Doré Copper Mining Advances High-Grade Joe Mann Gold Mine with CEO Ernest Mast

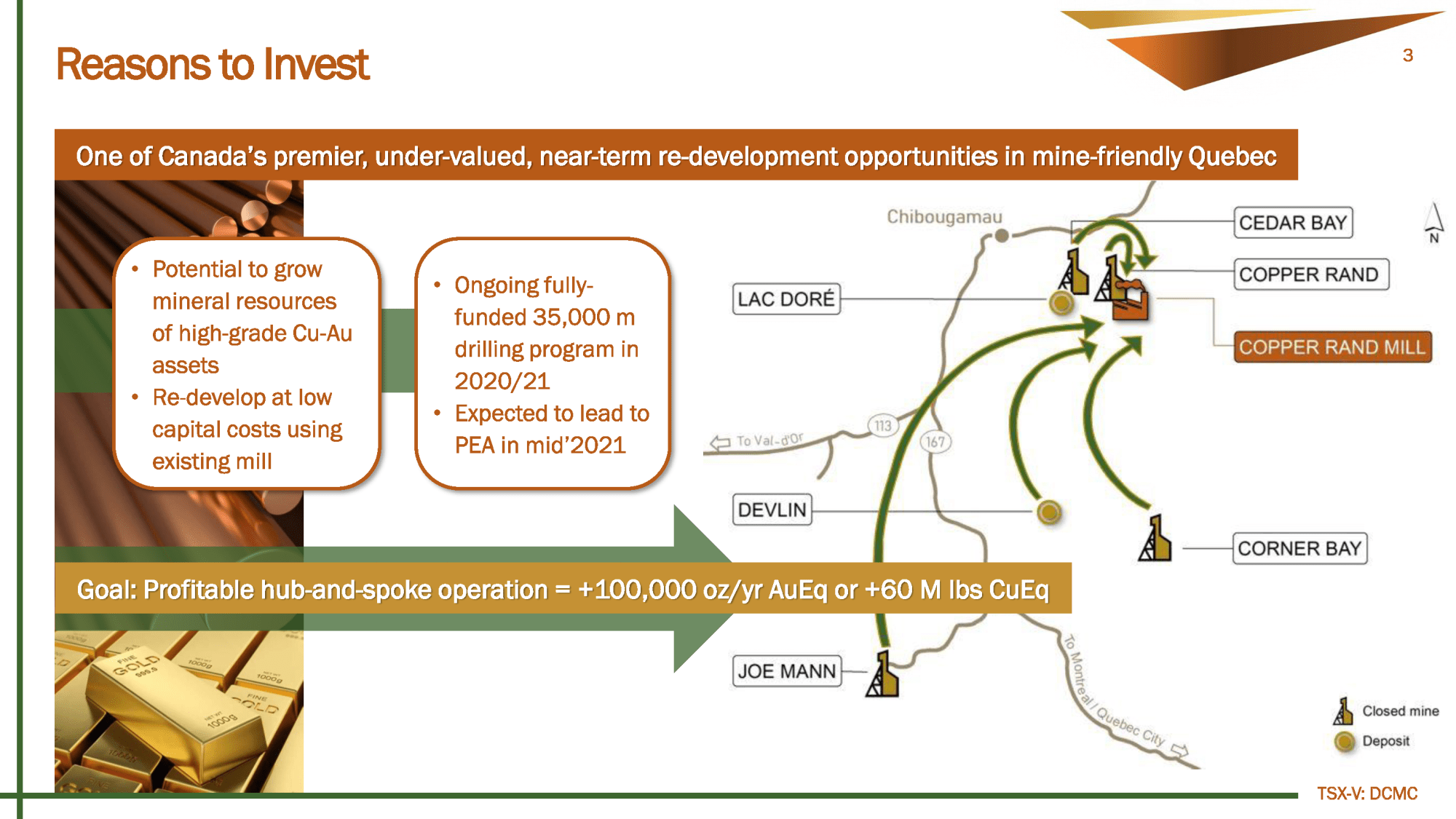

Doré Copper Mining’s (TSXV: DCMC – OTCQB:DRCMF) assets contain some of the highest-grade undeveloped copper and gold deposits in North America. The company’s projects are located just 14 km from the town of Chibougamau in mine-friendly Quebec and are one of Canada’s premier near-term redevelopment opportunities. Doré Copper is debt-free and owns a 2,700 tpd mill with a 8.0Mt tailings facility. There is already power to site and it is accessible by paved highway and rail. The goal is to

