Tight Share Structure + Uranium Discovery = Massive Wealth Creation with Baselode CEO James Sykes

Baselode Energy Corp. CEO James Sykes is no stranger to uranium discovery success. James has been directly and indirectly involved in the discovery of over 450M lbs U3O8 in the Athabasca Basin including being the lead geologist on NexGen’s world-class Arrow discovery. Now James is at the helm of a new early-stage uranium exploration play in the Athabasca Basin. Baselode Energy Corp. is part of Stephen Stewart’s Ore Group and has an extremely tight share structure and low float. Baselode plans to begin drilling its flagship Shadow project in the next few months. James explains in this interview regarding Shadow’s prospectivity: “I’ve never seen anything like it in my life.” If James’ exploration theory proves true with such a tight share structure coupled with a uranium bull market the returns for Baseload shareholders could be staggering.

00:00 Introduction

1:27 James Sykes: successful geologist with multiple uranium discoveries

4:01 Athabasca Basin: world-class uranium grades

4:46 Athabasca Basin mining challenges & James’ exploration thesis

8:11 Why did you choose Shadow and Hook projects?

10:25 Shadow project: outside-the-box thinking

12:19 Plans to drill shadow project

15:29 Treasury, burn-rate and financing

16:36 Drill spacing for Shadow project

17:40 Executive compensation

19:01 “I’m after reputation.”

19:27 Tight share structure + U3O8 discovery = massive wealth

21:42 Forthcoming OTCQB listing for U.S. investors

TSXV:FIND OTC:BSENF

TRANSCRIPT:

Bill Powers: Introduce yourself to my listeners regarding some of your success in the Athabasca Basin please.

James Sykes: Absolutely. I’ve told this story many times. So when I started out in my career, I was with Denison Mines. At that time, they did not have the discoveries that they have today, but I was part of the team that eventually led to those discoveries. So we were the exploration generators that really targeted the Phoenix discovery and then the Gryphon discovery. And in particular with Gryphon, I was relogging core and came across some clay alteration and said, “Whoa, this is fantastic and it’s got uranium. Let’s really focus on this.” And lo and behold, it became Gryphon.

After that, I went to Hathor Exploration, which I’m pretty sure most people in the uranium space on the investor side know Hathor, because that was the junior that kicked off this whole junior exploration rush with the discovery they made there. But I did a lot of geological work, came up with a 3D model that suggested we were looking on the wrong trend. So we shifted focus, we discovered two more deposits out there, so success in that regards.

After that, I went to Rio Tinto for a brief stint when they bought out Hathor, and from there I jumped over to NexGen Energy prior to their discovery. I was the lead geologist behind the discovery there, and I’m pretty sure most of your listeners do know the NexGen story. That’s the big one that people know about uranium today. So with NexGen, that was a wonderful success. And I think that just, it solidified a lot of ideas for me that I had going, and it’s really helped develop my career right now. And this is where I’ve taken everything that I’ve learned in the past and bringing it over to Baselode. And from what I see with Baselode right now, we’re primed for a very wonderful success.

