What Market Trends Will Drive Through To 2022?

Some interesting facts related to market trends and the global economy have come into play recently. After the COVID-19 virus event began, global central banks entered a phase of extended easing. This move was an attempt to transition through the economic concerns related to the immediate shutdown caused by COVID-19. These actions have translated into a new phase of market trending where the Consumer became hyper-active in the global economy while inflationary trends were somewhat muted.

COVID Shifts Global Market Cycles Into Faster & Broader Trends

Now that inflation is starting to rise, we may transition away from consumer and speculative market cycles. Over the next 6 to 12+ months, the markets may shift into a late-stage Bullish rally phase. My opinion is the COVID-19 virus, and economic event process has resulted in a speedy, possibly 24 to 36 month, extreme cycle phase.

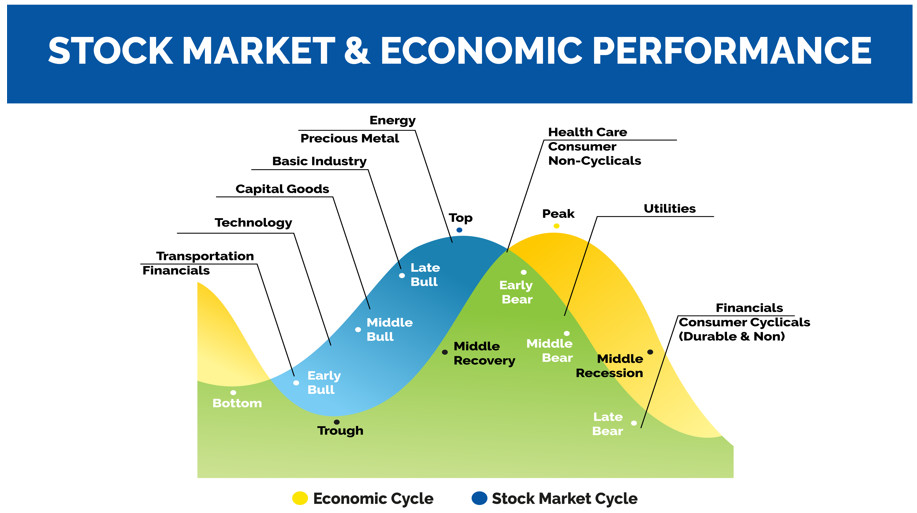

Take a quick look at the Stock Market & Economic Performance cycle example below. We can see that Financials/Transports, Technology, and Capital Goods usually lead a market rally after a bottom in cycle trends. This trend is generally followed by a rally in Basic Industry, Precious Metals, and Energy before we near a peak level in the stock market.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

What has happened in the US since COVID-19 hit is vastly different than this cycle presents. First, consumers shifted away from metropolitan areas. This move started driving up Real Estate, Consumer Goods (Technology), Automobiles, and Capital Goods prices as they relocated and settled. Then, as supply chains slowed down and lock-downs persisted, consumers shifted gears again and began to alter spending habits, anticipating a longer-term COVID-19 recovery.

This shift in spending and earning prompted many retail investors and consumers to focus on the incredible price trends in the US stock market in late 2020 and early 2021. I’m sure you remember the “Reddit Rallies” that set the stock market on fire in January 2021? While many consumers could still earn and save because of the COVID-19 lock-downs, the shift in working schedules allowed many to become traders. This surge drove an incredible rally in the US markets over the past 12+ months.