produce a profitable hub-and-spoke operation of +100,000 oz/yr AuEq or +60 M lbs CuEq by 2023/2024. Because of the existing infrastructure and location, a low capex is anticipated to recommence production. In this interview, Doré Copper Mining’s president and CEO Ernest Mast provides an update on the company’s C$6M financing, recent share price action, Joe Mann drill results and upcoming catalysts.

0:00 Introduction

0:38 C$6M financing & type of investors

1:44 Recent share price action

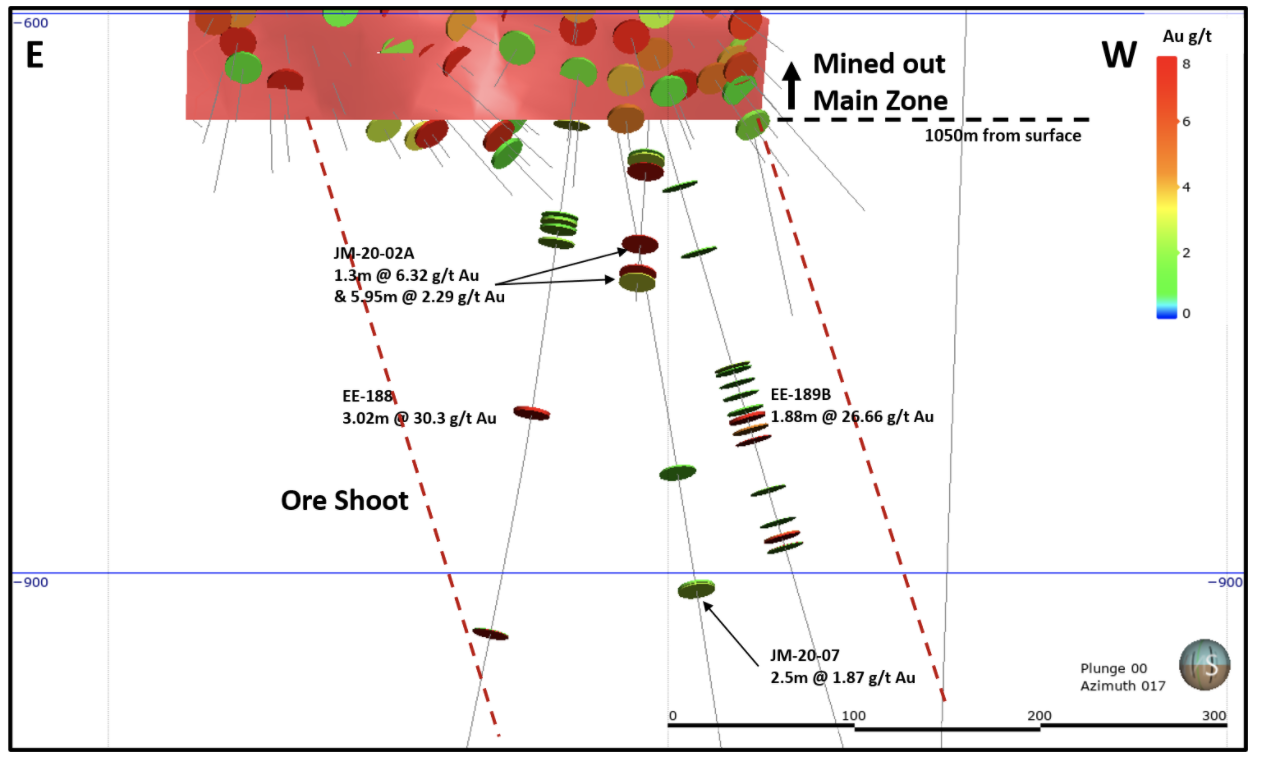

