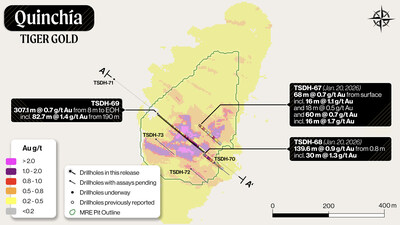

Tiger Gold Intersects 82.7 m @ 1.4 g/t Au Within 307.1 m @ 0.7 g/t Au at Tesorito and Identifies Vector Toward Potential Feeder Zone

VANCOUVER, BC, Jan. 29, 2026 /CNW/ – Tiger Gold Corp. (TSXV: TIGR) (FSE: D150) (“Tiger” or the “Company”) is pleased to report assay results from the third hole of its ongoing drill campaign at the Tesorito deposit of its Quinchía Gold Project in Colombia. The Tesorito campaign forms part of Tiger’s broader initial 10,000-metre Phase 1 drill program. The Quinchía Gold Project is located in central Colombia’s prolific Mid-Cauca gold belt, approximately 20 kilometres south of Aris Mining’s Marmato Gold Mine and Collective Mining’s Guayabales and San Antonio projects.

Highlights:

- TSDH-69 intersected 307.1 m at 0.7 g/t Au from 8 m downhole, including 82.7 m at 1.4 g/t Au from 190 m, including 4 m at 3.5 g/t Au, and ended in mineralization.

- Increasing sulphide intensity encountered at depth, providing a vector for a potential feeder zone.

- Two rigs continue infill and extension drilling at Tesorito.

- A third rig is now exploration drilling at Dos Quebradas.

- Assays pending from four additional drillholes and will be reported in due course.

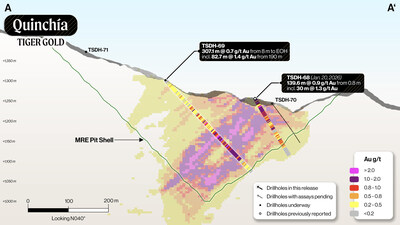

The assay results reported in this release, summarized in Table 1, targeted the south-central portion of the Tesorito block model. Figure 1 shows the location of these drillholes, together with drillholes for which assays are pending. Figure 2 is a cross section of the reported results.

Robert Vallis, President & CEO, commented, “Results from Tesorito continue to impress, with TSDH-69 returning 0.7 g/t Au over 307.1 m from near surface, including 1.4 g/t Au over 82.7 m within the core of the system. This broad intercept reinforces both the continuity and the scale of the higher-grade portion of our current model and supports the ongoing infill drilling program. Of particular interest, increasing sulphide intensity and locally elevated chalcopyrite at depth may indicate proximity to a higher-grade feeder structure, providing an additional vector for targeted follow-up drilling.”

More Results Expected Shortly as Drilling Continues at Tesorito and Dos Quebradas

Drilling is ongoing with two diamond drill rigs at Tesorito, and additional assay results are anticipated in the coming weeks. A third rig has commenced drilling at Dos Quebradas, executing upon the Company’s plan to test high-impact targets across the Quinchía Gold Project.

Tesorito Drill Program Targets Resource Growth and Improved Confidence

The Tesorito drill program is designed to improve confidence in the Mineral Resource and to test margins and depth extensions to expand known mineralization. Drilling includes both step-out and infill components, with infill drilling intended to support upgrading the Inferred Mineral Resource to the Indicated category and advance the project towards a pre-feasibility or feasibility-level study. A summary of Mineral Resources and the Preliminary Economic Assessment (“PEA”) for the Quinchía Gold Project is provided below.

TSDH-69 Returns Strong Interval and Vectors Toward a Potential Feeder Zone

TSDH-69 intersected 307.1 m grading 0.7 g/t Au from 8.0 m downhole to end of hole (315.1 m), including 82.7 m grading 1.4 g/t Au (190-272.7 m), including 4 m grading 3.5 g/t Au (190-194 m). The hole intersected a porphyry-style system hosted in porphyritic andesite and intrusive breccia/diorite. The 196-306 m interval (110 m grading 1.0 g/t Au) is interpreted to represent the core porphyry domain and is characterised by potassic alteration (potassium feldspar plus secondary biotite), A-, B-, and M-type vein stockwork, gypsum veinlets with traces of molybdenite and chalcopyrite, and disseminated sulphides (pyrite and chalcopyrite) and magnetite. The hole ended in an altered sedimentary package with elevated gold concentrations starting at approximately 307 m that warrant further investigation.

