Renegade Gold Reports Significant New Mineral Resource Estimate at Red Lake Project, Ontario

Vancouver, British Columbia–(Newsfile Corp. – February 18, 2026) – Renegade Gold Inc. (TSXV: RAGE) (OTCQB: RENGF) (FSE: 0700) (“Renegade” or the “Company“) is pleased to announce a new Mineral Resource Estimate (“MRE“) consisting of 370,000 ounces in the Indicated category and 439,000 ounces in the Inferred category (See Table 1. Rebel Mineral Resource Estimate below), at its 100%-owned Red Lake gold project, now renamed the Rebel Gold Deposit (the “Project“). The MRE supports both open pit and underground development scenarios and demonstrates strong grade continuity across a structurally controlled gold system, establishing Rebel as a significant gold asset for the Company within the Red Lake Mining District of Ontario (Figure 1). The Project was previously referred to as the Newman Todd Deposit.

Highlights

- Total Mineral Resource includes 370,000 ounces Indicated and 439,000 ounces Inferred at the 100%-owned Rebel Gold Deposit.

- Open Pit Resource:

- 5.57 Mt @ 2.07 g/t Au (370,000 ounces Indicated).

- 2.50 Mt @ 2.42 g/t Au (194,000 ounces Inferred).

- Underground Resource:

- 1.55 Mt @ 4.91 g/t Au (245,000 ounces Inferred).

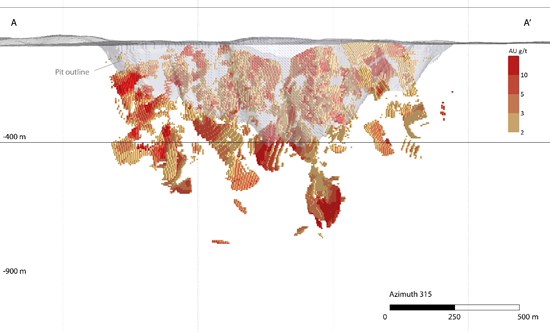

- Deposit Extended at Depth: Recent drilling by Renegade has confirmed gold mineralization beyond 700 m depth, more than doubling the historical drill depth, which was largely focused within the upper 300 m. Substantial expansion potential remains between 300 m and 700 m and at depth (Figure 2).

- 2026 drilling program planning in progress to target resource expansion toward the one-million-ounce benchmark.

Table 1. Rebel Mineral Resource Estimate1

| Category | Open Pit | Underground | ||||

| Tonnes | Au g/t | Contained Au (oz) | Tonnes | Au g/t | Contained Au (oz) | |

| Indicated | 5,568,000 | 2.07 | 370,000 | |||

| Inferred | 2,495,000 | 2.42 | 194,000 | 1,553,000 | 4.91 | 245,000 |

Devin Pickell, President and CEO for Renegade, commented, “This Mineral Resource Estimate marks a significant milestone for Renegade. With over 800,000 ounces defined, including a solid Indicated base and a high-grade underground component, Rebel is emerging as a robust gold deposit in the Red Lake district. The resource demonstrates grade continuity in both open pit and underground scenarios, reinforcing the strength of the mineralized system. Improved structural modelling has enhanced our understanding of plunge and strike controls, which provides a clear path for targeted expansion drilling in 2026. In the context of the Red Lake camp, Rebel has the potential to contribute meaningful ounces toward existing milling capacity.”

Rebel 2026 Mineral Resource Estimate

- The Rebel deposit contains in-pit and underground resources. The mineral resource totals 370,000 oz of gold (5.57 million tonnes at an average grade of 2.07 g/t Au) in the Indicated category, and 439,000 ounces of gold (4.05 million tonnes at an average grade 3.37 g/t Au) in the Inferred category.

- The open pit mineral resource includes, at a base case cut-off grade of 0.6 g/t Au, 370,000 oz of gold (5.57 million tonnes at an average grade of 2.07 g/t Au) in the Indicated category, and 194,000 ounces of gold (2.50 million tonnes at an average grade of 2.42 g/t Au) in the Inferred category.

- The underground mineral resource includes, at a base case cut-off grade of 2.2 g/t Au, 245,000 ounces of gold (1.55 million tonnes at an average grade of 4.91 g/t Au) in the Inferred category.

Table 2. Rebel In-Pit and Underground Mineral Resource Estimate, at Various Au Cut-off Grades2

