Trillion Energy is Deeply Undervalued and Poised for Rerating with CEO Art Halleran

Trillion Energy (CSE:TCF – OTC:TCFF – FSX:3P2N) is deeply undervalued and poised for a significant rerating explains CEO Art Halleran in this interview. The current cashflow of about US$2M from its oil production easily justifies the company’s US$10M market cap. But Trillion is currently getting no value for its SASB project’s US$608M of fully built-out infrastructure which is about to be producing natural gas in 2021. The company owns 49% of the SASB project in the Black Sea just off the cost of Turkey and has an offtake partner ready to purchase its gas.

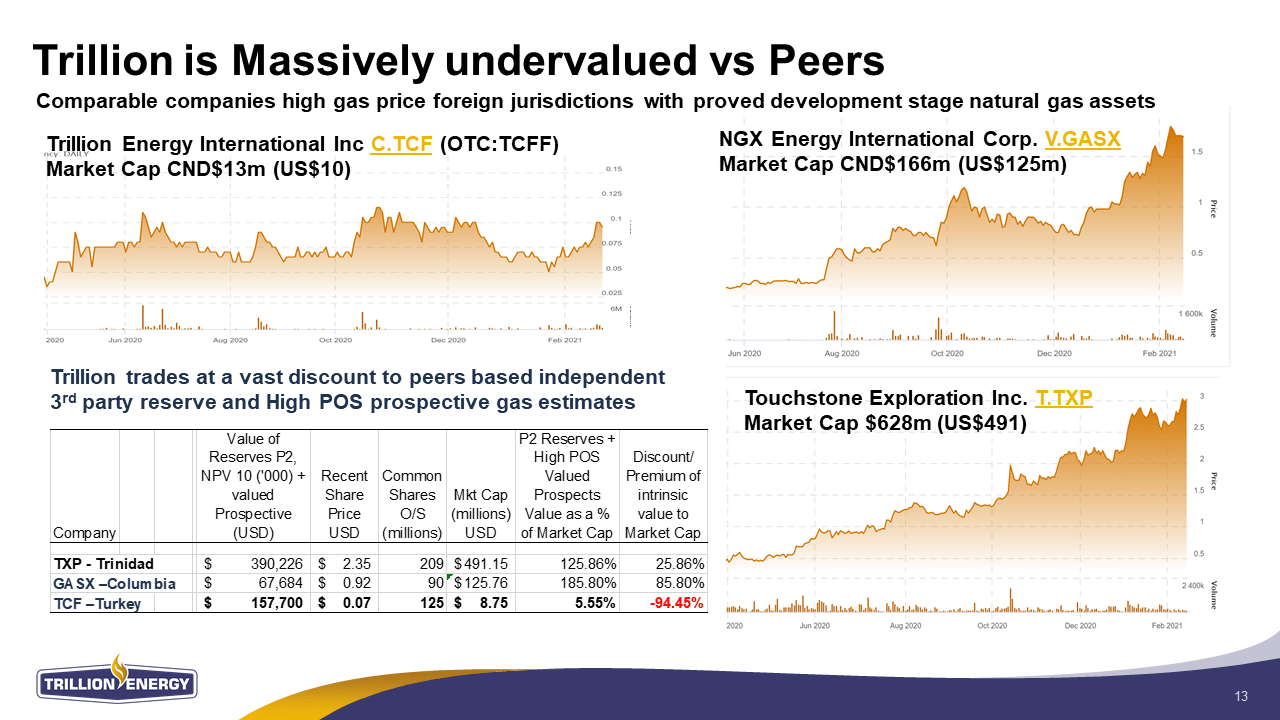

Art said that if he were to sell the project’s production platforms and processing facility for scrap metal it would be worth more than Trillion’s current US$10M market cap. Not only is Trillion’s liquidation value higher than its current market cap but the company also calculates the intrinsic value of its gas reserves at US$1.25/share while shares have only been trading between 6 and 8 cents US per share recently. And to further demonstrate how undervalued Trillion is, Art pointed out that a Columbian natural gas producer NG Energy has less than half of the reserves as does Trillion yet it has a current market cap of US$125M.