Of significant interest, trace amounts of chalcopyrite were observed in the upper andesite and locally elevated at depth, which may reflect increasing proximity to a mineralising feeder structure and support further drilling to test for a potentially higher-grade zone.

Table 1: TSDH-69 assays results

|

Drillhole |

From |

To |

Interval |

True Width |

Au |

|

ID |

(m) |

(m) |

(m) |

(m) |

(g/t) |

|

TSDH-69 |

8 |

315.1 |

307.1 |

291.5 |

0.7 |

|

including |

190 |

272.7 |

82.7 |

78.8 |

1.4 |

|

1. |

All composite intervals are reported over a minimum downhole length of 10 m at a minimum length-weighted grade of 0.2 g/t Au, allowing for up to 10 m of consecutive internal dilution below cut-off. |

|

2. |

All reported intervals refer to downhole core lengths. True width estimates are based upon the Company’s current interpretation. |

|

3. |

Higher-grade intervals reported as any interval over a minimum length of 5 m at a minimum length-weighted grade of 1 g/t Au, allowing for up to 5 m of consecutive internal dilution below cut-off. No assays were capped. |

Table 2: Drillhole collar information (EPSG:32618)

|

Drillhole |

Easting |

Northing |

Elevation |

Length |

Azimuth |

Dip |

|

ID |

(m) |

(m) |

(m asl) |

(m) |

(°) |

(°) |

|

TSDH-69 |

423,630 |

584,545 |

1,302 |

315.1 |

130 |

-47.8 |

Third Rig Drilling at Dos Quebradas High-Priority Target

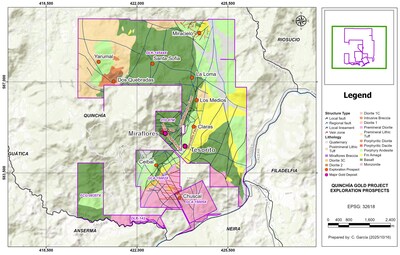

The Dos Quebradas target area is located approximately 3 km northwest of the Tesorito and Miraflores deposits (Figure 3). Historical drilling at Dos Quebradas comprises 23 diamond drillholes totalling 9,326 m completed between 2011 and 2012. The Company has mobilised its third drill rig to Dos Quebradas and drilling has commenced on an initial 1,000 m program focused on advancing high-priority targets, strengthening the geological framework, and refining the Company’s exploration model, building upon encouraging field work and modelling completed in the fourth quarter of 2025.

The most recent historical Mineral Resource estimate for the Dos Quebradas deposit was prepared by Resource Development Associates Inc. with an effective date of February 25, 2020, and reported by LCL Resources Limited in accordance with the JORC Code (2012). The historical estimate consisted of an Inferred Mineral Resource of 20.2 Mt at 0.71 g/t Au (for 459,000 oz of gold) using a 0.5 g/t Au cut-off.

The historical Dos Quebradas estimate was based upon 19 diamond drillholes (8,824 m) drilled on 25 m section spacing, defining mineralisation over a ~400 m by 300 m area from surface to approximately 550 m depth. Mineralisation is hosted within diorite porphyry and intrusive breccias.

This estimate is considered historical and has not been verified by Tiger. A QP has not done sufficient work to classify this estimate as current, and Tiger is not treating it as current. Recommended work programs include assaying of historical core to confirm grades, database validation and verification to ensure data integrity, and updated geological modelling to align with current CIM Definition Standards for Mineral Resources and Mineral Reserves. Tiger considers Dos Quebradas an exploration prospect within the Quinchía Gold Project, with potential requiring further drilling and evaluation.

Mineral Resources and PEA

Quinchia Gold Project PEA

A Preliminary Economic Assessment (“PEA”) and technical report for the Quinchía Gold Project (effective September 18, 2025) was completed by Ausenco Engineering and filed on SEDAR+ on December 10, 2025.

The PEA base case evaluated the Quinchía Gold Project’s Miraflores and Tesorito deposits at a US$2,650/oz gold price and US$29.51/oz silver price using a discounted cash flow analysis at a 5% discount rate and, based upon the assumptions set out in the technical report, resulted in a post-tax net present value (“NPV”) (5%) of US$534 million, an internal rate of return (“IRR”) of 21.3% and a payback period of 3.83 years. Over the 10.2-year mine life, the PEA reported average annual payable production of 138 koz of gold and 104 koz of silver (141 koz gold equivalent), with cash costs of US$1,199/oz Au and all-in sustaining costs (“AISC”) of US$1,340/oz Au. The PEA also outlined an upside case at US$3,700/oz Au that yielded a post-tax NPV (5%) of US$1.188 billion and an IRR of 36.5%.

