Fury Gold Mines’ Massive >80,000m Drill Program with CEO Mike Timmins & Chairman Ivan Bebek

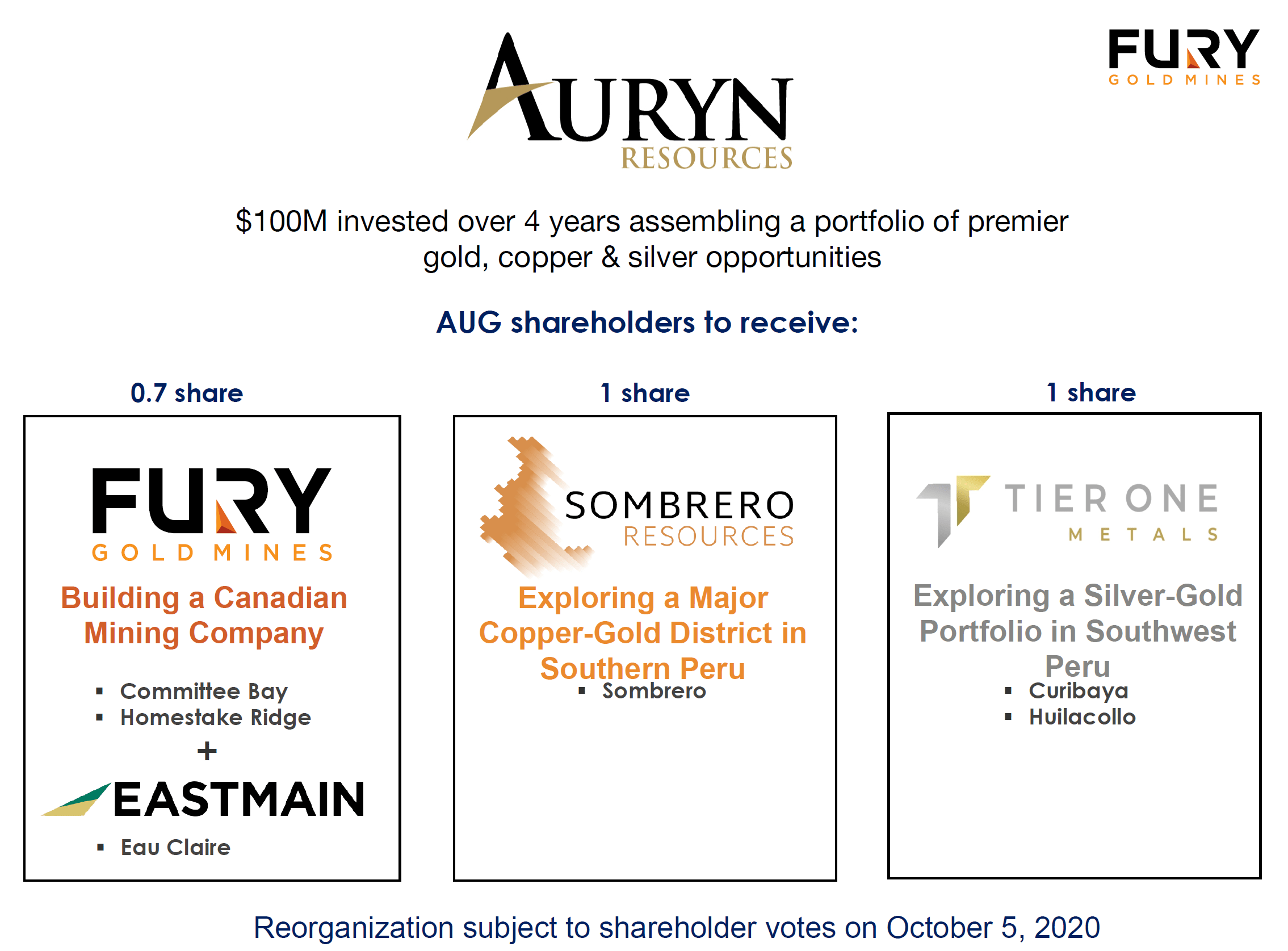

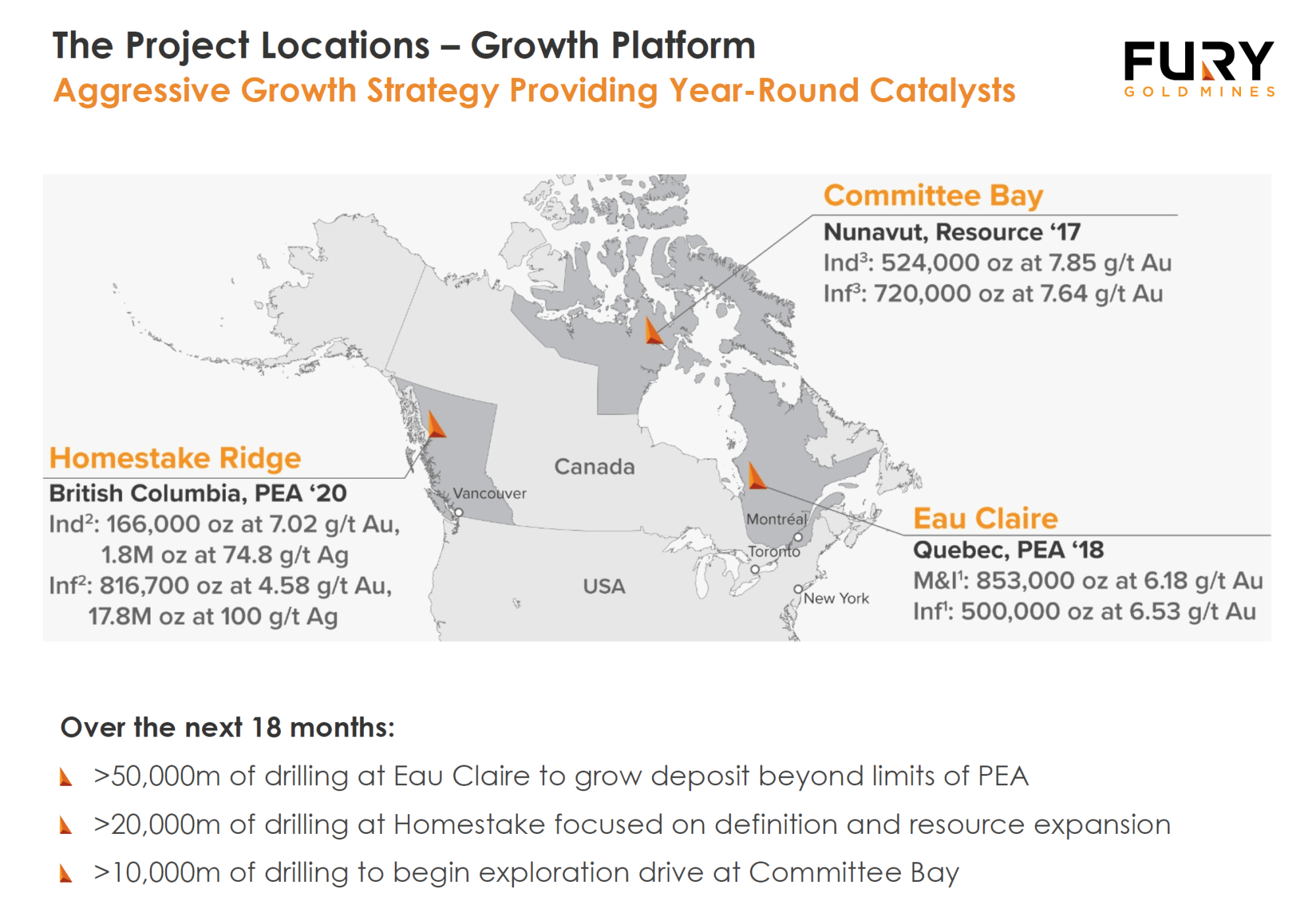

Fury Gold Mines plans to commence by early November over 80,000 metres of drilling at its three high-grade gold projects. Fury will be fully-funded with over C$20M in the treasury and trade under the ticker FURY on the NYSE and TSX. Fury Gold Mines will be the resultant company of Auryn Resources’ acquisition of Eastmain Resources and will hold three Canadian gold projects: Eau Claire, Committee Bay and Homestake Ridge. The scheduled close for the transaction and launching of Fury is October 9th. Auryn and Eastmain shareholders can vote by proxy by October 1st and the virtual arrangement vote is October 5th. In this interview, Auryn Executive Chairman Ivan Bebek, Fury CEO Mike Timmins and Eastmain CEO Blair Schultz discuss the closing of this transaction as well as the vision and growth plans for Fury Gold Mines.

00:00 Introduction

1:21 Ivan Bebek on recent C$23M financing

3:10 Blair Schultz on why Eastmain did this deal with Auryn

4:44 Mike Timmins on Fury Gold Mines’ vision

7:19 Mike’s vision for the Committee Bay project

10:12 Mike’s vision for the Homestake Ridge project

11:33 When to expect Fury to acquire more projects

12:33 Ivan on Committee Bay’s untapped potential

14:17 Ivan on Fury Gold Mines’ potential

17:21 Concluding remarks

TRANSCRIPT:

Kerry Lutz: Welcome and thank you all you for tuning in. I’m Kerry Lutz. I’m joined by Bill Powers of Mining Stock Education and we’re here to update you on a series of transactions taking place by Auryn Resources. Number one, of course, is Auryn Resources’ acquisition of Eastmain Resources and the resulting successor company, Fury Gold Mines. Number two is Auryn’s spin out of its Peruvian copper assets into a new company, Sombrero Resources. And number three, its spin out of its Peruvian silver gold assets into a new company, Tier One Metals. And here to discuss this and update you is Ivan Bebek, Auryn’s current executive chairman, Blair Schultz, president and CEO of Eastmain Resources, and Michael Timmins, who will be the CEO of Fury Gold Mines. Gentlemen welcome here and let’s get to the first question. Ivan, recent financing is completed. Can you give us an update?