2:32 Joe Mann gold mine drill results

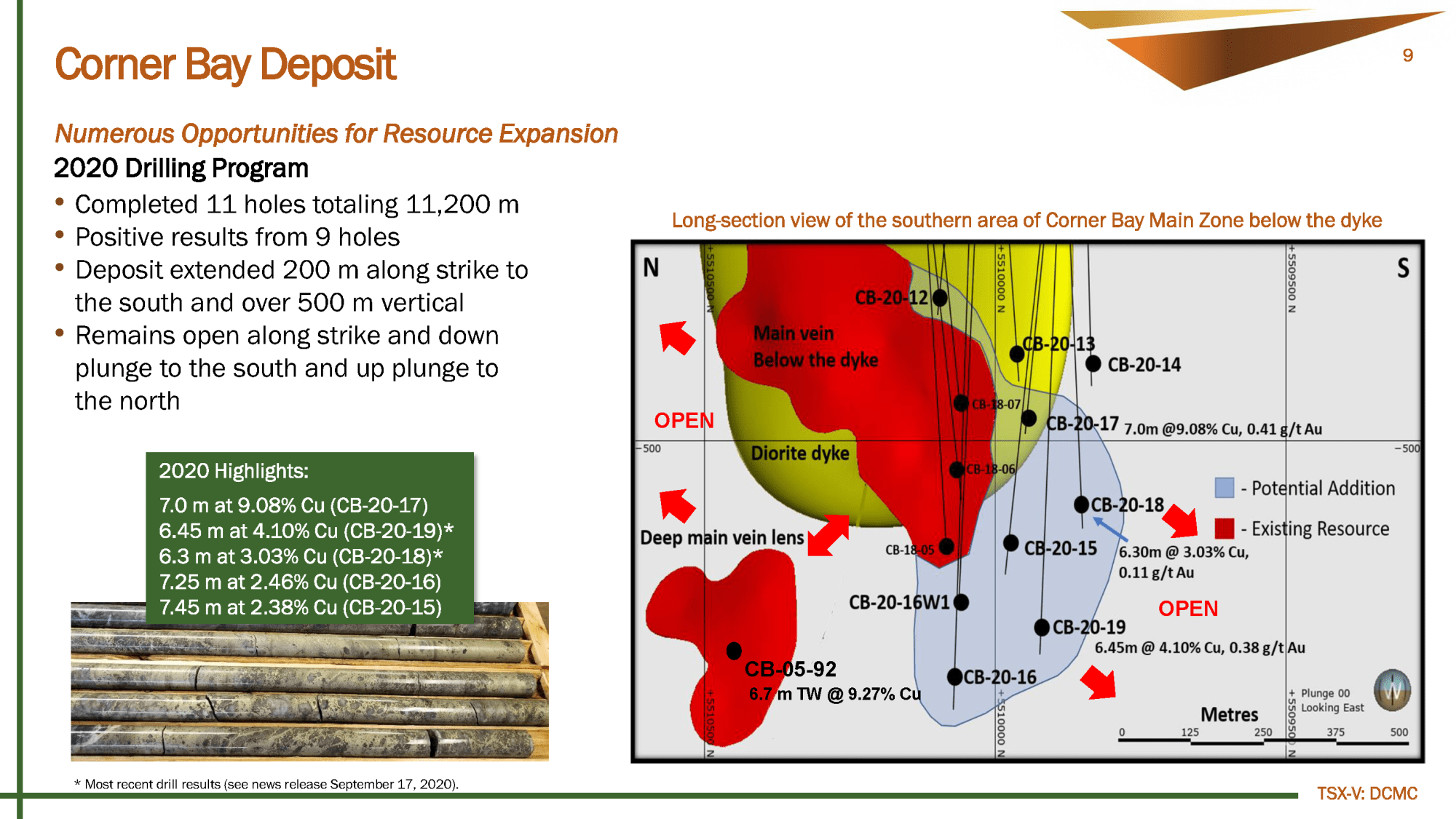

8:50 Corner Bay deposit update

High-Grade Gold and Copper on the Pathway to Production with Doré Copper Mining CEO Ernest Mast

TRANSCRIPT:

Bill Powers: Ernest, welcome back onto the program. Since we last spoke, you’ve released a couple press releases. One of those has to do with a $6 million Canadian financing that you just completed. So please review that with us. What type of investors did you bring in and what type of money do you have in the treasury as we speak?

