US Federal Reserve – Playing With Fire Part II

The US Federal Reserve has recently taken steps to communicate a change in future policy – suggesting raising interest rates and acting more aggressively to combat inflation. Throughout the last few weeks of 2021 and early 2022, these comments and posturing by the US Fed have created some very big downside price moves in the US major indexes. As a result, the US markets’ volatility levels (VIX) have moved to a recent average between 17~21 – nearly 3x historical normal levels.

US Fed Likely To Move Very Slowly On Rates

One thing that I believe has become evident to many people is that we have moved past the COVID stimulus conversations of the past 24+ months. Inflation, rising prices, constricted supply-chains, and an excess of capital throughout many global markets appear to have shifted how the US Fed interprets future risks. The Fed is telegraphing these concerns to investors very clearly right now, which means traders/investors are shifting their focus away from high-flying Growth stocks.

Even though traders are attempting to shift capital away from certain risky sectors in the US and global markets, I still believe we have about 60 to 120+ days before the bigger market shift takes place.

The US Federal Reserve will likely start addressing inflationary concerns by reducing their balance sheet assets – not by aggressively raising interest rates. I feel the US Fed will navigate Q1:2022 and Q2:2022 by reducing balance sheet assets while allowing the global supply-chain issues to attempt to resolve themselves. By June/July 2022, or later, I believe the Fed may start to consider rate increases as a means to slow inflation.

Fed Comments Shift Investor Sentiment – Metals In Focus For Later 2022

This move away from Dovish/easy-money policies will push traders to consider more traditional hedge investments – like Gold and Silver. I’m sure you’ve read some comments over the past 24+ months about Gold being an extremely undervalued asset as the US Fed poured trillions of stimulus dollars into the economy? These comments were made concerning the fact that Gold rallied from 50 in 2019 to almost 00 in 2020 – over 12 months (over +43%). Could a big move in Gold/Silver happen again in 2022 or 2023?

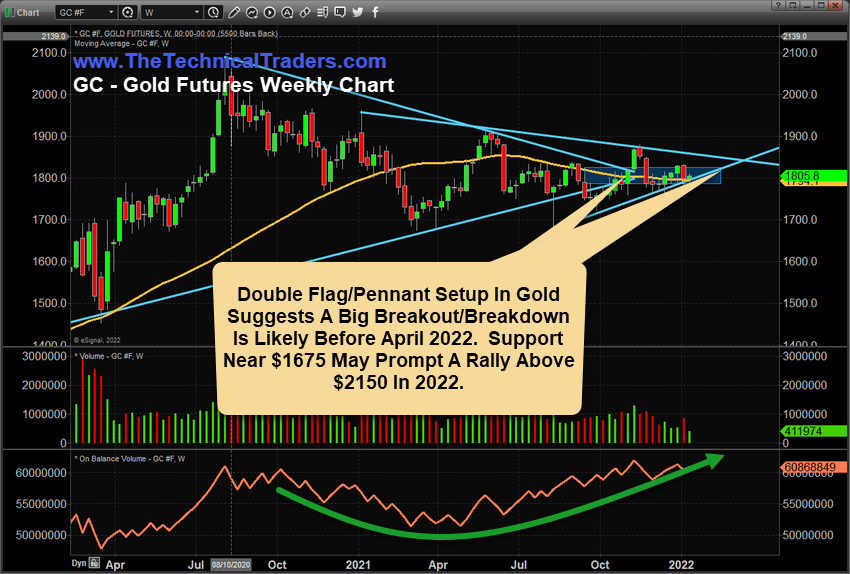

My research suggests a Double Pennant/Flag formation in Gold suggests the 75 support level becomes critical soon. It also indicates a Breakout/Breakdown move may start to happen before March or April 2022 – near the APEX of the current Pennant/Flag formation.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

The key APEX range is currently between 85 and 30. This represents a very tight price range where Gold may attempt to consolidate as we move towards the March/April Apex. My research suggests a move to levels near 40 to 50 may happen just before the Apex Breakout/Breakdown initiates. So, watch for a bit of downside price volatility in Gold before the end of February 2022.

