Stuve Gold Corp. Announces Las Animas Property Acquisition and Proposed Private Placement

|

|||||||||

CALGARY, ALBERTA – February 11, 2026 – TheNewswire – Stuve Gold Corp. (“Stuve Gold” or the “Corporation”) (TSXV: STUV) announces that it has entered into an arm’s-length agreement to acquire the 3,100-hectare Las Animas property located in Chile’s IOGC belt near the Monto Verde open pit copper mine (the “Acquisition”).

The Acquisition

The Las Animas property is being acquired from Compania Minera Cobalto Chile Limitada (“Cobalto Chile”) for a purchase price of CAD $800,000 payable via the issuance of 3,333,333 common shares of Stuve Gold at a deemed price of $0.24 per common share. No warrants will be issued in respect to the Acquisition and no “control person” will be created as a result of the common share issuance to Cobalto Chile. The common shares issued in respect of the Acquisition will be restricted from being transferred until a date that is four (4) months and one day following closing of the Acquisition. Closing of the Acquisition remains subject to the approval of the TSX Venture Exchange.

The Las Animas Property

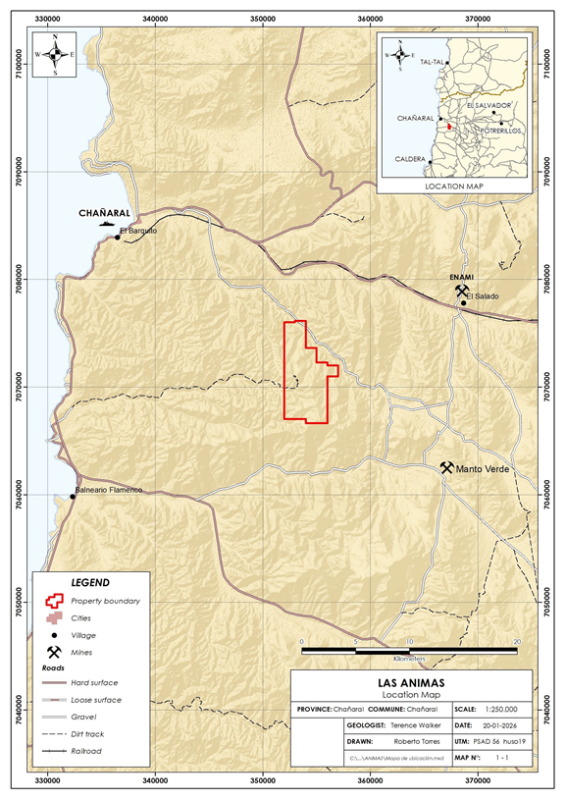

The Las Animas property is located in Chile, approximately 725 kilometres north of Santiago and is within the historic Las Animas high grade oxide copper-gold mining district. It is readily accessible by paved and good gravel roads from the coastal city of Chañaral, 25 kilometres to the northwest (see Figure 1).

The Las Animas property consists of 15 exploration concessions totaling 3,100 hectares that are 100% owned and are not subject to any royalties, NSRs or any other encumbrances.

Property Geology

The Las Animas property covers a 10-kilometre stretch of the Atacama Fault System 12 kilometres northwest of Capstone Copper´s Manto Verde open pit copper mine which, after 28 years of production, had recently reported measured and indicated resources exceeding 594 MT1 with grades ranging from 0.35 to 0.57% Cu, together with 0.09 to 0.1 g/t Au and with 85 to 175 ppm Co. It should be noted that the information pertaining to the Manto Verde mine is not necessarily indicative of mineralization on the Las Animas property.