Ernest Mast: Thanks, Bill. Currently that raise that we announced was really strategic in that we had some new Quebec funds come in, as well as some of the existing funds that are currently invested in the company. We also had some new investors come in. We’re pretty excited about diversifying our investor base with this raise. We closed in two traunches, one the end of last year and one at the beginning of this year. That’s all settled away. Currently we have a little over C$6 million in treasury. Most of those funds will be used for drilling purposes. But essentially, we’re fully funded now to get to the point where we can issue new resources and a PEA later this year.

Bill: When we last spoke, I think the share price was somewhere around 70 cents Canadian, and then it ran up to a dollar. And it’s down, back around 70 cents Canadian as we speak, like a round trip since we last spoke. Can you talk to us a little about what occurred in the share price movement since we last spoke?

Ernest: Yeah, sure. Well, I’d say it’s about 70… Well, it’s a little over 70 cents, say 74, 75 now. But one of the things I think that occurred is that there was a run-up in a lot of copper stocks and a few of them have retraced a bit. And also we had some flow-through shares become tradable at the beginning of the year. And that may have created some additional sellers. We think a lot of that’s out of the system now. So as we discussed before, I believe the next zoom up we have should be a much more sustainable.

Bill: You released some drill results from your Joe Mann project. This is one of the highest grade historic gold mines in Canada that you’re looking to bring back into production. You’re doing the hub and spoke model. So just give us an overview again of this Joe Mann project and how it fits into your overall model that you’re working with.

Ernest: The Joe Mann mine produced 1.2 million ounces of gold and it stopped operating in 2007. At that time, the company running the mine decided to invest in a copper mine. Gold prices weren’t as strong as copper in the mid 2000s, if you recall. Essentially, they closed the mine in an orderly fashion. Over the life of the mine it produced at a grade of 8.26 grams per ton gold and also at 0.3% copper. Over the last four years of the mine’s life, the ore actually was processed in our Copper Rand mill, where recoveries were about 85% gold and over 90% copper.