Junior Gold Miners May Rally +45%, Or More, On A Gold Price Rally

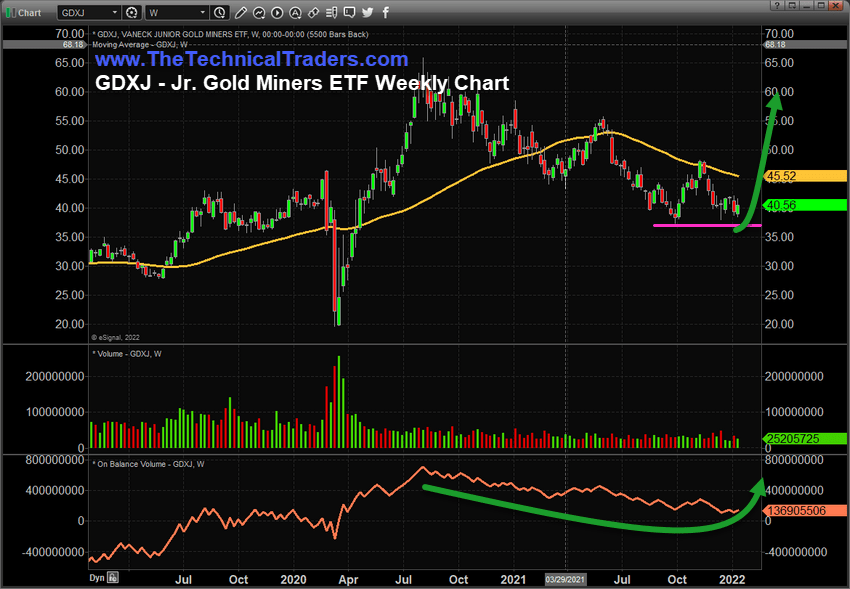

The Junior Gold Miners (GDXJ) Weekly Chart shows a firm support level near .35 that should act as a floor for price. My research suggests the next 45+ days will see GDXJ prices stay below to – trading in a reasonably tight range before starting to rally higher near the end of February 2022.

I believe Metals and Miners are aligning for a late February 2022 or Q2:2022 rally. The reason is that I believe the positioning by the US Fed, and expectations related to later 2022 (a mid-term election year), may prompt quite a bit of concern for the US and global equities. This will likely push investors and traders into “old-school” hedge instruments – like Gold and Silver.

That means Junior Gold and Silver Miners maybe about 55+ days away from an explosive upside price trend.

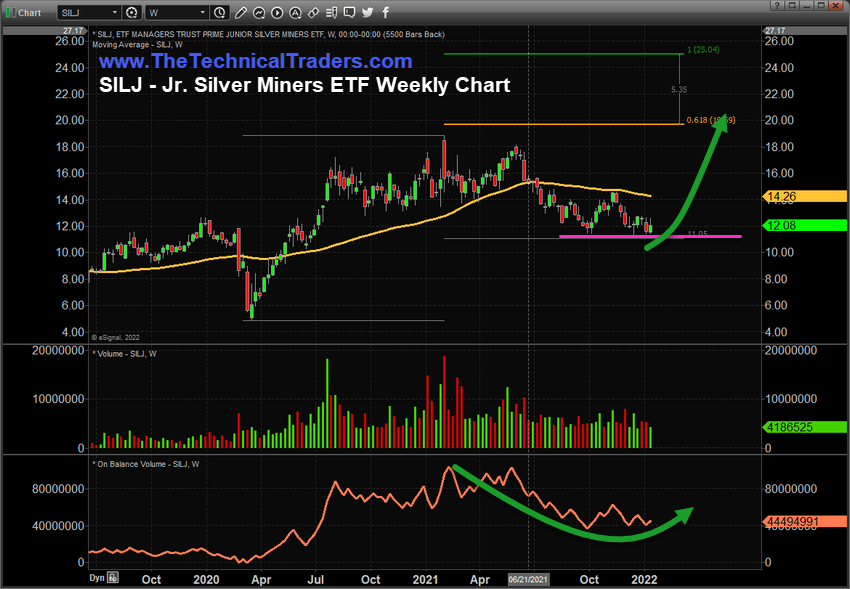

SILJ May Rally +70% to +100%, Or More, On Fed Actions

Near the end of 2022, I published a research article highlighting the incredible opportunity in Silver – focusing on how the Gold/Silver ratio had recently reached another peak level and had started to decline: Fear May Drive Silver More Than 60% Higher In 2022. This move suggests the disparity between the price of Gold to the price of Silver shows Gold is appreciated (and holding greater value) than Silver over the past few years.

The COVID virus event, and the subsequent Fed/Government stimulus, shifted investors/traders focus away from precious metals and into the equities market speculative rally. Now that the US Fed is starting to warn of more aggressive rate increases and other actions, precious metals are suddenly much more important as a hedge against future risks.

This SILJ Weekly Chart highlights the incredible base level, near , that continues to offer traders a fantastic hedge against a sudden Fed move. Using a simple Fibonacci Price Extension, we can see a target level (+61%) and a .64 target level (100%). If the level holds as a base/support, SILJ may be one of the easiest and best hedges against a sudden Fed move right now.