Ivan Bebek: Great, thanks for having us all here today to talk about the transaction and everything we’re going to talk about. We just completed a C$23 million financing for Fury Gold Mines, as you know, specific to Fury. It was a condition of the acquisition of Eastmain, and we were very fortunate that we had some very, very key investors that we wanted in our registry to be added in this funding. And I think in terms of raising a lot of money in the business there’s different times, different markets to do this, and it was a little bit more challenging than we set out to go and undertake because of the subscription receipts. And there was a lot of complexities, there still is, until the vote’s complete, but coming through this financing the way we did, a very strong shareholder base. And I think a lot of people that missed the financing will have a lot easier time being investors, post-Fury trading, assuming the vote goes well in October.

So, a great outcome, great investors. It gives us 50,000 meters of drilling to start in November 1st. And for the benefit of how we’ve created so much value for Auryn, this is the biggest drill program we’ll ever undertake as former Auryn management. It will be a tremendous catalyst for investors to look forward to starting a few weeks after the vote in November 1st. So it’s a great point of the company to move forward with a very strong treasury.

Kerry Lutz: And, Ivan, what’s the date of that vote again?

Ivan Bebek: The vote is on October 5th. And if you haven’t voted, we’d encourage you to submit your proxies by October 1st and once the vote’s complete, assuming a positive vote, new shares will trade on October 12th. The last day to buy Auryn shares is on October 9th to get shares of the SpinCos.

Kerry Lutz: Excellent. And, Blair, tell us why the merger makes sense for Eastmain shareholders and why you did this deal.

Blair Schultz: Eastmain was in an interesting position. We parted ways with our CEO back in December and we didn’t put ourselves up for sale. The board really carefully weighed the idea of going in alone and raising capital or looking for a partner to help to bring this project to production. And at the time going it alone and finding a new management team seemed like a very difficult challenge. And what we found is, everything involved, a significant amount of dilution for our shareholders.

And so we went looking for, we didn’t actually go looking, we found a partner that suited us greatly. And at the end of the day, we got a nice premium for our shareholders and, with the team of Ivan and Mike, you grabbed a team that has great experience to build a mine, one, and, two, to access the capital markets for our shareholders. And we won’t be diluting our shareholders and we also get the upside of two great projects, Committee Bay and Homestake. So what it really came down to was our shareholders. We’re trying to get the best transaction for our shareholders and the best return. And we believe that Mike Timmins, leading the charge forward with Fury Gold, will bring that. And we’ll see a project being built in the coming years.

Kerry Lutz: Excellent. And, Mike, the vision for Fury, what made you want to join the team and, and tell us about the drill program coming up and the aggressive growth plan for the coming year?

Michael Timmins: I think the vision for Fury should be pretty straightforward, right? I mean, the vision is to build a Canadian mining company from the ground up and advance all three of our assets into production, right? So straight forward. Internally, we’re saying to the crew we want to be pouring gold by 2025, right? And that’s sufficiently aggressive to keep everyone focused on our growth objectives. Externally we’re telling people to expect bigger, sooner, right? The sooner we know what we have in the portfolio, the sooner we’ll be advancing the business. So you can expect us to invest heavily in exploration and also look out for us to make smart acquisitions as we go and grow the business. I’ve known Ivan and Sean, since the Cayden acquisition back in, in 2014, and these guys are authentic, they’re people-focused, and they have a great track record of creating a ton of value for owners in the mining space.

And when they approached me middle of the summer to put the game plan together for Fury, I went back to them and I said it’s very clear that you need to have the right ingredients here to be successful. And what are those ingredients, right. An experienced management team that can execute, unencumbered access to capital that we’ve demonstrated recently with financing, scalable high quality projects similar to what Blair just took us through and genuine market support. Right? All of which we have at Fury.