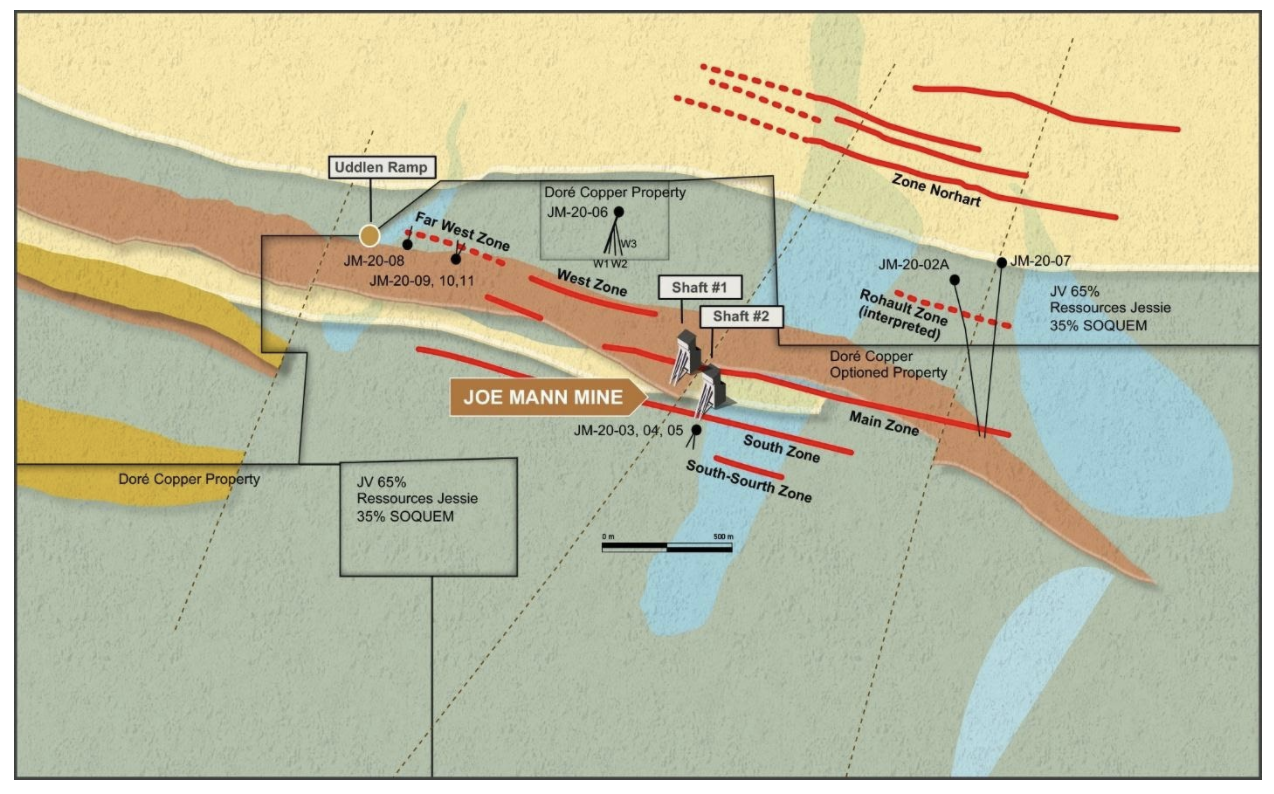

So how this fits into our hub and spoke model is that the Joe Mann mine, when it returns to operation, can be co-mingled with, say, the Corner Bay ore. We would produce doré from the Joe Mann mine, but also some of the gold in Joe Mann is in solution with the copper mineralization and that’s going to increase the gold content of our copper concentrate. The Joe Mann mine has a strike of over one kilometer and the majority of the ore mined was from the main zone and the west zone.