In-Pit

| Cut-off Grade (Au g/t) | Tonnes | Grade (g/t Au) | Contained Au (oz) |

| Indicated | |||

| 0.3 | 6,577,000 | 1.82 | 385,000 |

| 0.4 | 6,266,000 | 1.89 | 381,000 |

| 0.5 | 5,927,000 | 1.98 | 377,000 |

| 0.6 | 5,568,000 | 2.07 | 370,000 |

| 0.7 | 5,195,000 | 2.17 | 362,000 |

| 1.0 | 4,049,000 | 2.54 | 331,000 |

| 1.5 | 2,555,000 | 3.31 | 272,000 |

| 2.0 | 1,740,000 | 4.06 | 227,000 |

| 2.2 | 1,480,000 | 4.39 | 209,000 |

| Inferred | |||

| 0.3 | 2,824,000 | 2.19 | 199,000 |

| 0.4 | 2,732,000 | 2.25 | 198,000 |

| 0.5 | 2,629,000 | 2.32 | 196,000 |

| 0.6 | 2,495,000 | 2.42 | 194,000 |

| 0.7 | 2,349,000 | 2.53 | 191,000 |

| 1.0 | 1,922,000 | 2.90 | 179,000 |

| 1.5 | 1,310,000 | 3.68 | 155,000 |

| 2.0 | 946,000 | 4.44 | 135,000 |

| 2.2 | 840,000 | 4.74 | 128,000 |

Underground

| Cut-off Grade (Au g/t) | Tonnes | Grade (g/t Au) | Contained Au (oz) |

| Inferred | |||

| 0.6 | 4,916,000 | 2.37 | 375,000 |

| 0.7 | 4,583,000 | 2.50 | 368,000 |

| 1.0 | 3,637,000 | 2.93 | 343,000 |

| 1.5 | 2,370,000 | 3.84 | 293,000 |

| 2.0 | 1,721,000 | 4.63 | 256,000 |

| 2.2 | 1,553,000 | 4.91 | 245,000 |

| 2.5 | 1,353,000 | 5.29 | 230,000 |

| 3.0 | 1,101,000 | 5.85 | 207,000 |

| 5.0 | 471,000 | 8.65 | 131,000 |

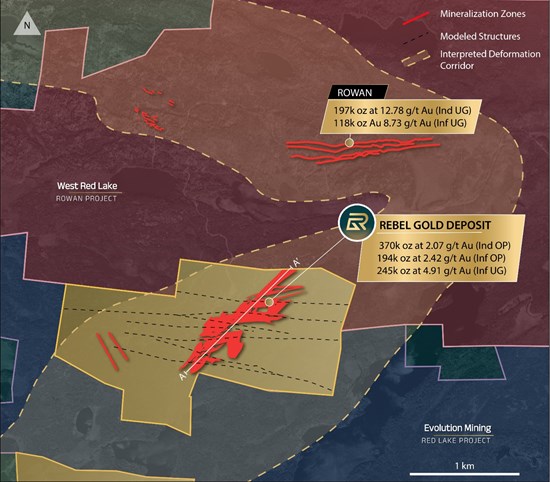

Figure 1. Plan view of the Rebel Gold Deposit highlighting interpreted mineralized zones and adjacent project areas. Rowan is considered an adjacent property and information disclosed for adjacent properties is not necessarily indicative of mineralization at the Rebel Gold Deposit.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9850/284376_dedbaea124382abf_001full.jpg

Figure 2. Long section of the Rebel Gold Deposit mineral resource block model (looking northwest).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9850/284376_dedbaea124382abf_002full.jpg

A technical report supporting the MRE disclosed in this news release will be filed under the Company’s profile on SEDAR+ within 45 days of the date of this news release.

The technical content of this news release has been reviewed and approved by Dale Ginn, P.Geo., the Executive Chair and director of the Company and a Qualified Person pursuant to National Instrument 43-101.

About the Rebel Gold Deposit

The 100%-owned Rebel Gold deposit is located approximately 26 km west of Evolution Mining’s Red Lake operations and 1 km south of West Red Lake’s Rowan deposit, within one of Canada’s most prolific high-grade gold districts. The Project is accessible via all-season maintained logging roads and includes an on-site exploration camp.

Rebel is hosted within a broadly mineralized chemical sedimentary package known as the Newman Todd Structure (“NTS“), 60 to 160 m wide corridor that extends over 2 km across the Property. The NTS hosts multiple styles of gold mineralization, including breccia vein systems and later-stage high-grade quartz veining commonly associated with visible gold.

Recent drilling and updated geological modeling have strengthened the Company’s understanding of structural controls on mineralization, including later east-west faulting events at the camp scale. Drilling completed in 2023 and 2024 confirmed gold mineralization beyond 700 m depth, more than doubling the previous drill horizon, and supports the interpretation that the system remains open and continues at depth.

2026 Focus

In 2026, Renegade plans to advance the Rebel Gold Deposit through a focused drilling program targeting resource expansion and develop new drill targets proximal to the existing Resource footprint. Metallurgical and environmental programs will continue in parallel to support future technical studies.

About Renegade Gold Inc.

Renegade Gold Inc. is a growth-oriented exploration company advancing a district-scale portfolio in the Red Lake region of Northern Ontario. The Company’s strategy combines advancing defined gold resources and development-stage assets with systematic greenfields exploration across one of Canada’s most prolific gold districts.

Renegade has assembled one of the largest and most prospective land packages in Red Lake, totaling approximately 1,380 km², strategically positioned near producing mines and advanced-stage deposits along the Confederation Lake and Birch-Uchi greenstone belts. The Company’s diversified portfolio includes both advanced exploration assets with established Mineral Resources and earlier-stage targets along key structural corridors that host many of Red Lake’s significant gold discoveries.