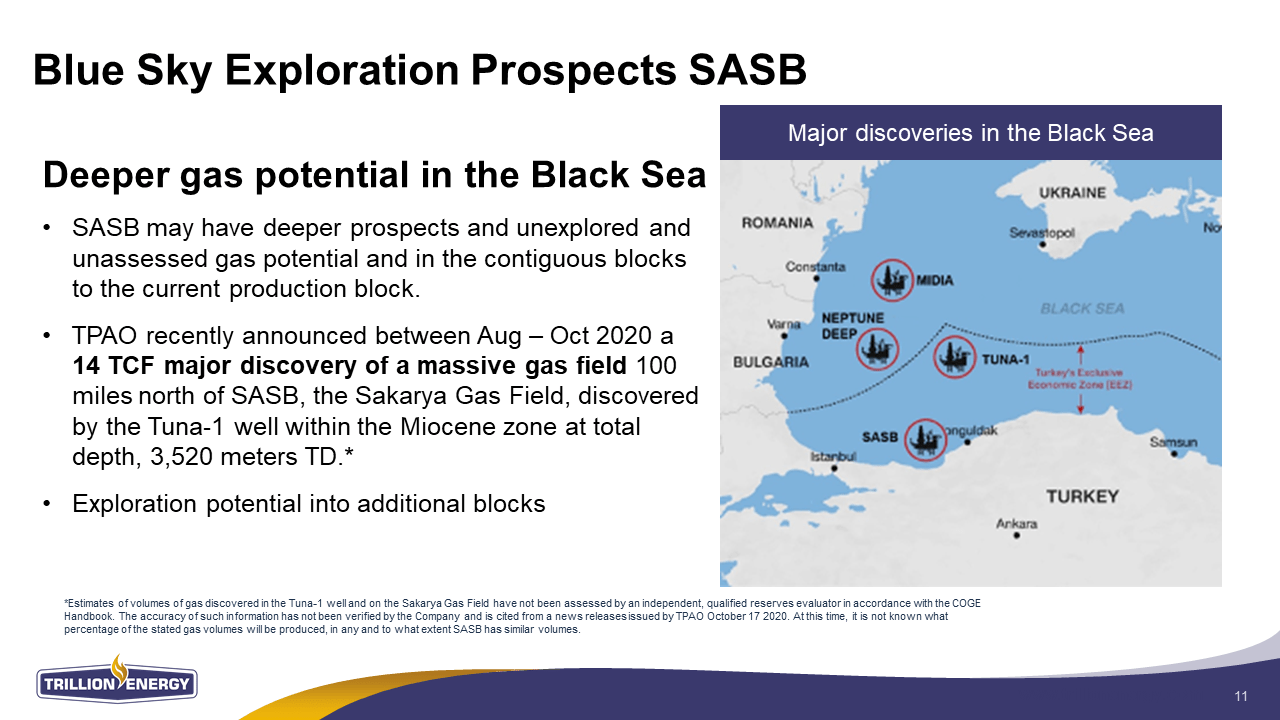

In addition to the clear fundamental value of the company, Trillion has tremendous blue sky potential on both its natural gas and oil license areas. The company’s SASB gas field is located just 100km south of the largest gas discovery in 30 years in Europe and is the only nearology play in the region. Trillion also owns a 100% interest in 42,833 hectares oil exploration block covering the northern extension of the prolific Iraq/Zagros Basin as well as in the Vranino 1-11 block in Bulgaria, a prospective unconventional natural gas property.

Art has already built several successful energy companies. Once such company is Canacol Energy which he co-founded and now has a US$500M market cap as the largest natural gas producer in Columbia. He has a Ph.D in geology and over four decades of experience in the gas and oil business. Art became involved with Trillion four years ago because of the quality of the SASB asset and has never sold even one share. He explained, “I’m going to hang onto my shares until I get the shares up to the value it should be.”