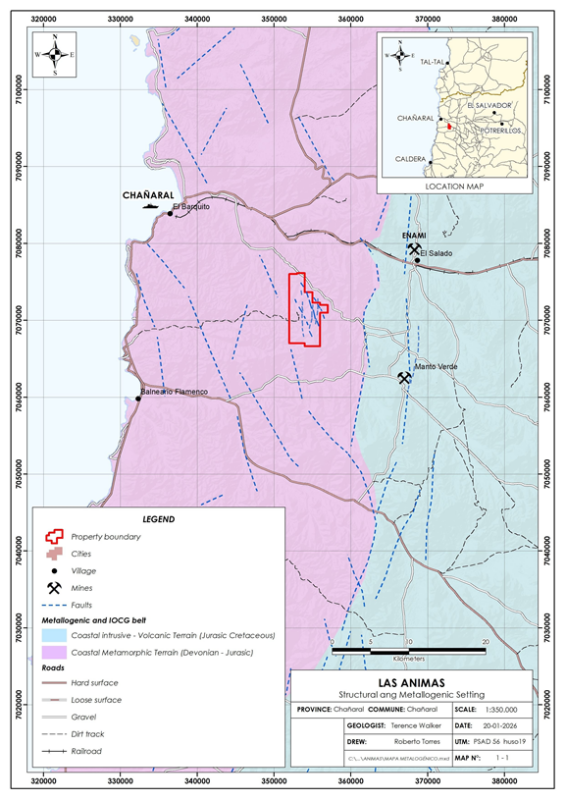

The Las Animas property is generally underlain by an Upper Jurassic monzonite-diorite-granodiorite intrusive complex belonging to the Coastal IOCG belt.

The whole package is cut by large, 5-30+ m wide, N to NW trending structures belonging to the Atacama fault zone (Figure 2). Local Cu-Au mining activity within small artisanal mines occurs within, and lateral to, these faults.