The PEA is, by definition, preliminary in nature and includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and there is no certainty that the PEA results will be realized. The results of the economic analyses represent forward-looking information and are subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those presented.

The technical report includes Mineral Resource estimates for the Miraflores and Tesorito deposits with an effective date of July 31, 2025. The Mineral Resources were estimated using CIM Definition Standards for Mineral Resources and Mineral Reserves (2014) and in accordance with CIM Mineral Resources and Mineral Resources Best Practice Guidelines (2019). Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

Tesorito Gold Deposit

At an open-pit cut-off grade of 0.20 g/t Au:

- Inferred: 104 Mt at 0.47 g/t Au for 1.57 Moz Au, and 0.58 g/t Ag for 1.96 Moz Ag

Miraflores Gold Deposit

At an underground cut-off grade of 1.37 g/t gold equivalent (“AuEq”):

- Measured: 2.8 Mt at 2.75 g/t Au for 0.24 Moz Au, and 2.37 g/t Ag for 0.21 Moz Ag

- Indicated: 3.3 Mt at 2.52 g/t Au for 0.27 Moz Au, and 2.20 g/t Ag for 0.23 Moz Ag

- Measured + Indicated: 6.1 Mt at 2.62 g/t Au for 0.51 Moz Au, and 2.28 g/t Ag for 0.44 Moz Ag

- Inferred: 0.08 Mt at 2.81 g/t Au for 0.01 Moz Au, and 2.54 g/t Ag for 0.01 Moz Ag

Sampling, Quality Assurance and Quality Control

All drill core is logged by a Company geologist, photographed, and cut in half at the Company’s core facility in Quinchía, Colombia. One half of the core is bagged and sent to ALS’ laboratory in Medellín for sample preparation and with sub-samples sent to ALS’ laboratory in Lima, Perú for analysis, while the other half is retained onsite as a witness sample. ALS’ Medellín and Lima laboratories are ISO/IEC 17025 accredited and are independent of the Company. All samples are analyzed for gold using 50 g fire assay with AAS finish (Au-AA26). Samples are also analyzed for a 48-element suite by ICP-AES and ICP-MS following a four-acid digestion (ME-MS61L). Where applicable, high-grade and overlimit assays are re-analyzed using an appropriate technique. In addition to the laboratory’s QA/QC practices, certified reference materials, coarse blanks, and duplicates are inserted into the sample stream to monitor analytical performance. Collar coordinates are preliminary and were recorded in the field using handheld GPS. Drill core was orientated, and downhole orientation surveys were collected at regular intervals. Only results that meet Tiger’s QA/QC protocols are reported.

Qualified Person

The pertinent scientific and technical information contained in this release has been reviewed and approved by Jeremy Link, M.Eng., P.Eng., Tiger’s Vice-President, Corporate Development, and César García, M.Sc., FAusIMM, the Company’s Exploration Manager in Colombia, each of whom is a “qualified person” as defined by Canadian Securities Administrators’ within the meaning of National Instrument 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

About Tiger Gold Corp.

Tiger is a growth-oriented mining exploration and development company focused on advancing its flagship asset, the Quinchía Gold Project, a multi-million-ounce gold project in the prolific Mid-Cauca belt of Colombia, which Tiger holds under an option to acquire a 100% interest. Tiger is led by a multidisciplinary team of experienced mine builders, engineering, metallurgical, ESG, and corporate finance professionals who have brought numerous mines into production at globally recognized mining companies including AngloGold Ashanti, Barrick Gold, Yamana Gold, and B2Gold. Tiger is led by President and CEO, Robert Vallis, who brings a strong record of strategic leadership and execution in the mining sector, including his role in the US$9.5 billion acquisition and integration of Placer Dome by Barrick Gold, as well as the US$3.9 billion joint acquisition of Osisko Mining by Yamana Gold and Agnico Eagle Mines.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-looking Statements

This news release contains forward-looking information and forward-looking statements, as such terms are defined under applicable securities laws (collectively, “forward-looking statements”). Often, but not always, forward-looking statements can be identified by the use of words such as “plans”, “expects” or “does not expect”, “is expected”, “estimates”, “budget”, “scheduled”, “forecasts”, “projects”, “intends”, “suggests”, “preliminary”, “confident”, “interpreted”, “targets”, “aims”, “anticipates” or “does not anticipate”, or “believes”, or variations of such words and phrases, or statements that certain actions, events or results “may”, “could”, “can”, “would”, “might” or “will” be taken, occur or be achieved. Forward-looking statements involve known and unknown risks, uncertainties, assumptions (which may prove incorrect) and other factors which may cause the actual results, performance or achievements of Tiger to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements.