Trillion Corporate Presentation

0:00 Introduction

1:35 Art has already built a US$500M energy company

3:04 SASB flagship gas asset severely undervalued

5:10 TCF has all infrastructure & gas buyer in place

5:51 TCF has cash-flowing oil asset on shore

6:17 US$20M needed to recommence gas production

8:54 Expecting cashflow approx. Aug 2021

9:44 TCF intrinsic value about $1.25 per share

10:41 TCF undervalued relative to peers

12:51 Expected FCF in 2022 is $1.2-$1.8M per month

15:15 Turkey as a jurisdiction

16:03 Turkey NatGas price $6-7 mcf which is higher than North America market

17:32 Plans to list on the London Stock Exchange

18:20 Share structure

TRANSCRIPT:

Bill: Art, please describe your experience in the energy sector and tell us about your last successful company?

Art: I have about 40 years of petroleum experience. I have a Ph.D in petroleum geology. I’ve gone from the juniors, majors to get a good background and then probably the last 17, 20 years mainly on my own or with startups I worked in 27 different countries. And one of the latest, good success stories I have is Canacol Energy in Columbia, which 2007, 2008, I formed with three other Colombians, and currently right now it’s valued at about half a billion dollars and it is the largest gas producer in Columbia. And then I have other successes in Egypt, which was a Rally Energy and Scimitar, that one sold for $600 million. And then there’s some other smaller success stories there. So I have a lot of good experience and been able to recognize undervalued assets.