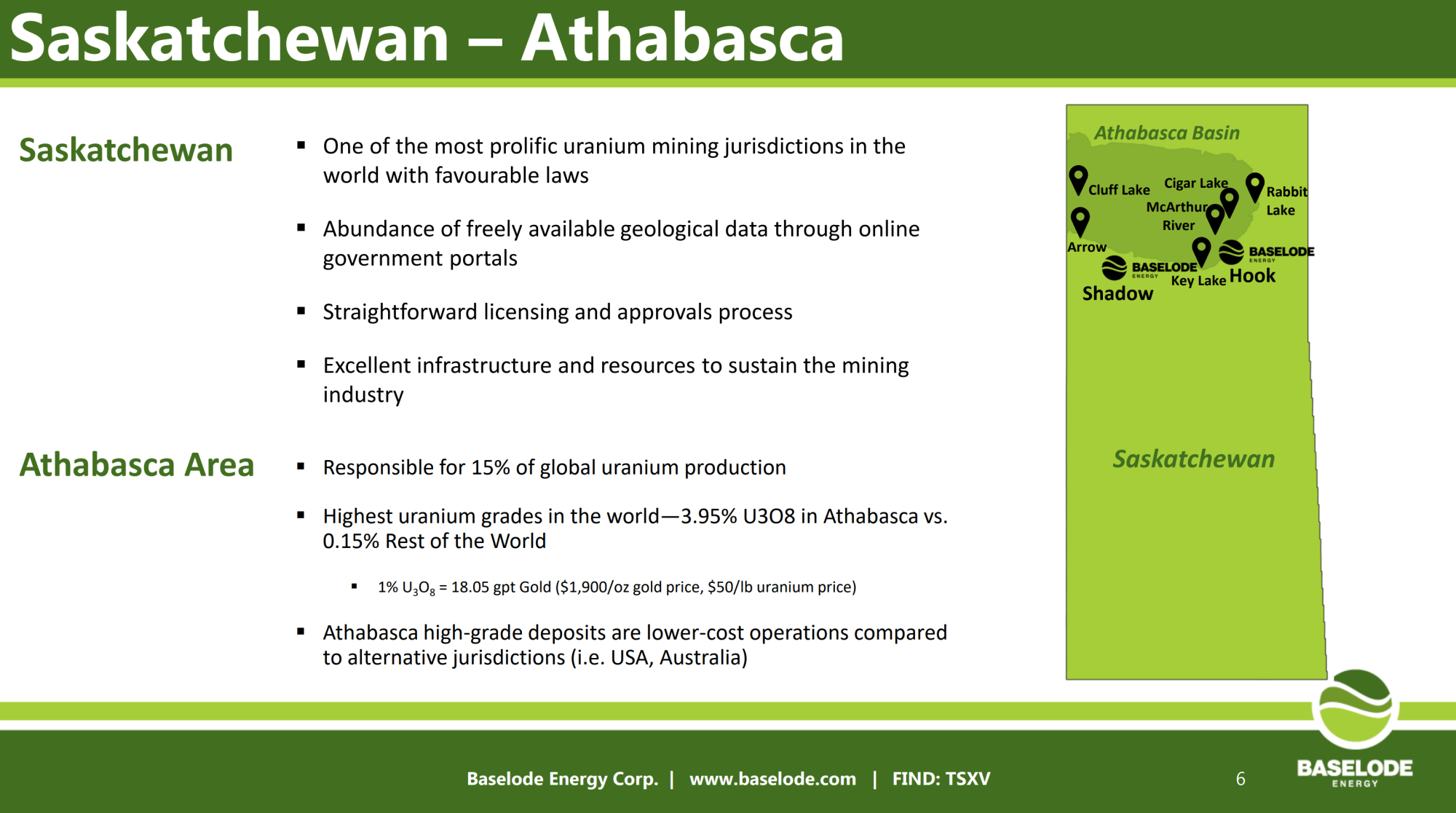

Bill: And for the listeners that aren’t familiar with Athabasca Basin, please just give an overview of why you’re focusing on the Athabasca Basin.

James: Absolutely. Athabasca Basin is elephant country for uranium. When you want to find a commodity, typically high grades are what you want. And you don’t get higher grades than what you find in the Athabascan Basin, these are world-class. Average grade for uranium across the globe, let’s say it’s about 0.1 to 0.15% U3O8. Average grades in the Athabasca Basin are about 3%. And if you get these monster deposits like McArthur River and Cigar Lake, you’re looking at above 20% U3O8. That’s phenomenal. Those are the richest commodities in the world, even when the uranium price was depressed.