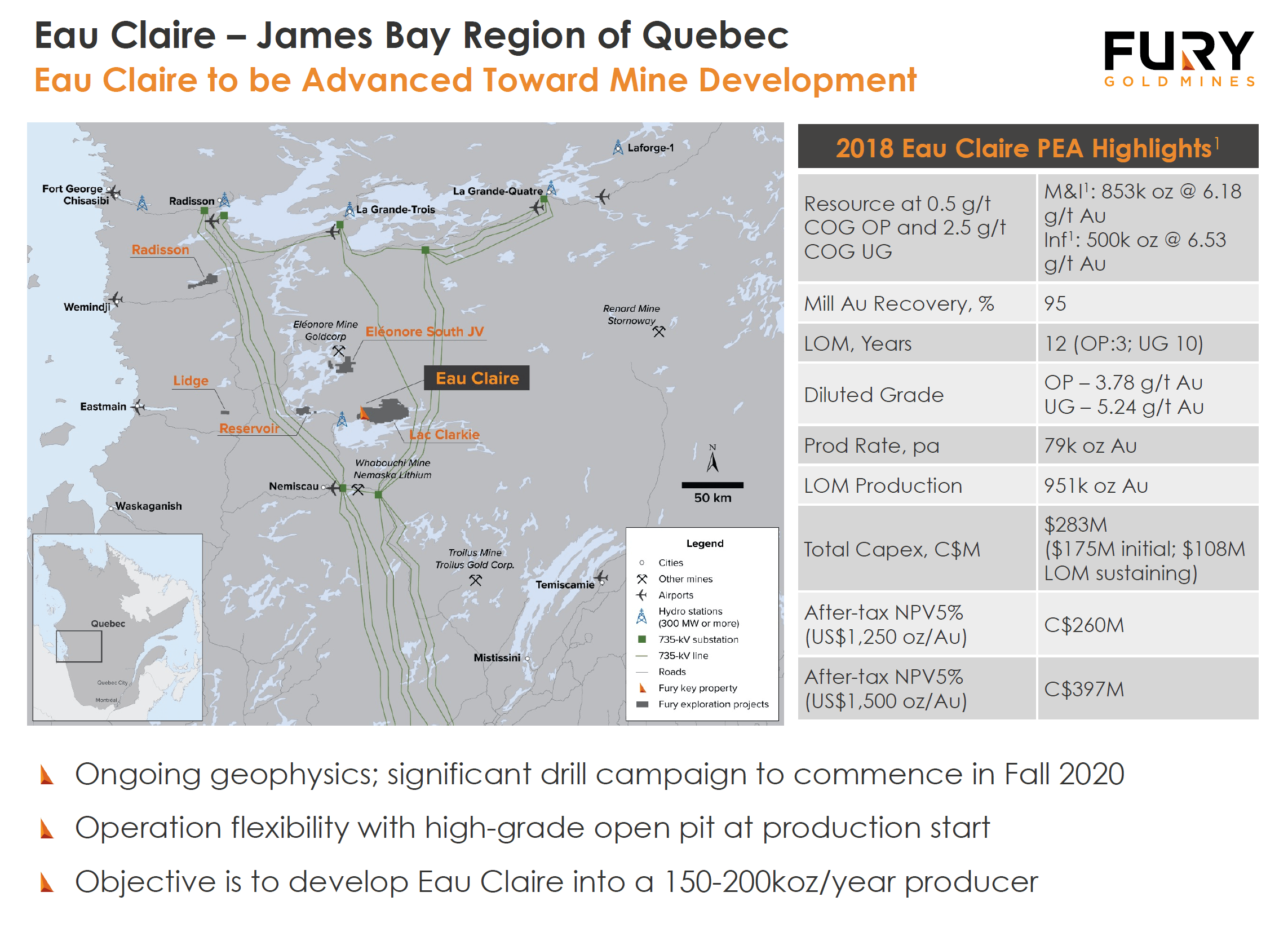

So a very attractive scenario for investors and, and exciting for me to come in as the new guy and the key component of the mix to kind of drive the thing forward. You can expect us to come hard out of the gate at Eau Claire, which is obviously the asset being acquired, and we’re share price focused, right. And the best way to have share price appreciation, certainly in this market is to be drilling high-grade gold deposits. And that’s basically going to be our plan coming out of the gate at Eau Claire. And certainly for the remainder of the year as we unleash the Fury and really set out on a campaign of sequential exploration activity, which really provides those great catalysts for investors to drive company valuation on a per share basis, which is really our primary objective.

Bill Powers: Mike, I’d like to ask you about Committee Bay. This is a project that has been in Auryn’s portfolio for some time, and a lot of money was sunk into it prior to Auryn acquiring this asset. What specifically gets you excited about Committee Bay? And can you share with the listeners that maybe aren’t familiar with your experience working in that region already?

