premium, we would entertain that if it made corporate strategic sense. If it’s ourselves, the new CEO will need to buy his position as well. And hopefully we can offer that opportunity for shareholders and the new CEO to buy in all at the same time. We’re going to do what’s best for shareholders so that we can create a company that’s well positioned to perform with some of these big discoveries that we’re going after in this rising bull market that we’re entering.

Bill: One more question before you go Ivan, Peru has a long stable mining history but there’s been recently some political upheaval in Peru. Is this of concern to you at all?

Ivan: To me, it’s not because I’ve been in Peru for two and a half years, working through navigating through permits on Sombrero and assembling the Tier One portfolio with our team so I’m very comfortable with it. And the recent upheaval you saw and presidential elections or the removal of the president and impeachment that’s taken place, it’s not uncommon to see this in South America. It does happen from time to time. A lot of that has settled down and it’s picked a direction that’s a lot more calmer now. What was really good for us out of that whole outcome was there’s been a big effort made towards improving the permitting process which plagues a lot of the exploration companies in Peru. And the Vice Minister has taken over as the Mine Minister which gives us continuity. And then now the new effort being advertised that they’re going to really shorten the permitting timeline.

We welcome that news. And I like to say I’m really excited that there’s change and there’s change for the better that’s coming. Now there is an election in April. Obviously there is going to be a few candidates that could warrant the new role as president and that will have impact. But I think we’re in a time of the commodity market of economies that have been weak due to COVID. We’ve seen this globally. And I think Peru a largest proponent of their GDP comes from mining. They’ve really recognized that and are going to drive forward a better process for us to get permits and drill our projects and potentially make these discoveries and expand their GDP and then obviously help support their economy. So I’m really excited about the outcome and I’m glad that the upheaval has passed and the fairly dramatic events that have occurred are behind us.

But I’ve spoken with a few major mining companies that operate in Peru and they have not even been fazed by the changes. And they think it’s business as usual. If they are the potential end buyers of what we’re doing and they feel comfortable, I feel comfortable as well. So I think when you look at the exploration industry, you have to look around and think about this as an investor, where will I make the most money on an investment? You’re going to make it on a large-scale discovery. And that’s exactly what the DNA is going to be on every project that Tier One goes after. Our initial inclinations that we were onto something I’d validated in our most recent press release seeing the subsurface targets. And there was another major project coming into Tier One Metals. Second point is where are some of the world’s largest mines?

And this falls down into Peru and Chile. These are two of our group’s favorite jurisdictions to be in aside from Canada where we think world-class copper and gold and silver discoveries can occur. We feel these are underexplored regions. They’ve been that way because it’s been challenging to get permits and drive things forward on a quick and timely basis. However, being really well positioned in Peru and soon in Chile with one of our other companies ahead of this bull market, the two and a half years it took us to get here to get to these projects is going to pay dividends at the best resource market we could have asked for it to happen in. I’d like to take credit fully on strategy but I’m going to actually be honest and say there was some luck and coincidence there that things took as long as they have.

And you’re an Auryn shareholder, you’re a Tier One shareholder. It’s been a long wait and big discoveries take time. And our goal is to make sure the wait is more than worthwhile. And so far what we’re seeing at Curibaya, it’s rivaling everything that we’ve been part of in our careers with opportunity. And we think we’re going to double that with a second acquisition before we come back trading. So look very forward to a series of press releases. A lot of more value to talk about the second asset, more stuff about Curibaya before we resume trading and look forward to one of the most exciting years as an investor in part of these potential world-class discoveries in Tier One Metals.

[…] from Mining Stock Education […]