Bill: So they’re rich in terms of their grade, but there’s also some complications with mining in the Basin, isn’t there?

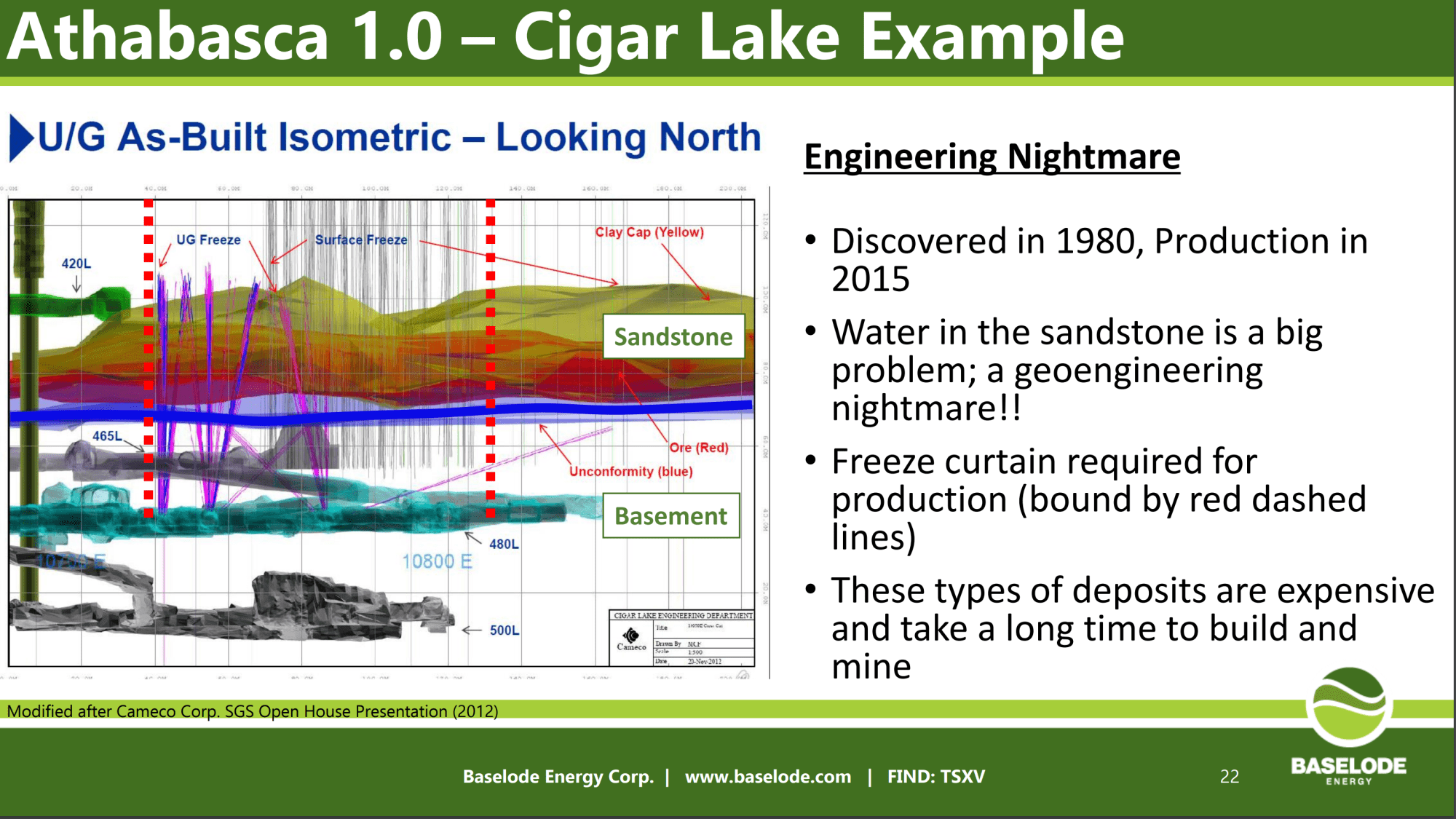

James: Oh, for sure. And it’s quite ridiculous. Again, with what I’ve developed over the past, and what I’m bringing up is actually not a new idea, but I’m a very strong proponent behind it. The Athabasca Basin itself is a sandstone, it’s a sandstone with water in it. And that water causes a lot of mining engineering issues. If you look at the two mines that have ever gone into production underground in the Athabasca Basin itself, Cigar Lake and MacArthur River, they both have flooded twice. So it’s expensive, it causes delays.

