The Put / Call Ratio – A Technique Used To Gauge Market Extremes

Perhaps you’ve heard of the “Put / Call Ratio” (PCR) and been unsure of exactly what it is or when and how to use it.

First, a quick review of what Calls and Puts are. Calls are option contracts that increase in value from a RISE in the price of the underlying stock or index. Puts are option contracts that increase in value from a DROP in the price of the underlying stock or index.

Let’s jump in and see what’s “under the hood” and how we might use that to better inform our decision-making as traders and investors.

What Is the Put / Call Ratio?

The PCR is a contrarian indicator based on the idea that market participants tend to get too bearish or bullish shortly before a reversal is about to materialize. When the market is at a point of extreme bearishness, participants tend to buy more Puts than usual. Conversely, when the market is at a point of extreme bullishness, participants tend to buy more Calls than normal. Contrarian logic suggests that most participants tend to be wrong when the market is near inflection points.

Mathematically the Put / Call Ratio is simply the number of Puts divided by the number of Calls. A value of 1 would indicate that the same number of Calls and Puts are being purchased. A value greater than 1 indicates more Puts than Calls purchased. It follows that a value below 1 means that more Calls than Puts are purchased.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

The PCR can be calculated using either open interest or volume of contracts. It can be calculated for individual stocks and for indexes. Most trading and charting platforms have several versions of the PCR available for the major indexes. Indexes generally have charts available, while individual stocks may only have daily numerical value readily available. The PCR is generally more useful as an overall market sentiment indicator for the major indexes like the S&P 500.

For most underlying, including major indexes like the S&P 500, the PCR tends to be below 1 much of the time. That makes some sense, as major indexes tend to have a long-term bullish bias. But in times of elevated fear, Put buying tends to be elevated in a rush to buy portfolio “insurance”. Outright bets on a market decline can add to that volume.

How Do I Use the pcr?

It helps to understand what “normal” behavior is for the number of Calls and Puts purchased for the particular index or stock. For an index like the S&P 500, a PCR of 0.9 or above suggests heavy Put buying and is typically seen as bullish from the contrarian view. For reference, at the height of the dot-com bubble in March 2000, the PCR dropped to as low as 0.39. Lots of calls were being purchased as the market was peaking.

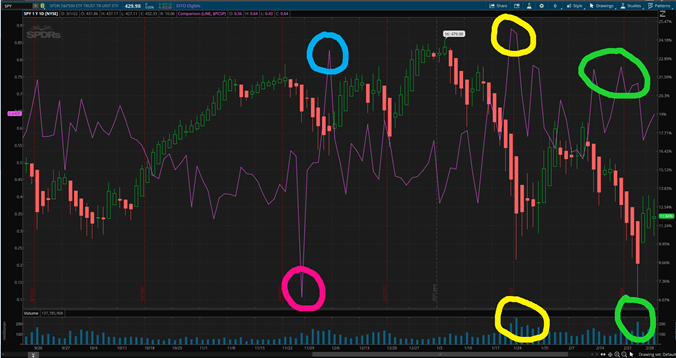

Let’s look at some recent examples where we see the Put / Call Ratio at extreme levels. Below we see a chart of the S&P 500 displayed with Heikin Ashi candles overlayed with the PCR (magenta line).

In the first instance (circled in magenta), we see a low in the PCR where significantly more Calls than Puts were purchased. When interpreted as a contrarian indicator, that suggests bearishness to come. And indeed, we do see five days of bearishness to follow.

We then see a sharp reversal to a relatively high PCR (blue circle), and we do see a bullish reversal that lasted for six days.

At the yellow circle, we see a spike up in the PCR accompanied by a sharp increase in the underlying volume. However, we see a few days delay before the bullish reversal materializes in this instance. And the market was rather volatile on those days, as evidenced by the tall candles with long tails.

At the green circle, we have a somewhat elevated PCR and another delayed reversal.

Conclusion

The PCR is not particularly useful in sideways markets. But it can be useful at market extremes, albeit at times with some delay.

Like many indicators, the PCR is far from 100% reliable unto itself. Used in conjunction with volume, volatility (VIX), support/resistance levels, trendlines, moving averages, and other technical indicators, the PCR can give us valuable clues about market sentiment and when a reversal may be in the making.

Now That You Know more About the put / call ration, Read On To Learn More About Options Trading

Every day on Options Trading Signals, we do defined risk trades that protect us from black swan events 24/7. Many may think that is what stop losses are for. Well, remember the markets are only open about 1/3 of the hours in a day. Therefore, a stop loss only protects you for 1/3 of each day. Stocks can gap up or down. With options, you are always protected because we do defined risk in a spread. We cover with multiple legs, which are always on once you own.

If you are new to trading or have been trading stock but are interested in options, you can find more information at The Technical Traders – Options Trading Signals Service. The head Options Trading Specialist Brian Benson, who has been trading options for almost 20 years, sends out real live trade alerts on actual trades, such as TSLA and NVDA, with real money. Ready to subscribe, click here: TheTechnicalTraders.com.

Enjoy your day!

Chris Vermeulen

Founder & Chief Market Strategist

TheTechnicalTraders.com

The post The Put / Call Ratio – A Technique Used To Gauge Market Extremes appeared first on Technical Traders Ltd..