What Are The Driving Forces Behind The Shift In Global Market Risks?

Global market risks have shifted dramatically over the past 90+ days. It almost seems as though the global markets turned 180 degrees overnight, generally going from moderately soft monetary policies to very extreme monetary policies and conditions. This sudden shift caught many traders and investors off guard and resulted in -20% to -25% losses for many.

The driving forces behind this sudden shift are inflation and excess capital (M2) because of nearly a decade of near-zero US interest rates. Much of the excess capital created over the past decade has been deployed into global equities, infrastructure, and various speculative instruments (art, homes, cryptos, collectibles, and others). However, without a doubt, the recent burst of inflation is also a result of COVID restrictions. Such restrictions reduced supply capabilities and the resulting interruptions of manufacturing/supply have been felt throughout the post-COVID global recovery.

Deleveraging Capital Excesses Causing Global Assets To Unwind Faster Than US Assets

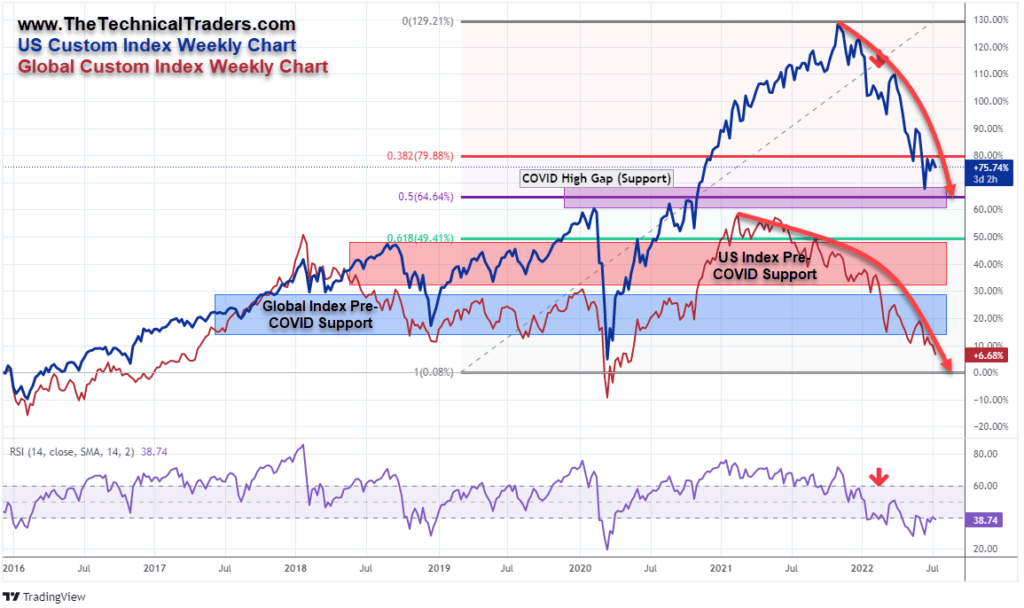

The US & Global markets have contracted by more than 25%~35%. The following Custom Global Market Index highlights the extensive devaluation in global assets compared to US assets. US assets have fallen -23% from recent highs. Global assets have fallen -32% from recent highs – and are breaking downward again.

If this overall trend continues, it is very likely that Chinese & Asian markets could lead to a global contagion event related to extended credit/debt liabilities, economic expectations (GDP/Consumers), and real asset valuations. Over the past 5+ years, I’ve published many articles showing how China/Asia was uniquely positioned to take advantage of the US easy money policies. Results from this could extend credit/debt risks far beyond reasonable expectations. Is this global inflation event driving a global devaluation of assets?

Excess Phase Peak Consumption Can Lead To Extreme Risk Events

This excess phase consumption of cheap credit prompted many nations to engage in very high-risk multi-billion dollar infrastructure projects and other excesses. The Belt-Road project is a perfect example of one nation extending billions of credit to at-risk nations to leverage cheap credit into future opportunities. As evidenced near every market peak, optimism near the peak of excess phases can be very addictive and dangerous.