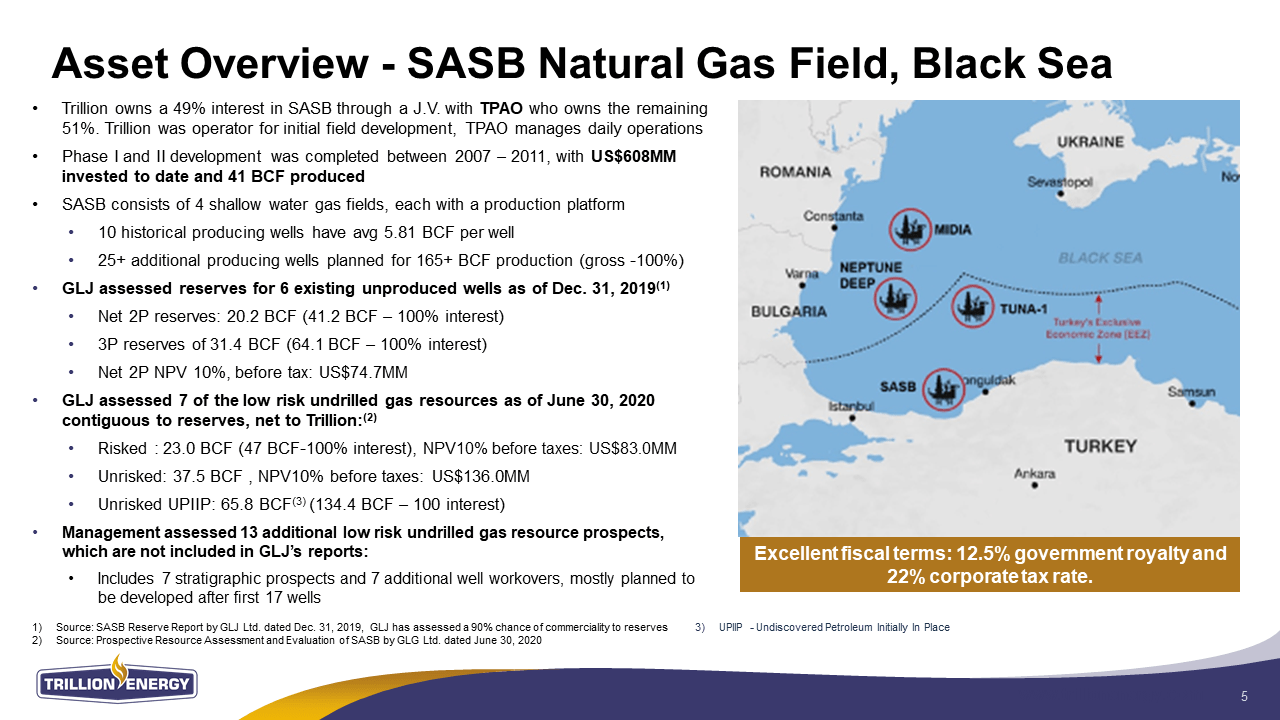

Bill: Your current flagship asset is the SASB gas field in the black sea just off the coast of Turkey. And your current market cap, I should mention, also has been fluctuating between about $9-12 million Canadian, but just on a fundamental basis, walk us through why the company is undervalued because of your flagship asset.

Art: We are a partner in the SASB offshore project in the black sea. It has a value of about $608 million of infrastructure. So four platforms, gathering system, onshore facilities, and like I said, we own 49% of that. In about 2007, 2008, they drilled four gas pools from those platforms and that’s what we’re producing out from. And those are the only four that they have put on production. So it’s from birth to almost the last end of the field’s life. We have four more identical gas pools that have been drilled, tested and mapped, which I can say are identical to the four ones that we produced. And so we can just reach from the existing platforms and put those on production. And because we go from the existing platforms, we will drill complete in a couple of months. And then we put the gas on, and within 45 days, we get our revenue starting to come in through cash. In addition to those four pools which we have a third party engineering report done on, we have six development locations or pools, which are again identical to the four that are produced, and to the four that are discovered but not produced. And with that together, just from the reserve reports and resource reports give us the value of over US$200 million.

Bill: And again, your market cap right now is between CAD$10-12 million. So there’s a disconnect there. You said you own 49%, so you’re half of the sunk costs is over US$300 million. And that’s the platforms, that’s the pipe at the bottom of the black sea, you have a processing facility and you already have an off-take agreement too, right?