2020~2022 Hyper-Cycle Event May Be Shifting Into Autumn/Winter Soon

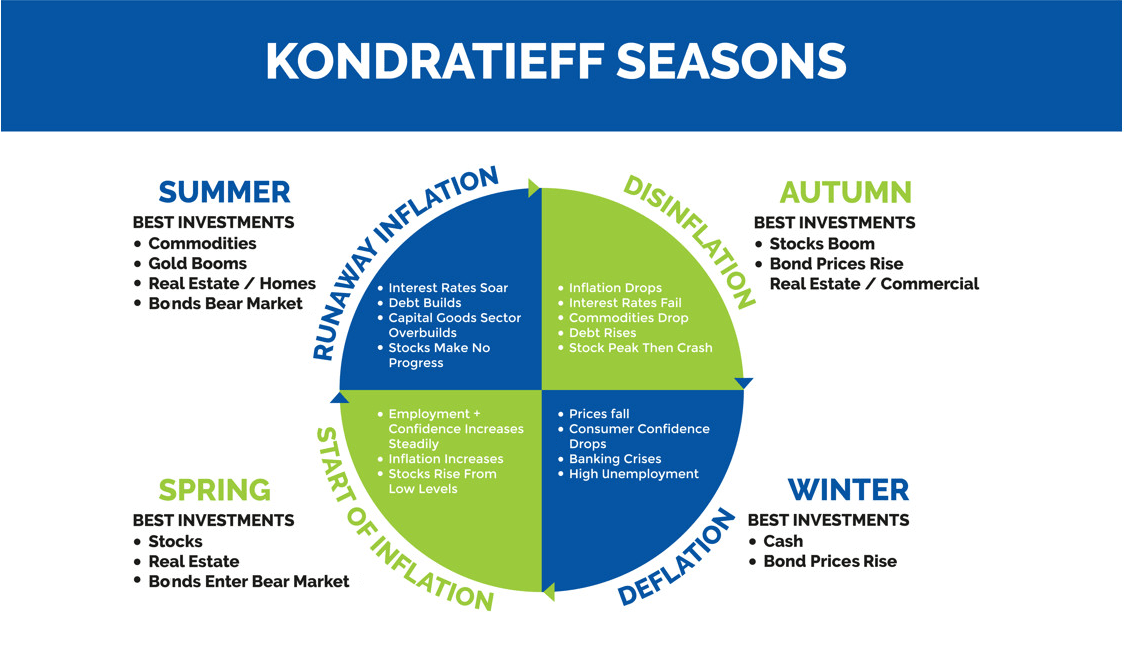

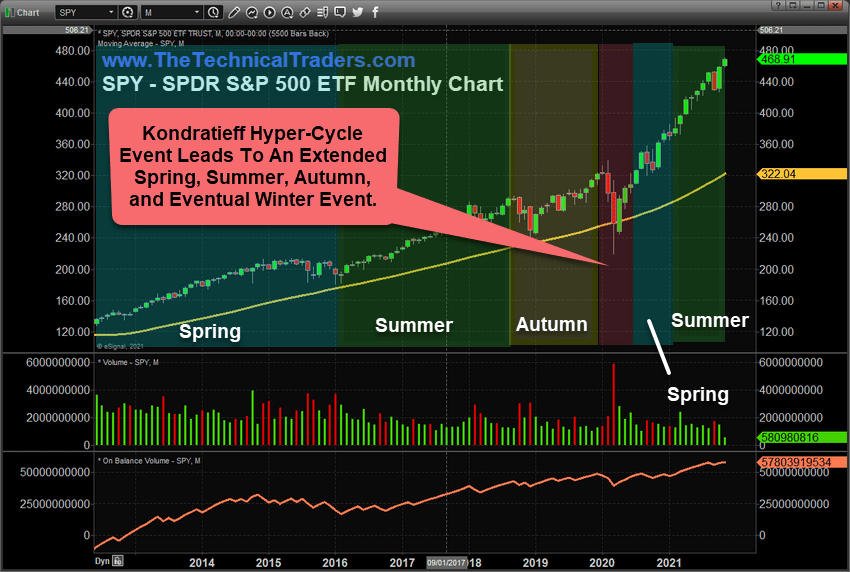

My opinion is that the globe pushed through a deep market contraction at the start of COVID-19. Following this was a strong global recovery phase – which happened within a 12-month window. After the November 2020 US Presidential Elections, while the extended COVID variants continued to plague the world, we entered a renewed type of Hyper-Kondratieff market cycle (Seasons).

