US Markets Stall Near End Of July As Global Markets Retreat – Are We Ready For An August Surprise?

One thing that seems to be certain in the markets right now is the past hyper-bullish trending which appears to have weakened since early 2021. As a result, the longer-term Custom Indexes we use to help gauge and understand market trends are showing a very clear weakening of trends.

In this article, we are going to review three of our custom index charts on a weekly chart basis, the Custom US Stock Market Index, the Smart Cash Global Market Index, and the Custom Volatility Index. Each of these charts highlights something unique related to current market trends.

Use this information to read between the line and to help establish your own expectations for the markets going forward. We’ll provide our conclusion near the end of this research article.

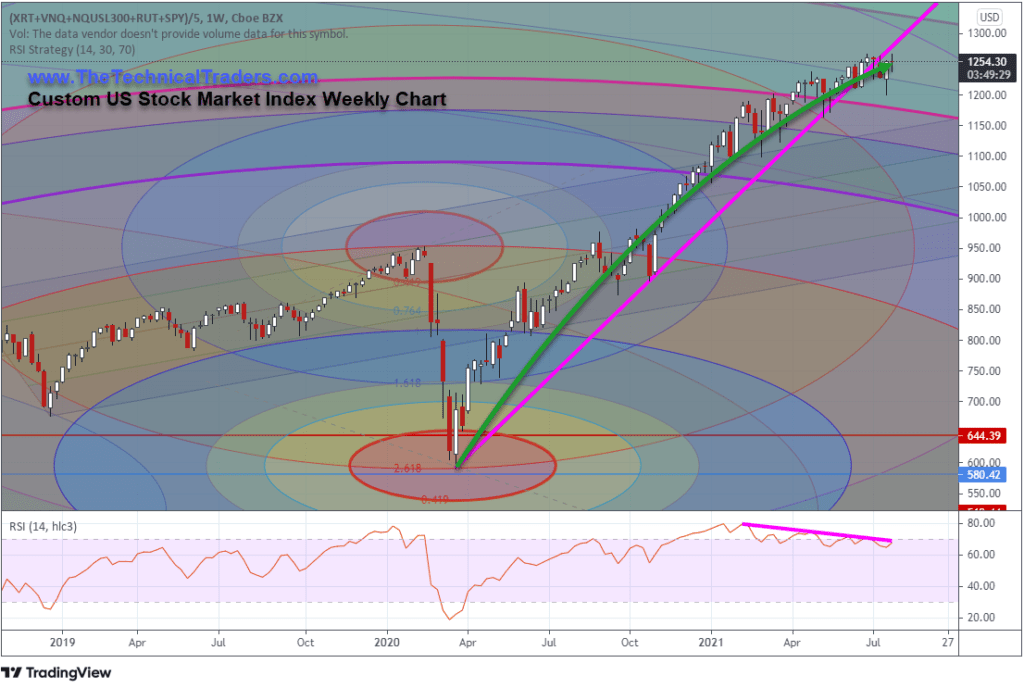

Custom US Stock Market Shows Divergent Market Trends

This Weekly US Stock Market Index chart highlights the rally from the November 2020 election into the start of 2021. After that peak is reached in late February, one can clearly see the divergence on the RSI indicator. Below, those trends counter to the moderate price rally phase on the chart. We believe this divergence is essential after such a strong rally and may be setting up a market base/momentum base where price may attempt another rally in the near future.

As of right now, we have not seen a breakdown event on this weekly chart, although one may take place before any new rally attempt starts. What we are seeing is a decidedly weaker price trend and a consolidation phase in the markets after the hyper-bullish rally phase of the past 15+ months.

Sign up for my free trading newsletter so you don’t miss the next opportunity to learn more!

The breakdown of the upward price trend, below the MAGENTA trend line, is a bit concerning, but overall the markets have not shown any extreme weakness yet and may continue to push higher after a brief consolidation/basing setup.

Still, traders and investors should be somewhat concerned that any breakdown in price may prompt a -13% to -18% pullback – targeting the $1025 level on this chart.