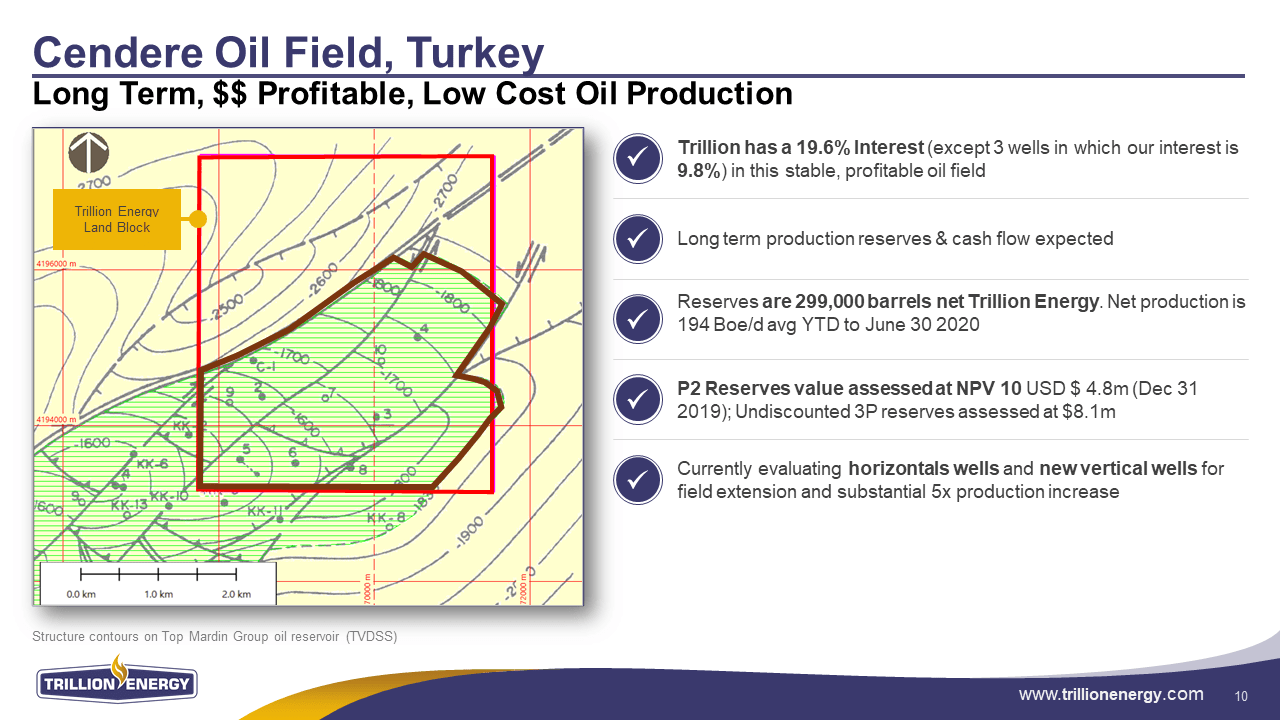

Art: That’s correct. Yeah. And it’s all the gas we produce, they will take it. To put on these other fields, there’s basically no additional facility costs or other infrastructure CapEx, which makes it very, very lucrative for us. And the one thing that I always forget to mention is that we actually have oil production onshore. We produce 155 barrels of oil per day. And that field alone is worth our market cap.

Bill: And what is your net cash flow per year on that note?

Art: For that one there, it’s probably about $2 million a year.

Bill: So with putting this gas field back into production, there is one hurdle. And that perhaps is one of the reasons why you’ve had a lower market cap. You need US$20 million in order to recommence production here, correct?

Art: That’s correct. So the real hurdle that occurred was when we got the field, the data for the gas fields was not up to par and kind of missing. And so to be able to get a security exchange, quality reserve report, we had to redo the seismic, re-look at it, remap it and so on. So that caused us a very big, a good delay. And we had everything ready. We had investors lined up and that was February 2020 and COVID came in. And so then as you know, the petroleum industry kind of ducked its head, and it took for awhile now for us to get things lined up. And so right now we have about US$10 million of equity that small equity banks are willing to put into the company. But for us, the share value is too little, we’re at CAD$0.10 and to put in US$10 million in equity would not be fair to the shareholders that are already in it.

But we are looking at a debt and part of that debt is we talked to now two drilling service companies and we’re getting a complete package. So they will do the drilling, provide the consumables and all the other services so we can see the value of that. And because they know that our four fields that we are going to put on production are a hundred percent there, we’re in discussions of making a payment plan so that we don’t have to come up with all the money up front, that some of the money will come out from future revenue. Which is kind of like a pseudo debt financing or instrument, which then means we can take less equity. And at the same time, we’ve also been approached for a debt-royalty-type instrument. So, that gives us a good choice of what we want to do and the idea is use as little equity financing as possible.

Bill: And how soon this year do you expect to be able to bring in the full 20 million dollars in order to start that countdown to production and cash flow?

Art: Well, again, we could bring in 10 million dollars tomorrow but we don’t want to. But I’d say you’re looking at probably a month to start bringing that money in. And then that means we would be spudding in August for the first well, right?

Bill: So cash flow this year?

Art: That’s correct. And that $20 million is going to give us the $200 million value because not only we will drill the four proven pools and put them on production, we will then with our revenue continue to drill the six development locations or pools. And at the same time, we have another seven exploration that we will be risking.