So now to mine, those out, they have to do what they call a freeze curtain. And that just freezes all the water on top so you can’t get any water infiltrating along these structures. And again, uranium in the Athabasca is all controlled by structures. So why would you want to mine something that is more than likely going to flood on you, is going to be absolutely expensive. And the only reason why you do that is obviously if you have a MacArthur River or a Cigar, and these things are monsters. They’re monster tonnage, monster grades, like I suggested.

There are a number of other deposits in the Athabasca that have been discovered in the seventies, eighties, there’s still no advancement on them. Why? Because of that sandstone. A couple of the larger companies have tried to look at the idea of doing an open-pit mine below a hundred meters depth, it can’t be done because that water infiltration is just too much. So in a lot of other commodities across the globe, you’ve got your open-pit mine. And you can go 200 meters, 300 meters, 400 meters, because the rock type is right. You can’t do that in the Athabasca Basin.

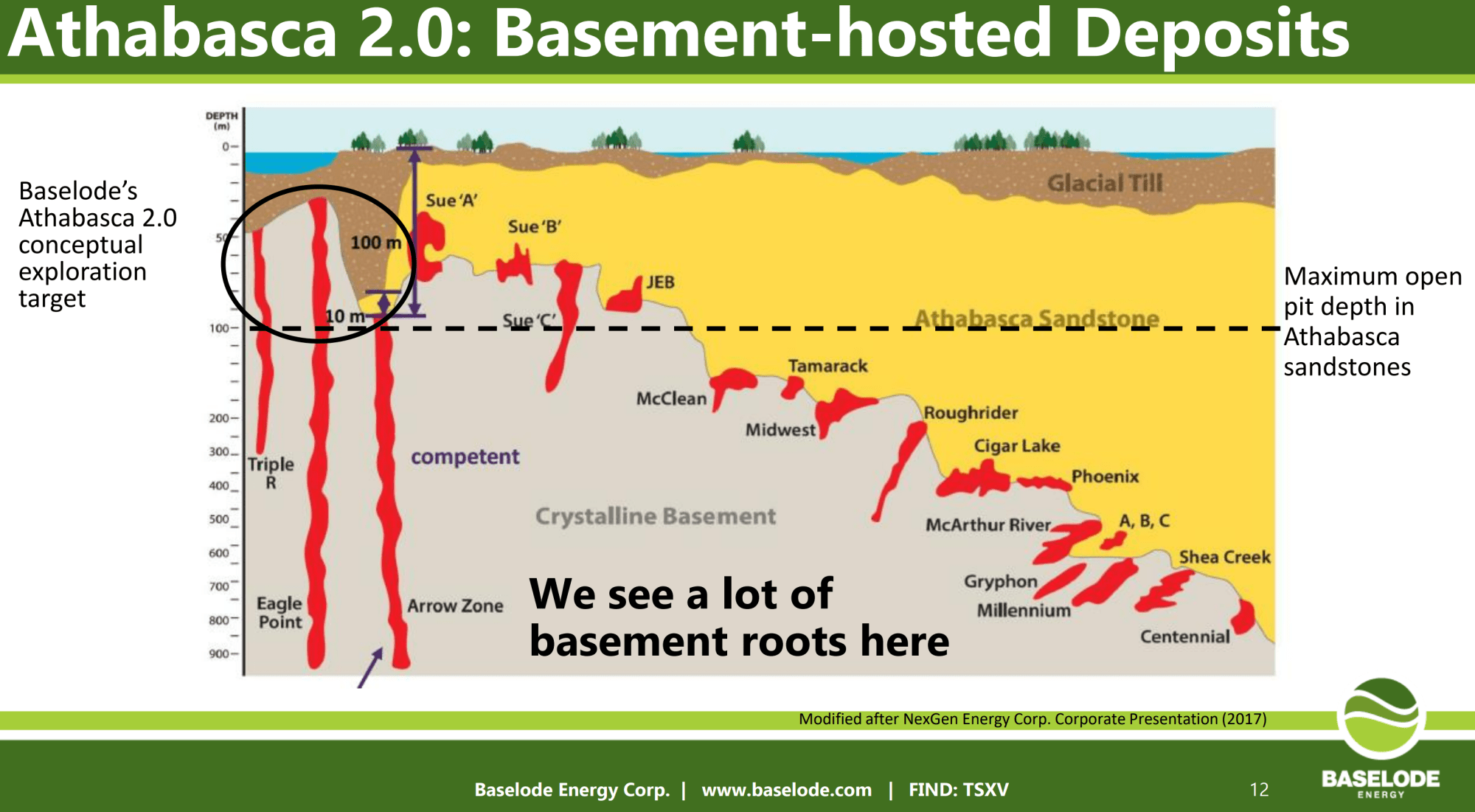

So it’s mind-blowing to me, is why are we still looking for those then? Then the chance of finding these monsters is very slim. So why are we looking for these smaller things? Yet, when you really look at the Athabasca Basin, most of that mineralization is along basement controlled structures and their basement-hosted still. So we know that the structures and the basement rocks have a huge role to play.