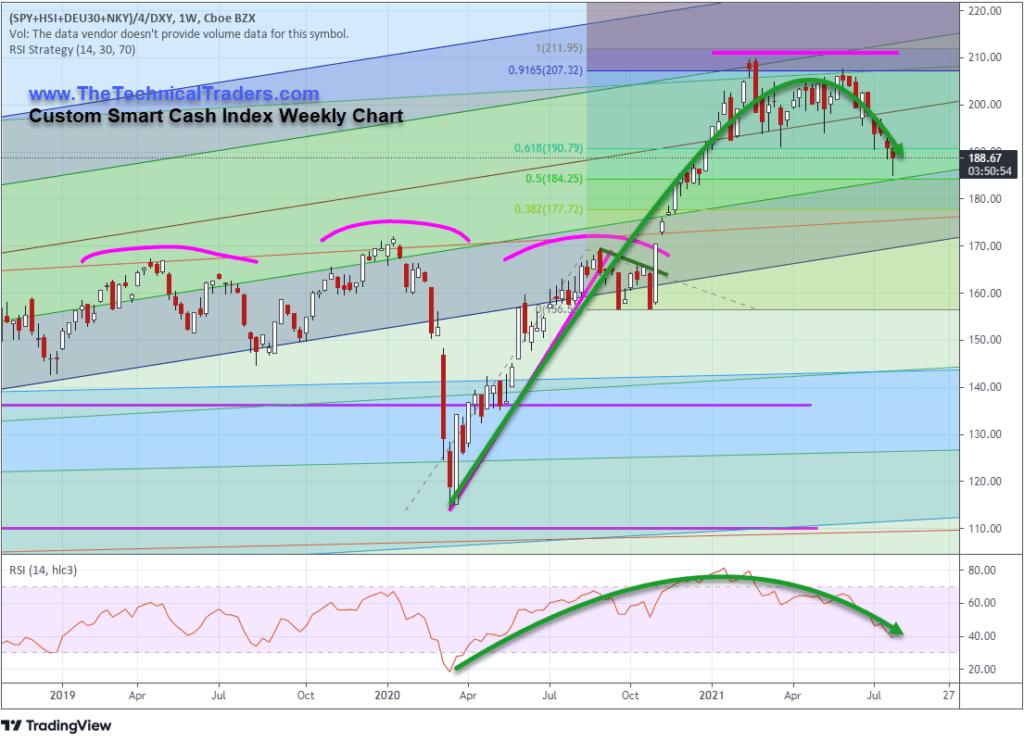

Global Market Trends Decidedly Weaker Than The US Markets

This Custom Smart Cash Index Weekly Chart is more global market-based, including the SPY, DAX, Hong Kong, and Hang Seng Indexes. This chart is used to show us how the global markets are reacting to market trends while attempting to balance US market activity and US Dollar strength. What we can see from this chart is that the Custom Smart Cash Index has rolled sideways after the February 2021 peak and has recently started to break downwards near the end of July 2021.

This extended 4+ month sideways price channel suggested the global markets failed to continue to rally as the US markets did from February through July 2021. This breakdown in trending between the global markets and the US markets suggests foreign markets are starting to retrace much more than the US markets are.

This suggests the Foreign markets are starting a mid-year price correction that may continue to move lower and attempt to target the $160 to $175 level before finding support. If this happens, the US markets may eventually break lower and attempt to follow the foreign markets downward as a moderate contraction event (reversion event) takes place after the strong bullish rally from the March 2020 COVID-19 lows.

An interesting component of the global market trends is setting up that also took place in July/August 2015, February 2018 through almost all of 2018, February 2020 (just before COVID hit), and now. If this setup is valid, as it has been in the past, then the US markets are likely going to enter a period of sideways, possibly downward, price trending fairly soon if the Custom Smart Cash (global) Index continues to fall.