The US Federal Reserve is, in my opinion, playing with fire

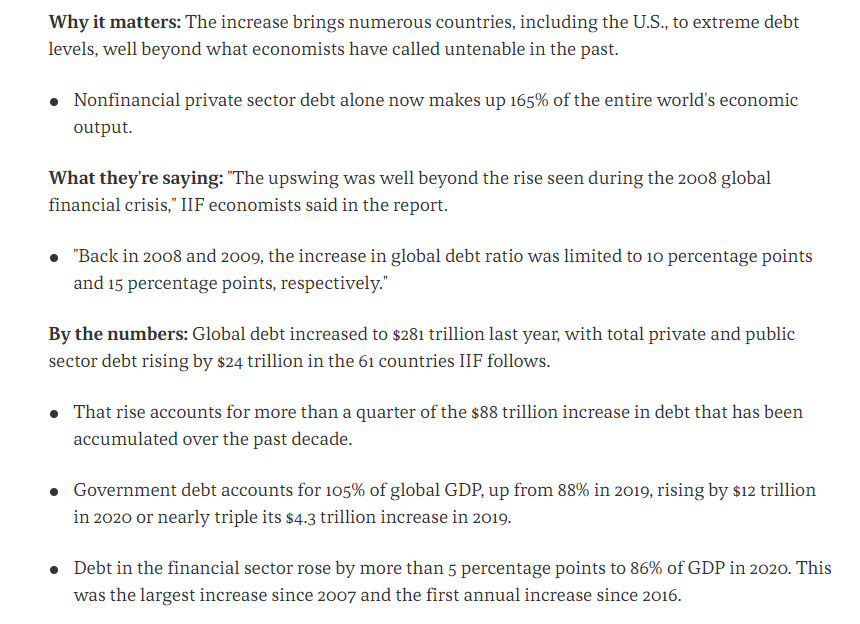

The COVID Virus Event pushed global debt levels higher by more than .5 Trillion Dollars (Source: Bloomberg ). The rush to attempt to save the global economy has created a massive surge in global debt levels – pushing the global debt to GDP level to well above 356% (Source: Axios).

Why is this so important right now? Because the US Federal Reserve is talking about an attempt to move interest rates and Fed decision-making back to near-normal levels. In my opinion, this was the one fault of Alan Greenspan in 2006-07. The thought that we can raise rates to “near normal level” at any time when we have grown debt levels excessively throughout the world is failed thinking and ignorant, in my opinion.

The US Federal Reserve is trapped and almost backed into a corner. I believe the US Fed will find any rate increases above 1.00 before the end of 2023 will significantly disrupt the global speculative bubble. Any attempt to move rates to levels near or above 2.00 would represent a nearly +2000% rate increase in less than 12 to 24 months. If you want to see a shock to the global markets where global debt to GDP is closing in on 400%, try raising the FFR by more than 2000% over a short period of time. That is what I call “playing with FIRE.”.

(Source: Axios)

2022 and 2023 will be filled with significant market trends and increased volatility. Right now, traders and investors need to understand the global markets are attempting to quickly transition away from a speculative/growth phase as the US Federal Reserve attempts to telegraph future rate increases. So it’s time to start thinking about how to prepare for unknowns and how to protect your capital more efficiently.

Growth sectors and US major indexes may continue to move higher for the next 30 to 60+ days, but my research suggests Q2:2022 may represent a “change in thinking” related to a late-2022 Fed shift. We are starting to see the markets move away from the speculative bubble-type trending we saw in 2020 and early 2021. Keep your eyes open and learn how to prepare for the big trends over the next 3+ years. The Fed is playing with fire right now. One wrong move and the markets could start a drastic price correction/reversion.

Finding The Right Trading Strategies

If you have struggled with finding opportunities over the past year or so and want to know which are the hottest sectors, or how to protect and grow your capital, then please take a minute to review my Total ETF Portfolio – Triple-Strategy Trading Plan to help you profit from these big market transitions.

Learn how I use specific tools to help me understand price cycles, set-ups, and price target levels in various sectors to identify strategic entry and exit points for trades. Over the next 12 to 24+ months, I expect very large price swings in the US stock market and other asset classes across the globe. I believe the markets are starting to transition away from the continued central bank support rally phase and may start a revaluation phase as global traders attempt to identify the next big trends. Precious Metals will likely start to act as a proper hedge as caution and concern start to drive traders/investors into Metals.

I invite you to learn more about how my three Technical Trading Strategies can help you protect and grow your wealth in any type of market condition by clicking the following link: www.TheTechnicalTraders.com

Chris Vermeulen

Founder and Chief Market Strategist of The Technical Traders Ltd.

The post US Federal Reserve – Playing With Fire Part II appeared first on Technical Traders Ltd..