I can show smaller basement deposits at least a hundred kilometers away from the Athabasca Basin edge. But we’ve had horse blinders on our exploration strategy since the seventies, eighties, nineties, and these carried into the 2000s that we have to look for this unconformity type of model. And the unconformity is basically the contact between this porous water-saturated sandstone with competent crystalline basement rocks. That, if you had no sandstone cover, you could easily open-pit something like that down to 200, 300, 400 meters.

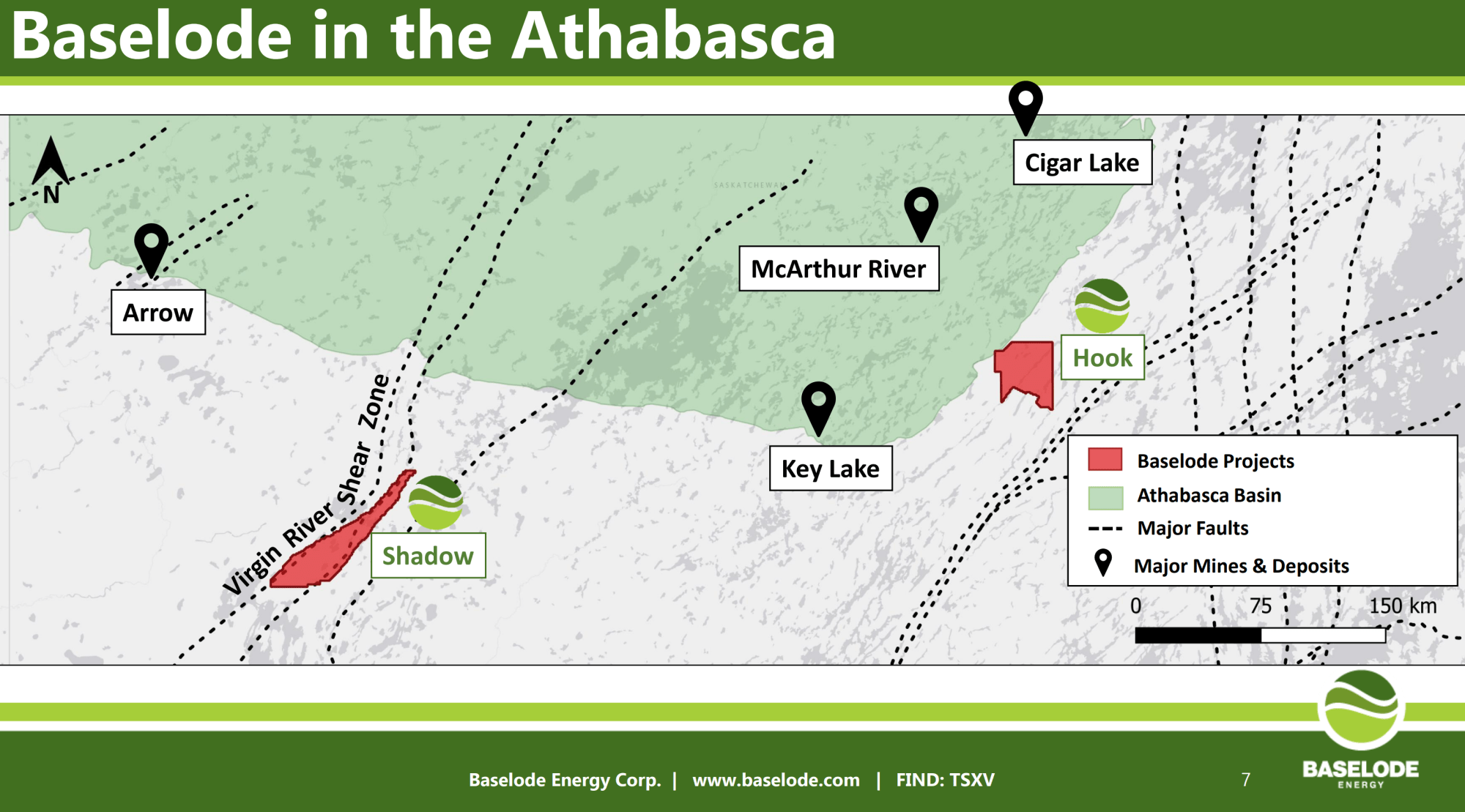

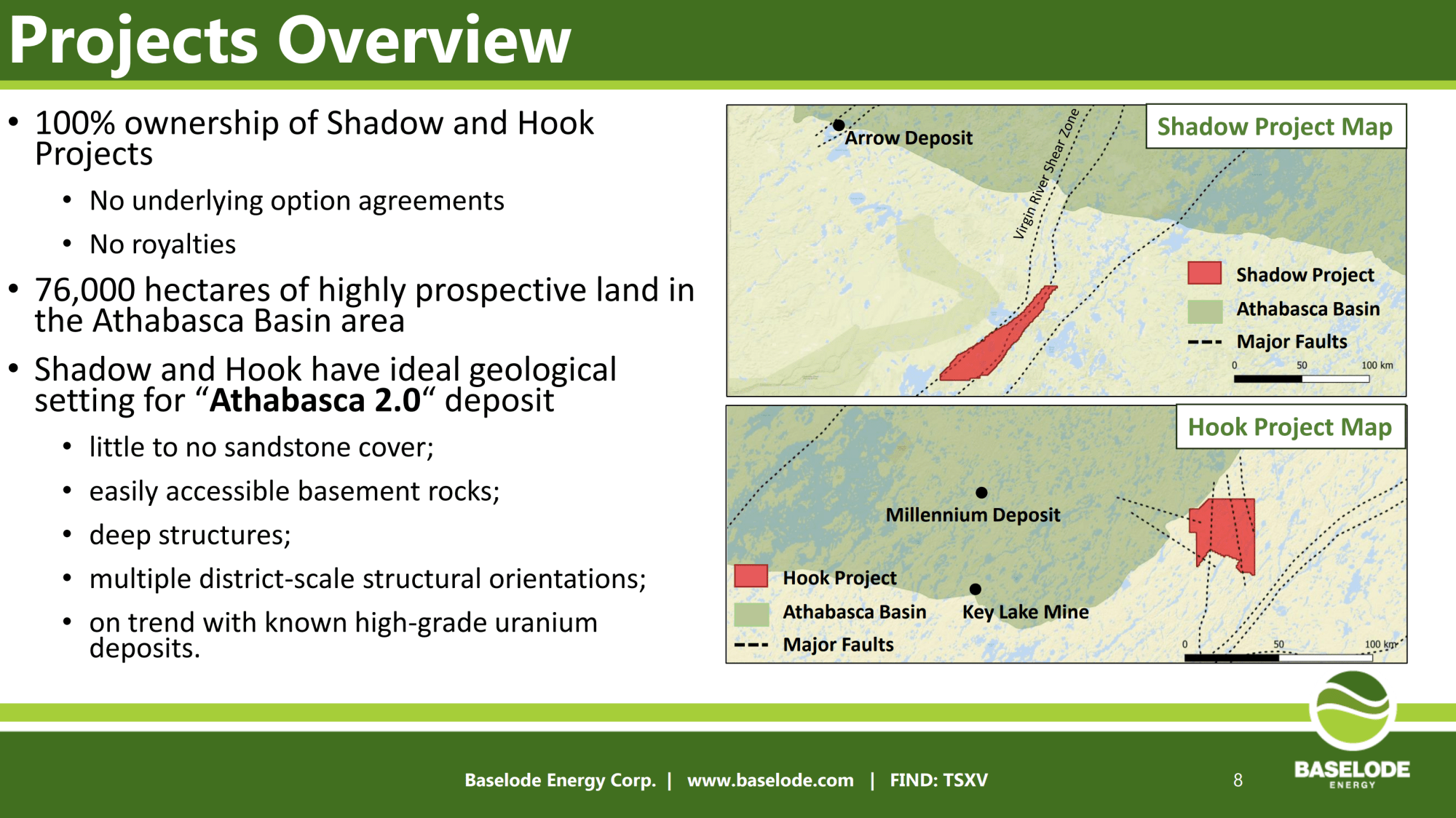

So the thesis that we have taken as Baselode progresses, is that we are looking for these basement-hosted deposits. And again, we know they’re there. Arrow is a perfect example, that’s all completely basement-hosted. Eagle Point, another 200 million pound deposit, all basement-hosted. And there are more and more being discovered today. Even I mentioned earlier, the Gryphon deposit that Denison Mines has, that’s a basement-hosted deposit. So if you can remove the sandstone from these and have them near a surface, you are looking at open-pit scenarios, and that’s our thesis. That’s what we’re calling the Athabasca 2.0, and we’re advancing this model.

Bill: So James, with this thesis, when you went about looking for properties, can you talk about how you used this thesis when you were looking at the radiometrics or geophysics? Whatever you were looking at to choose your first couple of properties, how did your operating thesis play into your selection?