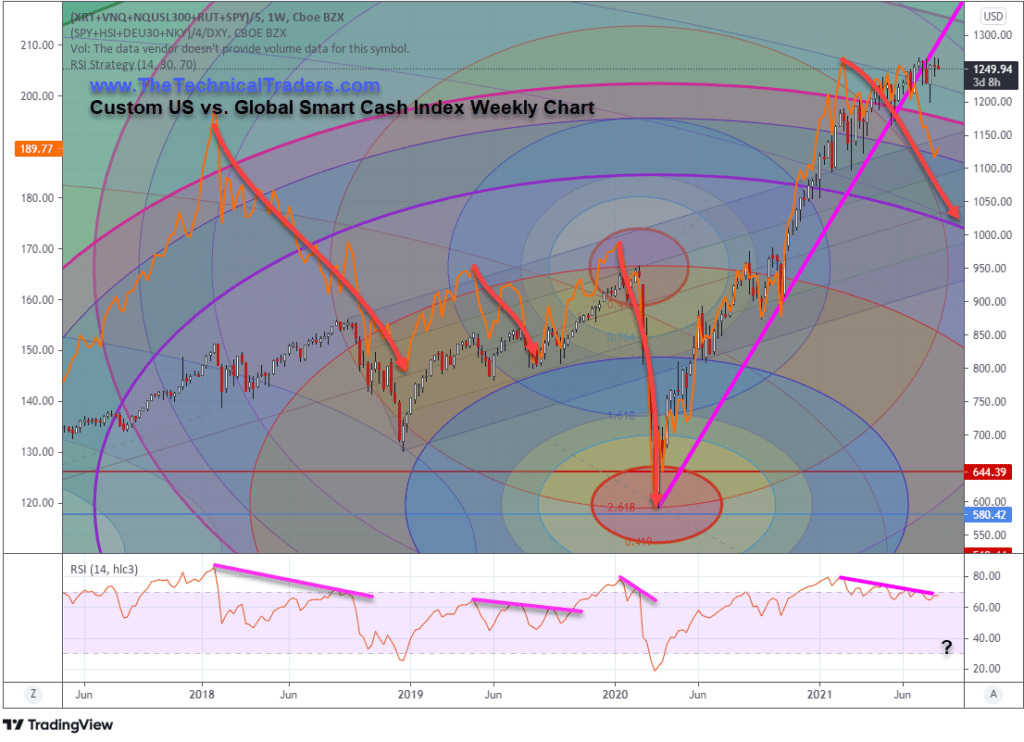

Combined Custom US & Smart Cash (Global) Index Weekly Chart

This combined Custom US & Smart Cash (Global) Index Weekly chart paints a very clear picture of the type of technical price pattern that is currently unfolding. The ORANGE line on the chart is the Custom Smart Cash (Global) Index Weekly data. The Japanese Candlesticks are the Custom US Index Weekly data.

What we’ve attempted to show you on this chart is how the Custom Smart Cash Index tends to break downward many weeks, or months, before the US market begins a move downward or sideways. For example, in early 2018, the Smart Cash Index peaked and rolled downwards while the US market entered a period of extreme volatility. The Smart Cash index continues to move downward while the US Market Index recovered. Until September 2018, when the US markets broke strongly to the downside as the US Fed pushed rates just a bit too far.

With the Custom Smart Cash (Global) Index moving decidedly lower recently, and really starting to break downward, are we nearing a reversion event in the US market? Have the markets transitioned away from the hyper-bullish trending phase and started a new phase of price trending that traders/investors are unaware of?