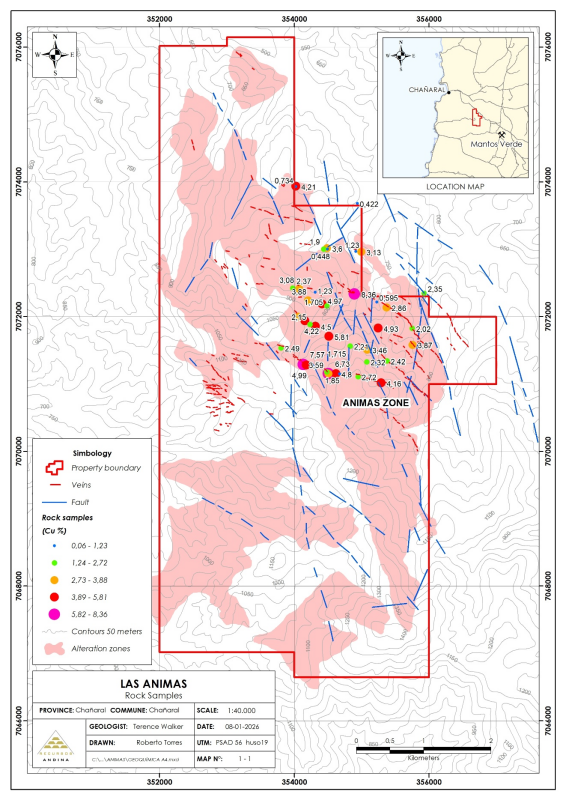

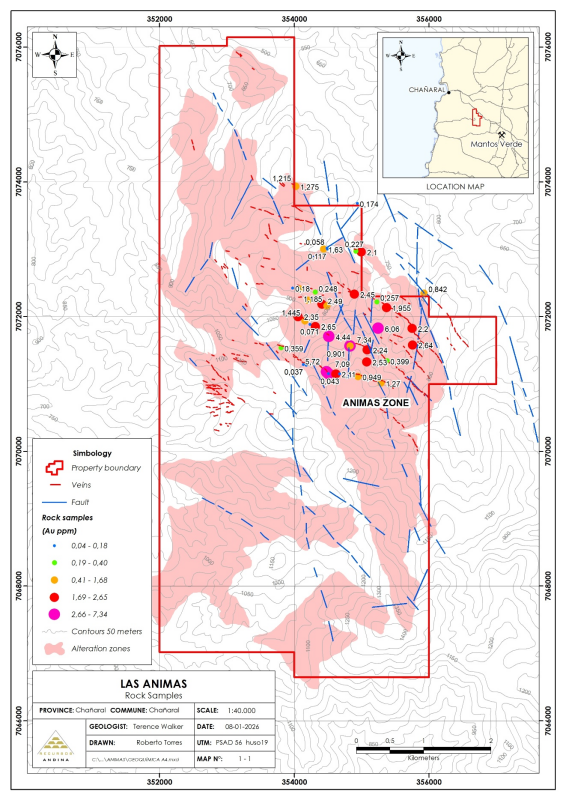

Several large 3 to 16 sq km zones of altered intrusives occur within the Las Animas property boundary. The largest, the Animas zone, occupies most of the NE half of the property and covers the junctions of several strong N and NNW trending structures.

Mineralization and Alteration

The mineralization encountered in old mines and the alteration zones present on the Las Animas property is typical of IOCG vein and disseminated deposits i.e. quartz-hematite-sericite plus copper sulphosalts, limonite and jarosite in the zone of oxidation and at depth as quartz-magnetite-cpy-py. Copper pitch and pitch blende also occur in the old dumps located within the Animas zone. Alteration within the structure zones is essentially sericitic to argillic and argillic adjacent to and within the alteration zones. Uranium mineralization is also suggested by elevated gamma ray spectrometer readings (see below).

Exploration History

Small scale mining was historically carried out on the larger structures in the area since at least the 1930s, whenever copper prices permitted. Judging by the size of the old workings and dumps at some mines, thousands of tons of copper-gold enriched material was mined over widths of 1-10m and to depths of at least 50-100m.

During field visits during 2009 and 2010 by personnel of the Canadian exploration company Polar Star Mining Ltd., most of the larger mines were checked for uranium using an Exploranium GS135 gamma ray spectrometer and detected several strong U readings above 100 ppm to a high of 840 ppm (1.85lbs/ton) (Walker, 2010).

During 2011, reconnaissance stream sediment sampling and residual soil and rock sampling programs were also conducted by the same technical team in the central sector of the Animas zone. The results from these surveys confirm that most of the N to NW trending structures, especially within and adjacent to the Animas zone, are enriched in Cu and Au. Rock samples from the Animas zone consistently assayed greater than 1% Cu and 0.5 g/t Au with peak highs of 7.57% Cu and 7.34 g/t Au (see Figures 3 and 4) (Walker, 2011).

Resource Potential

The sampling program results obtained to date, together with strong presence and continuity on satellite imaging, suggest that the structures and their junctions and splay points exhibit good potential for significant sized IOCG vein/breccia deposits. Local deposits of the IOCG type range in size from 1 to 580 million tons, the largest being the Manto Verde deposit 12 km SE of the property.

The Manto Verde mine area is located at the junction of a strong NNW-SSE fault trend and a prominent N-S fault within a 15 square kilometer alteration zone. Several similar structural confluences occur on the Las Animas property in the 16 square kilometer Animas alteration zone. Hence, by comparison, management of the Corporation believes the upside tonnage potential at Las Animas could be the same as the Manto Verde mine.

Regarding the Las Animas property’s potential, Terence Walker noted: “This is much more than a greenfield property. It sits on a parallel structural system like that at the nearby Manto Verde mine complex. Significant old surface workings already exist on the Las Animas property. Sampling of those workings, together with extensive rock and soil sampling already conducted, have yielded significant copper and gold grades. This has the potential for significant mineralization and tonnage.”

Perhaps of equal importance is the Las Animas property’s general geographical location. Being within the coastal IOGC belt of Chile means that it is not at a high and difficult elevation. Furthermore, much of the infrastructure needed to bring a mine into production such as improved roads, a nearby port, a nearby smelter, high voltage power and a skilled mining labor force are already either in place or nearby. The Corporation’s management is excited to expand the surface geo-chem work it did in the past which is expected to be followed by geophysical surveys. Shortly thereafter, and depending on the interpretation of the geophysical program, the Corporation intends to commence the drilling with the objective of delineating a major resource.