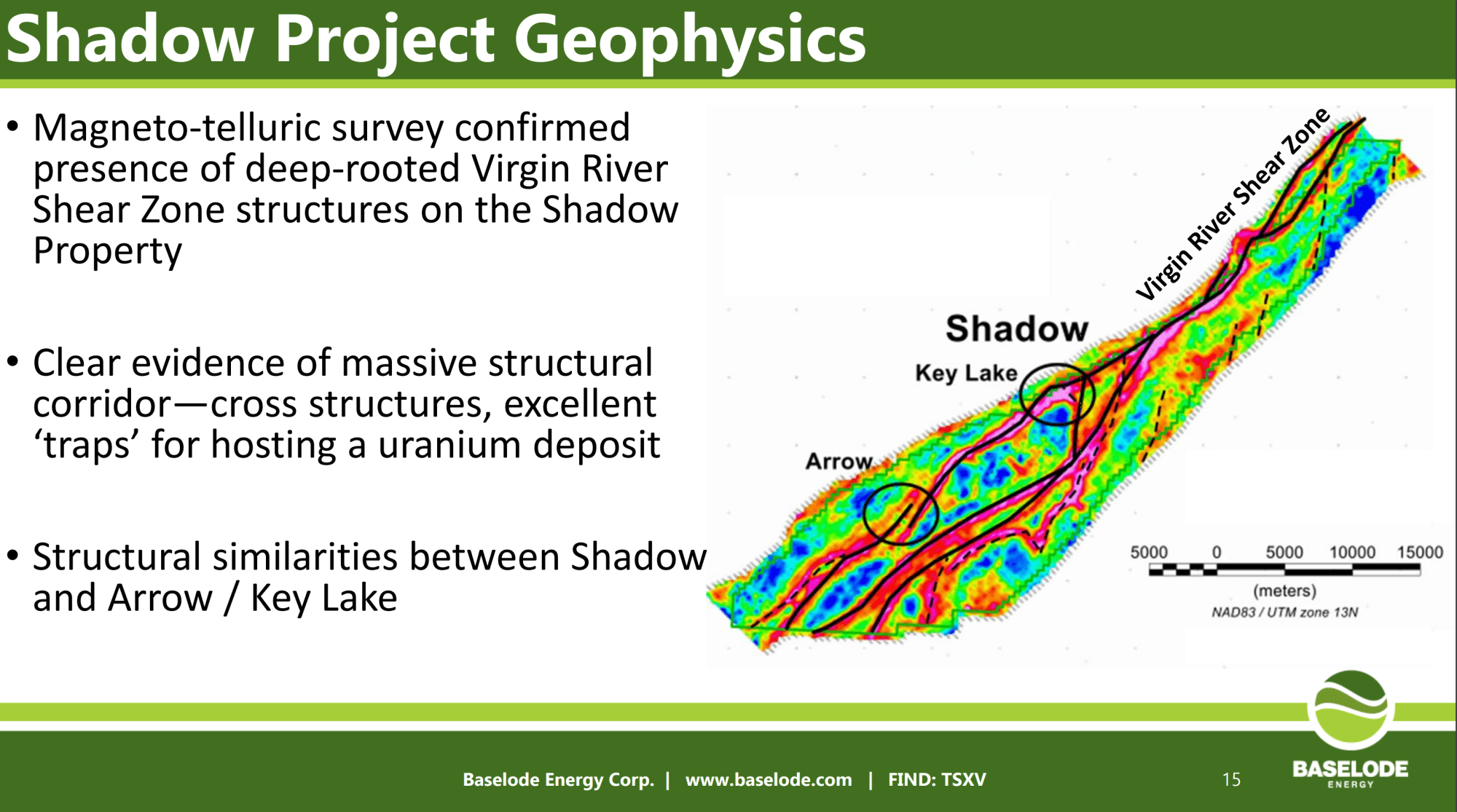

James: Yeah, so basically the thesis is we’re looking for structures. Structures are first and foremost to move basically any commodity that you have in today’s mining world. Soon as you have a structure, you’ve introduced a porosity in the rocks, even these are really hard, brutal rocks. Structures will allow fluids to migrate along there. So that’s what we need first and foremost, structure, structure, structure. I can’t emphasize that enough.

And then we’re looking at areas that have the right type of structure, and had the ability to increase its porosity. Looking at the airborne radiometrics as well, it’s nice to have a fertile sources of uranium to start with. Because if your rocks are already enriched in the element that you’re looking for, so in our example, uranium, you throw a structure through that. That’s how you can start to remobilize uranium and deposit it in a structural trap, down the whole structural system. So that’s what we’re looking for.

We’re also looking for something that was unique. We didn’t want to continue beating the horse anymore, as a lot of other companies would do. And again, that’s staying outside of the Basin. So our focus and mandate is basically, “Let’s step outside the Basin, let’s actually see what’s there.” Because we do know that there is a mineralization out this way. And in looking at that, the radiometrics is great for a surface. So I think we’ve identified some areas like that.

And even looking for showings in the area, if there were any reported boulders or surface showings. And especially our Hook Lake project that we have, now our properties contiguous with a very high-grade, 40% U3O8, showing that surface and that trends right along to McArthur River. So we’re looking for things like that.

Bill: And you have the Hook project, but you also have the Shadow project. And my understanding is you’re going to be starting working on the Shadow project to begin with?

James: Yes. Right now Shadow, I would say, is the more advanced of the projects, although Hook has been explored since the seventies. We’ve just compiled a lot of historic assessment reports on Hook, so we will be putting all that information together and figuring out what the next steps are for that.

But yes, with Shadow, Shadow is completely outside-the-box thinking. This is an area that has never been explored. And I really have to emphasize that this is as green as it gets. So we’re not following up on something that somebody else has done. This is us taking this thesis, us taking these ideas, and us moving forward with this area. And I’ve recently done a presentation, we posted it last week on the website, which I really, I detail the structural elements why I think Shadow is quite favorable.

It’s got all the makings, and I can’t emphasize it enough. There’s so many similarities on Shadow to other high-grade uranium deposits, especially basement-hosted uranium deposits that it’s uncanny. I’ve never seen anything like it. Someone once told me that … They told me that basically what I’ve done was I’ve taken the entire history of the Athabasca Basin deposits and just summarized it all in this one little property. And that’s exactly what it is. It’s very unique.

So our outside the box thinking has been able to look at something like this and identify it at a very early stage. So again, we are the outside-the-box thinkers, we’ve got a strategy that we will be employing. And we really think that we’re onto something here.

Bill: James, as you know, this is a bet-on-the-jockey type, early stage exploration play. And I watched the 30 minute presentation and I will put a link to that in the show notes. I would encourage you if you want the more in-depth geological deep dive, click on the link in the show notes to hear James full explanation of this theory.

But it made me think about what Rick Rule said, that when you invest, or I should say speculate in an early stage company, you’re betting on management. And the key asset is not even the projects, but it’s what’s between the two ears of the management, the intellectual ability and thinking and mindset. And that’s basically what we have here. We’re betting on you, this idea is out of the box. But then the next question we need to ask as speculators is, “Okay, what are the steps to test this theory? And what type of money are you going to need to do it? So can you tell us, what are you doing in terms of testing this theory?”

James: Yeah, absolutely. So every time I think about this property and think about that video, I get shivers up my spine because I’m so excited about it. So we flew in airborne serving, and MT airborne survey. We’ve got our magnetics, we’ve got our EM. That’s a great first pass, but now we need to be a little bit more diligent because obviously we do want to drill. You don’t make a discovery without the diamond drill.

