Gold Price Flag Suggests A Big Rally May Start Soon

As precious metals traders have waited out this extended sideways/downward price contraction in price over the past 14+ months, a very broad Pennant/Flag price formation is nearing an APEX level which suggests Gold may begin a new rally phase over the next 60+ days. Support near $1675 is a critical price level that has been tested three times over the past 8 months. The true APEX of the Pennant/Flag price formation will be reached near November 15, 2021 – nearly 30 days before the US Debt Ceiling issue will become another big issue in Washington DC.

Gold Price Flag Initiated After The $1675 Level Based In March 2021

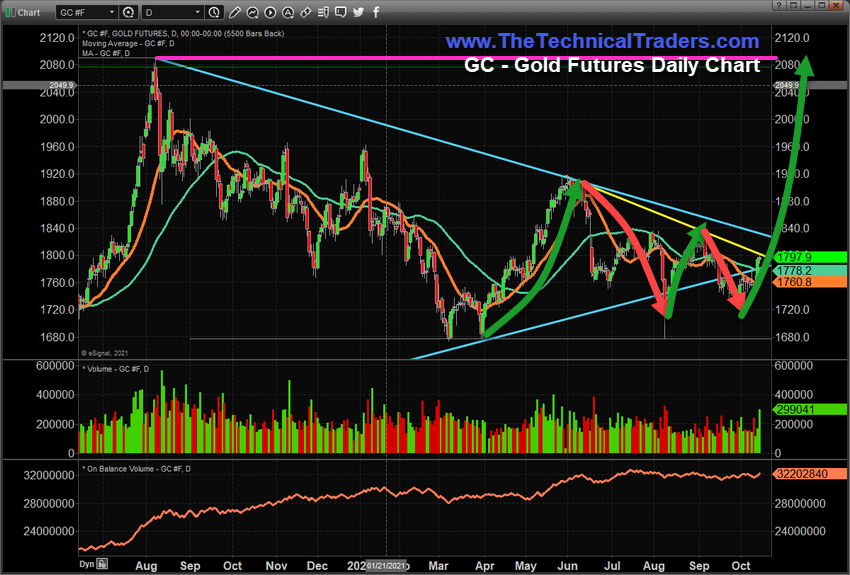

Let’s start with this Gold Daily Chart. I’ve drawn an upper line from the peak price level, in August 2020, across the recent highs in June 2021. Additionally, I’ve drawn a lower line from the lows near September 2020 across a series of price levels that are acting as support. These two major price channels have converged into a Pennant/Flag type of price formation recently.

The unique price lows near March 2021 first identified the $1675 price support level. I believe the downward price trend from August 2020 to these lows in March 2021 represented a downward price wave/phase for Gold. I also believe the recent upward price rally, after the March 2021 lows, and subsequent retesting of the $1675 level while the Pennant/Flag price pattern setup reflects a sideways price flag that is currently nearing the APEX level.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

The APEX level of these types of price flags typically suggests a potentially explosive price trend will initiate – possibly equal to the range of the Price Flag Range – in this case, more than $250. The current Price Flag APEX level in Gold is near $1800. A rally of $250 or more from this level would push Gold up to levels near $2100 or higher if my research is correct.

$1675 Must Hold In Order To Prompt A Bigger Price Rally In Gold

As the current Pennant/Flag price formation in Gold nears the APEX level, it is important to understand that increase price volatility will happen and there is a possibility that another downside price rotation, possibly nearing $1675 again, could take place. It is important that the $1675 level continues to hold and act as support if this happens. If the $1675 level is breached, then the critical support level for Gold has been broken – which may suggest a deeper downside price move is possible.

In my opinion, I believe Gold will attempt to settle between $1700 and $1860 over the next 4+ weeks as we move closer to the November 15, 2021, True APEX date. The closer we get to that date, the more likely we are going to see increased price volatility in Gold, and a potential for a breakout price trend.

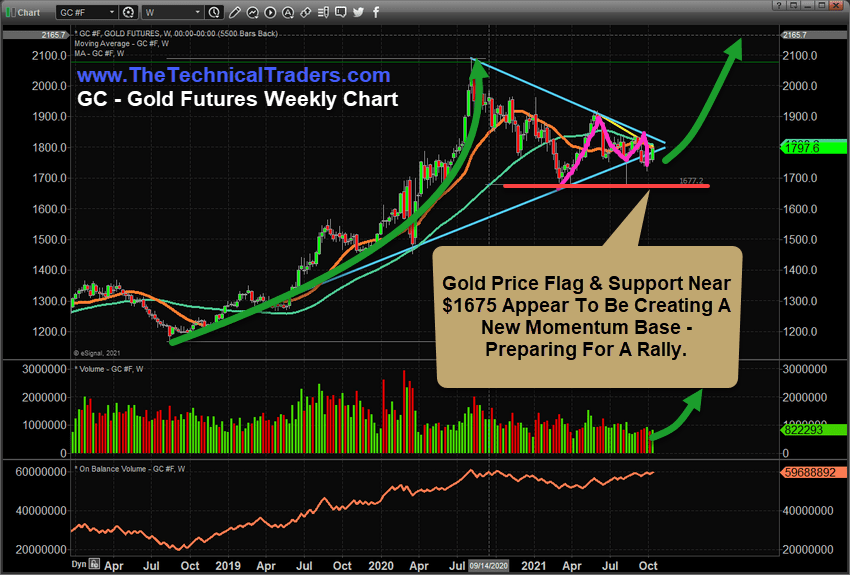

The Pennant/Flag formation, which I’ve drawn in Magenta on the Weekly Gold Chart below, has already completed four of the five total price waves. The 5th wave, in this structure, appears to be a bullish price breakout wave. This, along with what I believe will likely be an increased overall caution in the markets throughout Q4:2021 and into early 2022, will push Gold higher as traders move to hedge risks.

I wrote about the broader market trends and price patterns in May 2021. At that time I suggested a Momentum Base appeared to be setting up which could confirm the larger Appreciation/Depreciation market cycles. This research article was created before the current Pennant/Flag price formation started to form. Overall, the Momentum Base level in Gold is still valid and the new Pennant/Flag pattern suggests we are nearing a big breakout/breakdown trend in Precious Metals.

- May 16, 2021: GOLD APPEARS TO BE STAGING NEW MOMENTUM BASE IN PREPARATION FOR A BIG UPSIDE MOVE (PART II)

Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may start a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.

Please take a minute to visit www.TheTechnicalTraders.com to learn about our Total ETF Portfolio (TEP) technology and it can help you identify and trade better sector setups. We’ve built this technology to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the TEP system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

Chris Vermeulen