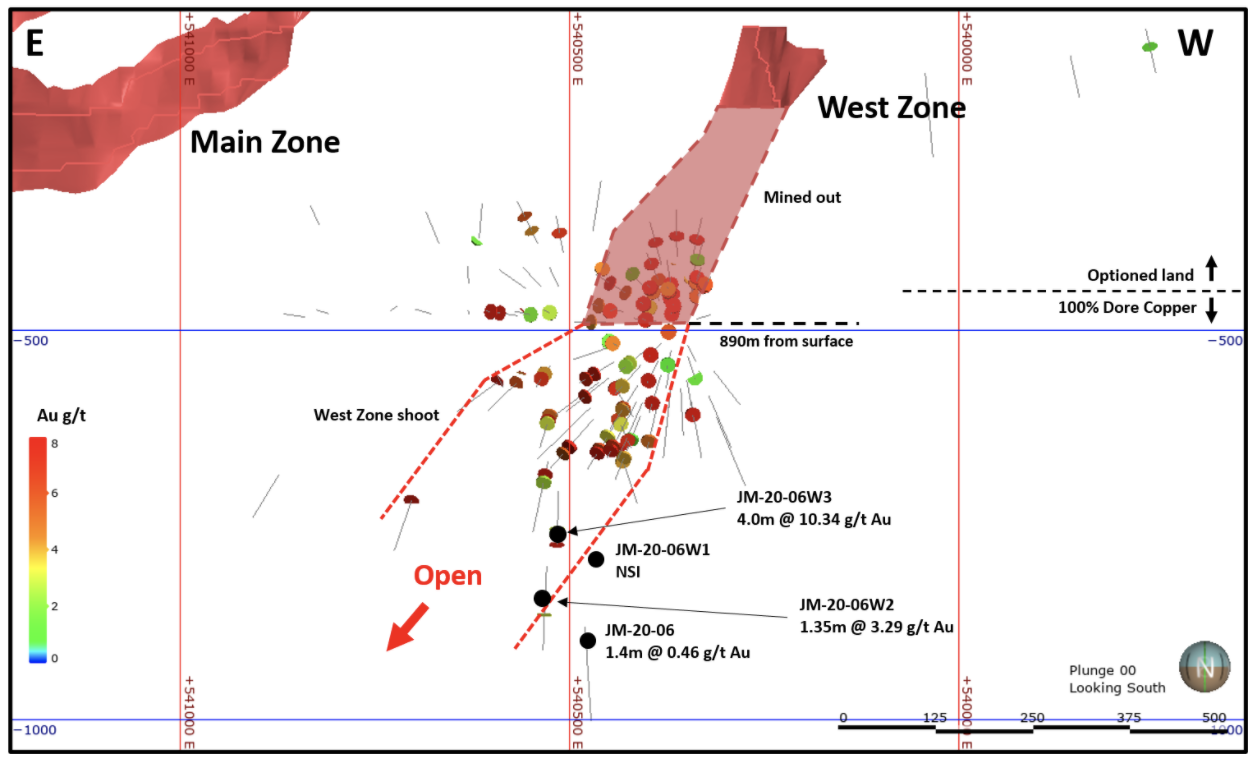

Bill: The west zone was made mention of in your recent press release. What did you discover in the west zone with this latest round of drilling?

Ernest: On the west side we drilled a deep pilot hole and then we did three wedges off that. The first two intercepts that we got were probably a little bit too far west and they missed the ore plunge. But then hole number three hit four meters at 10 grams per ton. This was about a hundred meters down dip of three intercepts that are very similar, meaning four to five meters and around 10 grams per ton. So we established the fact that the mineralization, the dip continues and we extended down dip by approximately a hundred meters. The deposit is still open in its flood zone towards the east. That’s going to be our next target that we’re going to drill. So we’re really happy with that result. Even the holes that didn’t get good mineralization, we hit the structures. So the structures are continuous and they’re persistent. And that just means with a little more drilling, maybe we can get some good intercepts there as well.

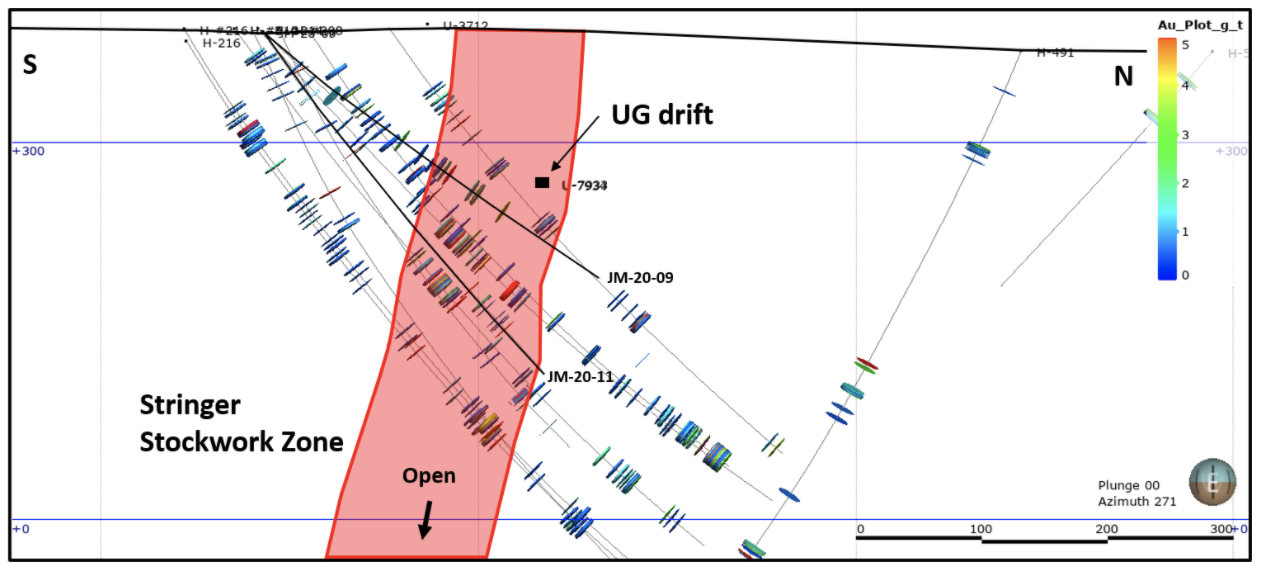

Bill: The second zone you were testing at Joe Mann was the far west zone. What did you find here?