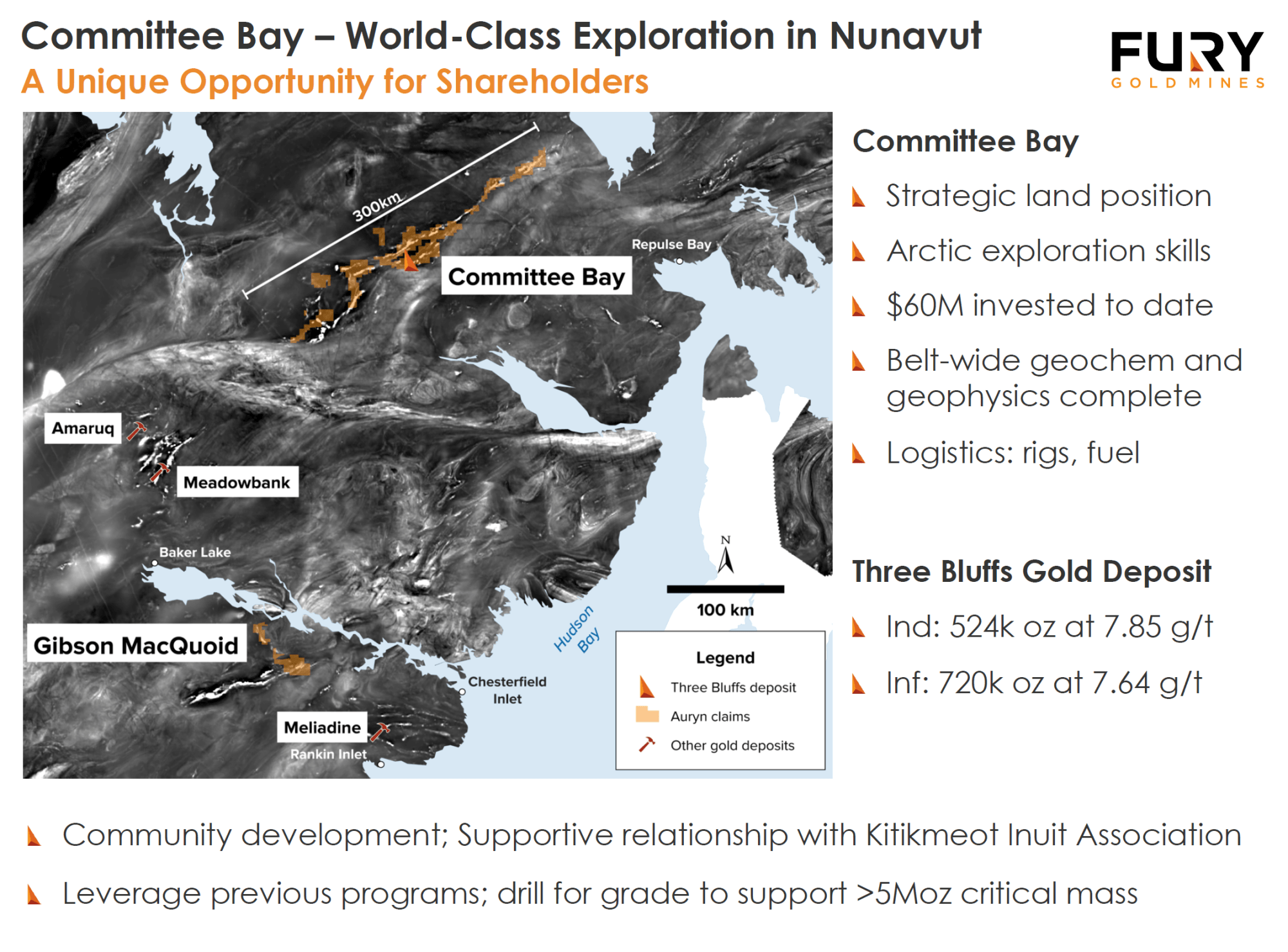

Michael Timmins: You know, the big part of the reason for me taking the role was Committee Bay, right. And that might be a surprise for some, but for it being basically our tertiary asset, what we’re trying to achieve here is to expose shareholders to some measured, wild, new discovery potential, right? We have two great development assets that we’re getting moving forward and that’s lower risk growth. But what we wanted to do is expose the owners to some discovery potential. ComBay does that. Having been part of the Agnico Eagle early experience in Nunavut, we’re all well aware and I’m certainly well aware of the long-term mindsets and patience that’s required to be a successful explorer and developer in the region. And particularly when you’re working on big systems. Forget just trying to advance one deposit. Another developer that, in Nunavut, earlier this week, put out an update. They’ve spent $350 million over the last 11 years to get the 7 million ounce deposit that they have today.