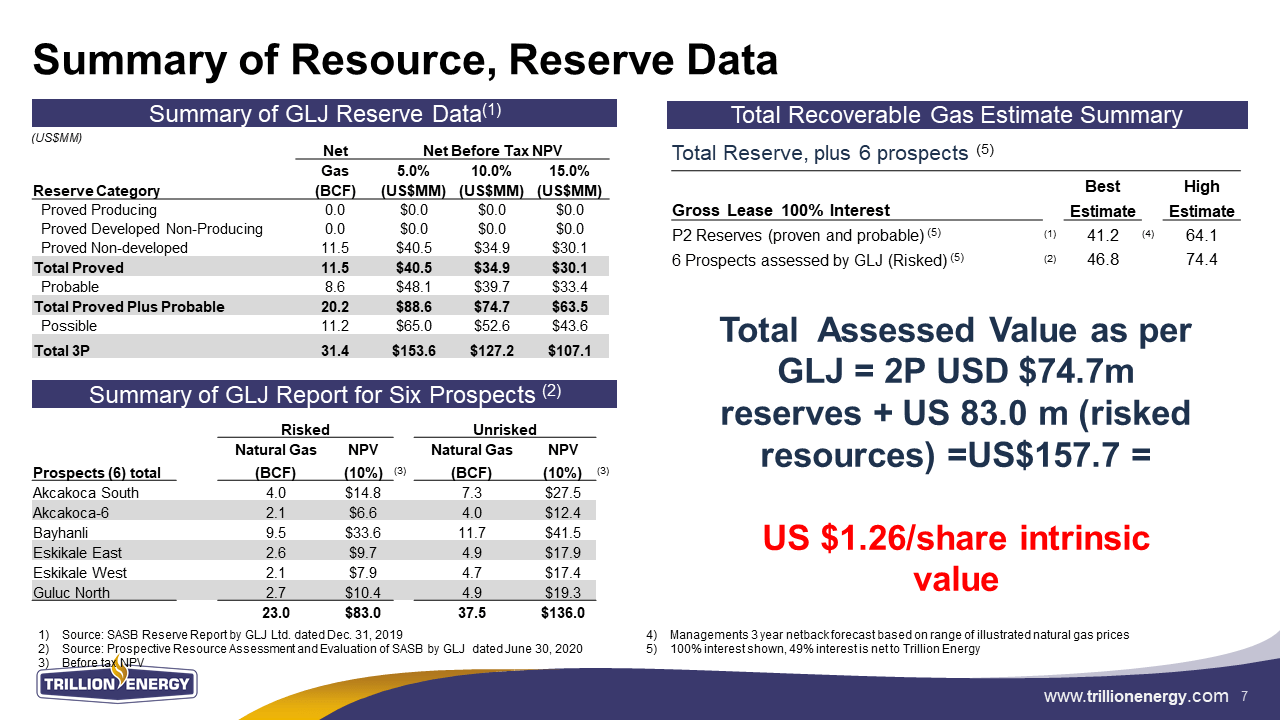

Bill: So what is the intrinsic value just based on the gas reserves that you know you have? Again, your share price is around 10 cents Canadian now, but what’s the intrinsic value as you calculate it?

Art: It’s about a buck and a quarter.

Bill: And could you elaborate a little bit how you got to that conclusion?

Art: So that would be with the 2P reserves. So that’s the reserve, they’re a hundred percent sure. And then we call them prospects but they’re not really prospects, they are actually development wells. And so they are bolted limbs of existing pools and they have about a 80-90% chance. So we risk it with that. That’ll be $83 million. The 2P is $74 million, and then with our share float, that gives us about a $1.25 value per share.

Bill: Art, so one of the most compelling points when we originally talked, you pointed out to comparable companies and their market cap relative to your $10 million U.S. market cap currently. Can you talk a little bit about these two companies and why you see yourself trending towards their market cap?

Art: Well, for NG Energy, the market cap is about US$125 million and then for Touchstone Exploration, it’s about US$491 million. And they’re comparable and they have roughly the same reserves as we have, and they’re also gas producers. And we’re at about, like you say, US$8-10 million, so we should be in roughly the same ballpark.