So to get to that point, I’m a huge fan of gravity surveying. And what gravity basically does is you’re mapping for clay alteration. The one thing these Athabasca deposits all have in common, aside from uranium, aside from structure, is a clay alteration envelope. So you’re basically targeting clay alteration. You’re not actually targeting the uranium itself just because that halo, that clay halo, is much larger than the uranium itself. So gravity will be able to do that because you’re looking at density contrast.

So for me, moving forward with Shadow, that’s the next big step that we have to do. That will actually save us drill holes down the road. We could go right now Shadow is actually in a drill-ready state. But to be more efficient with our drill dollars, because we want to see more drilling. We want our investors to realize that, “Hey, these guys, they’re not just pony show here, to this is not their first rodeo. You guys know what they’re doing. They’re going to be wise with our investor dollars.

So yes, the gravity will get us to better targeting on the ground. And we’re hoping to be doing that by early December and have some results prior to the end of the year, because yes, we would like to get drilling. And so basically that’s the next steps that we need to do is to Shadow. It’s almost there, by the end of the year, we should be ready to start drilling. Early January at the latest, which we’re basically right there.

Bill: And is this project drillable all year round?

James: Yes. Preferable in the winter. We haven’t actually done enough of assessment, like flying over it to see what the Lake type situation as well. We’ve seen the lakes from the satellite imagery, but swamps and things like that. Sometimes they’re not totally apparent from satellite imagery, but wintertime is always the best to drill in the Athabasca Basin, just so you can get access to any part of the property anywhere.

Bill: Okay. Let’s talk about finances. What is in the treasury right now? What’s your burn rate, and when are you going to need to raise money next?

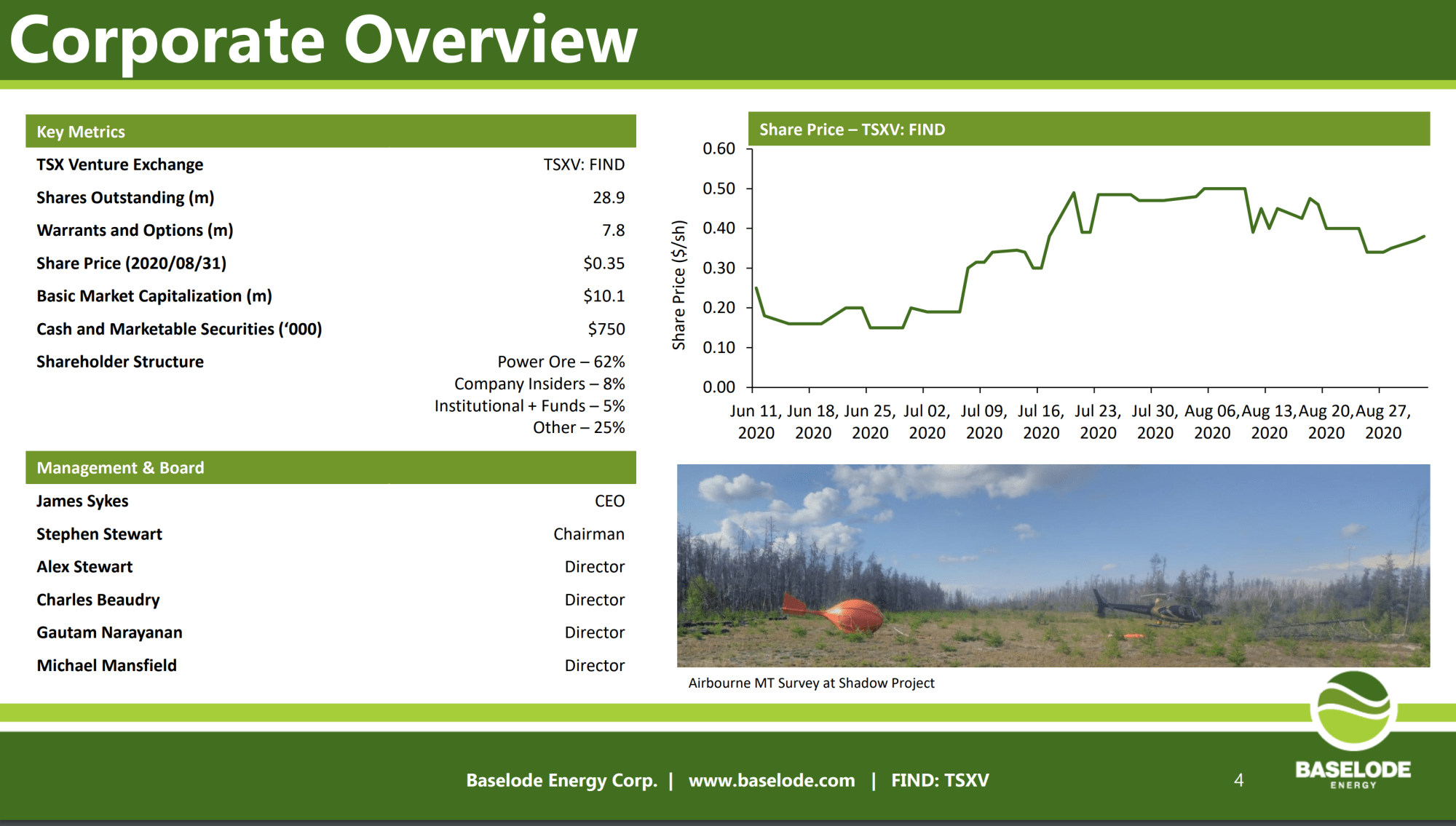

James: So in the treasury right now, we have about $500,000. We are currently doing a raise. And so once this raise is done, I’m hoping that we can have about to $2 million behind her back. I would obviously love to see more, but that’s all we basically need to move forward with Shadow and to get that diamond drilling project done.

