The Greatest/Biggest Asset You Own May Be Under Pressure Soon – Real Estate

Real estate is one of the biggest investments of our lifetime. It’s one of our best assets but there will be times when it does very well, which we’ve recently seen, and there will also be tough times when real estate can be dormant. There will come a time where there will be better places to focus our time and capital.

In this report, I’m going to cover the real estate sector, ETFs, interest rates and the long-term trends, and the short-term bias of the real estate market.

Watch Video Report Version here

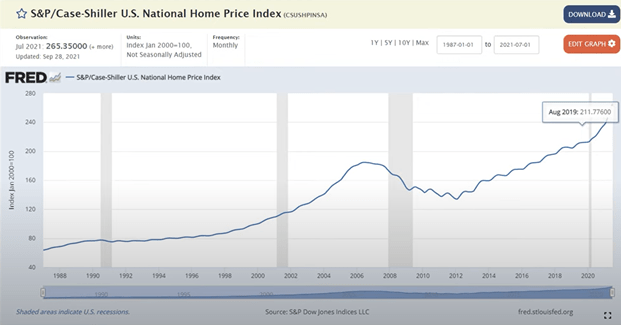

FRED ECONOMIC DATA CHART

This is the national home price index going back to the mid-80s. On average we all know that real estate is a long-term investment and that if you hold it long enough it should rise in value. The chart shows some great appreciation since the year 2012 and the COVID-19 has created a strong increase in home values, which I believe will become the tipping point for the real estate market to top.

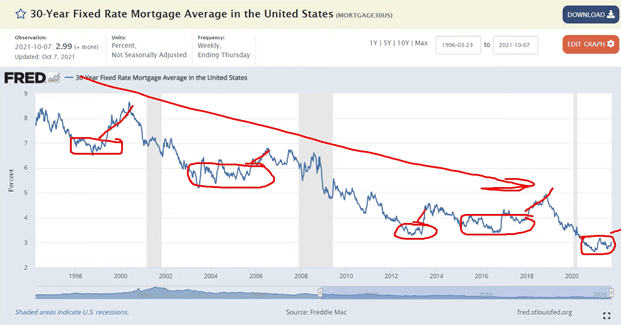

FRED 30-YEAR FIXED-RATE MORTGAGE

The 30-year fixed-rate mortgage is showing a bottoming pattern here. In fact, based on the technical analysis, it looks like it’s building a base and is primed and ready to start to rise. When people get nervous about things, we can see interest rates begin to move up.

If we look at the longer-term chart for this, and we can see the type of price action going on. Notice the similarity between the year 2020 and the years between 2015-2018 where there is basing formation before the price starts to rally higher.

After a long downward trend in rates, it can resolve in a strong pop and rally. Currently, rates have been falling for a long time. We could see rates start to move up, and because there’s a lot of leverage in the real estate market, when rates move up, even just a little, it causes quite awake in real estate prices.

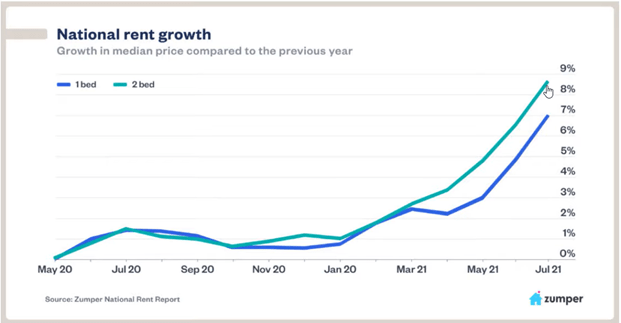

NATIONAL RENT GROWTH

Normally, people need to renew their mortgages every 3-5 years. So when interest rates increase so do the carrying costs of owning real estate. When this happens, the owners require more capital and will need to increase the rent for tenants and/or put more money down towards their homes upon renewal. When financial requirements cannot be met, this is when we start to see more homes come up for sale as individuals downgrade and start to deleverage. Rising rates and more strict requirements are the early signs of a weakening real estate market.