Ernest: The far west zone is a very interesting zone in that it’s never been mined, but there’s a drift or a tunnel going through the area at a depth of 145 meters. We intercepted three meters at 10 grams on the far west zone and also had an intercept of 0.4 meters at 41 grams and .6% copper. This far west zone has numerous intercepts that are very high-grade, including some intercepts over a hundred grams. When we model the area, we’re not seeing the same type of continuity along structure at the Joe Mann main mine. We’re having a deeper look at the information. The other thing that we’re doing on the far west zone is, it’s obviously nuggety in nature because of that, say, [inaudible 00:06:43] of 0.4 meters at 40 grams when we really didn’t anticipate anything from that analysis. So we’re going to analyze the whole core and see what kind of nuggety nature that there is, but we’ll have a look at it and see if there’s some potential for mining.

In the past I believe they wouldn’t have mined it, because gold prices were relatively low. With today’s high-grade gold prices, we could probably put together more of a disseminated model and see what that would look like. So lots of potential there as well. Recall that it’s very shallow. It’s about a hundred to 250 meters deep and there’s a drift already going through this area.

Bill: Does this type of deposit typically get higher grade as you get to depth?

Ernest: On Joe Mann, I would say it’s high-grade all the way through, so you get 40 gram intercepts close to surface and at depth as well. But I don’t think we really know enough about the far west zone to comment on that. It’s possible. If it does get higher grade intercepts, then we’re going to start getting hundred gram intercepts. Should be great.

Bill: And the main zone, I understand you’re looking at that again as a possibly de-watering to lower your cost of future drilling, is that right?

Ernest: Correct. In the current program that we did, we had an intercept of 1.3 meters at 6.3 grams per ton gold and 0.52% copper. That intercept was located between two historic intercepts of an ounce per ton and the historical working. So what we’d like to do is infill in that area a little more in the future. And it makes a lot more sense for us to do it from underground, where the drilling distance would be, call it, a hundred to 150 meters as opposed to over a thousand meters from surface. So there’s a cost implication of drilling from surface, but even bigger is that it’s hard to keep the drill exactly where you want it to be. You end up deviating from your intended target. So we’re looking to de-water the Joe Mann mine, which last operated in 2007 and it has all of its infrastructure in there to be able to get back down underground.

Bill: What would something like that cost to de-water?

Ernest: A de-watering effort there would probably be a couple of million dollars. However, in the next couple of weeks we’re going to embark on a study to get a much harder number.

Bill: And what are you doing at Corner Bay? Is there anything going on there right now?

Ernest: Yes. When we recommence drilling in the new year, as we digest and analyze these Joe Mann results, we’re drilling at Corner Bay. The Corner Bay deposit, during the course of 2020, we very successfully drilled the deposit, extending it out to the south at depth. We will continue to do that. But at the present time, we’re actually drilling the deposit on the north side and testing some of the high-grade intercepts that have occurred there in the past and drilling those up dip. So we’re looking to expand upon the tonnage there. Just as a reminder to the viewers, Corner Bay is a deposit with over 3% copper. There’s very few of those deposits in the world. We currently have 3 million tons, but with the drilling that we did last year and the drilling we intend to do this year, we should significantly be expanding the deposit.

Bill: So should we expect resource updates at both Joe Mann and Corner Bay this year?

Ernest: Correct. That’s right. We’d like to incorporate a little more drilling in both of those deposits. For Joe Mann, we don’t necessarily have to do the de-watering and and drilling from underground before updating the resource, but we may do a couple more holes from the surface.

Bill: Then you also have a PEA at Joe Mann we should expect, right?

Ernest: Correct. The PEA will be on Corner Bay and Joe Mann and some other deposits that we have. In the PEA we’d like to prove out the hub and spoke theory, where we have a couple of mines feeding a centralized mill. That’s just really to give the market an indication that we are going to be a cash flowing, profitable business with underground mines. As we do know, as you start working underground and you continue to drill more and more, the resources expand. So we’re only going to get the resources to a certain level before this PEA, but it should be enough to put forward a profitable business plan going forward.

Bill: For listeners new to the story, the timeline is about three to three and a half years from now, it’ll hopefully being production, right?

Ernest: Correct. That’s right.