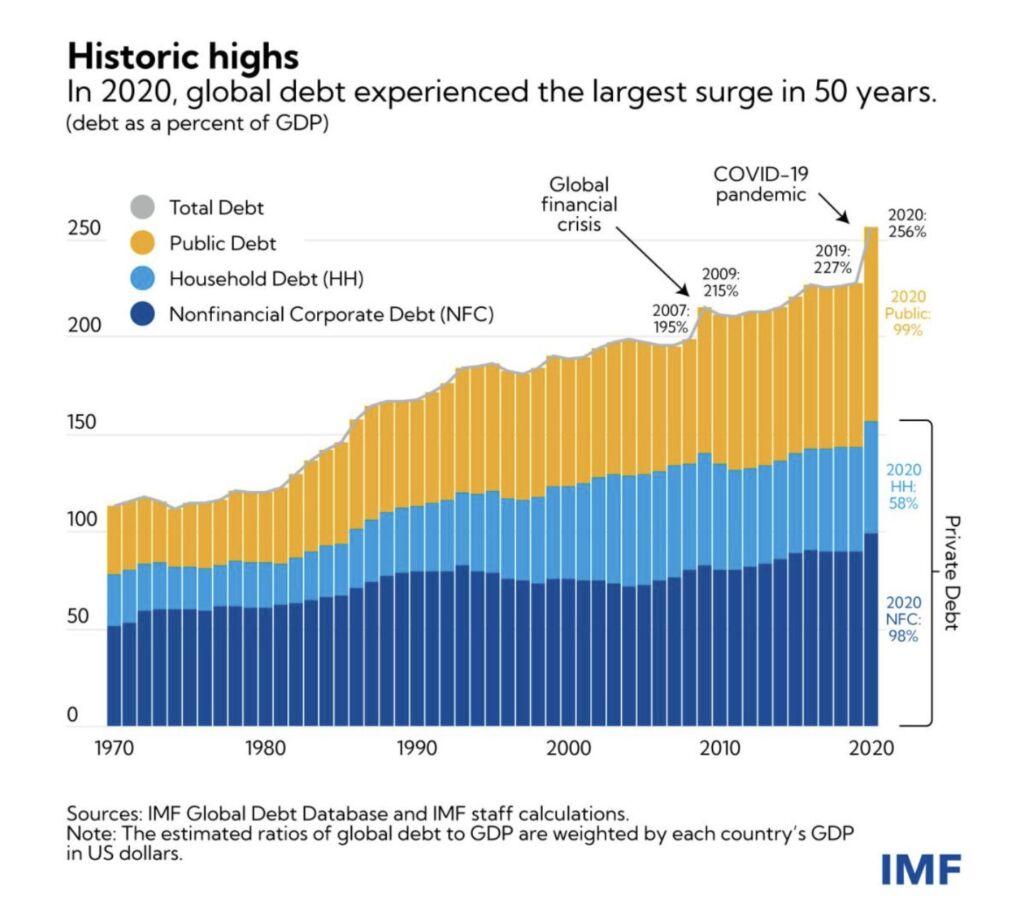

Global debt levels have skyrocketed over the past 5+ years. With the US prompting extreme easy money policies, many foreign nations extended debt levels far beyond reasonable expectations when COVID hit. The following chart from the IMF shows consumers and corporations increased debt levels at an excessively higher rate in 2020. The excessive global debt levels are now evidently working as a liability for many Asian & Emerging markets.

(Source: https://www.imf.org/en/home)

Protecting & Growing Wealth When Markets Are In Chaos

I receive many questions from investors and traders every week. Generally, the most common question is “what can I do to profit right now from what is happening throughout the world?”. The simple answer to that question is to not extend any greater risk within your portfolio than necessary.

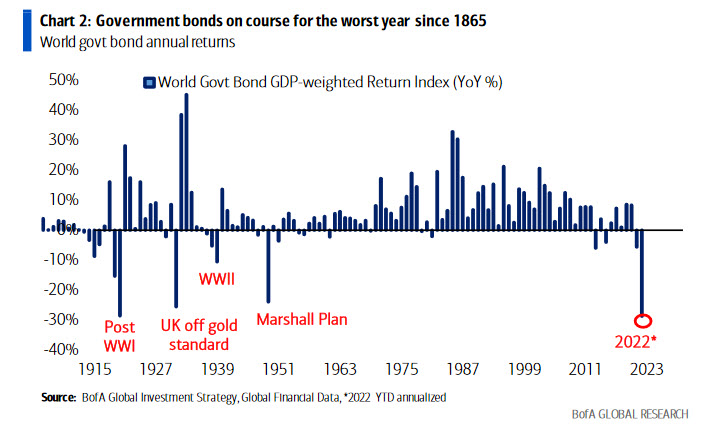

This chart from Bank of America Investment Strategies shows how aggressively World Government Bonds are reacting to inflation and global central bank rate increases. The short story of this chart is that Bonds are pricing in very unfavorable growth and capital function conditions over the next 3 to 5+ years. World Government bonds have reached risk levels we’ve not seen since post-WWI (1918+) or the Great Depression (1930+).

(Source: BankofAmerica.com)

Research & Technology Highlighted Risks & Opportunities

My research team and I have posted articles over the past 5+ years highlighting how global markets were taking advantage of the US monetary policy and inadvertently gorging themselves on cheap credit to address infrastructure, industrial, and consumer demand. We’ve been warning of this moment and have strategies/technology to help you protect and grow your wealth as this chaos continues.

- April 1, 2020: Concerned That Asia Could Blow A Hole In The Future Economic Recovery

- January 19, 2019: Will China Surprise The US Stock Market?