Bill: And they went up significantly over the last year, I think we should point out too, right? Their re-rating occurred over the last 12 months.

Art: That’s correct. And I think for Trillion, we just have not got our message out, right? So I also like to say that our market cap, if you remove the oil, which is about four or five million dollars, I can get more for the scrap metal on the offshore platforms and the facilities than what our market cap is worth. And the other thing about Trillion is that, what I always tell everybody, I’m a geologist but I don’t mention geology in this because I don’t have to complicate it with anything other than if you can think of cars. So we have 14 cars, they’re identical and we’ve driven four cars. We bought them, we have driven them from the beginning to the wrecking yard. We have another 10 cars identical that we have parked in the garage. And that is what we have, we have four proven, drilled pools that are not produced. Six more development pools that are identical to the four that we’ve already done. So there is no mystery, right?

Bill: And just to put things in perspective again, because this is what sold me on the company. In 2022, if you’re successful with this plan, what will your free cash flow be?

Art: So our free cash flow will be between 1.2 to 1.8 million dollars per month. The rig companies and so on are actually looking at us to say, okay, they don’t mind if we make payments after the project is finished drilling, right?

Bill: And so in two years if you’re successful and you build out, your cash flow I understand is even going to increase beyond that.

Art: Yeah, that’s correct. So I always talk about the reserves first, and then we have the prospects, the development locations. But there are other ones that we’re working on, that’s got another seven. When you look at our presentation, we have the tail going down, well, we’re not going to have that steep of a decline because there are additional prospects that are there. And then getting back to the new discovery that they have. So TPAO or the Turkish government has made one of the largest discoveries in Europe in the last 30 years. And that’s North of our block, and it’s like 14 TCF. What that tells us is that there is a lot more gas being generated in the source rocks and migrating into traps and so our block now we’re looking not only for the pools, like I say, the cars that we have already defined, we are looking at a deeper potential.

And we’re also looking at the similar type cars around our block, which are contiguous because nobody can compete with us. And we’re looking now at larger, more, I would say blue sky, but they’re a lot larger, bigger hitting gas targets that are not necessarily on our block but nobody could compete with us because we have the infrastructure. But we are now looking at them with the fact that there’s a lot more gas being generated in the black sea than what was thought before. And we are the only public company that is producing in the black sea on the Turkish side.

Bill: One of the first objections I had for you when we first spoke was the fact that the jurisdiction is Turkey. Could you share with my listeners, why you think that could actually be an asset not a risk?

Art: So our royalty is 12.5% And corporate taxes is 22%. We won’t be paying corporate taxes for awhile because of the amount of investment that we have. And for the 12.5% royalty, that’s a really good fiscal regime. And we’ve been producing there since 2007. We’ve never had an issue. We’ve always got our money and the royalty has never changed.

Bill: And relative to North America, you actually make more money for your product too.

Art: Yeah, that’s correct. So we’re getting $6 to $7 an MCF, and it’s been like that for probably six, seven years. And it’s projected to be roughly the same in the future. And the reason is they import 99% of their gas and we are a domestic producer, so we get the same price as what they pay for their gas.

Bill: And the fact that your JV partner which owns 51% of the project is a state-owned company, that’s actually a security feature for this project too, isn’t it?

Art: It is because it gives us a scale that we could never actually have, because you have this huge company. So we get services, nobody is going to make an issue with the gas contract because the people who buy the gas must buy it also from the government, and so things are pretty stable. They also look to us to operate and drill the off shore because our staff in Turkey are the only ones that have the expertise in this depth of water in the offshore in the Black Sea. And the thing that also people don’t realize is, we have four production platforms offshore with all the gas facilities and everything.

Bill: You currently trade on the CSE in Canada and on the OTC in the States, as you bring this into production and you really start to generate cash flow, are there any plans to upgrade possibly what stock exchanges you trade on?