Follow my thinking through this process:

A. COVID became a known issue in late 2019. The Global markets are holding up reasonably well at that time. (Likely Moderate Spring/Summer in Kondratieff Seasons)

B. COVID HITS (Late February 2020). Lock-downs start, and consumers shift their spending/saving habits. The mass transition begins for millions as the collapse of the global markets (a Hyper-Autumn/Winter/Spring Kondratieff cycle) takes place over only 4~5 months.

C. By July/August 2020, the global markets are starting to recover. Retail traders and institutions are eyeing the perceived recovery and believe the economic contraction is over. Retail traders begin to engage in the markets and start to drive trends (a post-COVID Spring and Early Summer event continues well into mid-2021).

D. The global markets, and many of the strongest ETFs and market indicators, peaked in February 2021 and entered an extended sideways/consolidation phase. That is, until recently. Inflation has started to become an issue. Global markets are struggling to find growth while the US markets continue to rally. (This is a late-stage Kondratieff Summer phase that is starting to transition into an early Kondratieff Autumn Season)

COVID Kondratieff Hyper-Cycle May Pressure Big Moves In Global ETFs/Sectors

Over the past 24 months, I believe we’ve completed a Hyper-Kondratieff Seasonal cycle phase. We may now be heading into an extended Summer/Autumn cycle phase lasting well into early 2022 – possibly longer. Following this, the Winter Kondratieff season may be longer and more extensive in scope as price trends have become exaggerated over the past 24+ months.

My research suggests global market trends and ETF sectors are poised for a powerful rally through 2021 and into early 2022 as Q4:2021 earnings and the continued Kondratieff Summer season extends. Retail and Institutional Traders will chase this rally phase while global central banks ease away from making any sudden moves to disrupt this cycle.

I believe many global central banks already understand the extreme trends and pressures pushed into the markets throughout COVID. These institutions continue to expect an extended Winter Season to creep into the global markets in the second half of 2022 or later. Given the inflationary pressures on the markets right now, one would think global central banks would be doing more to contain the potential for runaway inflation. They are, however, staying overly cautious.

The ECB recently commented that raising rates may do more harm than good (Source: Bloomberg). The US Federal Reserve also indicated extreme caution related to monetary policies recently. I think they are expecting a future contraction of inflation and pricing pressures as supply-chain issues resolve and as the current Summer Season shifts into Autumn and eventually Winter.

Traders need to stay prepared for any number of extreme price events over the next 12 to 24+ months, focusing on the strongest trending asset classes/sectors. If my research is correct, we should be transitioning into a late Summer Season – leading to an Autumn Season in early 2022. A Kondratieff Autumn season is indicative of a “Blow-Off Rally Phase” in the markets where a peak in price eventually sets up.

Want To Learn More about market trends?

Part II of this article will explore some ETF sectors that may benefit from the extended Summer/Autumn Kondratieff seasons.

Follow my research and learn how I use specific tools to help me understand price cycles, setups, and price target levels. Over the next 12 to 24+ months, I expect large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase. Next, a revaluation phase may begin as global traders attempt to identify emerging trends. Precious Metals will likely start to act as a proper hedge as caution and concern drive traders/investors into Metals.

Kindly take a minute to visit www.TheTechnicalTraders.com to learn about my Total ETF Portfolio (TEP) technology and how it can help you identify and trade better sector setups. My team and I have built these strategies to help us identify the strongest and best trade setups in any market sector. Every day, we deliver these setups to our subscribers along with the TEP system trades. You owe it to yourself to see how simple it is to trade 30% to 40% of the time to generate incredible results.

Chris Vermeulen

The post What Market Trends Will Drive Through To 2022? appeared first on Technical Traders Ltd..