The chart below shows the rent from May 2020 to July 2021. This shows the one and two-bedroom rent increases of about 7%-8% in just one year.

The NARADA REAL ESTATE INVESTMENTS REPORT talks about many areas having 20% gains. We see inflation in rents, but also groceries, electronics, vehicles, travel, etc. Unfortunately, incomes levels haven’t increased much making it difficult for most people to afford the increase in living expenses.

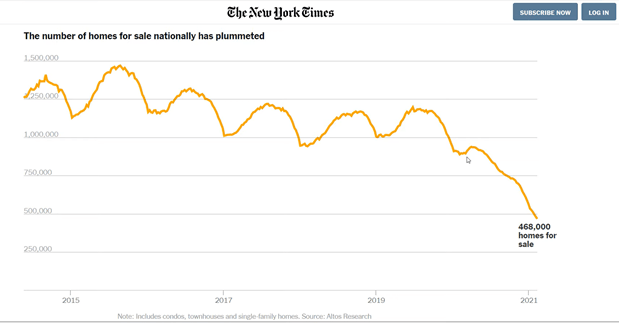

NUMBER OF HOMES FOR SALE NATIONALLY

This is the number of homes for sale nationally which has plummeted from 2020. What this is telling us is that there are not many homes for sale. As uncertainty rises and home values rise, people are holding on to their biggest and best asset and don’t want to sell.

Since nobody wants to sell their homes, but the population continues to increase, the law of supply and demand drives the price higher.

Source: https://www.nytimes.com/2021/02/26/upshot/where-have-all-the-houses-gone.html

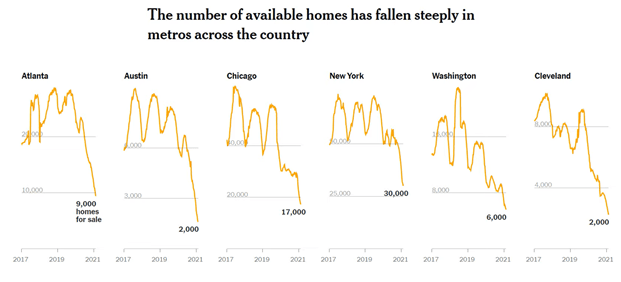

WHERE HAVE ALL THE HOUSES GONE?

This report from The New York Times is telling us the number of homes available has fallen steeply in Metro areas across the country. You can see that from COVID-19 beginning in March until now; there is this huge outside, the norm, kind of deviation of no one wanting to sell their homes.

As with any big move outside of a standard deviation, eventually, there will be a revert to the mean type of move. 1-3 years from now, I would expect the market will be flooded with homes for sale because as the economy will be weaker, mortgages will be up for renewal, and financing will be very tough to get. As my dad always said, you can’t have great times without some tough times – and they will happen!

Source: https://www.nytimes.com/2021/02/26/upshot/where-have-all-the-houses-gone.html