Art: We are actually looking at the London exchange. We see ourselves as a low-risk, or de-risked gas producer because that’s a good niche now to be in that in Turkey and so on, because they need the gas. And so we’d like to grow in Turkey and also there’s other opportunities in some of the Eastern European countries, and London has more of an investment appetite for those areas.

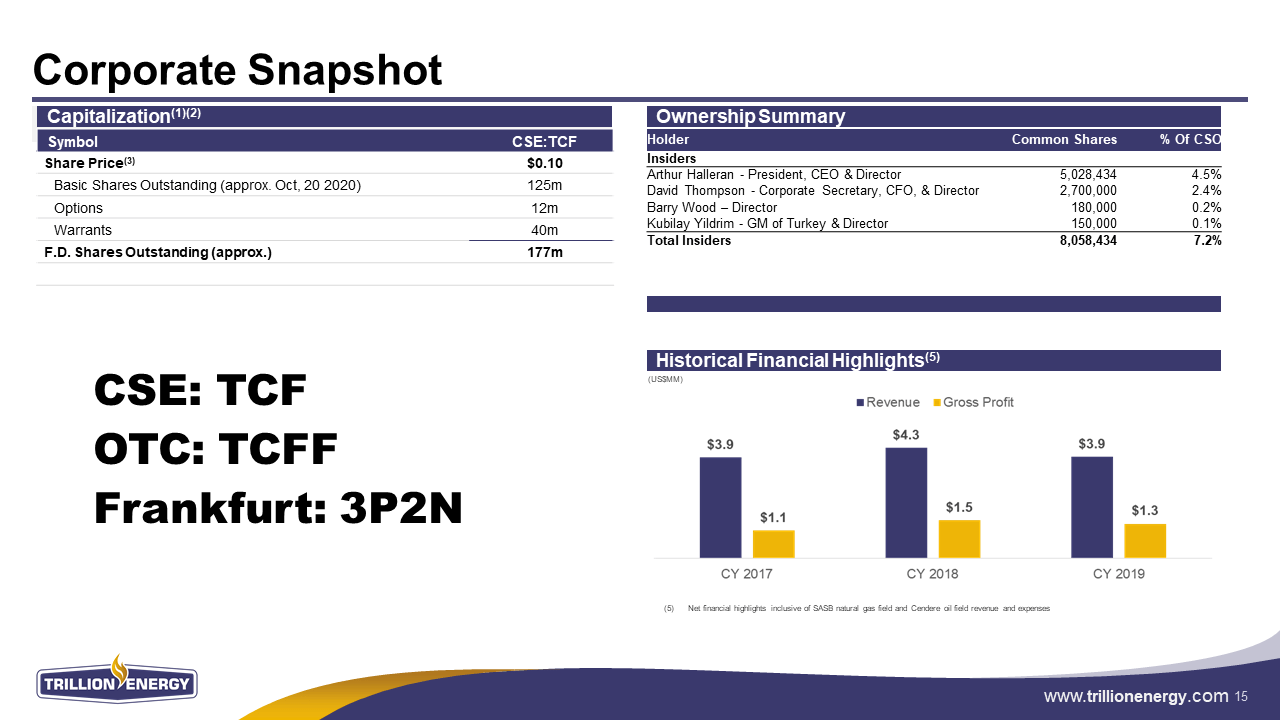

Bill: What about your share structure. Talk to us about the current share structure of the company please?

Art: Let’s see, probably about six to ten percent is owned by insiders and the rest are out in the public there. And also for myself, I’ve been involved in the project now for almost four years, and I have not sold one share. I’ve hung on to them all the time, because I see that there’s a good upside value in this. And the reason again, when you talk about Canacol Energy or when you talk about Rally Energy and Scimitar in Egypt, and now you talk about Trillion, what attracted me to Trillion Energy was the asset, right? And the asset is always there, it’s very, very good asset. And so I’m going to hang onto my shares until I get the shares up to the value it should be.