For further information, please contact:

Renegade Gold Inc.

Devin Pickell

President, CEO and Director

[email protected]

Tel: 604-678-5308

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note regarding Forward-Looking Statements

Statements contained in this press release that are not historical facts are “forward-looking information” or “forward-looking statements” (collectively, “Forward-Looking Information”) within the meaning of applicable Canadian securities legislation and the United States Private Securities Litigation Reform Act of 1995. The words “anticipate,” “significant,” “expect,” “may,” “will” and similar expressions are intended to be among the statements that identify Forward-Looking Information. Forward-Looking Information is subject to known and unknown risks, uncertainties and other factors that may cause actual results to differ materially from those implied by the forward-looking information. In preparing the Forward-Looking Information in this news release, the Company has applied several material assumptions, including, but not limited to, assumptions that general business and economic conditions will not change in a materially adverse manner and all requisite information will be available in a timely manner. Factors that may cause actual results to vary materially include, but are not limited to, inaccurate assumptions concerning the exploration for and development of mineral deposits, currency fluctuations, unanticipated operational or technical difficulties, risks related to unforeseen delays; general economic, market or business conditions, regulatory changes; timeliness of regulatory approvals, the risks of obtaining necessary licenses and permits, changes in general economic conditions or conditions in the financial markets and the inability to raise additional financing. Readers are cautioned not to place undue reliance on this Forward-Looking Information. The Company does not assume the obligation to revise or update this Forward-Looking Information after the date of this release or to revise such information to reflect the occurrence of future unanticipated events, except as may be required under applicable securities laws.

Appendix A

Rebel Deposit Mineral Resource Estimate Notes:

(1) The effective date of the Rebel project Mineral Resource Estimate (“MRE”) is February 5, 2026.

(2) The mineral resource was estimated by Allan Armitage, Ph.D., P.Geo. of SGS Geological Services and is an independent Qualified Person as defined by NI 43-101. Dr Armitage conducted a recent site visit to the Red Lake Project on February 5, 2026.

(3) The classification of the current Mineral Resource Estimate into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards – For Mineral Resources and Mineral Reserves.

(4) All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

(5) The mineral resources are presented undiluted and in situ, constrained by continuous 3D wireframe models, and are considered to have reasonable prospects for eventual economic extraction.

(6) Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

(7) The Project mineral resource estimates are based on a validated database which includes data from 274 surface diamond drill holes totalling 102,429 m. The resource database totals 97,545 drill hole assay intervals representing 92,170 m of data.

(8) The MRE for the Rebel deposit is based on 37 three-dimensional (“3D”) mineral resource models.

(9) Grades for Au were estimated for each mineralization domain using 1.0 metre capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains. An average density value was assigned to each domain.

(10) Based on the location, surface exposure, size, shape, general true thickness, and orientation, it is envisioned that parts of the Rebel deposit may be mined using open-pit mining methods. In-pit mineral resources are reported at a base case cut-off grade of 0.6 g/t Au. The in-pit resource grade blocks are quantified above the base case cut-off grade, above the constraining pit shell, below topography/overburden and within the constraining mineralized domains (considered mineable shapes).

(11) The pit optimization and base-case cut-off grade consider a gold price of $3,000/oz and considers a gold recovery of 90%. The pit optimization and base case cut-off grade also considers a mining cost of US$2.50/t mined ($2.00/t mined for overburden), pit slope of 55⁰ degrees, and processing, treatment, refining, G&A and transportation cost of USD$31.50/t of mineralized material.

(12) The results from the pit optimization, using the pseudoflow optimization method in Whittle 2022, are used solely for the purpose of testing the “reasonable prospects for economic extraction” by an open pit and do not represent an attempt to estimate mineral reserves. There are no mineral reserves on the Property. The results are used as a guide to assist in the preparation of a Mineral Resource statement and to select an appropriate resource reporting cut-off grade. A Whittle pit shell at a revenue factor of 0.52 was selected as the ultimate pit shell for the purposes of this mineral resource estimate.

(13) Based on the size, shape, general true thickness, and orientation, it is envisioned that parts of the Rebel deposit may be mined using underground mining methods. Underground mineral resources are reported at a base case cut-off grade of 2.2 g/t Au. The mineral resource grade blocks were quantified above the base case cut-off grade, below surface/pit surface and within the constraining mineralized wireframes (considered mineable shapes). Based on the size, shape, general thickness, and orientation of the mineralized structures, it is envisioned that the deposits may be mined using a combination of underground mining methods including sub-level stoping (SLS) and/or cut and fill (CAF) mining.

(14) The underground base case cut-off grade of 2.2 g/t Au considers a mining cost of US$90.00/t mined, and processing, treatment, refining, G&A and transportation cost of USD$31.50/t of mineralized material.

(15) The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

1 A full list of underlying assumptions can be found at Appendix A

2 Values in these tables reported above and below the base-case cut-off grades for in-pit MREs and for underground MREs should not be misconstrued with a Mineral Resource statement. The values are only presented to show the sensitivity of the block model estimates to the selection of the base case cut-off grade (highlighted). All values are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284376