Forward-looking information in this news release includes, but is not limited to, statements regarding Tiger’s objectives, goals or future plans; statements regarding exploration results, potential mineralization, potential feeder zones, and the potential to expand mineralization or improve grade, including through infill, extension, and step-out drilling; Tiger’s plans to execute and complete its Phase 1 and Phase 2 exploration programs, including drill programs and Mineral Resource estimate updates; statements regarding planned field programs and future technical studies, including preliminary feasibility or feasibility-level studies; exploration and project development plans at the Quinchía Gold Project and regionally; statements regarding regional exploration potential and the ability to develop exploration targets, drill targets and define resources; the establishment of mutually beneficial partnerships with local and Indigenous communities; the timing of the commencement of operations; and estimates of market conditions. Forward-looking statements are based upon assumptions including, without limitation, the availability of drilling rigs and other equipment, contractors and supplies, continued site access, receipt of required permits and approvals, the Company’s ability to maintain community and stakeholder support, and that exploration and drilling results will be consistent with management’s expectations. Such forward-looking information also includes statements regarding the Preliminary Economic Assessment for the Quinchía Gold Project, which by definition is preliminary in nature, includes Inferred Mineral Resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as Mineral Reserves, and for which there is no certainty that the economics or results described will be realized. Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Any references to nearby projects, properties, or mines are provided for regional context only, and mineralization on adjacent or nearby properties is not necessarily indicative of mineralization on the Quinchía Gold Project.

Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, failure to intersect potentially economic intervals of mineralization; uncertainties related to geological continuity, potential mineralization and the extent of mineralization, which may not yield economically viable results; additional mineralized zones that may not contain economically viable mineralization due to geological complexity or insufficient drilling data; risks that historical drilling data may be incomplete, inaccurate, or insufficient; risks that field programs may be reduced, delayed or may not proceed at all; risks that the Company may not satisfy minimum expenditure requirements or other work commitments under its property agreements (including option or earn-in agreements), which could adversely affect the Company’s ability to maintain or earn its interest in the project; delays in assay processing or data validation issues; failure to identify Mineral Resources; the preliminary nature of metallurgical test results; delays in obtaining or failures to obtain required governmental, environmental, or other project approvals; changes in governmental regulation of exploration and mining operations; political risks and social unrest; inability to fulfil consultation or accommodation obligations in respect of Indigenous peoples or to maintain constructive relationships with local communities; uncertainties relating to the availability and costs of financing needed in the future; changes in equity markets; inflation; changes in exchange rates; fluctuations in commodity prices; delays in the advancement of projects; capital and operating costs varying significantly from estimates; and the other risks involved in the mineral exploration and development industry.

While Tiger anticipates that subsequent events and developments may cause its views to change, Tiger specifically disclaims any obligation to update these forward-looking statements. These forward-looking statements should not be relied upon as representing Tiger’s views as of any date subsequent to the date of this news release. Although Tiger has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

The factors identified above are not intended to represent a complete list of the factors that could affect Tiger. Additional factors are noted under “Risk Factors” in Tiger’s public disclosure record, including in the filing statement and other documents available under Tiger’s profile on SEDAR+. The forward-looking statements contained in this news release are expressly qualified in their entirety by this cautionary statement. The forward-looking statements included in this news release are made as of the date of this news release and Tiger undertakes no obligation to publicly update such forward-looking statements to reflect new information, subsequent events, or otherwise unless required by applicable securities legislation.

Cautionary Note on Non-IFRS Measures

The Company prepares its financial statements in accordance with International Financial Reporting Standards (“IFRS”). The Company believes that investors use certain non-IFRS as indicators to assess mining companies and projects. They are intended to provide additional information and should not be considered in isolation or as a substitute for performance measures prepared in accordance with IFRS.

“Total cash costs per ounce” and “all-in sustaining costs per ounce”, as used in this release, are non-IFRS measures commonly reported by gold mining companies to assess operating performance on a unit of production basis and the ability of a company to generate cash flow from operations. These measures do not have standardized meanings under IFRS and may not be comparable to similar measures presented by other companies. In this context, “total cash costs” consist of operating cash costs plus royalties and offsite charges (refining and transportation). “All-in sustaining costs” consists of total cash costs plus sustaining capital but excludes corporate and administrative costs and share-based compensation.

SOURCE Tiger Gold Corp.