With the raise being done, we’ll be able to advance the project. Will we need to do another raise? We’re not entirely sure yet. We’ll see what the demand is like out there, because after that video went out, demand has pretty well increased on our finance as it is right now. So that is definitely something that we want to get investors exposed to Baselode as early as possible, because we do feel that there is a quite a number of successful opportunities to be had at Baselode.

Bill: James, with the two million dollars, how many meters will you be able to drill?

James: At least 5,000m, which is a very healthy approach to a first pass exploration strategy.

Bill: Okay. And what is the spacing? Do you have an estimation of the spacing? Are you just going to do at one small target area, are you going to space it wider to see where you hit and then zone in from there.

James: I can’t assess that until we actually do our gravity survey. We do have the three main targets that have identified in that presentation. And I think that’s very realistic that we will hit all three. Obviously if we hit very early on, then that would become the strategy is to drill that out as quickly as possible. Bring on a second drill, maybe even a third drill, where one of those would continue on to the other targets that we have and just seeing what’s out there.

And if we keep hitting, we just keep adding more drills. But obviously we would need to finance for those, and so we’d come back out to the market. But after an initial success, I don’t think it would be hard to really get much … Yeah, I don’t think it’d be an issue trying to finance those.

Bill: So the first step is to show the market that there’s something behind this theory, a proof of that there’s legitimacy to this theory?

James: Yes, absolutely.

Bill: So what would be your burn rate as of right now, before you get the drill rigs turning?

James: About $400,000 annually.

Bill: Who is compensated? How many employees does the company have right now and what are they compensated?

James: Right now, basically there is myself, acting as CEO and President technical side of things. And Stephen Stewart, who is Chairman of the Board. He’s really the guru behind the whole Baselode operation. So because we are a part of Stephen’s Orefinder’s group, we do get to share a lot of the administrative side of things. So there’s a lot of cost savings in that regards.

None of us have taken any salaries yet. And that’s, we really want to see the money go into the ground where it belongs. Once we get the drills turning, then we’ll come back and then we can start taking some salary. Compensated-wise, myself, I have about 1.5 million shares, both in options and shares as part of the IPO financing. So I’m nicely compensated that way, very happy about that. I know Stephen’s got some shares and options through those as well.

Power Ore, which is now Quebec Copper, they own about 60% of the company. And that’s again, another one of Stephen’s companies. So we’re very tightly held through our insiders and through Stephen’s group.

Bill: Obviously you have the passion and the motivation, and the true financial reward for you is going to come through discovery, isn’t it? It’s not-

James: Absolutely.

Bill: That’s what you’re after here.

James: I’m after reputation, because I’ve got a nice reputation going with me right now. And as you called it, you’re betting on the jockey. I want this jockey to be number one, I want my name to be number one in Athabasca uranium. Because for me, that just goes far.

Bill: If you do hit coinciding with a uranium bull market that we’ve been expecting and with your share structure, if it can stay anywhere near where it is right now, I mean, your share price will perform very well. Because I’m looking at your share structure, it’s a very tight share structure. Talk to us about your share structure. And if you could address some recent market action, where your shares basically went up 50% in a day. Could you please speak to that?

James: Yeah. So like you mentioned, we do have a tight share structure. We’ve got about 30 million shares, fully-diluted. We’ve got about 9 to 10 million outstanding right now. So there’s not a lot of float going around, which again, it took about $30,000 on the open market to bump our stock up 50%. And that’s because we don’t have a lot of float, which is good and bad because obviously we could drop the same amount. The financing that we’re doing right now that will hopefully alleviate some of that. But we’re not entirely sure where the investment came from, but again, it shows that I think that people have watched the webinar. They are very interested in the property. They like what they’re seeing, and they’re just buying on the open market, which is great, we can’t ask for anything more than that.

But I’m also reminded of a company that was very successful to their investors, and that was Alpha uranium, which Fission bought the Triple R property off of them. But Alpha uranium was a penny stock, they’re down to cents or 10 cents. And then they found the uranium boulders had surfaced, and then they drilled and made a discovery. They went through the roof, they were at least $10 and more per share.

That’s what we can do with our current share structure, because we are so tight. I think any discovery that we can make right now will just send us through the roof, and I want our investors to reap all the rewards possible. Again, I’ve generated quite a lot of investor wealth in the past through Hathor, through NexGen. And indirectly through Denison Mines with these discoveries. Now’s the time to really make it big for involved in Baselode, and that’s my end goal right here.

Bill: And I should point out you also trade on the OTC, but it’s by appointment only for US investors. James, do you have any plans to upgrade that OTC listing in the future?

James: Yeah, absolutely. I think it’s the wisest move that we can do. Well, we just got to finish off this financing first and then we’re seriously considering putting ourselves on the OTCQB as soon as possible. We realize that our neighbors to the south, USA, there’s a lot of investor potential, there’s a lot of investor interest. And there’s just far more access to investors in general in the States than there are here in Canada. So it’s a very smart move on our behalf to get listed on the QB.

Bill: To learn more, go to baselode.com. The company again is Baselode Energy Corp. Find it on the TSXV under the ticker F-I-N-D, find, which is what James is trying to do. And on the OTC, the current ticker is BSENF. And look for that upgraded OTCQB listing that James spoke about. James really appreciate you coming on and providing this overview. And we’re going to be following this story closely.

James: Thank you very much, Bill. And I hope that you do, and I hope your listeners do, because this is very exciting. Now I can’t guarantee you discovery. I really wish I could, but I can take the necessary steps to get to what I think are the best locations for discovery. And that’s what I’ve done. That’s what I’ll keep doing.

[…] from Mining Stock Education […]