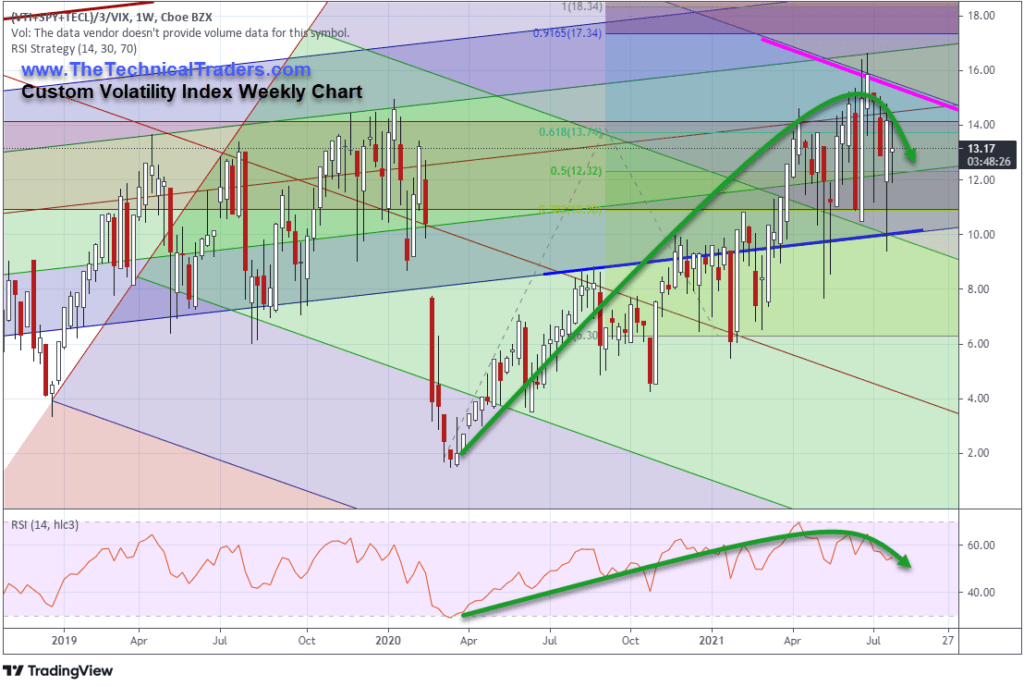

Custom Volatility Index Suggests Extreme Overbought Levels Have Been Reached In April/June 2021

This Custom Volatility Index Weekly chart shows how the markets rallied after the November 2020 US elections, through the reflation trade expectations, and pushed even higher in early 2021. The Custom Volatility Index chart peaked in April 2021 and peaked even higher in late June 2021. These peak levels, above 13.5 to 14.0, are historically very high overbought levels on this chart. Whenever the Custom Volatility Index reaches levels above 11 or 12, a moderate price peak usually sets up within a few days or weeks.

There was only one other time in recent history where the Custom Volatility Index level closed above 14, and that was January 2020, the peak price level just before COVID-19 hit the markets.

The most recent Custom Volatility Index highs, above 15, are the highest levels printed on this chart over the past 20+ years. They represent extreme overbought market levels and the Custom Volatility Index has already started to move downward from these peaks.

A move on this Index below 7~8 would represent a fairly strong downside price correction – representing a possible intermediate bottom setup.

A move below 5~6 on this Index would represent very strong selling, likely pushing the markets into a moderate downside price event that may last many weeks or months.

Our research has not confirmed any bearish price setup or any immediate actions to take related to the potential for a peak or rollover price event based on these charts. Our research suggests the US markets may continue to “melt upward” for a period of time as global investors pour into the US equities markets in search of profits and safety. Yet, underlying all of this, we still see some warning signs that the markets are starting to diverge in a way that is somewhat similar to past breakdown events with the Custom Index charts.

We are attempting to present this information so you can become better prepared for the potential price swings related to this type of reversion event and attempt to protect your open trades before any volatility event takes place. There are going to be some really big price swings taking place over the next 24+ months. Make sure you are prepared to profit from these big events. Don’t let yourself get caught in these next cycle phases unprepared.

Want to know how our BAN strategy is identifying and ranking various sectors and ETFs for the best possible opportunities for future profits? Please take a minute to learn about my BAN Trader Pro newsletter service and how it can help you identify and trade better sector setups. My team and I have built this strategy to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the BAN Trader Pro system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

As something entirely new, check out my new initiative URLYstart to learn more about the youth entrepreneurship program I am developing. This is an online program of gamified entrepreneurship designed to introduce and inspire kids to start their own businesses. Click-by-click, each student will be guided from their initial idea, through the startup process all the way to their first sale and beyond. Along the way, our students will learn life lessons such as communication, perseverance, goal setting, teamwork, and more. My team and I are passionate about this project and want to reach as many kids as possible!

Have a great day!

Chris Vermeulen

Chief Market Strategist