Figure1 – Las Animas Property Location Map

Figure 2 – Structural and Metallogenic Setting

Figure 4 – Gold Anomaly Map

Proposed Private Placement

Stuve Gold announces that it intends to complete a private placement of up to 12,500,000 units (“Units”) for gross proceeds of up to $3,000,000 (the “Offering”). Each Unit will be priced at $0.24 and will consist of one common share of the Corporation (“Common Share”) and one half of one common share purchase warrant (“Warrant”). Since the Corporation is relying on the TSX Venture Exchange’s “part and parcel” pricing rules, each full Warrant will entitle the holder to purchase an additional Common Share for a period of one (1) year from the date of closing of the Offering at a price to be determined based on the trading price of the Common Shares over the next few trading days. The Corporation may pay commissions of six percent (6%) to qualified finders or agents and may issue broker warrants (“Broker Warrants”) for up to six percent (6%) of the total number of Units issued pursuant to the Offering. Each Broker Warrant will entitle the holder to purchase a Common Share at a price of $0.24 for a period of one (1) year from the date of closing of the Offering.

Proceeds from the Offering, assuming the maximum Offering, will be used to conduct exploration activities on the Las Animas property ($1,000,000), Stuve Gold’s existing properties ($1,500,000), as well as for general working capital purposes, for expenses related to the Offering, for the possible acquisition of other properties and for repayment of debt obligations (up to $500,000). With the proceeds of the Offering, management of the Corporation plans to recommence exploration activities, that will include a significant portion of the proceeds and the majority of management’s time, on the Corporation’s existing portfolio of properties, especially on the Corporation’s Teresa/Coba SW property. See “Existing Stuve Gold Properties” below.

The Common Shares, Warrants and Broker Warrants issued pursuant to the Offering will be subject to a four month and one day hold period. Completion of the Offering remains subject to the approval of the TSX Venture Exchange.

Director and Officer Appointments

Discussions with individuals who may be appointed to Stuve Gold’s board of directors or who will assume certain executive positions have commenced and are ongoing. Stuve Gold expects that further announcements regarding additional executive and board appointments will be made prior to, or concurrent with, closing of the Offering.

Existing Stuve Gold Properties

Stuve Gold continues to hold a promising portfolio of properties that have the potential to host accumulations of gold and/or silver and/or copper. Those properties include Teresa/Coba SW, Roma, Santa Gracia and El Bosque. The Teresa/Coba SW property was drilled by Stuve Gold in 2021. That drilling program returned significant gold and copper grades such that Teresa/Coba SW remains a core property for Stuve Gold. Stuve Gold expects that its property portfolio includes properties that the Corporation will not be able to properly advance and may be the subject of joint ventures with other industry participants in the future.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Terence Walker, M.Sc., P. Geo., who is the VP Exploration of the Corporation and who is a “qualified person” within the meaning of National Instrument 43-101.

About Stuve Gold

Stuve Gold is advancing mineral properties in Chile that hold promising potential for gold, copper, silver, cobalt and uranium accumulations exhibited by historical mining activities on, or associated with, those properties.

Stuve Gold’s Common Shares are listed on the TSX-V under the symbol “STUV“. More information on Stuve Gold may be viewed on www.sedarplus.ca or the Corporation’s website www.stuvegoldcorp.ca.

Cautionary Note Regarding Forward-Looking Statements

This news release includes certain “forward-looking statements” under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, the Corporation’s ability to obtain necessary approvals from the TSX Venture Exchange with respect to the Acquisition and Offering, the use of proceeds of the Offering, the Corporation’s proposed drilling programs and anticipated results, potential director and officer appointments, and potential joint venture opportunities. Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; delay or failure to receive board, shareholder or regulatory approvals; the price of metals including gold, silver copper, cobalt and uranium; and the results of exploration programs. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements. Stuve Gold disclaims any intention or obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For further information, please contact:

Terence Walker

Phone: +56 9 5179 5902

Email: [email protected]

Or:

Al Kroontje

Phone: +1 403 607 4009

Email: [email protected]

1 Source: Ausenco Engineering Canada ULC NI 43-101 Compliant Technical Report dated July 1, 2024.

Copyright (c) 2026 TheNewswire – All rights reserved.