And so it takes time in these regions. You have to have the right logistical skillsets. You have to have these relationships in place in order to advance it. The other key learning that everyone should be aware of is that every subsequent exploration program needs to be more impactful than the last. You have a good hundred days of the year to really move the needle in Nunavut every season that you go up and you have to be smart with your time and with your money. And that’s all part of the Auryn skillset that we’ll be continuing on with Fury.

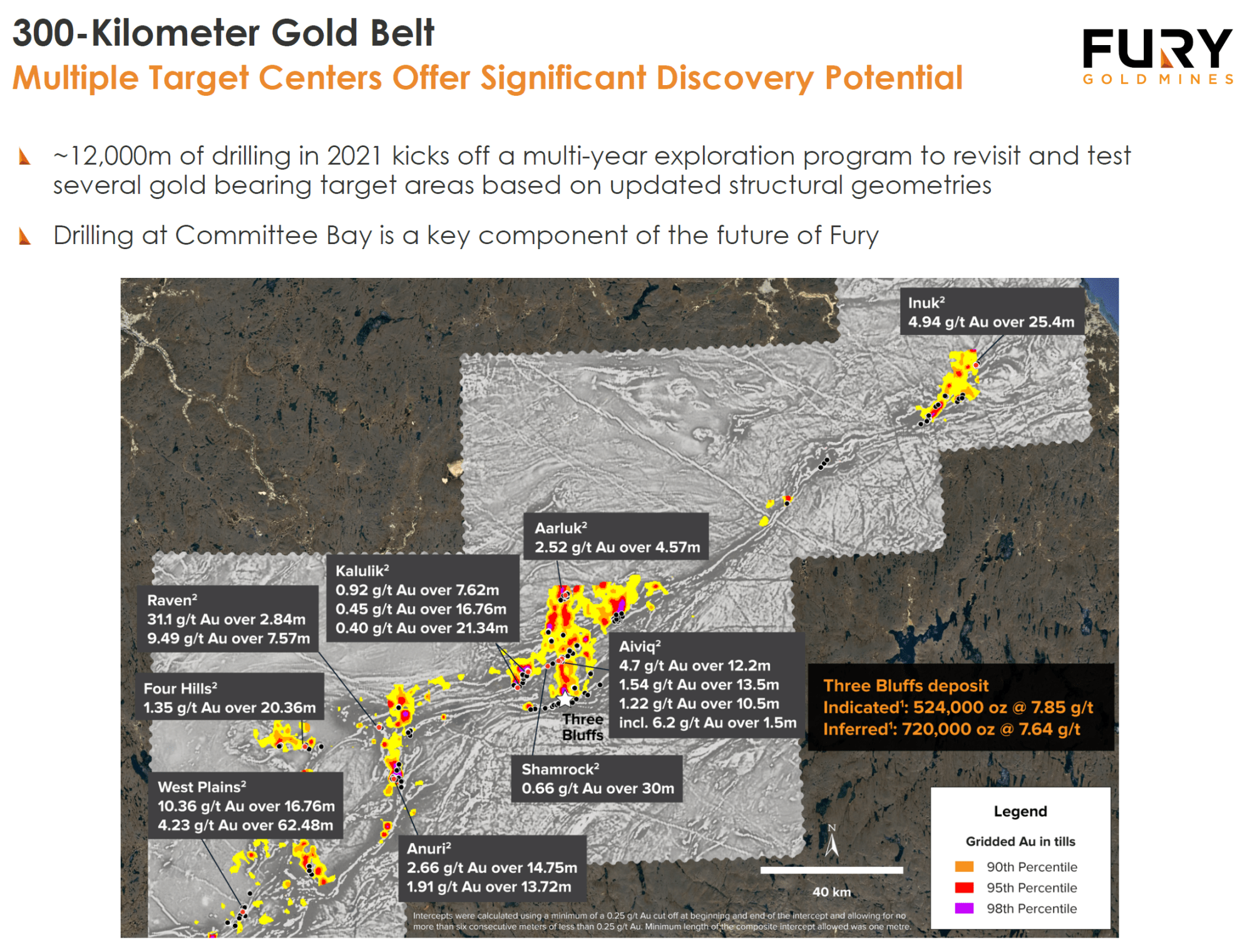

In June, we’re going to be commencing a minimum of 15,000 meters. That’s going to be testing out three to four of the new updated target centers that we have. You can expect us to add ounces at Three Bluffs, which is going to be exciting, and potentially convert one of our many mature exploration targets into a mineable deposit, which is code for a new discovery. Committee Bay is, in my view, a big part of our future for Fury. And we’re never going to stop being active on that belt and relentless and systematic exploration. I think that’s key over the long-term.

Bill Powers: As the soon to be CEO of Fury Gold Mines, what is your perspective on Homestake Ridge? What can you share with investors?