- July 9, 2018: China, Asia, and Emerging Markets Could Result In Chaos

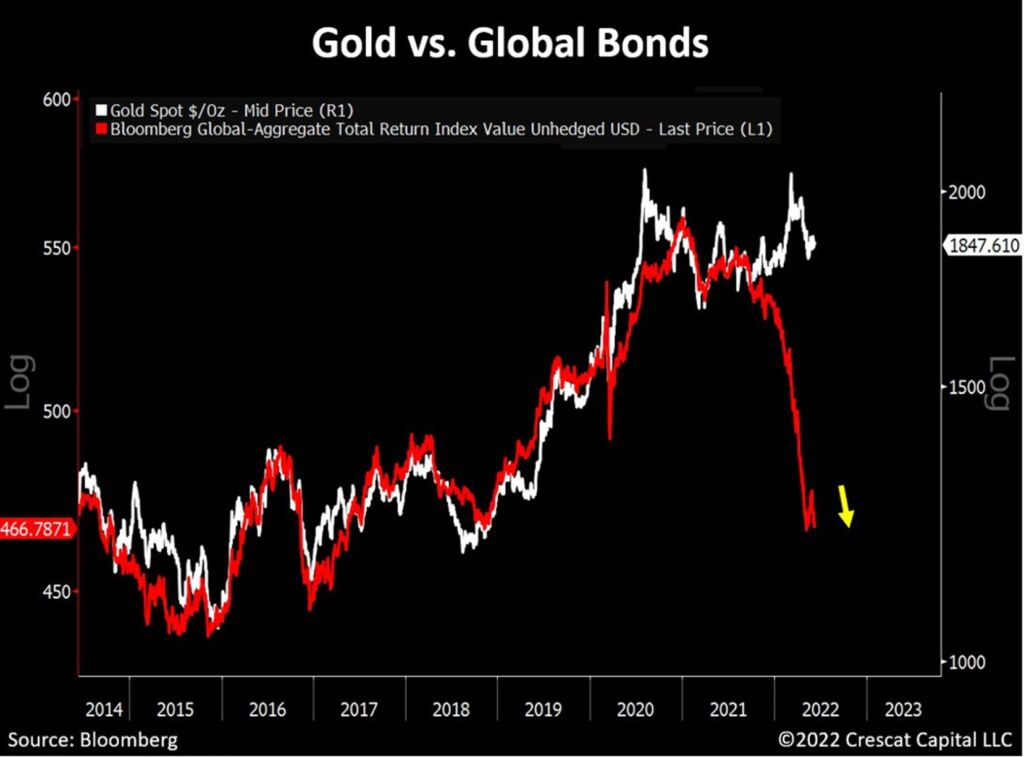

This Bloomberg Gold vs. Global Bonds chart highlights how aggressively global Bonds have adjusted to extreme risk factors. What this is telling traders/investors is that global central banks appear to have very few tools to efficiently manage inflationary trends – and these reflect in extreme risk factors in global bonds. Quickly raising rates to combat inflation trends may aggressively compound risk factors at this point. This chart is clearly showing us that global risk factors have never been this extreme, or disconnected, over the past 8+ years.

(Source: Bloomberg.com)

I suggest taking immediate action while this market chaos continues. Even though it may seem frightening, this is one of the best opportunities for you to take control of your assets, and also learn how to better protect and grow your wealth while the markets deleverage and resettle. Eventually, a market bottom will confirm, and global assets will begin another rally phase. Before this happens, though, all traders/investors need to begin taking immediate actions/steps to manage, protect and grow their wealth as efficiently as possible.

WHAT STRATEGIES CAN HELP YOU NAVIGATE THE CURRENT MARKET TRENDS?

Learn how we use specific tools to help us understand price cycles, set-ups, and price target levels in various sectors. Also, learn how we identify strategic entry and exit points for trades. Over the next 12 to 24+ months, we expect very large price swings in the US stock market. The markets have begun to transition away from the continued central bank support rally phase. A revaluation phase has started as global traders attempt to identify the next big trends. Precious Metals may start to act as a proper hedge as caution and concern begin to drive traders/investors into safe havens.

Historically, bonds have served as one of these safe havens. This isn’t proving to be the case, so if bonds are off the table, what bond alternatives are there? How can they be deployed in a bond replacement strategy?

HOW WE CAN HELP YOU LEARN TO INVEST CONSERVATIVELY

At TheTechnicalTraders.com, my team and I can do these things:

- Safely navigate the commodity and crude oil trend.

- Reduce your FOMO and manage your emotions.

- Have proven trading strategies for bull and bear markets.

- Provide quality trades for investing conservatively.

- Tell you when to take profits and exit trades.

- Save you time with our research.

- Proved above-average returns/growth over the long run.

- Have consistent growth with low volatility/risks.

- Make trading and investing safer, more profitable, and educational.

Sign up for my free trading newsletter so you don’t miss the next opportunity!

We invite you to join our group of active traders who invest conservatively together. They learn and profit from our three ETF Technical Trading Strategies. We can help you protect and grow your wealth in any type of market condition. Click on the following link to learn how: www.TheTechnicalTraders.com.

Chris Vermeulen

Founder & Chief Market Strategist

TheTechnicalTraders.com

The post What Are The Driving Forces Behind The Shift In Global Market Risks? appeared first on Technical Traders Ltd..