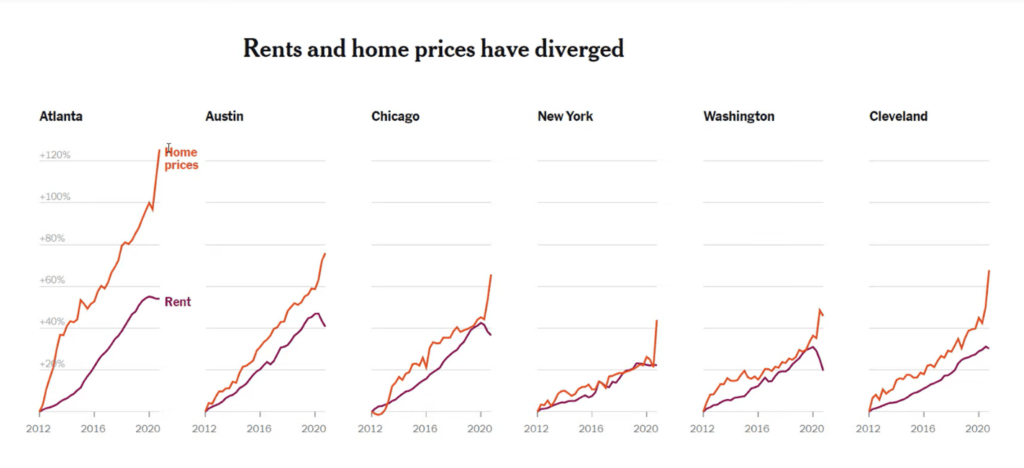

Moreover, in this report, we see the higher home prices also start to result in increased rents. Since people are not willing to pay these skyrocket rents because they cannot afford them, rents actually start to move downwards.

The divergence in the chart below is an early warning sign indicating that housing prices keep going up while rents are falling. People aren’t willing to pay the higher rents, so the rising home prices, which require higher rents to cover the mortgage and carrying costs, will eventually stall and start to decline. This extra-strong price appreciation in homes is typical of what we see just before a major market top and is what the analysis is indicating.

The housing market can be dormant and slow-moving for long periods of time. But then suddenly experience massive surges of appreciation. This is what we have just experienced over the past year.

The housing market could be under pressure and give back many gains and become dormant for several years. The strong home price surge while rents decline is a leading indicator that the real estate market rally is coming to an end.

Source: https://www.nytimes.com/2021/02/26/upshot/where-have-all-the-houses-gone.html

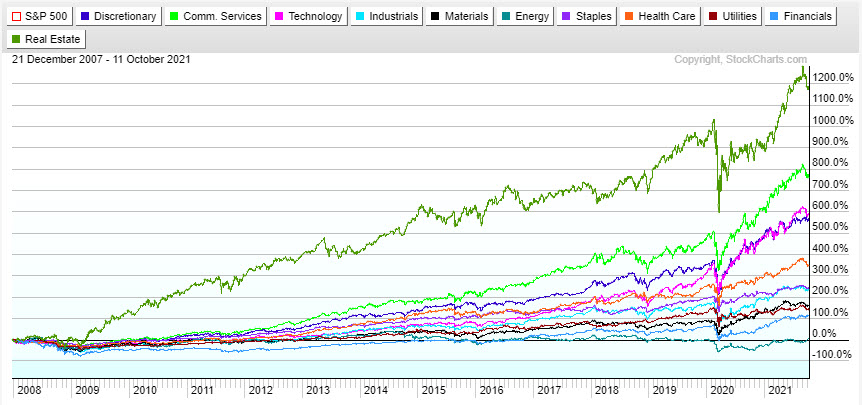

If we were to look at real estate as an investment by sectors and asset classes, real estate is the clear leader. The top green line is the real estate ETF. It has just continued to chug its way higher with a series of pauses and rallies since 2007.

IYR, IShares U.S. Real Estate ETF Daily Chart

The IShares U.S. Real Estate ETF seeks to track the investment results of an index composed of U.S. equities in the real estate sector.

The type of reversal that we see on this chart now usually happens at short-term market tops. These sharp initial pullbacks in price have happened repeatedly on this chart. Will real estate have a quick pullback and pause, or will it last many months or longer, that is the big question right now.

CONCLUSION

Almost every wealthy individual or retiree that I have spoken to when asked what their best investments were and how they gained most of their wealth, say real estate.

Since I was a kid, my father always told me to buy my first house as soon as I possibly could. Then, go out and buy another, and another, etc. Hands down, it is one of the easiest ways to leverage your money and get paid to own assets that are increasing value.

My first home was a small 1014 sq subdivision home I bought with my wife. Now, we have over 75 tenants (income streams). It’s absolutely amazing the power of real estate and the low, near-free money to borrow and leverage.

Just be sure you never get overextended and can cover your carrying costs if the world was to fall apart for 1-2 years. Improperly managed real estate/leverage can ruin you financially, your relationships, and your partnerships.

If you would like my daily, weekly, and monthly trading and investing ETF signals so you can grow your wealth, join me at TheTechnicalTraders.

Chris Vermeulen

Chief Market Strategist

www.TheTechnicalTraders.com