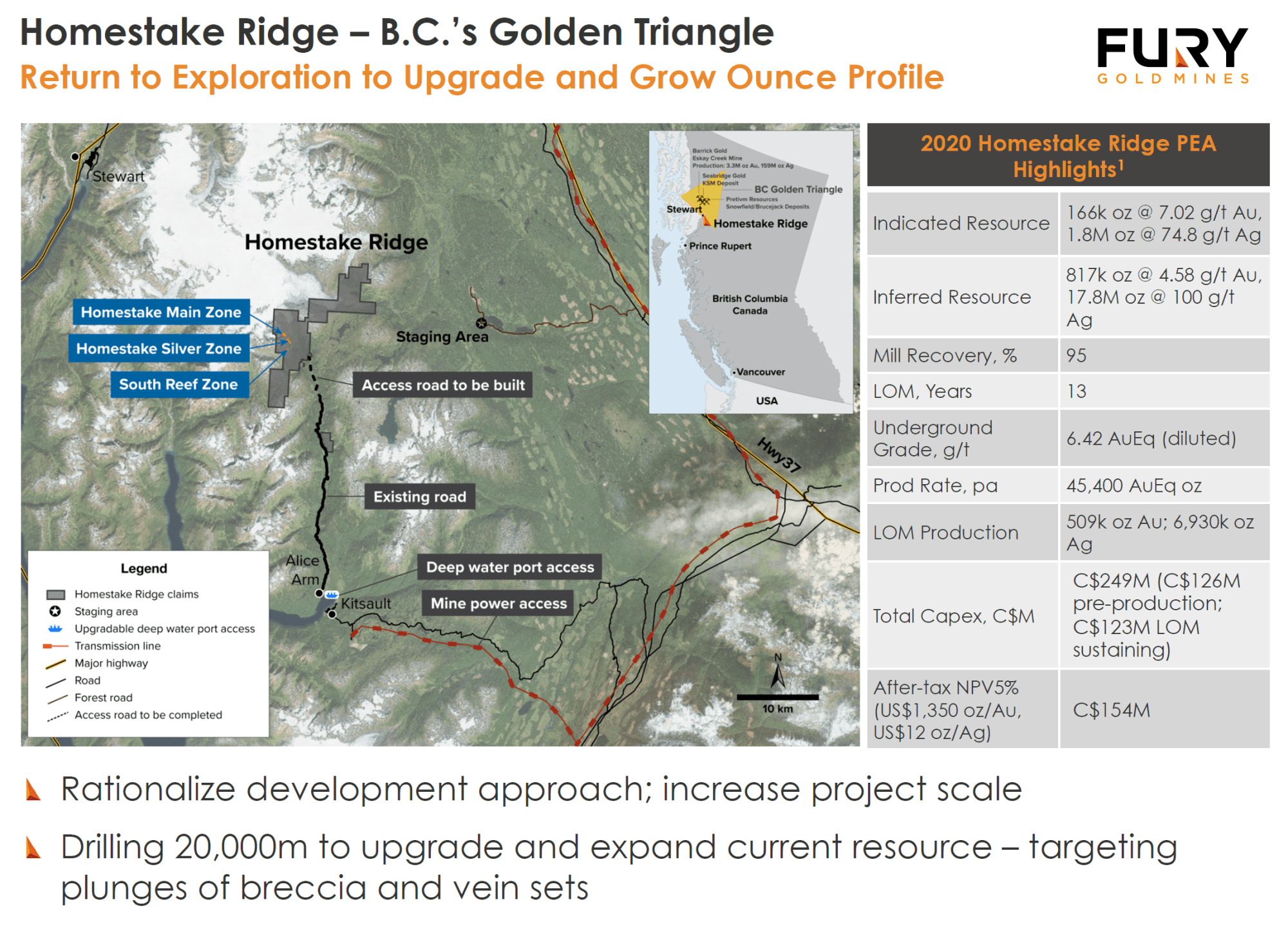

Michael Timmins: Homestake, I think, is a misunderstood asset. Back in the old Auryn, which was primarily an exploration company, it, might’ve not had a home in that company, right. And it was previously signaled as an asset potentially for sale, which would have been, at the time, quite a smart, non-dilutive financing where they could just redeploy those funds into exploration, which is basically a wheelhouse skillset. But in Fury, it’s a development company, Homestake tucks very nicely, right in behind Eau Claire in the development pipeline. It has a recent PEA, which outlines 1.2 million ounces, gold equivalent mining scenario, which is a great start. Personally, I would like to have that project’s ounce profile increased. So the growth there will start next summer. We are right now setting out a 20,000 meter program to upgrade and expand the current resource. We’re also going to have news out, probably November timeframe, to articulate our targeting and provide the market some technical backdrop ahead of our marketing activities in Q1 next year.

Bill Powers: Mike, can you share any more about the timing of potential acquisitions? Obviously you have three big projects on your hands already, but, as a CEO, what’s your mindset and thoughts regarding future acquisitions in terms of timing?

Michael Timmins: The acquisitions for any company have to occur within windows of strength. We certainly have a business to establish first. We want to build currency in the share price. We want to convert on a lot of proof of concept things. We certainly want to show success at Eau Claire. So I think once that’s completed, once a lot of the team has been built, once the board has been set out, committee set out, and really a business has been established, we will go to look for acquisitions that fit.

Bill Powers: That makes sense. Thank you, Mike. Ivan, I’d like to get your thoughts on Committee Bay. What more would you like to add about what’s going on in Committee Bay and what’s your current perspective on Committee Bay?

Ivan Bebek: Sure. Well, it’s a project that I signed up for when we first acquired it, that I would drill until we made the discovery. And that’s something that hasn’t changed from my thoughts toward it. The price is up there. It’s a big one, and we think there’ll be more than one of them. In the next week, after this interview, you’ll see the Committee Bay targeting results. This is the backstop of $60 million of learning that’s happened up there. And a few people have been asking if it’s still as of importance, is it still have that potential? You’re going to see about 11 targets on the belt with this new targeting methodology breakthrough. And although the science gets interesting, it’s not going to bode well with many retail investors. You have to take our word on it, that these will be the best holes we’ve ever drilled up there.

And to go up to Committee Bay with not only the exploration team mindset, but somebody like Mike Timmins coming from Agnico Eagle, where Mike was obviously part of the acquisitions and he overlooked and saw the development of the Committee Bay assets at Agnico, I think there’s a tremendous new depth of pedigree that comes in with Committee Bay. So Committee Bay for me is worth a lot more on a discovery now with Mike Timmins as our CEO than it was previously in our hands. And no discredit to ourselves, but here’s somebody that’s not afraid of the Arctic that likes it as much as we do. And his background is more on the development side as well. So Committee Bay is an outstanding asset. I can’t wait until everyone sees these targets and to all the Eastmain shareholders who know a lot about Eau Claire.

And I do want to point out, I’m glad you guys brought up Homestake and Committee Bay today because these assets have generated Auryn’s current market cap by themselves twice at $1,350 gold. And there’s a reason for that. And there’s a lot of reason or a lot of value that’s being missed in Fury right now, or in where we funded the company. But we’re fine with that because we’re going to build that out and post the formation of Fury. You’re going to have a lot of news, you’re to have a lot of things to be excited for that could really change the performance of how everyone’s looking at Fury from the current being of growing.

And I think the one point I’ll make is the biggest strength in any gold company in this environment to go and create value for shareholders is through drilling. So if you take the numbers that Mike gave you and you take the Fury drilling we’re going to do at Eau Claire, you’re looking at about 85,000 metres minimum that we’re going to drill in the next 12 months in the backstop of an incredible start to a gold bull market, the growth in the mature stage of both Eau Claire and Homestake Ridge. They’re past PEA red light, green light, meaning they’re past knowing whether you should spend more money, whether it’s worth seeing if they could get bigger, whether they could be built as is. They’re past that threshold and they can only get a lot better in our view going forward in terms of size. And a lot of things that we haven’t really got to yet in terms of potentials in Quebec at Eau Claire and surrounding targets, as well as looking at the feeder structures underneath Homestake Ridge.

But if we come out of Committee Bay next summer, as Mike has pointed out, we’re going to be drilling near Three Bluffs on some peripheral targets that we believe we’re going to add ounces as a consequence to not making that huge discovery as a worst case scenario, which is a great place to land in the current gold environment. But if we make a discovery and one of the three targets that we drill, away from Three Bluffs, I think it would be an outstanding surprise and return for shareholders because of the gold environment we’re in and to Mike’s vision, to build the Canadian mining company, we want to build that growth profile first for Fury. We want to show the pipeline of growth that’s really challenging for the major mining companies and mid tiers to find because discoveries have not been found.

And I think that the thing that Committee Bay does, it gives you a shot at 5 to 10 million ounces right out the gate, and that would be substantial. So our neighbor up there has spent $350 million to get to 7 million ounces. I think Agnico has done a tremendous job, not only mining in the Arctic, but they’ve also made new discoveries, such as Amaruq. And I think that these are great deposits, but you have to look at Committee Bay as the big belt up there. And I would say that it’s gone from being very difficult to being very exciting. So it’s not in our share price right now, to the extent where it should be. It’s definitely not in Fury’s valuation. And I think if you look at the gold market, the amount of drilling we’re going to do across all three, I think we have a very exciting share price performance to look forward to in the next 12 months. So, very exciting.

[…] Source : miningstockeducation.com […]